- Home

- »

- Medical Devices

- »

-

U.S. Male Infertility Market Size, Industry Report, 2030GVR Report cover

![U.S. Male Infertility Market Size, Share & Trends Report]()

U.S. Male Infertility Market Size, Share & Trends Analysis Report By Test (DNA Fragmentation Technique, Oxidative Stress Analysis, Microscopic Examination, Sperm Agglutination), By Treatment (ART & Varicocele Surgery, Others), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-273-4

- Number of Report Pages: 101

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Male Infertility Market Size & Trends

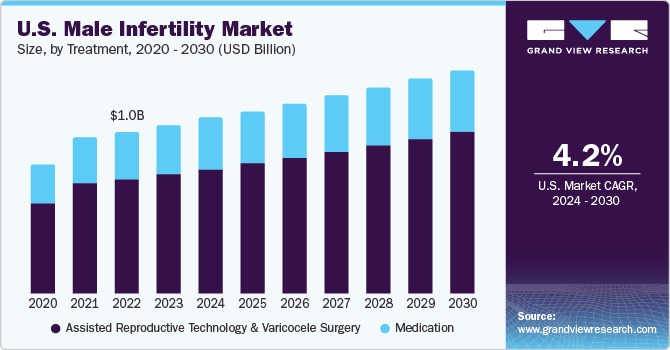

The U.S. male infertility market was valued at USD 1.01 billion in 2023 and is expected to expand at a CAGR of 4.2% from 2024 to 2030. Increasing awareness of fertility diagnosis paired with improving success rates of assisted reproductive technology (ART) is significantly driving the market growth. A higher success rate than other medications and advancements in technology are expected to increase the demand for ART, which is likely to drive growth over the forecast period.

In 2023, U.S. accounted for over 26.0% in the global male infertility market. Increase in number of approvals & launch of innovative devices, high adoption of technologically advanced devices, and significant healthcare spending are some of the key factors supplementing this market’s growth. Furthermore, the increasing disposable income is resulting in a high adoption rate of ART. This growth is also attributed to the large number of medical institutions offering ART-based services. The government is undertaking various initiatives to remove the stigma & hesitation around ART and raise public awareness through advertising & policies, which are likely to propel market growth. For instance, in over 14 states including New York, Rhode Island, Texas, Ohio, and Montana, the state governments have mandated health insurance coverage for infertility treatments, which is fueling the market for ART treatments.

The fertility rate in the U.S. has been decreasing over the years. As per the Centers for Disease Control and Prevention (CDC) data, birth rate in the country declined significantly from 2007 to 2022, dipping from 14.3 births per 1000 people to 11.1 births. According to WHO, over 15.0% of couples in the U.S. suffer from infertility. As per statistics, around 50.0% infertility cases are related to male. More distinctively, approximately 20.0% of infertility cases are entirely due to males, with an additional 30.0% to 40.0% cases involving both males and females.

Market Concentration & Characteristics

The market growth stage is medium (CAGR: <5%) and pace of the market growth depicts an accelerating trend. Continuous efforts in R&D are being carried out for improving the success rates of treatment. Companies are investing in the development of devices for identifying the root cause and targeted treatment. Furthermore, improved safety of patient data due to standardization of regulations is expected to increase patient preference for infertility treatments.

-

Introduction of advanced fertility treatments is likely to drive the U.S. male infertility market during the forecast period. Advanced innovations, including sperm preparation media & catheters by Irvine Scientific; in-vitro tubes & dishes by Thermo Fischer; three unique technologies Gavi, Geri, & Gems by Genea Biomedx; Eeva test (noninvasive system) by Merck, and a range of fertility treatments by Boston IVF are opening new growth avenues for the market.

-

The market is witnessing an increasing number of merger & acquisition (M&A) activities that are being undertaken by the prominent players. Several key U.S. male infertility companies are adopting these strategies to upgrade their portfolio. For instance, in March 2022, Ro, a virtual care direct-to-consumer company acquired a sperm testing & male fertility start-up Dad, to launch Ro Sperm Kit. The sperm kit allows users for home collection of samples for storage and analysis.

-

Semen analysis and sperm function tests are high-complexity tests and are regulated by the Clinical Laboratory Improvement Amendments of 1988 (CLIA '88) in the U.S. Strict compliance with standards and on-site inspections are essential. The FDA regulates drugs and devices used in IVF, followed by implementation of the Fertility Clinic Success Rate and Certification Act by CDC. Male fertility testing devices are classified under class II devices. The Centers for Medicare and Medicaid Services (CMS) is responsible for approving diagnostic tools and determining reimbursement for ART procedures.

Test Insights

The DNA fragmentation segment accounted for the largest revenue share of 21.9% in 2023. It is also expected to grow at the fastest CAGR over the forecast period. The dominance is attributable to the ability of the diagnostic techniques to provide a reliable analysis of sperm DNA integrity. Adoption of this technique is increasing in the market as sperm DNA fragmentation is a leading cause of infertility in males.

Semen analysis is an excellent method to test sperm count, morphology, motility, and pH. However, it does not give any information about the DNA integrity of sperm. Hence, a separate test is available to test DNA damage in sperm cells. DNA damage generally increases with age. Various factors such as chemicals, excessive heat, chronic prostate infection, smoking, and chemotherapy may damage the DNA in sperm. DNA fragmentation helps identify males with higher risk of infertility and to determine the treatment accordingly.

Treatment Insights

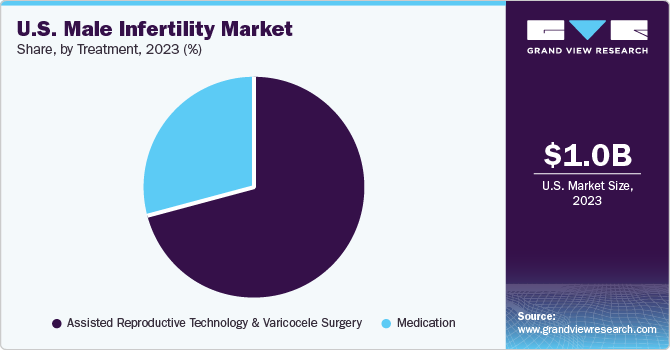

The ART and varicocele surgery segment dominated the market with a revenue share of 70.9% in 2023. It is also expected to grow at the fastest CAGR over the forecast period. The most preferred technique for treatment of male infertility is enhancing spermatogenesis with the help of hormonal therapy for a natural pregnancy, especially among males with a low sperm count.

ARTs are used to treat major factors responsible for male infertility, such as sperm autoantibodies, viral orchitis, epididymal dysfunction, accessory gland infection, and other idiopathic factors. Standardization of procedures through automation, regulatory reforms, and government funding for sperm storage are some of the contributing factors for the segment growth.

Key U.S. Male Infertility Company Insights

The market has been characterized by intense competition. Market players undertake strategies such as development of innovative technologies for diagnosis and treatment, acquisitions, and partnerships or collaborations for development and commercialization of products to remain competitive in the market. Moreover, market players are availing certification from the regulatory agencies to strengthen their position in the market.

Key U.S. Male Infertility Companies:

- Bayer Healthcare

- Andrology Solutions

- Aytu BioScience, Inc.

- Cadila Healthcare Ltd.

- Halotech DNA SL

- EMD Sereno, Inc.

- SCSA Diagnostics, Inc.

- Intas Pharmaceuticals Ltd.

Recent Developments

-

In August 2023, Reproductive Medicine Associates (RMA) acquired Conceptions Reproductive Associates of Colorado. RMA added Colorado to its network of 25 fertility centers in New Jersey, Texas, Florida, California, Pennsylvania, and Washington.

-

In July 2021, Hamilton Throne Ltd. Global provider of ART research acquired IVFTECH ApS (IVFtech) and its associated firm, K4 Technology ApS. IVFtech is dedicated to providing laminar flow workstations and huge-capacity incubators for the ART with the aid of its associated firm, K4. The transaction was worth USD 8 million.

U.S. Male Infertility Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.15 billion

Revenue forecast in 2030

USD 1.47 billion

Growth Rate

CAGR of 4.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test, treatment

Country scope

U.S.

Key companies profiled

Bayer Healthcare; Andrology solutions; Aytu BioScience, Inc.; Cadila Healthcare Ltd.; Halotech DNA SL; EMD Sereno, Inc.; SCSA Diagnostics, Inc.; Intas Pharmaceuticals Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Male Infertility Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. male infertility market based on test and treatment:

-

Test Outlook (Revenue in USD Million, 2018 - 2030)

-

DNA Fragmentation Technique

-

Oxidative Stress Analysis

-

Microscopic Examination

-

Sperm Agglutination

-

Computer Assisted Semen Analysis

-

Sperm Penetration Assay

-

Others

-

-

Treatment Outlook (Revenue in USD Million, 2018 - 2030)

-

Assisted Reproductive Technology and Varicocele Surgery

-

Medication

-

Frequently Asked Questions About This Report

b. Some key players operating in the U.S. male infertility market include Bayer Healthcare; Andrology solutions; Aytu BioScience, Inc.; Cadila Healthcare Ltd.; Halotech DNA SL; EMD Sereno, Inc.; SCSA Diagnostics, Inc.; and Intas Pharmaceuticals Ltd.

b. Key factors that are driving the U.S. male infertility market growth include the increasing infertility rate across the globe and the adoption of assisted reproductive technologies (ARTs).

b. The U.S. male infertility market size was estimated at USD 1.01 billion in 2023 and is expected to reach USD 1.15 billion in 2024.

b. The U.S. male infertility market is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 1.47 billion by 2030.

b. DNA fragmentation technique segment dominated the U.S. male infertility market with a share of 21.93% in 2023 owing to the ability of the diagnostic techniques to provide a reliable analysis of sperm DNA integrity.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."