- Home

- »

- Next Generation Technologies

- »

-

U.S. Legal Technology Market Size, Industry Report, 2033GVR Report cover

![U.S. Legal Technology Market Size, Share & Trends Report]()

U.S. Legal Technology Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution (Software, Services), By Type (E-discovery, Legal Research, Practice Management), By End Use (Law Firms, Corporate Legal Departments), And Segment Forecasts

- Report ID: GVR-4-68040-303-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Legal Technology Market Size & Trends

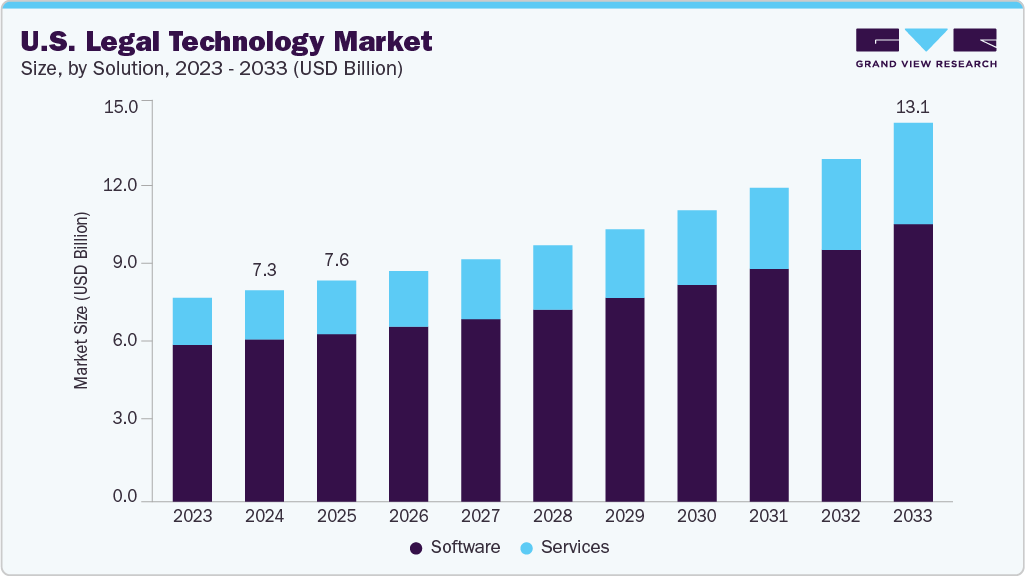

The U.S. legal technology market size was estimated at USD 7,316.9 million in 2024 and is projected to reach USD 13,116.4 million by 2033, growing at a CAGR of 7.0% from 2025 to 2033. The market growth is fueled by law firms and corporate legal departments investing heavily in technology solutions that automate case management, document review, e-discovery, contract analysis, and legal research, thereby enhancing operational efficiency and reducing manual workloads.

Artificial intelligence (AI) and machine learning are major drivers in the U.S. legal tech industry. AI-powered tools offer capabilities such as natural language processing, predictive analytics, and document automation, enabling legal professionals to extract insights faster and perform complex tasks more accurately. For example, AI legal assistants like Casetext's CoCounsel streamline routine and sophisticated legal work, freeing lawyers to focus on higher-value activities. These innovations also contribute to increased access to justice by making legal services more affordable and efficient.

The adoption of blockchain technology for smart contracts, which enhances transparency, security, and efficiency in legal transactions, is shaping the U.S. legal technology industry landscape. Furthermore, cloud-based legal services have gained prominence, supporting remote work and virtual collaboration, trends that have accelerated due to recent shifts in workplace dynamics. Regulatory technology (RegTech) is also emerging in the U.S., helping firms navigate complex compliance landscapes, particularly under stringent regulations such as the California Consumer Privacy Act (CCPA).

Furthermore, the U.S. legal technology industry is also witnessing a consolidation trend where law firms prioritize technology providers that offer stability, efficiency, and integration capabilities. Small Language Models (SLMs) are gaining traction for their privacy advantages and cost-effectiveness in specialized legal tasks, complementing larger AI models. Furthermore, increased training and adoption initiatives are underway to bridge the gap between technology investment and user proficiency among legal professionals.

Moreover, key companies are strategically focusing on large-scale adoption of generative AI and automation to enhance productivity, streamline workflows, and deliver client value, moving beyond experimentation to practical, data-driven implementations. Firms are prioritizing clear goal setting before technology adoption, investing heavily in training to ensure effective use, and shifting toward alternative pricing models aligned with client expectations. Collaboration with alternative legal service providers (ALSPs) is increasing to optimize efficiency by outsourcing routine tasks, while the consolidation of technology vendors ensures stability and integration. Such strategies by key companies are expected to drive the U.S. legal technology industry's growth in the coming years.

Component Insights

The software segment dominated the market with a revenue share of over 75% in 2024, driven by the increasing demand for automation and digital transformation within legal processes. Cloud-based solutions are growing rapidly due to their scalability and remote accessibility, especially post-pandemic. AI-powered tools, such as natural language processing and predictive analytics, are being integrated into software to enhance document review, legal research, and case management. In addition, cybersecurity concerns push vendors to focus on data protection features. User-friendly, customizable interfaces are becoming a trend to meet diverse law firms' and corporate needs.

The services segment is expected to witness the fastest CAGR of over 8% from 2025 to 2033. Legal technology services are expanding as firms seek expert implementation, integration, and training support for new tools. The complexity of modern software demands tailored consulting and ongoing maintenance, fueling growth in managed services and tech support. The rise of hybrid legal models, combining traditional legal expertise with tech-driven efficiency, is pushing service providers to offer strategic advisory roles. Increasing regulatory compliance requirements also drive demand for services that ensure systems meet legal and ethical standards. Client expectations for faster turnaround times and cost transparency are shaping service offerings.

Type Insights

The contract lifecycle management (CLM) segment dominated the market in 2024, propelled by the need to streamline contract creation, negotiation, and compliance processes, reducing risks and accelerating business cycles. The growing volume and complexity of contracts in both law firms and corporate legal departments emphasize automation’s value in reducing manual errors and improving visibility. The growing integration with enterprise systems such as CRM and ERP is becoming essential. Trends include AI-driven clause analysis, contract analytics, and automated renewal alerts. Organizations prioritize scalability and user-friendly platforms to support cross-functional teams and remote collaboration.

The analytics segment is expected to witness the fastest CAGR from 2025 to 2033, driven by the growing demand to leverage data for predictive insights, risk assessment, and performance measurement. Law firms and corporate legal departments increasingly use analytics to inform litigation strategy, optimize resource allocation, and benchmark performance against peers. The integration of big data and machine learning technologies enhances the accuracy of outcome predictions and client advisories. There is a growing trend toward visual dashboards and real-time data reporting, making analytics more accessible to non-technical legal professionals. Privacy and ethical use of data remain critical considerations.

End Use Insights

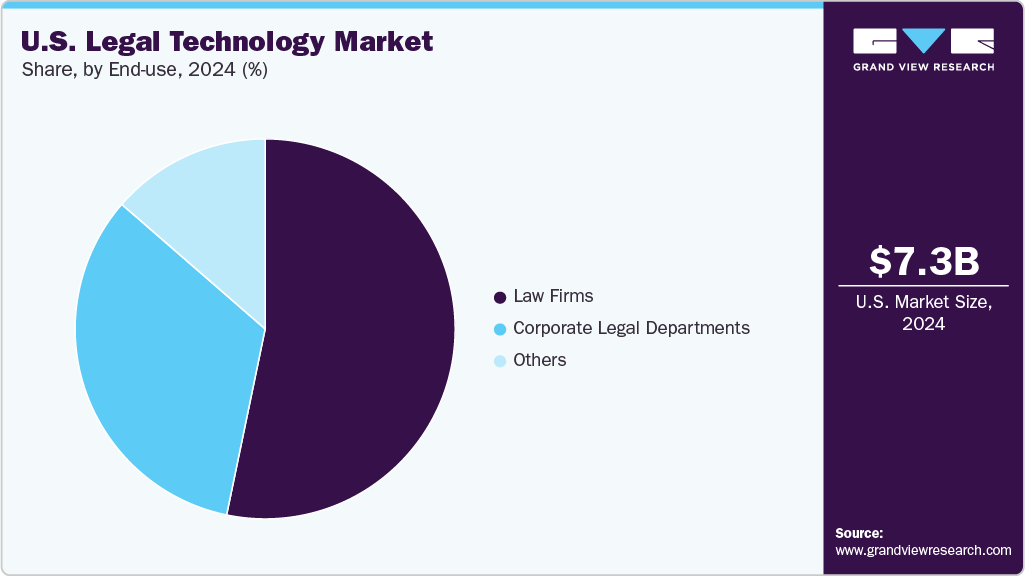

The law firms segment accounted for the largest market share in 2024. Law firms are adopting technology to improve efficiency, reduce costs, and meet client demands for transparency and speed. Key drivers include competitive pressure to offer innovative services, manage increasing workloads, and comply with evolving regulations. Cloud adoption, mobile access, and AI tools for legal research, e-discovery, and case management are widespread trends. The emphasis on cybersecurity and remote work capabilities continues to shape tech investment.

The corporate legal departments segment is expected to witness the fastest CAGR from 2025 to 2033. Corporate legal departments are driving tech adoption to increase operational efficiency, reduce legal spending, and better manage regulatory compliance. They are increasingly leveraging CLM systems, e-billing, and matter management tools integrated with broader enterprise technology stacks. Risk management and data privacy are top priorities, fueled by stricter regulations such as GDPR and CCPA. Corporate legal teams are also adopting self-service portals and AI tools to handle routine tasks, freeing lawyers for strategic work. The trend toward digital transformation is further supported by increased collaboration with external law firms via secure platforms.

Key U.S. Legal Technology Company Insights

Some of the key players operating in the market are DocuSign, Inc., and LexisNexis Legal & Professional Company, among others.

-

DocuSign, Inc. is a global provider of electronic signature technology and digital transaction management solutions. The company enables organizations to securely prepare, sign, act on, and manage agreements digitally. Its cloud-based platform significantly accelerates contract workflows, reducing reliance on paper and manual processes. The company serves a wide range of industries, including legal, real estate, financial services, and healthcare. It continuously innovates by integrating AI and automation tools to enhance contract lifecycle management and compliance.

-

LexisNexis Legal & Professional, a division of RELX Group, is a prominent provider of legal research, risk management, and business analytics solutions. The company offers a comprehensive suite of software and content services that support law firms, corporate legal departments, government agencies, and academic institutions. The company specializes in delivering advanced legal research databases, practice management tools, and analytics platforms powered by AI and machine learning. LexisNexis is known for its authoritative legal content, extensive case law archives, and innovative technologies designed to streamline legal workflows and improve decision-making.

Icertis, Inc. and Filevine, Inc. are some of the emerging market participants in the U.S. market.

-

Icertis is a U.S.-based software company specializing in AI-powered contract lifecycle management (CLM). The company offers its flagship platform, Icertis Contract Intelligence (ICI), to enterprises across various industries. The platform leverages artificial intelligence to digitize, organize, and centralize business contracts, enabling organizations to automate processes, maximize contract value, ensure compliance, and manage risk through insights derived from their commercial agreements.

-

Filevine, Inc. is a cloud-based legal technology company that provides a comprehensive legal work platform that streamlines case management, document automation, billing, and analytics for law firms and legal teams. Filevine's platform is designed to enhance productivity and collaboration within legal practices, offering customizable tools that integrate with existing workflows.

Key U.S. Legal Technology Companies:

- Icertis, Inc.

- Filevine Inc.

- DocuSign, Inc.

- Casetext Inc.

- ProfitSolv, LLC

- Knovos, LLC

- Mystacks, Inc.

- TimeSolv Corporation

- Everlaw, Inc.

- LexisNexis Legal & Professional Company

Recent Developments

-

In May 2025, Filevine introduced an innovative feature within its FilevineAI platform, enabling legal professionals to "Chat with Your Case." This embedded AI assistant provides instant, conversational access to comprehensive case data, including notes, documents, communications, deadlines, and more

-

In February 2025, Icertis, Inc. announced the integration of its platform with DeepSeek R1. This collaboration is part of Icertis' Omni Model strategy, offering customers the flexibility to choose from various AI models to address complex contracting challenges.

-

In January 2023, Everlaw, Inc. secured a five-year, up to USD 10.6 million task order with the U.S. Department of the Interior (DOI) to modernize its electronic discovery (e-discovery) and Freedom of Information Act (FOIA) processes.

U.S. Legal Technology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,617.0 million

Revenue forecast in 2033

USD 13,116.4 million

Growth Rate

CAGR of 7.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, type, and end use

Country scope

U.S.

Key companies profiled

Icertis, Inc.; Filevine Inc.; DocuSign, Inc.; Casetext Inc.; ProfitSolv, LLC; Knovos, LLC; Mystacks, Inc.; TimeSolv Corporation; Everlaw, Inc.; LexisNexis Legal & Professional Company.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Legal Technology Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. legal technology market report based on solution, type, and end use:

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Cloud-based

-

On-premises

-

-

Services

-

Consulting Services

-

Support Services

-

Others

-

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

E-discovery

-

Legal Research

-

Practice Management

-

Analytics

-

Compliance

-

Document Management

-

Contract Lifecycle Management

-

Time-Tracking & Billing

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Law Firms

-

Corporate Legal Departments

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. legal technology market size was estimated at USD 7,316.9 million in 2024 and is expected to reach USD 7,617.0 million in 2025

b. The U.S. legal technology market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2033 to reach USD 13,116.4 million by 2033.

b. The software segment led the market with a revenue share of over 76% in 2024. The increasing trend toward digital transformation and the widespread adoption of remote work practices are playing a pivotal role in driving the demand for software solutions in the legal technology market.

b. Some key players operating in the U.S. legal technology market include Icertis, Inc.; Filevine Inc.; DocuSign, Inc.; Casetext Inc.; ProfitSolv, LLC; Knovos, LLC; Mystacks,Inc.; TimeSolv Corporation; Everlaw, Inc.; LexisNexis Legal & Professional Company

b. Factors such as rising demand for efficiency in highly complex legal work and increasing investments in research & development are driving the U.S. legal technology market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.