- Home

- »

- Homecare & Decor

- »

-

U.S. Laundry Facilities & Dry-Cleaning Services Market, Report 2030GVR Report cover

![U.S. Laundry Facilities & Dry-Cleaning Services Market Size, Share & Trends Report]()

U.S. Laundry Facilities & Dry-Cleaning Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Coin-Operated Services, Retail Laundry/Dry Cleaning Services), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-127-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

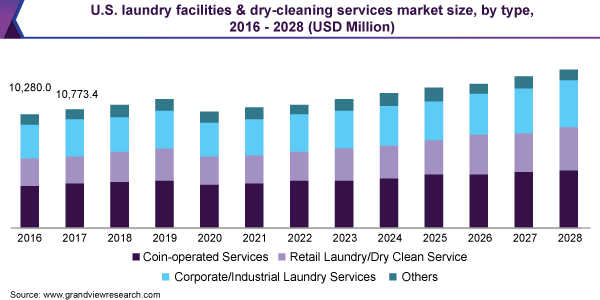

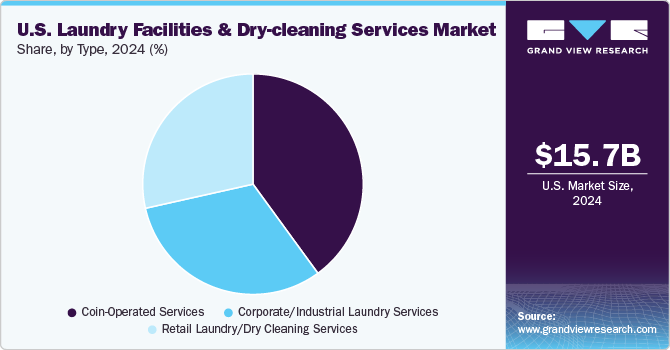

The U.S. laundry facilities & dry-cleaning servicesmarket size was estimated at USD 15.75 billion in 2024 and is expected to grow at a CAGR of 6.3% from 2025 to 2030. As more Americans live in urban areas where in-unit laundry is less common, the convenience of professional laundry services has become essential. In addition, busy schedules drive demand for time-saving services that reduce household chores, especially as many facilities offer pickup and delivery options to accommodate fast-paced lifestyles, likely favoring the market growth.

Technological advancements have played a pivotal role in driving the market growth. Over the past decade, integrating digital platforms, automation, and smart laundry systems has revolutionized the industry, making it more efficient, accessible, and customer-centric. One of the key technological innovations is adopting sophisticated software and mobile applications that streamline the ordering process for consumers and businesses. Customers can now book laundry or dry-cleaning services via apps or websites, schedule pick-ups, and track the status of their laundry in real-time. This level of convenience and transparency has significantly enhanced the customer experience and increased service usage frequency.

Laundry & dry-cleaning service providers focus on advancements in application development to create a more user-friendly experience, which favors market growth. They also focus on adding various features to improve user experience. For instance, filter and search options allow customers to easily select required services based on price and turnaround time. These apps also allow customers to personalize cleaning preferences and pick-up and drop timings based on availability.

Furthermore, the rising demand from the corporate and hospitality sectors fuels the demand for laundry & dry-cleaning services in the U.S. In the hospitality sector, hotels, resorts, and vacation rentals require frequent and high-volume laundry services to maintain the quality of linens, towels, uniforms, and guest clothing. With growing competition and a focus on guest satisfaction, establishments in this industry are under pressure to ensure pristine linen quality and hygiene standards. Outsourcing these tasks to professional laundry services ensures efficiency and reduces the burden on in-house staff, allowing businesses to focus on core operations.

The stringent linen cleaning requirements of the hospitality industry directly drive the growth of the laundry facilities & dry-cleaning services market by creating a consistent demand for professional, high-capacity cleaning solutions. Hotels, resorts, and other hospitality establishments require frequent and large-scale linen cleaning, adhering to strict hygiene, quality, and sustainability standards. This high volume of linen rotation and specific cleaning protocols encourages many businesses to outsource these tasks to professional laundry services, ensures efficiency, and reduces the burden on in-house staff, allowing businesses to focus on core operations.

Type Insights

The coin-operated services segment held a market share of about 40.0% in 2024. The coin-operated laundry services market remains a vital segment within the broader laundry services industry, catering primarily to urban residents, college students, and individuals in densely populated areas with limited access to in-home laundry facilities. This market benefits from consistent demand, driven by the high proportion of renters and multi-unit dwellings in metropolitan areas. Coin-operated laundromats are valued for their convenience and affordability, with some facilities now enhancing their appeal by incorporating card payment systems, Wi-Fi, and modernized, energy-efficient machines to attract tech-savvy and eco-conscious users. This trend likely drives the segment's demand.

The demand for retail laundry/dry cleaning services is expected to grow at a CAGR of 7.0% from 2025 to 2030. Retail laundry and dry-cleaning services are increasingly popular in the U.S. for convenience and time savings. Many individuals, especially busy professionals, find that outsourcing laundry allows them to focus on other tasks or enjoy downtime. These services are particularly useful for large or delicate items like duvets, rugs, and suits that require specialized care. In addition, dry cleaning preserves fabric quality, texture, and shape, helping clothes last longer and reducing the need for frequent replacements. This combination of convenience and garment care makes dry cleaning appealing to many.

Regional Insights

The laundry facilities & dry-cleaning services market in the northeast U.S. accounted for a market share of around 26% in 2024.Population growth in the northeast U.S., reversing previous declines, signals potential stabilization for the region's laundry facilities and dry-cleaning services market. Large cities saw a 0.2% growth in 2023 (U.S. Census Bureau, May 2024), and demand for these services in the northeast U.S. has increased with the gradual population influx. Larger populations in urban areas tend to drive up demand for convenient laundry and dry-cleaning services, especially in densely populated cities where space for home laundry machines may be limited. This reversal of decline suggests an opportunity for businesses to capitalize on growing urbanization.

The demand for laundry facilities & dry-cleaning services market in the southeast U.S. is expected to grow at a CAGR of 6.8% from 2024 to 2030. The Southeastern U.S. has experienced significant population growth, outpacing the national average by nearly 40% over the past 50 years, largely driven by remote work and a desire for less dense living environments, according to a blog published by HKS Inc. in September 2022. This influx of residents and businesses, including numerous Fortune 500 companies relocating to cities like Raleigh and Atlanta, has spurred economic expansion exceeding 10% in 2021. As the region continues to attract diverse industries, the demand for laundry facilities and dry-cleaning services is expected to rise. This growth presents opportunities for businesses to establish services that cater to the evolving needs of a larger, more dynamic population.

Key U.S. Laundry Facilities & Dry-Cleaning Services Company Insights

The market is highly fragmented, with a mix of national chains, regional players, and numerous small independent operators competing for market share. Major brands like Tide Cleaners and Lapels Dry Cleaning have established strong brand recognition, while others like Comet Cleaners and CD One Price Cleaners appeal to cost-conscious customers with competitive pricing. The market is influenced by urbanization trends, with demand highest in densely populated areas where many rely on external laundry services. As convenience becomes a key factor, on-demand laundry services and mobile app-based solutions are also gaining traction, intensifying competition within this evolving landscape.

Key U.S. Laundry Facilities & Dry-cleaning Services Companies:

- CSC ServiceWorks, Inc.

- Lapels Dry Cleaning

- Yates Dry Cleaning & Laundry Services

- ByNext

- Lavatec Laundry Technology GmbH

- E-Laundry LLC

- Tide Cleaners

- Rinse, Inc.

- ZIPS Dry Cleaners

- The Huntington Company

Recent Developments

-

In September 2024, Tide Cleaners and Tide Laundromats announced the expansion of their new locations in Florida. This growth reflects Tide's ongoing strategy to broaden its footprint in key markets, offering both dry-cleaning and laundry services. The new Florida locations aim to provide customers with convenient, high-quality garment care solutions backed by Tide's trusted brand. This expansion is part of the company's commitment to meeting the increasing demand for reliable and accessible laundry and dry-cleaning services across the region.

-

In July 2024, Lapels Cleaners announced the expansion of its operations in North Carolina by opening new locations, further growing its presence in the state. The company, known for its environmentally friendly cleaning services, continues offering signature dry-cleaning solutions focusing on sustainability and customer convenience. This expansion is part of Lapels' broader strategy to increase its footprint in key regions, providing residents access to eco-friendly garment care through innovative processes and technology. The new locations aim to meet the area's rising demand for green cleaning services.

-

In June 2024, ZIPS Cleaners announced a partnership with Mulberrys Garment Care in a strategic move to expand its service offerings. This partnership aims to combine ZIPS' affordable one-price dry-cleaning model with Mulberrys' premium, eco-friendly garment care services. By working together, the companies seek to provide a broader range of dry-cleaning and laundry solutions, appealing to customers who prioritize both cost-effectiveness and sustainability. The collaboration is set to enhance the reach and capabilities of both brands in the garment care industry.

U.S. Laundry Facilities & Dry-Cleaning Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.60 billion

Revenue forecast in 2030

USD 22.51 billion

Growth rate (revenue)

CAGR of 6.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Country scope

U.S.

Key companies profiled

CSC ServiceWorks, Inc.; Lapels Dry Cleaning; Yates Dry Cleaning & Laundry Services; ByNext; Lavatec Laundry Technology GmbH; E-Laundry LLC; Tide Cleaners; Rinse, Inc.; ZIPS Dry Cleaners; The Huntington Company

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Laundry Facilities & Dry-cleaning Services Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. laundry facilities & dry-cleaning services market report based on type and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Coin-Operated Services

-

Retail Laundry/Dry Cleaning Services

-

Corporate/Industrial Laundry Services

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Northeast

-

Southwest

-

Midwest

-

West

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. laundry facilities & dry-cleaning services market was estimated at USD 15.75 billion in 2024 and is expected to reach USD 16.60 billion in 2025.

b. The U.S. laundry facilities & dry-cleaning services market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 22.51 billion by 2030.

b. The West region dominated the U.S. laundry facilities & dry-cleaning services market, with a share of around 20% in 2024. This is owing to the rising demand for trendy U.S. laundry facilities & dry-cleaning services across the region coupled with rising key players' initiatives to introduce technologically advanced products, such as coin—or card-operated machines.

b. Some of the key players operating in the U.S. laundry facilities & dry-cleaning services market include CSC ServiceWorks, Inc.; Lapels Dry Cleaning; Yates Dry Cleaning & Laundry Services; ByNext; Lavatec Laundry Technology GmbH; E-Laundry LLC; Tide Cleaners; Rinse, Inc.; ZIPS Dry Cleaners; and The Huntington Company

b. Key factors driving the U.S. laundry facilities and dry-cleaning services market growth include the increasing number of people joining the workforce, technological advancements, consumers' increasingly opting for laundry facilities and dry-cleaning services, and rising residential and commercial building construction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.