- Home

- »

- Digital Media

- »

-

U.S. Manga Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Manga Market Size, Share & Trends Report]()

U.S. Manga Market (2025 - 2030) Size, Share & Trends Analysis Report By Content Type (Printed, Digital), By Gender (Male, Female), By Distribution Channel, By Genre, By Audience, And Segment Forecasts

- Report ID: GVR-4-68040-203-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Manga Market Size & Trends

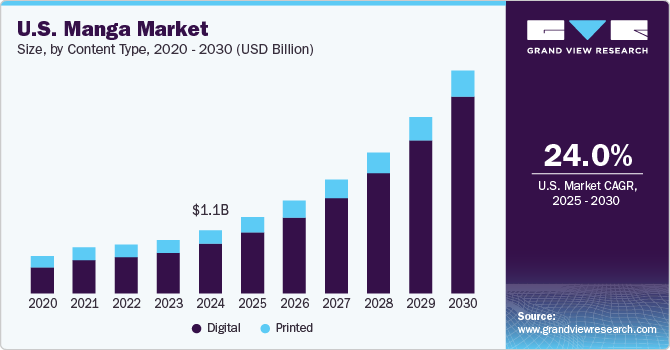

The U.S. manga market size was estimated at USD 1.06 billion in 2024 and is expected to grow at a CAGR of 24.0% from 2025 to 2030. The growing popularity of digital manga is transforming the U.S. market, as more readers prefer the convenience and accessibility offered by digital platforms. In addition, the increasing popularity of manga among diverse demographics, and the influence of social media in promoting manga content to a wider audience is expected to present lucrative opportunities for the U.S. manga industry in the coming years.

The increased presence of retail stores and the high consumer spending capacity in the U.S. have made manga more readily available to a wider audience. This growing proliferation of bookstores, comic shops, and online platforms has made it easier for consumers to access a wide variety of titles. This accessibility is further enhanced by the rise of e-commerce, allowing readers to purchase manga conveniently from home. The combination of these retail avenues caters to a diverse audience, ensuring that manga is available to fans across different demographics. This trend is expected to further drive the expansion of the U.S. manga industry.

The impact of social media on reader engagement and content promotion is another key trend driving market growth. Social media platforms have become vital tools for publishers to connect with potential readers. They allow for sharing manga-related content, fan art, and discussions that foster community engagement. This digital interaction not only broadens the reach of manga but also creates a vibrant community where fans can share their passion and discover new titles. The ability for publishers to promote their works directly through these channels has significantly changed how they market their products and enhance sales in the U.S. manga industry.

The growing popularity of anime adaptations has also played a pivotal role in driving manga sales in the U.S. As numerous manga series are adapted into animated formats, they gain increased visibility and attract new audiences who may not have previously engaged with the original material. This trend creates a cycle where successful anime can lead to higher sales of the corresponding manga, further enhancing its market presence.

Furthermore, including manga in educational settings contributes to its growth. Schools and libraries increasingly recognize the value of graphic novels and manga as tools for literacy and student engagement. The incorporation of these materials into curricula supports language development and critical thinking skills, making them appealing to educators. This trend not only boosts sales but also legitimizes manga as an important literary form, expanding its reach into academic environments and thereby propelling the U.S. manga industry's growth.

Content Type Insights

The digital segment recorded the largest revenue share of over 80% in 2024. Digital manga is experiencing rapid growth in international markets, driven by the increasing penetration of digital media and e-commerce platforms. The convenience of accessing a vast library of titles online has attracted a broad audience, leading to a significant shift in how consumers engage with manga. As more readers prefer digital formats, this segment is expected to grow significantly in the coming years, driven by technological advancements and changing consumer habits.

The printed segment is projected to register a significant CAGR from 2025 to 2030. Fans are increasingly seeking out manga with superior print quality, including hardcover volumes, premium paper, and high-definition artwork. These editions offer a more luxurious reading experience and often become prized possessions for collectors. As publishers focus on quality production, the market for premium printed manga continues to grow, reflecting consumers’ desire for high-end, collectible products.

Distribution Channel Insights

The online segment accounted for the largest revenue share in 2024. reflecting the shift in consumer purchasing behavior towards digital platforms. Online retailers provide an extensive selection of titles and often feature exclusive releases, making it easier for readers to discover new content. This trend is complemented by the offline segment, which is also expected to witness significant growth as brick-and-mortar stores enhance their offerings and create immersive experiences for fans through events and community engagement.

Offline is anticipated to record a significant CAGR from 2025 to 2030, driven by the enduring appeal of physical copies among dedicated manga enthusiasts. Traditional bookstores and libraries play a crucial role in this segment, offering a tactile experience that digital formats cannot replicate. Many consumers appreciate the aesthetic qualities of printed manga, such as high-quality artwork and collectible editions, which enhance their reading experience. In addition, establishing new offline stores that focus on manga content creates opportunities for increased sales and engagement.

Genre Insights

The action & adventure segment held the largest market share in 2024,driven by its widespread appeal across various demographics. These genres often incorporate elements from other media, such as video games and films, which helps to attract a diverse audience. Meanwhile, the romance and drama segment is anticipated to grow at the highest rate, reflecting changing societal norms and increasing interest in narratives that explore emotional depth and interpersonal relationships.

The romance & drama segment is expected to grow at the highest CAGR from 2025 to 2030, owingto the popularity of mature-themed manga that resonates with older readers. However, the teenager segment is projected to grow at an impressive rate as publishers increasingly target younger audiences with relatable stories and characters. This focus on teenagers highlights the industry's adaptability and commitment to engaging with emerging generations of readers.

Gender Insights

The male segment held the largest revenue share in 2024, largely owing to the historical appeal of action-oriented narratives and strong male protagonists. Popular series that resonate with male readers, featuring dynamic storylines and character-driven plots, consistently support this segment. The distinctive art styles and themes prevalent in many manga titles further cater to male interests, fostering a loyal customer base and thereby driving segmental growth.

The female segment is anticipated to witness the highest CAGR from 2025 to 2030. This growth is attributed to the increasing diversity of narratives that focus on female protagonists and relatable character dynamics. Publishers are actively creating content that appeals to women, particularly in genres such as romance and drama, which explore emotional depth and relationships. The rise of influential female manga creators and the growing acceptance of female readership in the manga community are also contributing factors that indicate a promising future for this segment.

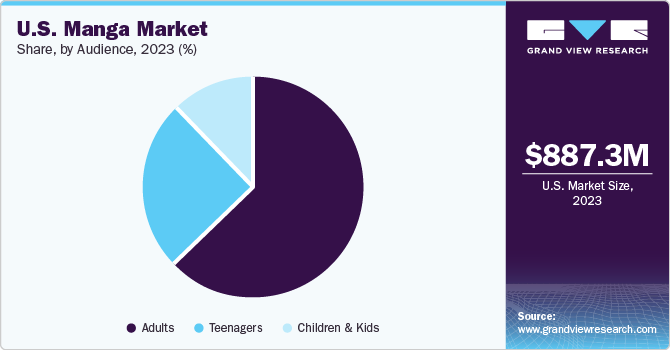

Audience Insights

The adults segment held the largest revenue share in 2024, driven by a growing interest in mature themes and complex storytelling. Many manga targeted at adults delve into sophisticated narratives that tackle serious issues, making them appealing to an older audience seeking depth in their reading material. Adaptations of adult-oriented manga bolster this segment's popularity into successful series on streaming platforms, which have further increased visibility and engagement among adult readers. As manga continues to gain recognition as a legitimate form of literature, its appeal among adults is expected to remain strong.

The teenagers segment is estimated to grow at the highest CAGR from 2025 to 2030. The growing industry's focus on creating engaging content that resonates with younger audiences is driving segmental growth. Publishers are increasingly developing stories that address themes relevant to teenagers, such as identity, relationships, and personal growth. The rise of social media platforms has also facilitated greater interaction among teenage readers, allowing them to share their interests and recommendations with their peer groups. As a result, this segment is poised for significant expansion as it captures the attention of a new generation of manga enthusiasts.

Key U.S. Manga Company Insights

Some of the key players operating in the market include Kodansha Comics and VIZ Media LLC.

-

VIZ Media, LLC specializes in publishing manga and distributing Japanese anime, films, and TV series. The company owns an extensive catalog of popular titles such as Chainsaw Man, Spy x Family, and Demon Slayer, which have garnered significant attention and readership among American audiences. The company's success is further enhanced by its commitment to digital platforms, including the Viz Manga app, which provides simultaneous English translations of popular series, making manga more accessible to readers across the country.

-

Kodansha Comics is the American subsidiary of Kodansha Ltd. and is known for publishing acclaimed series like Attack on Titan, Fairy Tail, and Tokyo Revengers. In addition to print publications, Kodansha Comics has embraced digital distribution through platforms like "K Manga," which offers a selection of titles for simultaneous release in English, thereby enhancing accessibility for fans across North America.

Some of the emerging market players in the market include Seven Seas Entertainment, Inc., and Dark Horse Comics., among others

-

Seven Seas Entertainment is a rapidly expanding manga publisher, best known for licensing and distributing Japanese manga titles in North America. The company specializes in publishing well-established and lesser-known manga, focusing on niche genres such as yaoi, yuri, and slice-of-life. Seven Seas has earned recognition for its high-quality English translations and its commitment to bringing diverse manga content to a broader audience. The company's portfolio includes popular manga and light novel series, appealing to both mainstream and niche markets.

-

Dark Horse Comics is known for its diverse catalog, including original works and licensed properties. Originally established as a comic book publisher, Dark Horse has expanded its offerings to include a wide range of manga titles featuring fan favorites like Berserk and Mob Psycho 100. While it may not be as dominant as some competitors, Dark Horse maintains a significant presence by catering to niche audiences and providing unique titles that appeal to dedicated fans.

Key U.S. Manga Companies:

- Dark Horse Comics

- Square Enix

- Webtoon Unscrolled

- Vertical, Inc.

- IDW Publishing

- Kadokawa Corporation

- Kodansha Comics

- Seven Seas Entertainment, Inc.

- VIZ Media LLC

- Yen Press LLC

Recent Developments

-

In October 2024, Square Enix unveiled five new manga series set for English-language publication in Fall 2025, along with an art book celebrating the 20th anniversary of Soul Eater. The new titles include Dragon Quest: The Mark of Erdrick, Bride of the Death God, Exquisite Blood: The Heretic Onmyoji, Mechanical Buddy Universe, and Holoearth Chronicles Side:E Yamato Phantasia. Each title is scheduled for release between August and September 2025, with pre-orders available starting in February 2025.

-

In July 2024, Kodansha Comics revealed an exciting lineup of new manga titles at San Diego Comic-Con, set to debut in Spring 2025 and August 2024. Among the highlighted releases is "That Beauty Is a Tramp," a steamy androgynous romance launching in August 2024, where a tomboyish girl overcomes her aversion to male touch through a unique relationship with a beautiful male model.

-

In October 2023, Viz Media LLC announced the launch of a new portal for one-shot proposals in the U.S., aimed at producing short, original stories under its Viz Originals line. This initiative reflects a strategic move to foster creativity and innovation within the manga landscape, allowing new narratives to emerge and potentially leading to licensing opportunities for anime adaptations and consumer products.

U.S. Manga Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.28 billion

Revenue forecast in 2030

USD 3.73 billion

Growth rate

CAGR of 24% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Content type, distribution channel, genre, gender, audience, region

Key companies profiled

Dark Horse Comics; Square Enix; Webtoon Unscrolled; Vertical, Inc.; IDW Publishing; Kadokawa Corporation.; Kodansha Comics; Seven Seas Entertainment, Inc.; VIZ Media LLC; Yen Press LLC.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Manga Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. manga market report based on content type, distribution channel, genre, gender, audience, and region:

-

Content Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Printed

-

Digital

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Genre Outlook (Revenue, USD Million, 2018 - 2030)

-

Action and Adventure

-

Sci-Fi and Fantasy

-

Sports

-

Romance and Drama

-

Others

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Audience Outlook (Revenue, USD Million, 2018 - 2030)

-

Children and Kids (Aged below 10 years)

-

Teenagers (Aged between 10 to 16 years)

-

Adults (Aged above 16 years)

-

Frequently Asked Questions About This Report

b. The U.S. manga market size was estimated at USD 1.06 billion in 2024 and is expected to reach USD 1.28 billion in 2025

b. The U.S. manga market is expected to grow at a compound annual growth rate of 24% from 2025 to 2030 to reach USD 3.73 billion by 2030.

b. The digital segment accounted for the largest revenue share of nearly 78% in 2024 and is anticipated to witness the fastest growth during the forecast period. The digital revolution has impacted the manga industry, facilitating the distribution and consumption of manga through digital platforms and services.

b. Some key players operating in the U.S. manga market include ALIEN BOOKS, Antarctic Press, Aurora Publishing, Dark Horse Comics LLC, DC, Idea and Design Works LLC, KODANSHA USA PUBLISHING, Penguin Random House LLC, Seven Seas Entertainment, Inc., TOKYOPOP, Tuttle Publishing, VIZ Media, Yen Press

b. The growth in the popularity of manga, i.e., graphic reading content, is attributed to original English-language (OEL) manga publications, thrilling stories, and attractive visuals in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.