- Home

- »

- Medical Devices

- »

-

U.S. Management Service Organization Market, Industry Report, 2030GVR Report cover

![U.S. Management Service Organization Market Size, Share & Trends Report]()

U.S. Management Service Organization Market (2024 - 2030) Size, Share & Trends Analysis Report By End-use (Ambulatory Surgery Centers (ASC), Physician Office), By Services (Revenue Cycle Management Services, Analytics & Consulting Services), And Segment Forecasts

- Report ID: GVR-4-68040-268-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

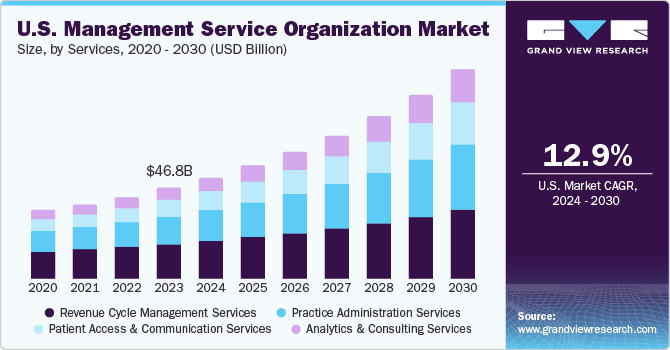

The U.S. management service organization market size was estimated at USD 46.78 billion in 2023 and is expected to grow at a CAGR of 12.96% from 2024 to 2030. The U.S. MSO market is expected to grow significantly, driven by the rise in investments by private equity firms, and the increasing consolidation of smaller practices. The rising focus on value-based care is attributed to several factors such as the shift toward value-based care models, which prioritize quality and outcomes over volume. This has prompted MSOs to adapt their services to meet the changing needs of healthcare providers and payers.

The growing demand for the expansion of service networks by health systems is leading to a rise in investments by private equity companies. Such investments enable organizations to provide quality clinical care without the burden of administrative and management functions. For instance, in April 2023, AmerisourceBergen Corporation and Tarrant Capital IP, LLC, an alternative asset management provider, acquired OneOncology, a network of oncology practices, from General Atlantic Service Company, L.P. This acquisition aims to strengthen AmerisourceBergen Corporation's relationships with community oncologists and expand on solutions in the specialty as well as build a platform in partnership with Tarrant Capital IP, LLC. Such investments and growing acquisitions by private equity firms are expected to drive the market in the coming years.

The growing availability of data and advancements in technology have enabled MSOs to better track and measure performance, identify areas for improvement, and implement evidence-based practices. Management service organizations are leveraging sophisticated IT infrastructure and analytics to categorize patients, determine best practices, and drive quality improvement initiatives. For instance, in November 2023, Apollo Medical Holdings, Inc. partnered with Wider Circle, a community health organization, to provide enhanced care management to Medicaid members across California. The partnership aimed to deliver high-quality, value-based care to all community members. The increasing emphasis on population health management and care coordination has propelled MSOs to focus on value-based care.

The emergence of next-generation MSOs in the U.S. brings new opportunities due to the shift of traditional practice management services and a broad range of administrative support services to physician practices. There has been a rise in private equity partnerships, and private practice physicians are investing and joining MSOs to achieve operational efficiency, removing administrative burdens while maintaining clinical autonomy. For instance, in October 2023, Ascend Capital Partners acquired a majority share of Seoul Medical Group (SMG). This acquisition aims to create premier community-focused healthcare companies equipped to manage Medicaid and Medicare patient populations. Such factors create opportunities for the growth of the market in the coming years.

Market Concentration & Characteristics

The U.S. management service management market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is medium, the level of partnerships & collaboration activities is also high, and service expansion is low. The impact of regulations on the market is medium, and the geographic expansion of the market is low.

Several industry players launching new services to improve their industry penetration. For instance, in October 2023, Centene's subsidiary, WellCare, launched co-branded Medicare Advantage plans in 2024 through a partnership with Mutual of Omaha. It would be available in Missouri, Washington, South Carolina, Georgia, and select areas of Texas.

Key industry players, including Network Medical Management (Apollo Medical Holdings, Inc.), Conifer Health Solutions, LLC, and Centene Corporation, are involved in merger and acquisition activities to expand their industry presence. For instance, in November 2023, Apollo Medical Holdings, Inc. partnered with Wider Circle, a community health organization, to provide enhanced care management to Medicaid members throughout California. The partnership aimed to deliver high-quality, value-based care to all community members.

The impact of regulations on the U.S. MSO industry is high. MSOs face a multitude of challenges in the healthcare industry, including navigating laws that restrict nonphysician-owned entities from practicing medicine or employing licensed healthcare providers, ensuring compliance with regulations like HIPAA for handling sensitive patient health information, adhering to billing & reimbursement regulations, avoiding kickbacks & self-referrals, complying with state-specific regulations & licensing requirements, and seeking legal & compliance guidance to mitigate risks & operate within the legal boundaries of the healthcare industry.

Industry players leverage the strategy of service expansion to increase their service capabilities and promote the reach of their service offerings. For instance, in April 2023, Conifer Health Solutions, LLC launched Conifer Connect, a digital health app designed to provide personalized health management solutions to users. This app helps users manage their daily health routines and builds a stronger connection with their personal health nurse.

The presence of several local companies that understand regional industry and customer preferences that pose significant competition to management service organizations. Some prominent companies in the industry are implementing various strategies, such as launching new services and geographical expansion, to consolidate their industry position across the country.

Services Insights

The revenue cycle management services segment dominated the market in 2023 with a revenue share of 37.31%. The growth can be attributed to the increase in the adoption of MSOs to provide services such as Coding & Clinical Documentation, Compliance Audit & Training, Charge Capture & Reconciliation, Billing/AR Follow-Up, Credentialing/Provider Enrollment, Payor Contracting, and Compliance. The growing adoption of outsourcing RCM services that improved efficiency, reduced costs, increased cash flow, and improved compliance with healthcare regulations is anticipated to grow in the coming years.

The analytics & consulting services segment is anticipated to grow at the fastest CAGR from 2024 to 2030. The growing investment in patient engagement tools, such as patient portals and mobile applications, empowers patients with information & enables them to participate in their care actively. For instance, in April 2023, Conifer Health Solutions, LLC launched Conifer Connect, a digital health app designed to provide personalized health management solutions to users. This app helps users manage their daily health routines and builds a stronger connection with their health nurses.

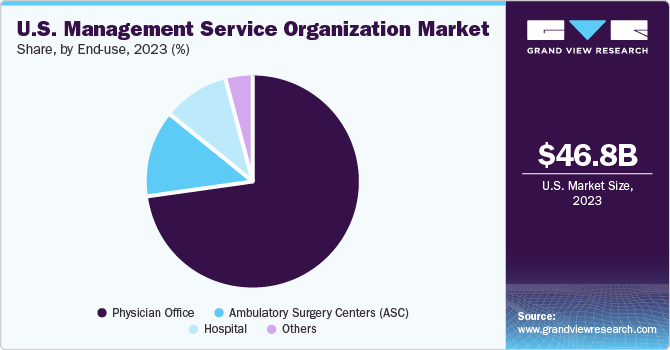

End-use Insights

The physician office segment dominated the market in 2023 with a revenue share of 72.97%. This can be attributed to the rise in the implementation of MSOs in managing physician clinical practices in the U.S., which offer various benefits such as optimizing operations, minimizing overhead costs, and allowing providers to focus on core competencies. Medium & large physician groups are forming MSOs to position themselves for greater flexibility to explore strategic investor transactions and potentially become part of regional or national healthcare organizations.

The Ambulatory Surgery Centers (ASC) segment is expected to grow at the fastest CAGR from 2024 to 2030. The growth can be attributed to efforts to capitalize on outpatient migration and the shift towards Value-based Care (VBC) by investing in ASCs, MSOs, and clinically integrated networks by orthopedic practices. These investments offer lucrative opportunities and better outcomes for patients. For instance, in October 2023, iOR Partners had 65 active centers and planned to open eight more, aiming to reach 120 centers by year-end. In addition, the company’s revenue grew from USD 1.98 million in 2020 to USD 12.57 million in 2022. Thus, establishing MSOs is expected to contribute to the growth of the ASC sector significantly.

Key U.S. Management Service Organization Company Insights

The demand for advanced MSO services has led to increased competition among companies in the U.S. Management Service Organization (MSO) market. Some of the emerging companies include Vanguard Health Solutions, Advanced Medical Management, and HealthSmart Management Services Organization, Inc.

Key U.S. Management Service Organization Companies:

- Conifer Health Solutions, LLC. (TH Medical)

- Network Medical Management (Apollo Medical Holdings, Inc.)

- MedPOINT Management, Inc.

- Vanguard Health Solutions

- Prospect Medical Holdings, Inc.

- Centene Corporation

- Advanced Medical Management

- HealthSmart Management Services Organization, Inc.

- Pacific Partners Management Services Inc., a division of HCA Healthcare

- MSO Inc. (Southern California)

Recent Developments

-

In January 2024, Apollo Medical Holdings, Inc. established a long-term strategic partnership with BASS Medical Group, a multispecialty medical group. The partnership aims to provide high-quality care through value-based arrangements to patients with various types of insurance, including Medicaid, Medicare, ACA Marketplace, and commercial.

-

In October 2023, Seoul Medical Group (SMG) acquired Advanced Medical Management, which provides comprehensive administrative support to physicians, including claims processing, quality training, and credentialing.

-

In May 2023, Conifer Health Solutions, LLC entered into a new partnership with Northwest Community Healthcare. With this partnership, the company was expected to continue to provide its expertise in RCM services to Northwest Community Healthcare.

-

In May 2023, Centene Corporation's Medicare brand, Wellcare, launched a preferred Medicare sales and distribution partnership program to improve quality and customer experience, strengthening sales partnerships.

U.S. Management Service Organization Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 52.19 billion

Revenue forecast in 2030

USD 108.44 billion

Growth rate

CAGR of 12.96% from 2024 to 2030

Actual data

2018 - 2022

Forecast data

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, end-use

Country scope

U.S.

Key companies profiled

HealthSmart Management Services Organization, Inc.; Conifer Health Solutions, LLC. (TH Medical); Network Medical Management (Apollo Medical Holdings, Inc.); MedPOINT Management, Inc.; Vanguard Health Solutions; Prospect Medical Holdings, Inc.; Centene Corporation; Advanced Medical Management; Pacific Partners Management Services Inc.; a division of HCA Healthcare, MSO Inc. (Southern California)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Management Service Organization Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. management service organization market report based on services and end-use:

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Practice Administration Services

-

Patient Access & Communication Services

-

Revenue Cycle Management Services

-

Analytics & Consulting Services

-

-

End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Physician Office

-

Ambulatory Surgery Centers (ASC)

-

Hospital

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. management service organization market size was estimated at USD 46.78 billion in 2023 and is expected to reach USD 52.19 billion in 2024.

b. The U.S. management service organization (MSO) market is expected to grow at a compound annual growth rate of 12.96% from 2024 to 2030 to reach USD 108.44 billion by 2030.

b. Key factors that are driving the U.S. management service organization (MSO) market growth include rise in investments by private equity firms, increasing consolidation of smaller practices and rising focus on value-based care models.

b. The revenue cycle management services dominated the market with a share of 37.31% in 2023. This is attributable to the increase in the adoption of MSOs to provide services such as Coding & Clinical Documentation, Compliance Audit & Training, Charge Capture & Reconciliation, Billing/AR Follow-Up, Credentialing/Provider Enrollment, Payor Contracting, Compliance.

b. Some key players operating in the U.S. management service organization (MSO) market include HealthSmart Management Services Organization, Inc., Conifer Health Solutions, LLC. (TH Medical), Network Medical Management (Apollo Medical Holdings, Inc.), MedPOINT Management, Inc., Vanguard Health Solutions, Prospect Medical Holdings, Inc., Centene Corporation, Advanced Medical Management, Pacific Partners Management Services Inc., a division of HCA Healthcare, MSO Inc. (Southern California) and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.