U.S. Luxury Travel Market Size, Share & Trends Analysis Report By Type (Safari & Adventure, Luxury Trains), By Age Group (21-30 Years, 31-40 Years), By Booking Mode (Direct Booking, Concierge Services), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-180-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

The U.S. luxury travel market size was estimated at USD 397.91 billion in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030. The U.S. luxury travel industry is experiencing notable growth due to evolving consumer preferences and economic factors. As high-net-worth individuals seek more meaningful and personalized travel experiences, there is an increasing inclination toward exclusive destinations and curated itineraries that prioritize privacy, comfort, and authenticity. Rising disposable incomes among affluent segments, coupled with a post-pandemic focus on experiential travel, have further fueled this trend.

Additionally, the expansion of high-end travel services, such as bespoke private tours and luxury transportation options, has enhanced accessibility to unique and remote locations. Technological advancements, enabling seamless booking and tailored experiences, have also contributed to the heightened interest in premium tourism offerings. This shift underscores a broader transformation where luxury travel transcends opulence to deliver culturally immersive and once-in-a-lifetime experiences.

As high-net-worth individuals and affluent travelers increasingly prioritize exclusivity, personalization, and comfort, there is a noticeable shift toward bespoke travel experiences that cater to their sophisticated preferences. The post-pandemic era has also fueled a desire for meaningful and transformative journeys, with travelers seeking private escapes to remote and pristine destinations that offer peace, privacy, and wellness-focused experiences.

The rising importance of sustainable tourism has further driven demand, as luxury travelers now seek environmentally responsible itineraries and accommodations without compromising on comfort and service excellence. The rapid growth of high-end amenities such as private villas, luxury yachts, and chartered flights has significantly contributed to this market expansion. Moreover, technological advancements have empowered travelers with seamless access to curated travel experiences through AI-driven concierge services and personalized travel platforms.

The growing desire to escape the stress, hustle-bustle, and routine of everyday life has driven the attraction for travel. The increasing life expectancy of people worldwide and improved health conditions, even in old age, are encouraging more and more consumers to enjoy an active and adrenaline-driven lifestyle. Studies have shown that compared to previous generations, a rising number of retired employees in recent years have been expressing a greater desire to participate in physically challenging leisure activities. This trend has impacted the choice of activities offered by tour operators and hotels. Gentle exercise programs and relaxing beach vacations replace soft adventure tourist activities in the luxury travel market.

Luxury travel has evolved tremendously since the early 20th century with the emergence of the internet and smartphones. The availability of unlimited apps specifically designed to suit the needs of different kinds of travelers has made the entire process easier and more exciting. These travel apps and websites also inspire travelers to explore new ways to travel in luxury.

The value chain of the U.S. luxury travel industry comprises key players such as tourism boards and government organizations, suppliers/vendors, tour operators, travel agents, global distribution systems (GDSs) and companies, destination management companies, ground handlers, and travelers. Government or tourism boards help market countries or cities as tourist destinations for potential luxury travelers. Suppliers include hotels, restaurants, and other activity providers, who often serve as intermediaries to agents and travelers.

Additionally, there is an increasing desire for unique and personalized travel adventures, which has led to a surge in demand for customized luxury trips. The expansion of luxury travel services, including private jets, yachts, and exclusive resorts, has also enhanced the attractiveness of this market segment. Moreover, the influence of social media and digital marketing in showcasing aspirational travel experiences plays a crucial role in enticing potential travelers. Furthermore, a growing focus on wellness and sustainable travel options encourages affluent travelers to invest in luxury travel that aligns with their lifestyle values and preferences.

In January 2025, The Luxurist, a pioneering luxury travel ecosystem, officially launched in the U.S., with plans to expand into European markets. This platform leverages advanced travel technology to connect top-tier travel advisors with exceptional global hotel properties seamlessly. Backed by HBX Group, it boasts over 3,300 handpicked properties across 141 countries. The luxury tourists aims to revolutionize luxury travel by providing AI-enhanced itinerary planning, real-time booking, exclusive property access, and 24/7 concierge services, setting a new standard in the luxury travel industry.

Consumer Survey & Insights

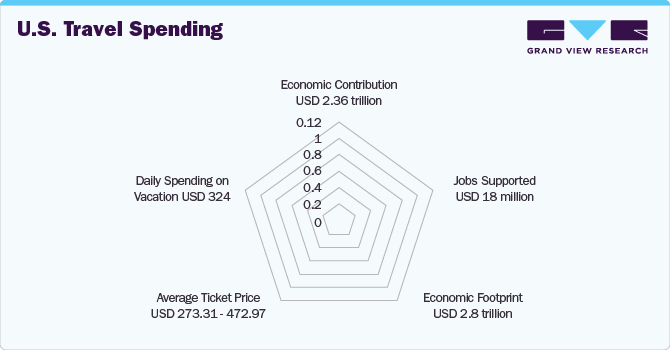

According to the World Travel & Tourism Council (WTTC), the U.S. Travel Association, the Bureau of Transportation Statistics (BTS), and Budget Your Trip. The U.S. stands as the world’s leading travel and tourism market, contributing USD 2.36 trillion to the national economy last year. This sector supports 18 million jobs across the country, with an economic footprint totaling USD 2.8 trillion. The average ticket prices at the top 10 busiest airports range from USD 273.31 to USD 472.97, with San Francisco having the highest. On average, travelers in the U.S. spend U.S. 324 per day on vacation, which includes USD 96 on meals, USD 46 on local transportation, and USD 262 on hotels. This data reflects the significant financial impact and extensive economic contributions of the U.S. travel and tourism industry.

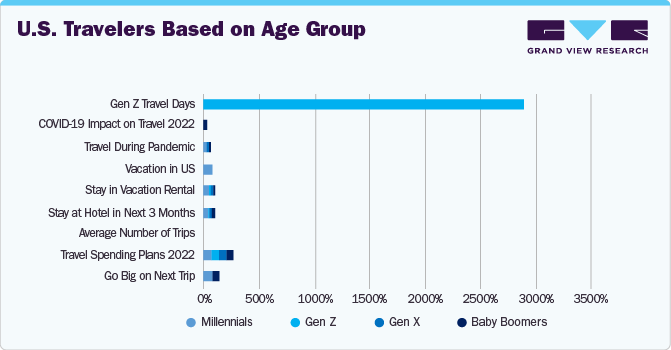

According to sources such as Forbes, The Vacationer, Roller, Press Reader, and Travel Perk, millennials are the most likely to spend significantly on their next trip, with 80% planning substantial travel compared to only 56% of travelers over the age of 50. In 2022, Gen Z individuals were expected to spend the most on travel, with 72% intending to spend the same or more than they did before the COVID-19 pandemic. This was followed closely by 70% of millennials, 67% of Gen X, and 61% of Baby Boomers. On average, millennials are expected to take 4.4 trips in the next 12 months, and they are most likely to stay at hotels (39%) and vacation rentals (46%).

Family travel is also popular among millennials, with 81% having taken their last vacation within the U.S. During the pandemic, only 11% of Baby Boomers traveled more, while 26% of Gen Zers and 25% of millennials increased their travel frequency. Despite concerns related to COVID-19, 82% of Boomers planned to take 1 to 5 trips in 2022. Gen Z travelers seek unique experiences, averaging 29 travel days per year.

Type Insights

Customized & private vacations accounted for a revenue share of over 27% in 2024, driven by a growing demand for personalized travel experiences that cater to individual preferences and privacy. This trend reflects an increasing desire among travelers to create unique, tailored journeys that offer exclusivity, comfort, and a high level of personalization. The rise in affluent consumers seeking bespoke travel solutions has significantly contributed to the growth in this segment, highlighting the importance of customization in the luxury travel market.

According to the enchanting Travels, tailor-made private tours in the U.S. feature 58 ecologically and culturally diverse national parks. Each park provides a variety of outdoor activities, including privately guided hikes and wildlife observation opportunities. Additionally, Enchanting Travels offers private boating excursions, luxurious glamping under starry skies, and secluded luxury hotel accommodations, ensuring a secure and expert-led experience in the USA's remarkable natural landscapes.

Culinary travel & shopping is expected to grow at a CAGR of 10.3% from 2025 to 2030. Culinary travel or food tourism packages comprise travel products and services with food- and/or drink-specific destinations, sites, attractions, or events. The primary purpose of culinary travel is to experience the unique food and drink of a particular region or area and understand the culture. Travelers generally participate in cooking classes, retracing historical culinary routes, exploring wine, beer, and spirits trails, attending food fairs and festivals, and touring food plants and processing centers for exploration. For instance, in January 2024, Brooklyn Dumpling Shop, an innovative fast-casual restaurant, launched its latest location at Resorts World New York City in Queens. This opening enhanced the venue's newly renovated food hall, offering a unique culinary experience that combines classic and contemporary dumplings. This strategic partnership bolsters Resorts World's appeal as a premier entertainment destination, drawing over 10 million visitors annually. The addition aligns with New York's tourism goals, reinforcing Queens' status as a vibrant food and entertainment tourism hub.

Age Group Insights

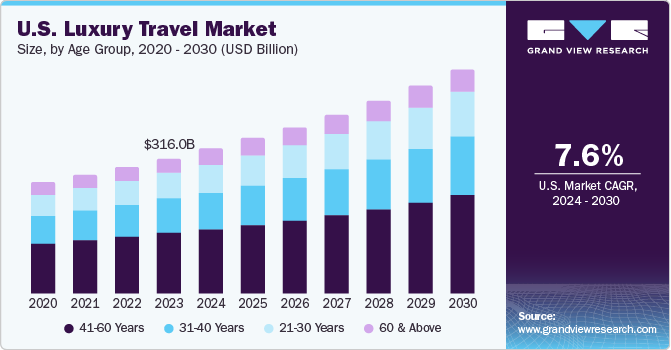

The use of luxury travel among the age group 41-60 years accounted for a share of about 38% of the overall U.S. luxury travel industry in 2024. This demographic’s significant share reflects their growing interest in and capacity for luxury travel experiences. It is driven by disposable income, a desire for unique and personalized vacations, and a focus on high-quality, exclusive travel services. Additionally, the increasing availability of luxury travel packages tailored specifically for this age group, advancements in travel technology making booking and planning more convenient, and a growing emphasis on wellness and experiential travel contribute to their prominent presence in the luxury travel market. Furthermore, many individuals in this age group have more leisure time, allowing them to explore and indulge in luxurious travel opportunities.

The 31- 40-year age group is expected to grow at a CAGR of 9.0% from 2025 to 2030. The growth is attributed to several factors, including the growing financial stability of individuals, increasing preference for luxury and unique travel experiences, and the influence of social media highlighting aspirational travel lifestyles. Additionally, advancements in travel technology and a strong focus on wellness and experiential travel contribute to this demographic's rising popularity of luxury travel.

Booking Mode Insights

Direct booking accounted for a revenue share of over 49% in 2024. This significant share reflects travelers' preference for booking directly through service providers, which often offer benefits such as better pricing, personalized customer service, and exclusive deals. The increasing trust in online platforms and the desire for a seamless booking experience further contribute to the dominance of direct bookings in the luxury travel market.

Booking through online travel agencies (OTAs) is expected to grow at a CAGR of 9.4% from 2025 to 2030 in the U.S. luxury travel industry. This anticipated growth is driven by the increasing convenience and accessibility offered by OTAs, which provide a wide array of options and competitive pricing. Additionally, the integration of advanced technologies such as AI and machine learning enhances user experiences and personalization, further boosting the preference for OTAs among travelers seeking efficient and tailored booking solutions.

Key U.S. Luxury Travel Company Insights

The U.S. luxury travel industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some key companies in the U.S. luxury travel market include Abercrombie & Kent USA, Lindblad Expeditions, Tully Luxury Travel Inc., Black Tomato, and others.

-

Abercrombie & Kent USA is a renowned name in the luxury travel industry, offering experiential travel since 1962. Known for its tailor-made journeys, the company specializes in creating unique, personalized travel experiences. Whether it is a private jet journey, a luxury safari, or a bespoke adventure, Abercrombie & Kent ensures every trip is extraordinary. Their offerings include private jet journeys, small group tours, luxury safaris, and cruises to exotic destinations around the world.

-

Lindblad Expeditions is another prominent player in the luxury travel industry, focusing on expedition cruises and adventure travel. The company is known for its small-ship voyages that offer immersive experiences in remote and pristine environments. Lindblad Expeditions emphasizes sustainable tourism and cultural immersion, providing travelers with opportunities to explore untouched landscapes and engage with local communities.

Key U.S. Luxury Travel Companies:

- Abercrombie & Kent USA

- Lindblad Expeditions

- Scott Dunn Ltd.

- Brownell Travel

- All Roads North

- Tully Luxury Travel Inc.

- Black Tomato

- Kensington Tours Ltd.

- Pique Travel Design

- The Luxury Travel Agency

Recent Developments

-

In January 2025, Trip Concierge, a leading luxury travel agency, launched Trip Concierge Luxury Cruises, a dedicated team for luxury cruise customers in the U.S. This new venture offers an array of services including pre-and post-cruise land tours, specialized onboard services, and dedicated travel experts for personalized experiences. Guests will enjoy cruises with Regent Seven Seas, Ritz-Carlton Yacht Collection, and others, with value-added benefits like up to USD 1,000 onboard credits. Leanna Houle, VP of Sales America, promises unparalleled elegance and refinement.

-

In December 2024, Luxury tour operator Abercrombie & Kent recently introduced two exclusive private jet itineraries for 2026, while also refining two existing journeys. These meticulously curated programs were designed to offer discerning travelers unparalleled access to remote and hard-to-reach destinations. The month-long expeditions were scheduled for February, May, September, and October, encompassing multiple countries and destinations worldwide aboard a private jet, providing a seamless and exceptional travel experience.

U.S. Luxury Travel Market Report Scope

|

Report Attribute |

Details |

|

Market revenue in 2025 |

USD 428.48 billion |

|

Revenue forecast in 2030 |

USD 634.27 billion |

|

Growth rate |

CAGR of 8.2% from 2025 to 2030 |

|

Actuals |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, age group, booking mode |

|

Country scope |

U.S. |

|

Key companies profiled |

Abercrombie & Kent USA; Lindblad Expeditions; Scott Dunn Ltd.; Brownell Travel; All Roads North; Tully Luxury Travel Inc.; Black Tomato; Kensington Tours Ltd.; Pique Travel Design; The Luxury Travel Agency |

|

Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Luxury Travel Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. luxury travel market report based on type, age group, and booking mode:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Customized & Private Vacations

-

Safari & Adventure

-

Cruises, Yachting & Small Ship Expeditions

-

Celebration Journeys

-

Culinary Travel & Shopping

-

Luxury Trains

-

Others (Eco-Tourism, Polar Travel, etc.)

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

21 - 30 Years

-

31 - 40 Years

-

41 - 60 Years

-

60 And Above

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Online Travel Agencies (OTAs)

-

Concierge Services

-

Frequently Asked Questions About This Report

b. The U.S. luxury travel market was estimated at USD 397.91 billion in 2024 and is expected to reach USD 428.48 billion in 2025.

b. The U.S. luxury travel market is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2030 to reach USD 634.27 billion by 2030.

b. Customized & private vacations dominated the U.S. luxury travel market with a share of around 27.15% in 2024. The growth of the segment is driven on account of a growing demand for personalized travel experiences that cater to individual preferences and privacy.

b. Some key players operating in the U.S. luxury travel market include Abercrombie & Kent USA, LLC; Lindblad Expeditions; Scott Dunn Ltd.; Brownell Travel; All Roads North; Kensington Tours Ltd.; Tully Luxury Travel; Black Tomato; Pique Travel Design; The Luxury Travel Agency.

b. Key factors that are driving the U.S. luxury travel market include the evolving trend of transformational travel surrounding wellness trips, and rising preference of customized and private tours.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."