- Home

- »

- Clinical Diagnostics

- »

-

U.S. Liver Cancer Diagnostics Market, Industry Report, 2033GVR Report cover

![U.S. Liver Cancer Diagnostics Market Size, Share & Trends Report]()

U.S. Liver Cancer Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Test Type (Laboratory Tests, Imaging, Endoscopy, Biopsy), By End-use (Hospitals & Diagnostic Laboratories, Pharmaceutical & CRO Laboratories), And Segment Forecasts

- Report ID: GVR-4-68040-290-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Liver Cancer Diagnostics Market Trends

The U.S. liver cancer diagnostics market size was estimated at USD 3.14 billion in 2024 and is projected to reach USD 4.44 billion by 2033, growing at a CAGR of 3.74% from 2025 to 2033. In the United States, liver and intrahepatic bile duct cancers remain a major health burden, with an estimated 42,240 new cases and 30,090 deaths projected in 2025 (National Cancer Institute; American Cancer Society). The U.S. liver cancer diagnostics market is driven by rising incidence linked to chronic hepatitis B/C infections, alcohol-related liver disease, and the growing prevalence of non-alcoholic fatty liver disease (NAFLD) and obesity. Increasing adoption of imaging modalities, biomarker-based blood tests, and molecular diagnostics is enhancing early detection and guiding targeted therapies, strengthening demand for advanced diagnostic solutions.

The U.S. liver cancer diagnostics market is experiencing rapid transformation, shaped by rising disease incidence, increasing innovation in early detection, and multiple FDA-backed approvals and designations that are reshaping clinical practice. According to the National Cancer Institute (NCI) and the American Cancer Society, an estimated 42,240 new cases of liver and intrahepatic bile duct cancer are expected to be diagnosed in 2025, with approximately 30,090 deaths projected in the same year. Hepatocellular carcinoma (HCC), the most common form of liver cancer, remains one of the fastest growing and deadliest cancers in the country, with mortality rates continuing to escalate due to late-stage detection and underlying risk factors such as hepatitis B and C, alcoholic liver disease, obesity, and the rising prevalence of non-alcoholic fatty liver disease (NAFLD).

Recent regulatory milestones are reshaping the treatment and diagnostics ecosystem. In July 2025, Sirtex Medical’s SIR-Spheres Y-90 resin microspheres received FDA approval for the treatment of unresectable HCC, making it the only radioembolization therapy approved for both HCC and metastatic colorectal cancer in the United States. Results from the DOORwaY90 clinical trial demonstrated outstanding efficacy, with an overall response rate of 98.5% and a 100% local tumor control rate, positioning SIR-Spheres as a powerful tool in liver-directed therapies.

Complementing therapeutic advances, diagnostics are also breaking new ground. In April 2025, Mursla Bio’s EvoLiver blood test received FDA breakthrough device designation for surveillance of HCC in patients with high-risk cirrhosis, marking the first such test in over five years. Backed by strong data from the MEV01 trial, EvoLiver demonstrated 86% sensitivity and 88% specificity in early-stage detection, significantly outperforming traditional ultrasound and AFP testing. By capturing organ-specific extracellular vesicles and employing multiomics biomarkers, EvoLiver introduces a more convenient, non-invasive, and highly accurate surveillance method with the potential to transform patient adherence and outcomes.

Strategic collaborations further highlight the market’s trajectory. In June 2025, FUJIFILM Medical Systems U.S.A. and Helio Health partnered to advance blood-based assays for early HCC detection, leveraging the HelioLiver Test in combination with Fujifilm’s µTASWako i30 system. Clinical data from the U.S. CLiMB trial showed higher sensitivity and specificity for early-stage HCC detection compared to existing modalities, underscoring the role of AI-driven biomarker panels in broadening surveillance access.

In parallel, FUJIFILM Healthcare Americas is leading the TRACER study, a large-scale, multi-center NIH-funded trial launched in 2024, evaluating the GALAD score, which combines biomarkers AFP, AFP-L3, and DCP with patient demographics to improve early HCC detection in high-risk patients. By enrolling 5,500 participants with cirrhosis or chronic hepatitis B, the study aims to validate biomarker-driven screening models that could reduce the rate of late-stage diagnoses.

Industry leaders are also focusing on biomarker-driven liquid biopsy platforms. In May 2024, Exact Sciences’ Oncoguard Liver liquid biopsy test, published in Clinical Gastroenterology and Hepatology, demonstrated 82% early-stage sensitivity and 88% overall sensitivity with 87% specificity, outperforming current AFP- and ultrasound-based methods. This test represents a significant advancement in HCC surveillance, with the potential to extend early detection to millions of at-risk Americans who remain unscreened.

Similarly, in November 2024, Delfi Diagnostics’ AI-powered liquid biopsy platform reported promising results, achieving 88% sensitivity at 98% specificity in liver cancer detection across diverse populations, including the U.S., EU, and Hong Kong. With its low-cost, scalable design, Delfi’s approach could more than double early detection rates compared to today’s standards.

At the same time, innovation is also advancing in fibrosis-related diagnostics. In October 2023, Siemens Healthineers’ Enhanced Liver Fibrosis (ELF) Test was granted FDA breakthrough device designation, addressing the unmet need of detecting advanced fibrosis in NAFLD/NASH patients through a non-invasive blood test. By replacing reliance on invasive biopsies, the ELF Test supports earlier identification of high-risk patients and better management of disease progression. In September 2023, Roche’s Elecsys GALAD score, which integrates AFP, AFP-L3, and PIVKA-II with demographic factors, also received FDA breakthrough device designation, highlighting the growing clinical recognition of biomarker-based algorithms as superior tools for detecting HCC at earlier stages.

Technological innovation extends to novel treatment modalities that intersect with diagnostics. In March 2024, Hoag Hospital became one of the first centers to deploy the Edison Histotripsy System, a robotic non-invasive technology using targeted ultrasound waves to destroy liver tumors without incisions. This innovation, FDA-approved for treating liver tumors, provides an alternative to radiation therapy and is already showing promise in patients otherwise ineligible for conventional surgery.

Expanding beyond diagnostics and therapies, in August 2024, Hepion Pharmaceuticals entered a strategic agreement with New Day Diagnostics to commercialize CE-marked diagnostic tests, including the mSEPT9 assay for early HCC detection. This move reflects the growing market opportunity, with the mSEPT9 test alone addressing an $8.7 billion global market projected to grow steadily through 2030. By targeting multiple disease areas alongside liver cancer, this collaboration broadens access to clinically validated diagnostics across the U.S. and Europe.

Together, these regulatory approvals, breakthrough designations, clinical trials, and strategic collaborations underscore a strong innovation-driven trajectory for the U.S. liver cancer diagnostics market. The shift toward liquid biopsies, AI-enabled biomarker algorithms, and non-invasive testing solutions is enabling earlier, more accurate detection of HCC, while novel therapies like Y-90 radioembolization and histotripsy are redefining treatment pathways.

As high-risk populations grow due to NAFLD, hepatitis, and obesity-related liver disease, the integration of advanced diagnostics into surveillance protocols will be essential. With survival rates as high as 70% when liver cancer is detected early, these developments mark a pivotal turning point, positioning the U.S. market as a global leader in innovation for precision oncology.

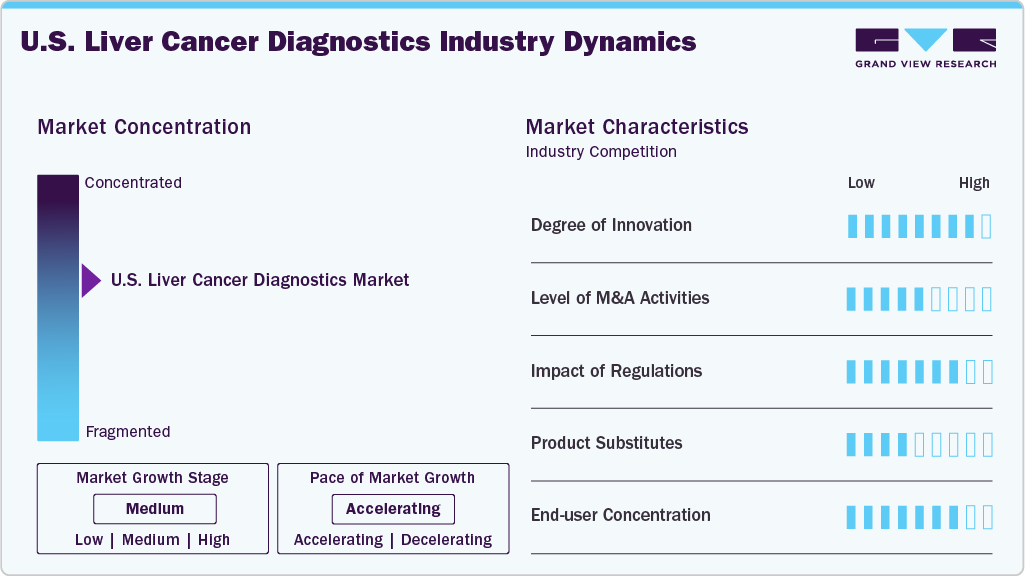

Market Concentration & Characteristics

The U.S. liver cancer diagnostics market shows a high degree of innovation, marked by FDA actions and rapid translation of multi-omics science. Breakthrough-designated blood tests (e.g., EvoLiver) and validated liquid biopsies (Oncoguard Liver, DELFI) greatly outperform ultrasound/AFP for early HCC detection. Biomarker algorithms (GALAD; AFP, AFP-L3, DCP) are in large NIH trials, while Siemens’ ELF advances noninvasive fibrosis staging that feeds surveillance. Parallel therapeutic advances (e.g., Y-90 radioembolization) reinforce the adoption of companion diagnostics. Overall, AI-enabled, blood-based, and algorithmic approaches are redefining surveillance pathways.

The U.S. liver cancer diagnostics market has witnessed moderate but strategic M&A activity, primarily aimed at strengthening early detection capabilities and expanding assay portfolios. Leading diagnostics firms and biotech companies are acquiring liquid biopsy start-ups and AI-driven biomarker developers to gain access to novel platforms for hepatocellular carcinoma (HCC) screening. Larger reference laboratories have also engaged in partnerships and acquisitions to integrate multi-omics and NGS-based panels into their services. These deals reflect a focused approach rather than high-volume activity, with emphasis on innovation-driven consolidation.

The U.S. liver cancer diagnostics market is heavily influenced by regulatory oversight, with agencies such as the FDA and CMS shaping test adoption and reimbursement. The FDA’s stringent approval pathways for liquid biopsy, imaging biomarkers, and NGS-based panels ensure diagnostic accuracy and patient safety, but can also delay market entry. At the same time, CMS coverage decisions play a pivotal role in driving adoption across hospitals and labs. Recent regulatory encouragement for precision oncology and biomarker-driven testing has accelerated investment, creating a supportive yet highly compliance-driven environment.

In the U.S. liver cancer diagnostics market, product substitutes primarily come from imaging modalities such as ultrasound, CT, and MRI, which remain standard tools for initial detection and monitoring. Serum biomarkers like AFP (alpha-fetoprotein) are also widely used, though they lack the sensitivity and specificity of advanced molecular tests. While these substitutes are more accessible and cost-effective, they cannot match the precision of NGS panels or liquid biopsy. As a result, substitutes may delay but not replace the adoption of advanced diagnostic tools.

In the U.S. liver cancer diagnostics market, end user concentration is largely centered around hospitals, specialized cancer centers, and academic medical institutions, which dominate due to their access to advanced diagnostic platforms, multidisciplinary expertise, and research-driven adoption of novel technologies such as NGS and liquid biopsy. Commercial diagnostic laboratories also hold a strong position, offering high-volume testing and broader accessibility across regions. Smaller clinics and physician offices play a limited role, often referring patients to larger centers. This concentration reflects reliance on specialized infrastructure and expertise for accurate liver cancer diagnosis.

Test Type Insights

Laboratory testing remains the largest contributor, accounting for 39.98% of revenue in 2024, supported by serum biomarker panels, immunoassays, and blood-based monitoring. Molecular tests, including next-generation sequencing (NGS), circulating tumor DNA (ctDNA), and microRNA profiling, are emerging as critical tools for early detection and prognosis, with liquid biopsy representing a promising non-invasive substitute for imaging modalities. Imaging tests such as ultrasound, CT, and MRI continue as frontline tools, but integration with biomarker data improves accuracy and clinical decision-making.

The U.S. liver cancer diagnostics market by test type reflects a rapidly evolving segment shaped by biomarker innovation, technological integration, and clinical adoption. Traditional biomarkers such as alpha-fetoprotein (AFP) remain widely used, particularly in cost-effective blood-based screening and disease monitoring. However, their limitations in sensitivity and specificity have accelerated the adoption of advanced biomarker assays such as AFP-L3 and des-γ-carboxyprothrombin (DCP), which provide enhanced diagnostic accuracy, especially in distinguishing hepatocellular carcinoma (HCC) from cirrhosis.

Notably, the FDA approval of CYRAMZA (ramucirumab) for AFP-high HCC patients highlights how biomarker-driven stratification is reshaping treatment and testing strategies. Going forward, multi-omics platforms, AI-assisted analytics, and histological biomarkers such as glypican-3, cytokeratin 19, and GP73 will expand the diagnostic toolkit, reinforcing the trend toward precision medicine in liver cancer care.

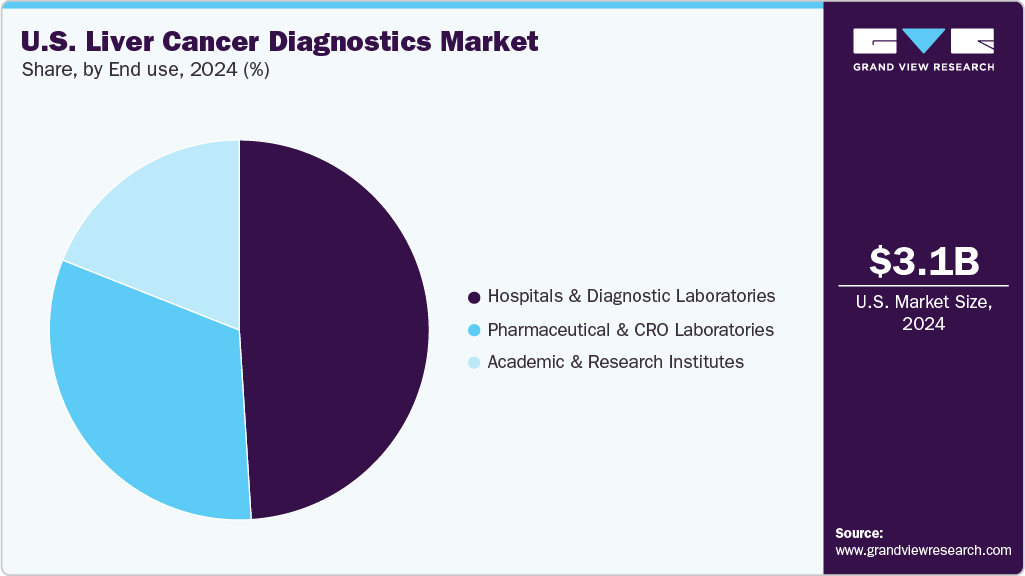

End Use Insights

The hospitals and diagnostic laboratories segment accounted for the largest revenue share of 49.26% in 2024, underscoring their central role in the U.S. liver cancer diagnostics landscape. Hospitals, equipped with advanced infrastructure and specialized departments, employ diverse diagnostic methods including imaging, biopsy, blood tests, and biomarker analysis to enable early detection and intervention. Diagnostic laboratories complement this by processing and analyzing patient samples with high precision, ensuring accurate results that guide clinical decision-making. Together, these institutions form the backbone of liver cancer diagnostics, delivering timely and reliable outcomes that improve patient survival rates.

Meanwhile, pharmaceutical companies and CRO laboratories are emerging as the fastest-growing segment, with a projected CAGR of 8.08% over the forecast period. CROs, in particular, are advancing research and innovation in diagnostic technologies, supporting clinical trials, precision medicine development, and regulatory validation. Their contribution is accelerating the adoption of novel diagnostic tools and expanding testing capabilities. The growing emphasis on digital collaboration, regulatory compliance, and faster turnaround times is also prompting hospitals to integrate remote technologies and advanced platforms. For example, in February 2025, Agilus Diagnostics partnered with Lucence to expand access to its LiquidHALLMARK test, an NGS-based liquid biopsy for ctDNA and ctRNA biomarkers, strengthening cancer diagnostic capabilities.

Key U.S. Liver Cancer Diagnostics Company Insights

The U.S. liver cancer diagnostics market is highly competitive, with key players including Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Thermo Fisher Scientific, Qiagen, Illumina, Guardant Health, and Exact Sciences. These companies dominate through strong portfolios in imaging, immunoassays, liquid biopsy, and NGS-based molecular diagnostics. Roche and Abbott lead in traditional assays, while Guardant Health and Exact Sciences are expanding rapidly in precision oncology. Collectively, top players capture a majority share, driving innovation and accessibility.

Key U.S. Liver Cancer Diagnostics Companies:

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Qiagen N.V.

- Siemens Healthineers

- Becton, Dickinson & Company

- Illumina, Inc.

- Epigenomics AG

- Koninklijke Philips N.V.

- Fujifilm Medical Systems U.S.A., Inc.

Recent Developments

-

In January 2025, the FDA granted breakthrough device designation to the EvoLiver test for monitoring hepatocellular carcinoma (HCC) in patients with high-risk cirrhosis, according to a recent announcement from the test's developer.

-

In October 2024, Hoag recently introduced a breakthrough technology for liver cancer care with the Edison Histotripsy System by HistoSonics, the only FDA-approved non-invasive therapy of its kind for liver tumors. Unlike radiation therapy, histotripsy uses focused ultrasound energy to generate microbubbles inside the tumor, creating mechanical pressure that destroys cancer cells while sparing healthy liver tissue. This precise outpatient procedure, performed by Hoag interventional radiologists, can be combined with chemotherapy and other treatments. With minimal side effects and same-day discharge, it represents a significant advancement in patient-centered liver cancer treatment.

U.S. Liver Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.31 billion

Revenue forecast in 2033

USD 4.44 billion

Growth rate

CAGR of 3.74% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, end use

Country scope

U.S.

Key companies profiled

Abbott Laboratories; Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche Ltd.; Qiagen N.V.; Siemens Healthineers; Becton, Dickinson & Company; Illumina, Inc.; Epigenomics AG; Koninklijke Philips N.V.; Fujifilm Medical Systems U.S.A., Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Liver Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. liver cancer diagnostics market report based on the test type, and end use:

-

Test type Outlook (Revenue, USD Million, 2021 - 2033)

-

Laboratory Tests

-

Biomarkers

-

Oncofetal and Glycoprotein Antigens

-

Enzymes and Isoenzymes

-

Growth Factors and Receptors

-

Molecular Markers

-

Pathological Biomarkers

-

-

Blood Tests

-

-

Imaging

-

Endoscopy

-

Biopsy

-

-

End use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Diagnostic Laboratories

-

Academic & Research Institutes

-

Pharmaceutical & CRO Laboratories

-

Frequently Asked Questions About This Report

b. The U.S. liver cancer diagnostics market size was estimated at USD 3.14 billion in 2024 and is expected to reach USD 3.31 billion in 2025

b. The U.S. liver cancer diagnostics market is projected to grow at a compound annual growth rate (CAGR) of 3.74% by 2033 to reach USD 4.44 billion by 2030

b. The laboratory tests segment accounted for the largest revenue share of around 39.98% in 2024. Laboratory testing includes biomarker tests and blood tests. Biomarker tests play a crucial role in the detection and management of liver cancer. These tests involve analyzing specific molecules or substances in the blood that can indicate the presence of liver cancer or provide information about the progression of the disease.

b. Some of the key players operating in the U.S. liver cancer diagnostics market include Abbott Laboratories, Guardant Health, Thermo Fisher Scientific, Inc., Illumina, Inc., F. Hoffmann-La Roche Ltd., and Qiagen N.V.

b. In the United States, liver and intrahepatic bile duct cancers remain a major health burden, with an estimated 42,240 new cases and 30,090 deaths projected in 2025 (National Cancer Institute; American Cancer Society). The U.S. liver cancer diagnostics market is driven by rising incidence linked to chronic hepatitis B/C infections, alcohol-related liver disease, and the growing prevalence of non-alcoholic fatty liver disease (NAFLD) and obesity. Increasing adoption of imaging modalities, biomarker-based blood tests, and molecular diagnostics is enhancing early detection and guiding targeted therapies, strengthening demand for advanced diagnostic solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.