- Home

- »

- Medical Devices

- »

-

U.S. Laparoscopic Retrieval Bag Market, Industry Report, 2030GVR Report cover

![U.S. Laparoscopic Retrieval Bag Market Size, Share & Trends Report]()

U.S. Laparoscopic Retrieval Bag Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Detachable, Non-Detachable), By Technique (Manual Opening, Automatic Opening), By Surgeries, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-396-0

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

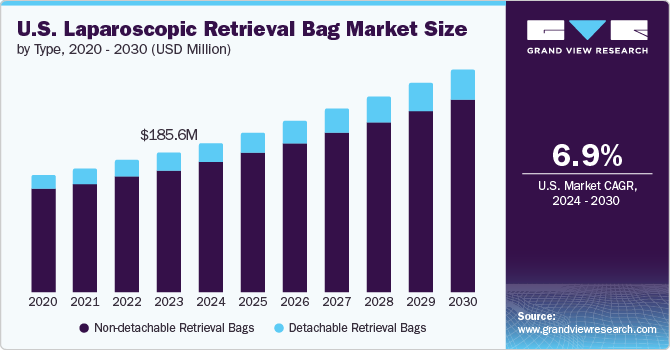

The U.S. laparoscopic retrieval bag market size was estimated at USD 185.60 million in 2023 and is projected to grow at a CAGR of 6.90% from 2024 to 2030. The laparoscopic retrieval bag market in the U.S. is driven by the growing demand for minimally invasive surgeries and a growing number of laparoscopic bariatric, gynecological & urological surgeries. Furthermore, the increasing prevalence of obesity in the country is expected to boost the demand for laparoscopic retrieval bag market.

For instance, in 2022, all U.S. states and territories recorded an obesity prevalence of over 20%, with more than one in five adults affected. The Midwest region boasted the highest obesity rate, with a staggering 35.8% of the population affected, and followed closely by the South with 35.6%. The Northeast region had an obesity rate of 30.5%, while the West region had a rate of 29.5%, according to U.S. Centers for Disease Control and Prevention.

Trends that are shaping the laparoscopic retrieval bag market in the U.S. include the development of specialized designs to meet the specific demands of various surgical procedures, reusable bags, and integration of laparoscopic retrieval bags with automated systems are increasingly becoming popular. For instance, EndoCatch retrieval bag, offered by Medtronic, is a cutting-edge solution for laparoscopic retrieval bag market. This innovative device features a rigid frame that enables easy specimen capture and extraction.

The unique design of the EndoCatch retrieval bag features a cone-shaped construction that facilitates smooth specimen removal while minimizing the risk of contamination. This cone shape allows for effortless specimen retrieval, reducing the risk of damage or disruption during the process. The rigid frame ensures that the bag remains stable and secure throughout the procedure, providing surgeons with added confidence and control.

The number of bariatric surgeries is significantly increasing, leading to a considerable rise in hospital admission rates, thus driving the market growth. According to the American Society for Metabolic and Bariatric Surgery (ASMBS) report, the total number of bariatric surgeries increased by around 41% from 2020 (198,651) to 2022 (279,967). Further, sleeve gastrectomy procedures increased by 221% from 2020 (488) to 2022 (1,567), as per the same source. The CDC Behavioral Risk Factor Surveillance System, in 2022 reported that West Virginia (41%), Louisiana (40.1%), Oklahoma (40.0%), and Mississippi (39.5%) had the highest rates of adult obesity in the same year. This makes the current increase in the obese population a significant factor contributing to the growth of the laparoscopic retrieval bag market in this region.

In addition, the increasing prevalence of uterine cancer and uterine fibroids is predicted to boost market growth in the U.S. over the forecast period. According to the American Cancer Society, around 67,880 new cases of uterus cancer are expected to be diagnosed by the end of 2024. In the U.S., uterine fibroids are responsible for 39.0% of all hysterectomies performed annually, making them the leading indications for hysterectomy.

Moreover, according to the International Agency for Research on Cancer, in 2022, about 13,920 cervical cancer cases were reported in the U.S.In 2021, the percentage of women receiving hysterectomies increased with age: 2.8% for women aged 18 to 44, 22.1% for women aged 45 to 64, around 35.0% for women aged 65 to 74, and 41.8% for women aged 75 & older. In addition, growing number of colon surgeries is also expected to fuel the market growth in the U.S. over the forecast period. As per the Society of American Gastrointestinal and Endoscopic Surgeons, over 600,000 colon surgeries are performed annually in the U.S.

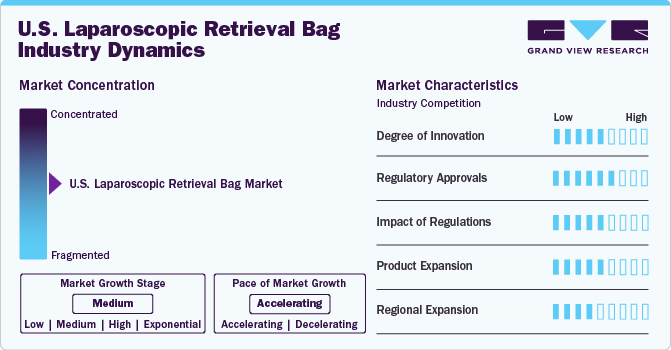

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The market is characterized by increasing demand for laparoscopic surgeries coupled with growing prevalence of obesity, gynecological and urological diseases.

The market has witnessed a moderate to high degree of innovation in recent years. The market is witnessing the introduction of new products with advanced features, improved designs, and enhanced types, which have significantly impacted the industry. Some of the innovations include the use of bags in a wide range of procedures, unique deployment mechanisms, an innovative guide bead that makes it easy to reopen and close the bag, and color-coded bags to facilitate the choice of size. Some companies have also developed ripstop nylon retrieval bags which are a popular choice for laparoscopic retrieval due to their durability, tear resistance, ease of use, and breathability. They offer several benefits, including increased surgeon confidence, improved patient safety, reduced cost, and enhanced visualization. For instance, Medtronic is the only company that now offers a next-generation retrieval ripstop nylon retrieval bag.

The market is regulated by the Food and Drug Administration (FDA), which oversees the safety and effectiveness of medical devices, including laparoscopic retrieval bags. The FDA's regulatory framework provides a framework for the development, testing, and approval of new products. Laparoscopic retrieval bags are classified as Class I or II devices, depending on their level of risk. Class I devices are considered low-risk and are subject to minimal regulation, while Class II devices are considered moderate-risk and are subject to more stringent regulations.

Regulations often set standards for safety and efficacy, driving manufacturers to invest in R&D to meet these requirements. Companies prioritize the development of innovative features and advancements in existing technologies to not only meet regulatory requirements but also to ultimately enhance patient outcomes and improve healthcare quality. Compliance with these regulations is mandatory, which can increase the cost and time required for product development and market entry. Additionally, Medicare and Medicaid policies influence the procurement strategies of Clinics, especially with regard to reimbursement rates and coverage for advanced medical equipment.

Market players are focusing on expanding their product portfolios to cater to a broader range of patient needs. The use of advanced types, such as nylon bags, color-coded bags, and large volume bags is expected to increase in the development of new products. Further, manufacturers are also focusing on developing products that cater to specific surgical procedures and patient needs, while also integrating their products with other instruments and systems.

Within the market, many companies focus on addressing several patient demographics or meeting specific therapeutic requirements. The market includes large, established companies such as Medtronic, CONMED Corporation, Teleflex Incorporated, Johnson & Johnson Services, Inc. (Ethicon), and Applied Medical Resources Corporation which offer a broad range of products and have significant market shares.

Forming strategic partnerships or collaborations with local distributors, healthcare providers, and key opinion leaders can facilitate market entry and accelerate adoption. Collaborating with established entities can provide valuable insights into regional market nuances, regulatory requirements, and customer preferences.

Brand Share Analysis

The laparoscopic retrieval bag market is dominated by a few key players, with Johnson & Johnson Services, Inc. (Ethicon) holding the largest market share. Other prominent players include Medtronic. CONMED Corporation, and Applied Medical Resources Corporation, among others. The market is expected to grow at a significant rate in the coming years, driven by the increasing adoption of minimally invasive surgery and the growing demand for advanced surgical instruments. However, the market also faces challenges such as high competition among manufacturers and regulatory requirements for product approval. To capitalize on growth opportunities, manufacturers must focus on innovation, product development, and strategic partnerships.

Company

Brand

Description

Johnson & Johnson Services, Inc. (Ethicon)

- ENDOPOUCH

The Endopouch Retrieval Bag is a popular and highly regarded laparoscopic retrieval bag designed by Ethicon, a subsidiary of Johnson & Johnson. The Endopouch is a single-use, sterile bag used to remove soft tissue, organs, and other surgical specimens during laparoscopic procedures.

Medtronic

- ReliaCatch

- EndoCatch

- Endobag

The Reliacatch, EndoCatch, and Endobag retrieval bags by Medtronic offer a range of benefits to surgeons and healthcare professionals involved in laparoscopic procedures. With their unique designs, easy-to-use features, and high-performance capabilities, these products are essential components of any laparoscopic surgery arsenal.

CONMED Corporation

- Anchor

Its unique design, easy-to-use features, and high-performance capabilities make it an essential component of any laparoscopic surgery arsenal. With its ability to reduce the risk of complications and improve patient safety, the Anchor Retrieval Bag is a valuable asset for any surgeon or healthcare professional involved in laparoscopic procedures.

Applied Medical Resources Corporation

- Inzii

Under Inzii brand, the company offers two types of bags including polyurethane and nylon bags. These bags enable multiple deployments and multiple specimen extractions within the same procedure.

Teleflex Incorporated

- MemoBag

The MemoBag Specimen Retrieval System is a cutting-edge solution designed to simplify the deployment, handling, and retrieval of pre-loaded tissue bags, ensuring effective protection against contamination in the operating field. This innovative system streamlines the surgical process, allowing for efficient and safe specimen retrieval.

Type Insights

Non-detachable segment dominated the market in 2023 driven by the rising demand for minimally invasive surgeries and the need for safe specimen extraction in cancer treatment & other procedures. These bags are expected to be increasingly important in modern surgical practice. The increasing prevalence of chronic diseases, such as cancer, which often require surgical intervention, is another key segment driver. The high incidence of bladder cancer, with approximately 83,190 new cases annually in the U.S., as per the American Cancer Society, highlights the critical need for effective surgical treatments.

Retrieval bags play a crucial role in procedures such as cystectomies and transurethral resections, safely containing tumors and facilitating their removal. As the fourth most common cancer in men, with 63,070 new cases annually, the demand for these devices is particularly pronounced. Their use supports advancements in minimally invasive surgery, reducing complications and enhancing patient outcomes. This highlights retrieval bags’ essential role in managing bladder cancer and improving the efficacy of surgical interventions.

The detachable segment is expected to register the fastest growth with a CAGR of 7.88% during the forecast period. Detachable bags offer greater precision and accuracy during surgical procedures, which is becoming increasingly important in modern surgery. This growing demand for precision and accuracy is expected to drive growth in the detachable bag segment. Medtronic and CONMED Corporation are among the leading companies in the industry that specialize in manufacturing detachable retrieval bags.

Technique Insights

Manual opening segment dominated the market in 2023due to the growing prevalence of minimally invasive surgical procedures in the U.S. Manual opening laparoscopic retrieval bags require two graspers to hold the bag edges and open it manually after introduction into the abdomen. They are suitable for most adnexal surgeries and are often more cost-effective than automatically opening bags. These bags are commonly used for removing tissue specimens such as gallbladders, appendices, lymph nodes, and adrenal glands during laparoscopic procedures.

Manual opening laparoscopic retrieval bags are used in various surgical procedures, including adnexal surgeries such as appendectomy, cholecystectomy for gallbladder removal, and lymph node dissection. They facilitate efficient specimen retrieval, reduce surgical fatigue by eliminating the need for manual deployment efforts, and ensure compatibility with standard laparoscopic instruments like graspers and scissors. Their versatility allows them to accommodate various specimen types, including tissue samples, gallstones, and surgical debris, making them adaptable to various surgical scenarios.

Further, the cost-efficiency of manual opening bags compared to automatic alternatives is a significant driver for their widespread use in healthcare facilities. They offer a streamlined retrieval process that saves surgical time and enhances operating room efficiency. Manual opening bag designs include rigid frames for structural integrity, expandable configurations for ample working space, and secure closure mechanisms to prevent specimen leakage & contamination.

Automatic opening segment is expected to register the fastest growth with a CAGR of 7.70% during the forecast period driven by the growing demand of technologically advanced retrieval bags for ease of use, patient safety, and reducing the time of surgical procedures. The automatic opening technique in laparoscopic retrieval bags contributes to surgical efficiency by eliminating the need for manual bag opening, thereby saving time and reducing contamination risks during procedures. These bags simplify the surgical process, enhance precision in specimen retrieval, and reduce physical strain on surgeons by automating the deployment process.

Automatic opening bags are designed to securely enclose specimens such as gallbladders, appendices, and lymph nodes, ensuring a sterile environment while optimizing surgical workflow. They contribute to faster specimen removal and reduce surgical site exposure time, which is crucial for minimizing infection risks.

Surgeries Insights

General surgery segment dominated the market in 2023. Laparoscopic retrieval bags are most frequently used in common general surgery procedures including cholecystectomies, hernia repairs and appendectomies. These work as bags for retrieving tissues, organs, or any other foreign objects from abdomen. The dominance of general surgery segment is attributable to the fact that many surgeons have embraced laparoscopy in performing these surgeries which have various advantages such as reduced postoperative pain, shorter hospitalizations and rapid recovery times.

The demand for laparoscopic retrieval bags in general surgery is driven by several factors including rising incidences of gallstones and hernias as well as increased preference for minimally invasive surgeries. In addition, increasing popularity of bariatric surgeries and other weight loss procedures is also driving the growth of laparoscopic retrieval bag market.

Market leaders in laparoscopic retrieval bags are focusing on developing innovative products tailored for the surgeons’ common requirements. This comes with various features such as enhanced closing systems or greater strength of the materials making them suitable for clearing off body parts and tissue safely without any chance of complications occurring.

The bariatric surgery segment is expected to register the fastest growth with a CAGR of 8.08% over the forecast period driven by growing prevalence of obesity, unhealthy lifestyles, coupled with increasing demand of laparoscopic procedures. Bariatric surgeries, such as sleeve gastrectomy, Roux-en-Y Gastric Bypass (RYGB), and others, are minimally invasive procedures that require specialized instruments, including retrieval bags, to safely remove tissue specimens & surgical debris from the abdominal cavity.

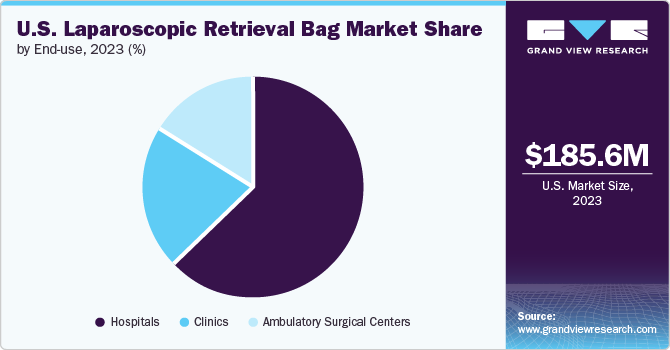

End Use Insights

Hospital segment dominated the market in 2023 due to its high patient volume, increasing prevalence of gynecological diseases, increasing preference for minimally invasive surgeries, and government initiatives driving the adoption of evidence-based treatments. As the market continues to evolve, companies must prioritize innovation, digital health solutions, and patient engagement to stay competitive and capitalize on growth opportunities. Laparoscopic retrieval bags are essential in hospitals across various surgical specialties such as general surgery, gynecology, urology, and oncology.

They help reduce infection risks and complications by containing and removing surgical materials within a sealed environment, ensuring sterile conditions & enhancing patient safety.Hospitals excel in managing complex cases and emergencies, offering specialized care with advanced equipment and a wide range of specialists. While hospitals are preferred for major surgeries requiring overnight stays, clinics and Ambulatory Surgical Centers (ASCs) provide more personalized experiences with shorter wait times & lower costs, making them popular choices for outpatient procedures.

Further, the ambulatory surgical centers segment is expected to register the fastest CAGR of 8.42% during the forecast period.Procedures at ambulatory surgical centers, including those utilizing retrieval bags, cost 82% less on average compared to hospital outpatient departments under Medicare. Ambulatory surgical centers offer convenient scheduling, closer proximity to patients, and personalized care in a smaller, more focused setting.

U.S. number of hospital data for the years 2023 and 2022

The growing demand for laparoscopic retrieval bags in the U.S. is expected to be fueled by the increasing number of Clinics, driven by various factors such as improved healthcare access initiatives, modernization efforts, and a shifting focus toward patient-centric care. As healthcare systems in the country continue to evolve and expand to meet the diverse needs of a growing patient population, this trend is likely to persist, presenting opportunities for market growth and development.

U.S. hospital statistics for the years 2023 and 2022

2023

2022

Total Number of All U.S. Clinics

6,129

6,093

Number of U.S. Community Clinics

5,157

5,139

Number of Nongovernment Not-for-Profit Community Clinics

2,978

2,960

Number of Investor-Owned (For-Profit) Community Clinics

1,235

1,228

Number of State and Local Government Community Clinics

944

951

Number of Federal Government Clinics

206

207

Number of Nonfederal Psychiatric Clinics

659

635

Other Clinics

107

112

Total Admissions in All U.S. Clinics

34,011,386

33,356,853

Total Expenses for All U.S. Clinics

NA

USD 1,213,881,001,000

Key U.S. Laparoscopic Retrieval Bag Company Insights

Key strategies implemented by players and government entities in the U.S. market are include product launch, expanding distribution channels, partnerships, collaboration, marketing & awareness campaigns, and other strategies. As the market continues to evolve, further innovations in product design, materials science, and manufacturing processes can be expected. Established players will need to adapt to these changes to maintain market share and remain competitive.

Key U.S. Laparoscopic Retrieval Bag Companies:

- Medtronic

- CONMED Corporation

- Teleflex Incorporated

- Johnson & Johnson Services, Inc. (Ethicon)

- Applied Medical Resources Corporation

Recent Developments

-

In November 2023, Applied Medical Resources Corporation received approval from the U.S. FDA for its Inzii Ripstop Redeployable Retrieval System. This product is indicated for removing organs, calculi, and tissue during laparoscopic & general surgical procedures.

U.S. Laparoscopic Retrieval Bag Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 197.88 million

Revenue forecast in 2030

USD 295.34 million

Growth rate

CAGR of 6.90% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume (Unit), Price (USD) and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Type, technique, surgeries, end Use, region

Key companies profiled

Medtronic; CONMED Corporation; Teleflex Incorporated; Johnson & Johnson Services, Inc. (Ethicon); Applied Medical Resources Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Laparoscopic Retrieval Bag Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. laparoscopic retrieval bag market report based on type, technique, surgeries, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Detachable

-

Non-Detachable

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Opening

-

Automatic Opening

-

-

Surgeries Outlook (Revenue, USD Million, 2018 - 2030)

-

Bariatric Surgery

-

Urological Surgery

-

Gynecological Surgery

-

General Surgery

-

Colorectal Surgery

-

Other Surgeries

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

South

-

West

-

Midwest

-

Northeast

-

Frequently Asked Questions About This Report

b. The U.S. laparoscopic retrieval bag market size was estimated at USD 185.60 million in 2023 and is expected to reach USD 197.88 million in 2024.

b. The U.S. laparoscopic retrieval bag market is expected to grow at a compound annual growth rate of 6.90% from 2024 to 2030 to reach USD 295.34 million by 2030.

b. Detachable segment dominated the market in 2023 and is also expected to register the fastest growth with a CAGR of 7.88% over the forecast period driven by the rising demand for minimally invasive surgeries and the need for safe specimen extraction in cancer treatment & other procedures. These bags are expected to be increasingly important in modern surgical practice. The increasing prevalence of chronic diseases, such as cancer, which often require surgical intervention, is another key segment driver.

b. Some key players operating in the U.S. laparoscopic retrieval bag market include Medtronic, CONMED Corporation, Teleflex Incorporated, Johnson & Johnson Services, Inc. (Ethicon), Applied Medical Resources Corporation, among others.

b. Key factors driving the market growth include the growing demand for minimally invasive surgeries and the growing number of laparoscopic bariatric, gynecological & urological surgeries. Furthermore, the increasing prevalence of obesity in the country is expected to boost the demand for laparoscopic retrieval bag market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.