- Home

- »

- Medical Devices

- »

-

U.S. Medical Affairs Outsourcing Market, Industry Report, 2030GVR Report cover

![U.S. Medical Affairs Outsourcing Market Size, Share & Trends Report]()

U.S. Medical Affairs Outsourcing Market Size, Share & Trends Analysis Report By Services (Medical Writing & Publishing, Medical Monitoring), By Industry (Pharmaceutical, Biopharmaceutical), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-224-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

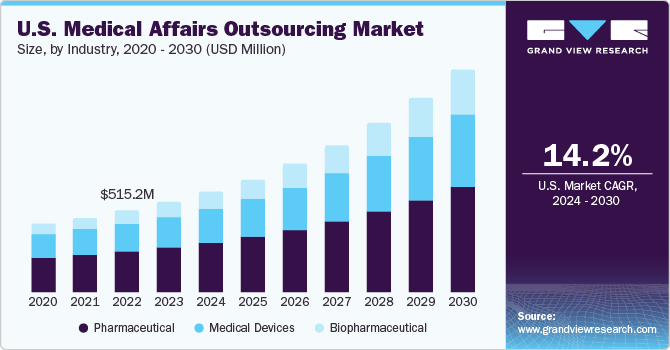

The U.S. medical affairs outsourcing market size was estimated at USD 569.07 million in 2023 and is expected to register a CAGR of 14.2% from 2024 to 2030. The increasing investment in R&D and clinical trials in the U.S., coupled with the need to limit liability exposure with respect to stringent regulatory requirements, is driving market growth significantly. With the increase in regulatory parameters post the COVID-19 pandemic, contract medical affairs outsourcing organizations such as Contract Research Organizations (CROs) are a preferable cost-effective solution for medical devices manufacturers.

The complex regulatory landscape in the U.S. pharmaceutical sector plays a significant role in driving the demand for medical affairs outsourcing services. Strict regulatory guidelines covering drug development, approval processes, and post-marketing surveillance necessitate pharmaceutical companies to seek professional assistance in navigating these requirements.

By outsourcing medical affairs functions, companies can access specialized expertise in areas like regulatory affairs, pharmacovigilance, and compliance management. This helps them maintain compliance with evolving regulatory standards, optimize operational efficiency, and minimize risks. According to Parexel International Corp, with an increasing focus on evidence-based decision-making and value-based healthcare models, the demand for real-world evidence (RWE) and market access support services is on a rise. The company has thus integrated Artificial Intelligence (AI) with real world evidence (RWE), enabling the monitoring of new drugs' performance in diverse patient populations over time, influencing market access decisions, and enhancing clinical trial design

Medical affairs outsourcing providers play a vital role in generating, analyzing, and utilizing RWE to showcase the effectiveness, safety, and value of medical products in real-world scenarios. Furthermore, these providers offer strategic assistance in addressing reimbursement challenges, formulary placements, and payer negotiations, enabling pharmaceutical and biopharmaceutical companies to maximize product adoption and market penetration.

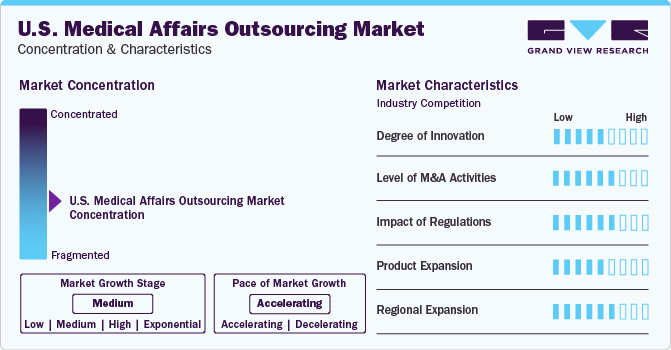

Market Concentration & Characteristics

Innovation in the industry is advancing through technological integration and patient-centric innovations. Leveraging AI and real-world data, CROs optimize clinical trial designs and generate real-world evidence for enhanced decision-making. Patient engagement strategies, including virtual trials and remote monitoring, are revolutionizing participant experiences, improving accessibility, and reducing costs.

The level of mergers and acquisitions in the market has been notable. Moreover, the pharmaceutical sector is advancing with strategic initiatives such as collaborations and partnerships in the product development segment, thus aiding market growth. For instance, Syneos Health Incorporated, a globally prominent North Carolina-based CRO, was acquired in May 2023 by Elliott Investment Management, Patient Square Capital and Veritas Capital, thus becoming a completely privately held industry player.

The regulatory framework for the U.S. medical affairs outsourcing market is complex due to its multifaceted nature and the involvement of various stakeholders. CROs, Contract Development and Manufacturing Organizations (CDMOs), and Clinical Support Organizations (CSOs) must navigate regulations from the Food and Drug Administration (FDA) and manufacturing regulations. Moreover, adherence to data privacy laws like HIPAA and ethical standards further adds to the complexity. Outsourcing medical affairs services to CROs and CDMOs in the U.S. is seen as a risk-reducing measure due to stringent regulatory authorities. This allows companies to focus on their core business operations while lowering risks.

Innovations in clinical trials, such as virtual trials, real-world data utilization, and patient-centric approaches, are compelling medical affairs outsourcing companies to evolve their services. Patient-centric approaches adopted by contract medical affairs companies prioritize participant needs through digital platforms and remote consenting processes, fostering engagement and retention.

The country’s large and well-established pharmaceutical and biotechnology industry, coupled with a robust ecosystem of pharmaceutical sponsors, academic research institutions, and healthcare providers, makes it favorable for services such as clinical research, regulatory affairs, pharmacovigilance, and medical writing. For instance, In January 2020, Ergomed, a global specialist pharmacovigilance provider, acquired Ashfield Pharmacovigilance Inc., a US pharmacovigilance services provider, from UDG Healthcare. This acquisition upsurged Ergomed’s market position and established a platform for the broader Ergomed services business in the US.

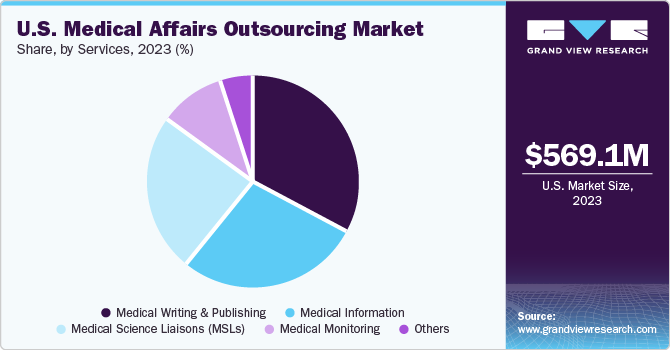

Services Insights

The medical writing & publishing segment dominated the market in 2023, commanding over 33% market share. There is a noticeable increase in the number of clinical trials due to rising investments in R&D activities. However, there is lack of skilled professionals in the field of medicine because the number of medical writers and publishers are not increasing at the same rate, which is expected to increase the scope for new writers & publishers to enter the market.

The medical science liaisons (MSLs) segment is expected to grow at the fastest CAGR from 2024 to 2030, owing to the rising use of MSLs in a consultative role for product development. Moreover, this trend stems from the growing recognition of the pivotal role MSLs play in bridging the gap between pharmaceutical companies and healthcare professionals. With their specialized scientific knowledge and strong communication skills, MSLs serve as trusted experts, providing valuable insights on products, clinical data, and therapeutic areas.

Industry Insights

In 2023, the medical equipment and supplies industry emerged as the frontrunner in the market with a revenue share of 55.6%. The medical equipment segment is further divided into diagnostic imaging equipment, surgical instruments, patient monitoring devices, and others. Among these, the diagnostic imaging equipment segment garnered the major share due to the increasing prevalence of chronic diseases, such as cancer and cardiovascular diseases, and the growing demand for early diagnosis and treatment. Furthermore, the rising geriatric population and advancements in medical imaging technologies, such as magnetic resonance imaging (MRI) and computed tomography (CT), have further propelled the growth of the diagnostic imaging equipment segment.

The medical supplies segment is projected to register the fastest growth rate during the forecast period. In this segment, the wound care products are expected to witness significant growth due to factors such as increasing prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, and the growing demand for advanced wound care products. Moreover, the rising incidence of sports injuries and road accidents has further boosted the demand for medical supplies, such as bandages, gauzes, and surgical tapes, among others. Additionally, the increasing adoption of home healthcare services and the growing number of outpatient surgeries have also fueled the growth of the medical supplies segment.

Key U.S. Medical Affairs Outsourcing Company Insights

The U.S. medical affairs outsourcing market has been witnessing a significant shift in the recent past, primarily due to the rise of new players in the market. Despite the low set-up costs, new entrants are evaluated stringently based on their credibility and quality, making the market fragmented. To expand their service offerings, access new markets, and achieve economies of scale, companies are focusing on strengthening their competitive positions in the market. To expand their service offerings and collaborate with regional players, several key companies in the U.S. medical affairs outsourcing market, such as Syneos Health Inc., Pharmaceutical Product Development, LLC, IQVIA Holdings Inc., SGS SA, and ICON plc, are rapidly expanding globally.

Moreover, to retain their market position, these companies are adopting various growth strategies such as partnerships, mergers, and acquisitions, and expanding their product portfolios. For instance, in February 2021, Ashfield Healthcare Communications Limited merged UK-based agencies Ashfield Digital and Creative and Pegasus, with US-headquartered Cambridge BioMarketing to establish Mind+Matter. This new agency operated across various specialist areas such as consumer wellness, established pharma, and rare and novel therapies, offering a comprehensive range of services in the healthcare sector.

Key U.S. Medical Affairs Outsourcing Companies:

- IQVIA Holdings Inc.

- Syneos Health Inc.

- Pharmaceutical Product Development, LLC

- ICON plc

- SGS SA

- Wuxi AppTec Clinical Development, Inc.

- Indegene Inc.

- The Medical Affairs Company (TMAC)

- Ashfield Healthcare Communications

- ZEINCRO Group

Recent Developments

-

In February 2023, Parexel International Corp, a leading clinical research organization (CRO), launched the Expert Series - New Medicines, Novel Insights. This series features fresh insights from global experts analyzing drug development trends, offering evidence-based guidance to drug developers.

-

In January 2022, Ashfield Healthcare Communications Limited collaborated with Huntsworth, a London-based healthcare communication company, to establish Inizio as a comprehensive solution provider for life sciences firms. Inzio offers diverse services, encompassing consulting, medical affairs, real-world evidence, branding, media, and marketing, as well as live, hybrid, and digital channels, and provides specialized services for developing and commercializing biologics and genetic technologies.

-

In January 2023, Syneos Health Incorporated (SYNH) partnered with Fosun Pharma USA, launching Serplulimab, an anti-PD-1 antibody for small-cell lung cancer. The company provided Full-Service Commercial support through its Syneos One team for the US launch. The collaboration aimed to leverage Syneos One’s clinical and commercial solutions expertise.

U.S. Medical Affairs Outsourcing Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 634.2 million

Revenue forecast in 2030

USD 1.40 billion

Growth rate

CAGR of 14.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Services, industry

Country scope

U.S.

Key companies profiled

IQVIA Holdings Inc.; Syneos Health Inc.; Pharmaceutical Product Development, LLC; ICON plc; SGS SA; Wuxi AppTec Clinical Development, Inc.; Indegene Inc.; The Medical Affairs Company (TMAC); Ashfield Healthcare Communications; ZEINCRO Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Affairs Outsourcing Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical affairs outsourcing market report based on services and industry.

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Writing & Publishing

-

Medical Monitoring

-

Medical Science Liaisons (MSLs)

-

Medical Information

-

Other Services (HEOR Activities, Strategic Planning Services, and Training & Education)

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Biopharmaceutical

- Medical Devices

-

Frequently Asked Questions About This Report

b. The U.S. medical affairs outsourcing market size was estimated at USD 569.07 million in 2023 and is expected to reach USD 634.2 million in 2024.

b. The U.S. medical affairs outsourcing market is expected to grow at a CAGR of 14.2% from 2024 to 2030 to reach USD 1.4 billion in 2030.

b. In 2023, the medical equipment and supplies industry emerged as the frontrunner in the market with a revenue share of 55.6%. The medical equipment segment is further divided into diagnostic imaging equipment, surgical instruments, patient monitoring devices, and others.

b. Key U.S. medical affairs outsourcing companies include Syneos Health Inc., Pharmaceutical Product Development, LLC, IQVIA Holdings Inc., SGS SA, and ICON plc.

b. The increasing investment in R&D and clinical trials in the U.S., coupled with the need to limit liability exposure with respect to stringent regulatory requirements, is driving market growth significantly.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."