- Home

- »

- Next Generation Technologies

- »

-

U.S. Laser Cutting Machines Market, Industry Report, 2030GVR Report cover

![U.S. Laser Cutting Machines Market Size, Share & Trends Report]()

U.S. Laser Cutting Machines Market (2024 - 2030) Size, Share & Trends Analysis Report By Process (Fusion Cutting, Flame Cutting, Sublimation Cutting), By Power (Low Power, High Power), By End-use, By Type, And Segment Forecasts

- Report ID: GVR-4-68040-287-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Laser Cutting Machines Market Trends

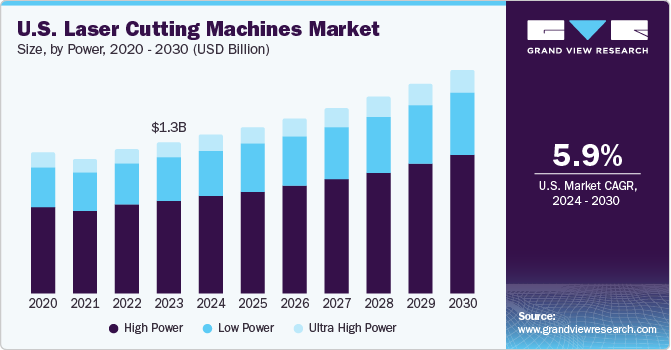

The U.S. laser cutting machines market size was estimated at USD 1.32 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. Laser-cutting machines play a significant role in manufacturing electronic components with complicated designs & precise cuts and delivering high-quality goods, leading to increased demand. Manufacturers aim to improve operating costs, enhance production, and decrease downtime. The rising adoption of industry 4.0 technologies, such as the Internet of Things (IoT), data analytics, and automation, has led to maximizing the efficiency of laser cutting machinery due to real-time information exchange that enables optimum output by allowing operators to monitor and manage their production process.

Automation reduces errors and increases productivity with less human intervention. In March 2024, TRUMPF launched the Runability Guide, an inaugural iteration of an AI-driven solution designed to streamline the operation of the high-performance TruMatic 5000 punch laser machine. TRUMPF's AI-powered software enables users to expedite and simplify the machine's setup, potentially eliminating idle periods of up to 20 minutes.

Due to high cutting flexibility & accuracy, laser cutting tools are widely used in the pharmaceuticals, packaging, automotive, aerospace, and metal fabrication industries, as they deliver high-quality goods with maximum outcomes. The U.S. is home to prominent automotive and aerospace companies, such as GM, Ford, Chevrolet, Chrysler, and Boeing, which are significant users of laser-cutting machinery. The focus on smart home automation, new product developments, and rapid expansion of the consumer electronics market in the U.S. are among the key factors responsible for driving product demand, thereby supporting market growth.

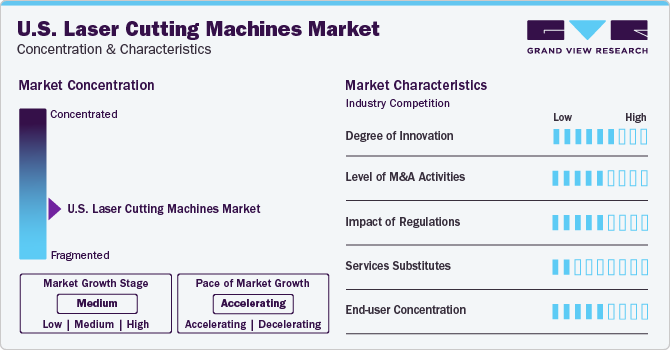

Market Concentration & Characteristics

The industry growth stage is medium, and the pace is accelerating. Technological advancements, such as improved laser sources, automation, and software integration, are driving the market growth. These advancements increase the efficiency & precision and expand the capabilities of laser-cutting machines.

Substitutes for laser cutting machines include plasma cutters, waterjet cutters, CNC routers, and CNC milling machines. Each alternative has strengths and limitations. Manufacturers must consider factors, such as precision requirements, material compatibility, budget, location, machine capabilities, and technical support while manufacturing the machines.

Rapidly growing end-user industries, such as electronics, automotive, aerospace, healthcare, and metal fabrications drive the product demand. These industries require high-precision cutting solutions for various applications, such as metal sheet cutting, shaping multiple body panels, cutting & processing printed circuit boards, and others.

Process Insights

The flame-cutting segment held the largest revenue share of 44.1% in 2023. Fast cutting speed, cutting precision, and finishing improvement offered by flame-cutting machines have led to growth in this segment. Flame cutting is used to cut and process steel and high-thickness materials. The demand for the flame-cutting process is expected to rise due to the increased demand for carbon alloy timing and small steel parts.

The fusion-cutting segment is anticipated to register the fastest CAGR during the forecast period. Fusion laser cutting machine easily cuts structural steel and electrical sheets for developing and manufacturing motors. Due to the ease of cutting and high flexibility offered by fusion cutting, this segment is expected to grow over the forecast period.

Power Insights

The high-power laser-cutting machines segment held the largest revenue share in 2023. With increased accuracy, precision, and power compared to traditional lasers, cutting multiple layers and large quantities is easy with these tools. These machines have smaller laser beam diameters, which result in fewer heat-affected zones (HAZ). As there is less HAZ, there is more accuracy and precision. The output power of a high-power laser-cutting tool is between 200W and 500W.

The low-power laser-cutting machine segment is anticipated to grow significantly over the forecast period. These machines help create complex shapes and decrease errors. Due to fine and delicate cutting, there is an increase in demand for these machines in various industries, such as packaging, electronics, and jewelry, which is driving the segment's growth.

Type Insights

The fiber lasers segment held the largest revenue share in 2023. These lasers offer faster cutting speeds, which boost output, and precisely cut various materials, such as plastic, metals, and composites. This high accuracy enables manufacturers to achieve enhanced precision and productivity levels, boosting their demand.

The solid-state lasers segment is expected to grow significantly over the forecast period. Their high power levels and excellent efficiency make them useful for industrial laser-cutting applications. Due to lower operating costs, low maintenance, high-quality output, and precise cutting, the adoption of solid-state lasers is anticipated to increase in the automotive, aerospace, and electronics industries.

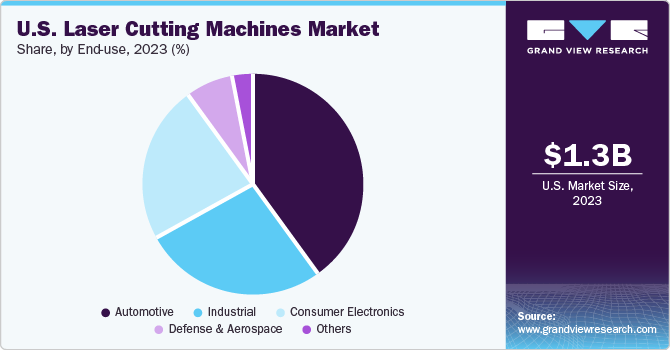

End-use Insights

The automotive sector held the largest share in 2023. Laser-cutting machines are used for welding and cutting automotive parts, such as doors, body panels, exhaust systems, engine parts, and exhaust components. Laser-cutting machines reduce errors, increase precision, and help build complex parts. These factors increase the manufacturing output of the companies.

The consumer electronic segment is anticipated to witness the fastest CAGR from 2024 to 2030. Laser-cutting machines are used in various industries, including consumer electronics. These machines are used for printing circuit boards, cutting and drilling mobile phone components, and finishing electronic components by reducing material waste and eliminating the need for complex tooling, ultimately leading to cost savings.

Key U.S. Laser Cutting Machines Company Insights

Some of the key companies operating in the U.S. laser cutting machine market include Coherent Corporation, IPG Photonics, AMADA WELD TECH Inc., DPPS Lasers Inc., and others.

-

Coherent Corp. manufactures high-quality materials and optics for industrial lasers. The company provides diverse applications and innovations for the electronics, communications, medical, industrial, and instrumentation markets. The company launched the next-generation pump laser diode in semiconductor lasers, with an output power of 65W for industrial and consumer applications

-

IPG Photonics develops and manufactures a variety of fiber lasers and amplifiers used in electronics, communications, biotechnology, entertainment, and other industries. Its technology platform enables superior output power and beam quality at a lower cost than competitors

Key U.S. Laser Cutting Machine Companies:

- Alpha Laser US

- AMADA WELD TECH Inc.

- Coherent Corp.

- DPPS Lasers Inc.

- Epilog Laser

- FANUC American Corporation

- Han’s Laser Corporation

- IPG Photonics

- Kern Lasers System

- Nukon.us

- Rofin-Sinar Technologies Inc.

Recent Developments

-

In January 2023, Coherent Corp. launched a Monaco infrared laser with 150 W output power to cut sizeable OLED display glass. This high-output power machine operates larger glass sheets used in smartphones. The new Monaco 1035-150-150 produces more pulse energy and power than existing configurations. It enables the precise cutting of large glass panels to create OLED screens that fit perfectly in next-generation IT devices

-

In September 2022, LPKF launched a new tool, ProtoLaser H4. This tool is used as a driller as well as a milling cutter. The ProtoLaser features a powerful laser and has an independent mechanical processing head. Both are mounted on a granite base and do not rely on a tool magazine. Without any need for multiple machines and reducing turnaround times, The ProtoLaser H4 switches between laser processing, drilling, and routing, ensuring optimal efficiency throughout the production process

-

In September 2022, Epilog Laser launched the Fusion Maker Laser System, an innovative CO2 laser engraving, cutting, and marking system designed for entry-level users. This cutting-edge system merges affordability with industrial-grade engineering, delivering top-notch performance. Users can achieve superior results while working with a wide range of materials, such as wood, acrylic, textiles, paper, and plastic

U.S. Laser Cutting Machines Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.95 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Process, power, end-use, type

Key companies profiled

Alpha Laser US; AMADA WELD TECH Inc.; Coherent Corp.; DPPS Lasers Inc.; Epilog Laser; FANUC American Corp.; Han’s Laser Corp.; IPG Photonics; Kern Lasers System; Nukon.us; Rofin-Sinar Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Laser Cutting Machines Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. laser cutting machines market report based on the process, power, end-use, and type:

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Fusion Cutting

-

Flame Cutting

-

Sublimation Cutting

-

-

Power Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Power

-

High Power

-

Ultra High Power

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Consumer Electronics

-

Defense and Aerospace

-

Automotive

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid State Lasers

-

Gas Lasers

-

Semiconductor Lasers

-

Fiber Lasers

-

Frequently Asked Questions About This Report

b. The U.S. laser cutting machines market size was estimated at USD 1.32 billion in 2023 and is expected to reach USD 1.38 billion in 2024

b. The U.S. laser cutting machine market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 1.95 billion by 2030

b. Flame cutting held the largest market share of 44.1% in 2023. Fast cutting speed, cutting precision, and finishing improvement have led to the growth of flame-cutting machines

b. Some key players operating in the U.S. laser cutting machine market include Alpha Laser US, AMADA WELD TECH Inc., Coherent Corp., DPPS Lasers Inc., Epilog Laser, FANUC American Corporation, Han’s Laser Corporation, IPG Photonics, Kern Lasers System, Nukon.us, and Rofin-Sinar Technologies Inc.

b. Factors such as advancements in hardware and software and rising demand for customization and personalization are driving demand in US laser cutting machine market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.