- Home

- »

- Next Generation Technologies

- »

-

U.S. Managed Services Market Size, Industry Report, 2030GVR Report cover

![U.S. Managed Services Market Size, Share & Trends Report]()

U.S. Managed Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution, By Managed Information Service (MIS), By Deployment, By Enterprise Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-217-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Managed Services Market Trends

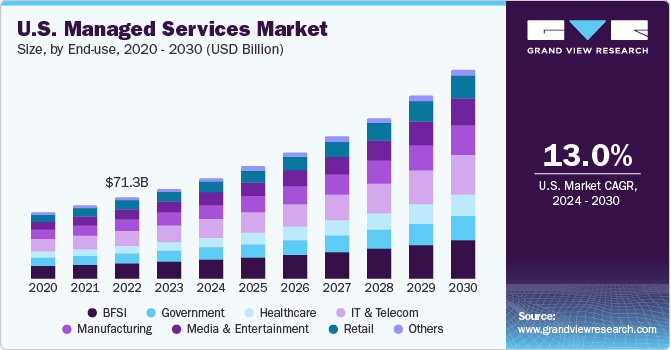

The U.S. Managed Services Market size was estimated at USD 79.17 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 13.0% from 2024 to 2030. The U.S. accounted for 26.5% of the global managed services market.Several U.S. organizations have begun a high level of business transformation to streamline their business operations and processes. The adoption of managed services is a part of their efforts to improve their service levels, ease their operational burdens, and proactively monitor resources to reduce the possibilities of any service downtime. Moreover, remote access to enterprise resources is driving demand for managed services in the U.S. market.

The subsequent rise in the number and size of data centers is presenting a growing need for managed data centers, which enable business entities to deploy new services to meet business demands rapidly. Additionally, it also allows the adoption of advanced technologies across new and existing company infrastructures in the U.S. market. Moreover, managed data center services help businesses optimize their business operations by enhancing automation in a hybrid architecture.

In addition, using hosted solutions deployment can simplify how U.S. organizations deliver services by offering virtual access. This method enables companies to access data from multiple connected devices at any time. Additionally, it provides greater flexibility for customization, making it easier to implement tailored analytical tools across various business channels. These factors are expected to fuel demand for managed data center services in the U.S. market over the forecasted period.

U.S. based Managed Service Providers (MSPs) are IT businesses overseeing and hosting specialized applications. They care, monitor, and safeguard application processes or outsourced networks on behalf of the organizations using managed services. MSPs possess the specialized infrastructure and human resources and hold all the necessary and relevant industry certifications. The growing need for specialized MSPs to reduce IT staffing costs and manage the complex IT infrastructure in the wake of a dynamic technology landscape is expected to drive the growth of the U.S. managed services market.

However, the regulatory landscape in the U.S. is evolving continuously, and organizations need help to ensure thorough regulatory compliance and appropriate organizational governance. U.S. based organizations are particularly finding it challenging to implement advanced solutions for storing and managing data while complying with various regulations and abiding by different business standards, both of which are changing dynamically in the wake of the growing instances of cybercrimes and data thefts. As a result, frequently changing regulations are restraining the U.S. managed services market.

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The managed services market in the United States is expected to grow due to significant advancements in technologies such as cloud computing, big data analytics, Artificial Intelligence (AI), Machine Learning (ML), and cybersecurity. Additionally, many U.S. companies are increasingly moving their business operations to cloud platforms, which is likely to create ample opportunities for the managed services market growth.

The U.S. managed services solutions are adopted across various industries especially in IT and telecommunication and healthcare. The U.S. companies are constantly striving to improve their services and stay ahead of substitutes. They focus on strengthening their portfolio of managed services to attract new customers and increase their revenue streams. To achieve this, these companies are committed to continuous innovation in their services, ensuring that they are always up-to-date with the latest industry trends and customer needs. By doing so, they are able to maintain their competitive edge and deliver top-notch services to their clients.

The growing size and complexity of U.S. regulations, which entails securing data, may have a significant impact on the market, influencing service delivery models and shaping industry standards. Stringent regulations and compliance requirements often force U.S. companies to opt for managed services to avoid changing regulatory guidelines. Still, the market has opportunities in the long run, and it is anticipated to propel the U.S. Managed Services Market growth in the forecasted period.

End-user U.S. companies may consider strengthening their internal IT infrastructure, which can hamper market growth. However, the growth of the U.S. managed services market is expected to be influenced by the concentration of end-users. Small and medium Enterprises (SMEs) in the United States are considerably seeking external assistance for managed service providers to access advanced IT solutions & services without investing in in-house technologies or infrastructure.

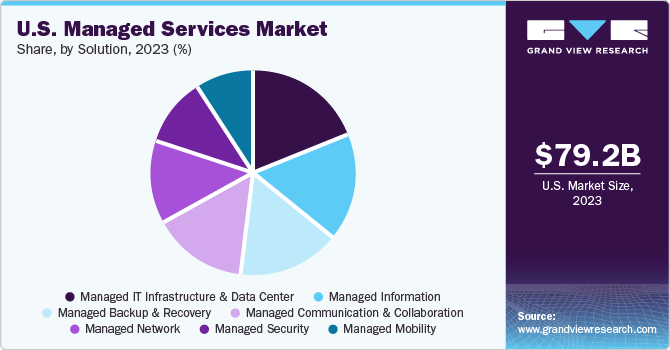

Solution Insights

Managed IT infrastructure & data center led the market and accounted for the highest revenue over 12.0% in 2023. A managed data center enables the deployment and rapid scaling of new services to meet business needs efficiently. It also enables significant adoption of next-generation technologies in existing and new business infrastructures. Managed data center services in a hybrid IT infrastructure help optimize operations through improved automation and management.

Managed security is anticipated to witness significant CAGR around 14% from 2024 to 2030 in the U.S managed services market. The utilization of managed security services is anticipated to significantly increase across various U.S. industries due to numerous benefits such as email threat management, data backup and restoration, security monitoring and management, and infrastructure support and maintenance management, among others. These factors are expected to drive the growth of the U.S managed security segment over the forecast period.

Managed Information Service (MIS) Insights

Business Process Outsourcing (BPO) led the market and accounted highest revenue in 2023. The use of BPO services is anticipated to be influenced by various factors, including a focus on process automation, investments in cloud computing, and attention to social media management tools. Large IT companies are expanding their presence in outsourcing services through various strategic activities such as mergers & acquisitions, and collaborations due to the rising demand for outsourcing services. As a result, BPO segment is anticipated to foster market share in the forecasted period.

Business support systems is anticipated to witness significant CAGR from 2024 to 2030 in the market. End-use industries in U.S. now opt for business support system services, such as business analysis, database integration, demand management, and project management, to enhance their productivity. Furthermore, managed systems provide specialized solutions for contact centers, enterprise-grade telephony, and crucial communications.

Deployment Insights

On-premise led the market and accounted for the highest global revenue in 2023. Several organizations in the U.S. have implemented on-premise managed services owing to the customization benefits of the software and services provided by on-premise service providers. A control center developed as part of an on-premise installation enhances operational efficiency, coordination, and control across all management responsibilities.

Hosted segment is anticipated to witness significant CAGR from 2024 to 2030 in the market. In the U.S., organizations opt for hosted deployment as it offers benefits such as high scalability & security and eliminates the need to upgrade cloud-based managed services regularly. Additionally, businesses prefer the hosted deployment method owing to easy upgrades and low operational costs. The U.S. firms save various license costs by upgrading the software systems when necessary. The hosted managed services deployment strategy is anticipated to become more popular over the forecast period.

Enterprise Size Insights

Large enterprise segment accounted for the largest market revenue share in 2023. Large enterprises are increasingly adopting managed services in U.S. to enhance security compliance, increase efficiency, reduce operating expenses and downtime, and accelerate time-to-market. Moreover, manage enterprise applications that can be customized according to individual needs, large enterprises are increasingly discarding their expensive, complicated IT environments with legacy systems that function in silos and impede agility, growth, and innovation.

Small & Medium Enterprises (SMEs) segment is expected to register the fastest CAGR during the forecast periodGovernments such as federal or states across the U.S. are undertaking consistent efforts to enhance the digital transformation journeys of their local SMEs through various campaigns. Such initiatives are creating a major impact on the U.S. managed services market growth as SMEs are observed using more managed services to improve their business operations. Additionally, several end-users have also witnessed a reduction in the overall operating costs owing to the adoption of distinct managed services. As the decrease in operating expenses plays a vital role in the productivity and profitability of a small business, the adoption of managed services among SMEs is poised to grow significantly over the forecast period.

End-use Insights

BFSI segment accounted for largest market revenue share in 2023. Financial services organizations increasingly adopt managed services to improve their focus on business resources, streamline IT operations, and enhance their digital transformation journeys. Moreover, the growing complexity in banking operations, owing to the rising number of security and compliance policies, is impelling organizations to opt for managed services that help in curbing complexities. Additionally, post-pandemic, a significant shift in customer demands has been observed across the U.S. BFSI industry.

Healthcare segment is expected to register the fastest CAGR during the forecast period. Protection of patient databases is becoming important since the healthcare sector has become a target for cybercriminals. Many healthcare businesses in the U.S. are implementing managed service technologies to protect patient data and provide secure financial transactions. Additionally, managed services facilitate the timely provisioning of personnel and medical equipment, boosting operational effectiveness and enhancing patient care and employee satisfaction.

Key U.S. Managed Services Company Insights

Some of the prominent participants operating in the market include AT&T Inc., International Business Machines Corporation, and Cisco Systems, Inc.

-

Unisys help organization with effective collaboration to drive innovation through digital workplace, cloud, enterprise computing and business process solutions.

-

Cisco Systems, Inc. is a global designer, manufacturer, and provider of networking hardware, telecommunications equipment, and services. The company offers hardware, software, and integrated communication solutions to large corporations as well as small- and medium-scale businesses. The company’s network and communication solutions also serve public institutions and government agencies.

-

Avaya Inc. is a global provider of unified communications, customer experience & contact centers, cloud devices, software, and services for intelligent and customizable real-time communication applications. It also offers professional services, managed services, support services, and learning and education services to customers located across the globe

-

Aryaka Networks, Inc. offers managed services for secure remote access, cloud migration, last mile connectivity, and to improve the performance of dynamic IP applications.

Key U.S. Managed Services Companies:

- Aryaka Networks, Inc

- AT&T Inc.

- Avaya Inc.

- BMC Software, Inc.

- Broadcom

- CenturyLink

- Cisco Systems, Inc.

- DXC Technology Company

- HCL Technologies Limited

- HP Development Company, L.P.

- International Business Machines Corporation

- ScalePad Software Inc.

- Unisys

Recent Developments

-

In February 2024, BMC, a global leader in Autonomous Digital Enterprise software solutions, joined forces with Amdocs to expedite connected digital operations across the telecommunications and financial services industries. This collaboration aims to deliver growth, automation, and efficiencies for customers.

-

In February 2024, Broadcom Inc. and Google Cloud announced plans to support license portability of VMware Cloud Foundation to Google Cloud VMware Engine. This collaboration enables customers to buy VMware Cloud Foundation software subscriptions from Broadcom and use them in Google Cloud VMware Engine and on-prem data centers.

-

In October 2023, Logicalis introduced a portfolio of Intelligent Connectivity solutions powered by Cisco Systems, including SASE, SSE, SD-WAN, and Private 5G. This will allow Logicalis customers to access digitally managed services built on Cisco technology and supported by the Logicalis Digital Fabric Platform.

-

In November 2022, Global technology solutions company Unisys Corporation and multi-cloud data services company Faction announced an end-to-end solution for fully-managed data protection, cyber recovery and business continuity services in both on-premises and multi-cloud environments.

U.S. Managed Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 88.13 billion

Revenue forecast in 2030

USD 183.47 billion

Growth Rate

CAGR of 13.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, managed information service (MIS), deployment, enterprise Size, end-use

Country scope

U.S.

Key companies profiled

Aryaka Networks, Inc.; AT&T Inc.; Avaya Inc.; BMC Software, Inc.; Broadcom; CenturyLink; Cisco Systems, Inc.; DXC Technology Company; HCL Technologies Limited; HP Development Company, L.P.; International Business Machines Corporation; ScalePad Software Inc.; Unisys

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Managed Services Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Managed Services Market report based on Solution, managed information service (MIS), deployment, enterprise Size, and end-use.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Managed IT Infrastructure & Data Center

-

Server Management

-

Storage Management

-

Managed Print Services

-

Others

-

-

Managed Network

-

Managed Wi-Fi

-

Managed LAN

-

Managed VPN

-

Managed WAN

-

Network Monitoring

-

Others

-

-

Managed Mobility

-

Application Management

-

Device Life Cycle Management

-

-

Managed Communication & Collaboration

-

Managed VoIP

-

Managed UCaaS

-

Others

-

-

Managed Information

-

Managed OSS/BSS

-

Business Process Management

-

-

Managed Security

-

Managed Firewall

-

Managed Vulnerability Management

-

Managed Risk & Compliance Management

-

Managed Antivirus/Antimalware

-

Managed Encryption

-

Managed Unified Threat Management

-

Managed SIEM

-

Managed IDS/IPS

-

Others

-

-

Managed Backup and Recovery

-

-

Managed Information Service (MIS) Outlook (Revenue, USD Billion, 2018 - 2030)

-

Business Process Outsourcing (BPO)

-

Business Support Systems

-

Project & Portfolio Management

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Hosted

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprise

-

Small & Medium-Sized Business (SME)

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Media & Entertainment

-

Retail

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. managed services market size was estimated at USD 79.17 billion in 2023 and is expected to reach USD 88.13 billion in 2024.

b. The U.S. managed services market is expected to grow at a compound annual growth rate of 13.0% from 2024 to 2030 to reach USD 183.47 billion by 2030.

b. Some key players operating in the U.S. managed services market include Aryaka Networks, Inc.; AT&T Inc.; Avaya Inc.; BMC Software, Inc.; Broadcom; CenturyLink; Cisco Systems, Inc.; DXC Technology Company; HCL Technologies Limited; HP Development Company, L.P.; International Business Machines Corporation; ScalePad Software Inc.; Unisys

b. The BFSI segment accounted for the largest revenue share of 19.38% in 2023. Financial services organizations increasingly adopt managed services to improve their focus on business resources, streamline IT operations, and enhance their digital transformation journeys.

b. The adoption of managed services is a part of their efforts to improve their service levels, ease their operational burdens, and proactively monitor resources to reduce the possibilities of any service downtime. Moreover, remote access to enterprise resources is driving demand for managed services in the U.S. market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.