U.S. Laboratory Automation Market Size, Share & Trends Analysis Report By Process, By Automation Type (Total Automation, Modular Automation System), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-282-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Laboratory Automation Market Trends

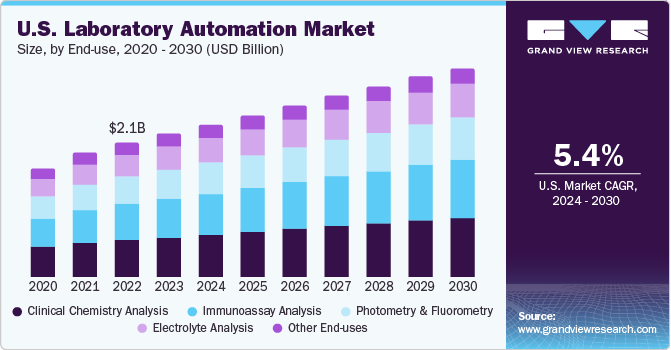

The U.S. laboratory automation market size was estimated at USD 2.18 billion in 2023 and is expected to grow a CAGR of 5.40% from 2024 to 2030. Key factors contributing to this market growth include the local presence of major key companies, easy availability of fully automated laboratory solutions, higher adoption of laboratory automation, and launch of newer solutions.

The U.S. laboratory automation market dominated the global laboratory automation market in 2023, accounting for nearly 30% of the total revenue generated. The region benefits from a robust healthcare infrastructure, fostering the uptake of laboratory automation systems. The presence of key companies and favorable reimbursement structures further propel the integration of innovative automation solutions. Rising cases of chronic and infectious diseases drive the demand for laboratory automation, fueling market expansion.

The U.S. government’s focus on technological progress and the rise in research and development funding fosters an environment that enables manufacturers of laboratory automation to utilize state-of-the-art technologies and maintain their competitiveness in the international market. Technological advancements pertinent to pharmaceutical laboratories and rising demand for laboratory automation are expected to fuel the demand for these systems in the coming years.

Furthermore, advancements in R&D labs, especially in pharmaceutical and biotechnological laboratories, will likely bolster market growth. A growing focus on improving the efficiency of laboratories is also poised to help the market gain tremendous momentum over the coming years. The use of Laboratory Information Management Systems in biobanking is on the rise. These systems are crucial for efficiently managing and tracking various aspects such as data quality, security measures, end-user billing, and patient demographic information. They also enhance the integration of data sampling and research information, simplifying data accessibility. Thus, the low implementation cost, efficient time management, and compliance with GDP, GCP, and GMP principles are key factors escalating market demand.

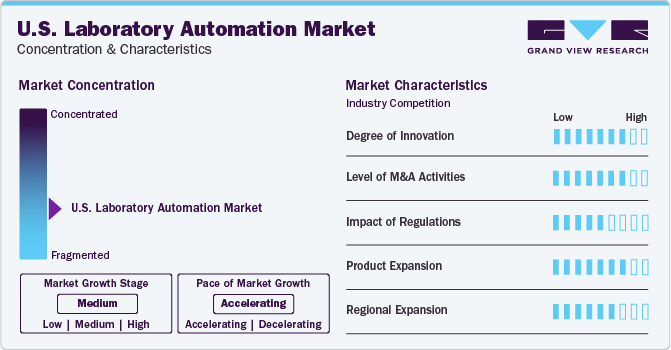

Market Concentration & Characteristics

The industry exhibits a high degree of innovation driven by rapid technological advancements and a focus on research and development. Businesses are incorporating artificial intelligence, machine learning, and cloud technologies into their automation workflows to boost efficiency, data analytics abilities, and decision-making procedures. Innovation in the industry is prioritized to remain competitive and cater to changing demands.

Mergers and acquisitions play a significant role, heading towards industry consolidation and portfolio diversification. Recent strategic acquisitions by key companies such as Thermo Fisher Scientific Inc., Siemens Healthineers AG, and other industry giants aim to drive innovation, expand product portfolios, and contribute to the competitive landscape. For instance, in September 2023, Takara Bio and Eppendorf announced a strategic partnership to automate Takara Bio’s chemistries on Eppendorf’s platforms, aiming to enhance lab efficiency and reliability.

Adherence to governmental rules, industry norms, and customer demands is vital for manufacturers to guarantee the quality, safety, and industry competitiveness of their products. For example, the U.S. National Institute for Occupational Safety and Health published a blog post in 2015 to create guidelines to safeguard interactions between humans and robots.

The industry is focused on developing innovative automation systems, liquid handling solutions, robotic arms, and software applications to enhance laboratory processes. This emphasis on product development aligns with the industry’s drive for technological advancements, efficiency, and accuracy in laboratory operations.

Many industry players are expanding across the West Coast, East Coast, Midwest, and South, and each region’s concentration of laboratories, research institutes, and pharmaceutical companies contributes to industry growth. This strategic expansion allows companies to tap into diverse industries, collaborate with local institutions, and cater to specific regional demands, enhancing their industry reach and competitiveness. For instance, in February 2023, Automata, a leader in laboratory automation, expanded into the U.S. industry. This expansion, following their success in the UK, marked a significant step in the company’s global evolution.

Process Insights

In 2023, continuous flow held the largest market share with over 55%. This is because continuous flow analysis is a well-established method that is particularly useful when a large number of samples need to be analyzed with fewer chemistries. Within this sector, sequential processing held the majority market share and is expected to continue its dominance in the future, as many organizations still depend on sequential tests for quality assurance. Moreover, parallel processing is predicted to experience significant growth in the coming years due to its benefits.

Discrete processing is anticipated to experience the fastest growth over the forecast period due to its benefits, such as minimal waste production, reduced reagent usage, and truly autonomous operation. Discrete analyzers maintain the sample isolated throughout the testing process and dispense precise quantities as required. Rotating individual cuvettes through the device instead of releasing the sample continuously reduces reagent waste and can produce hundreds of results per hour. The simplicity of operation and the potential to reduce testing and consumables expenses have led many labs to adopt discrete analyzers.

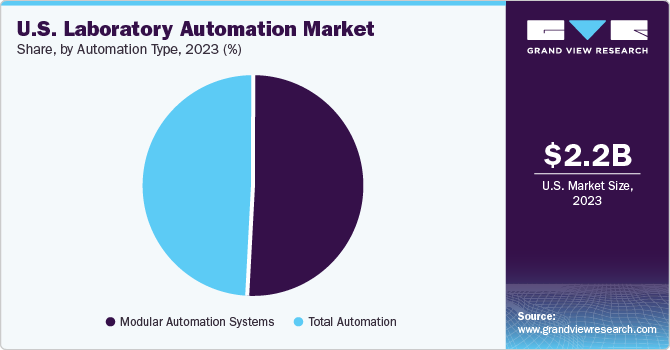

Automation Type Insights

Modular automation systems were at the forefront in 2023, accounting for over 50% of the total revenue. These systems were primarily utilized in industries such as fine chemicals, pharmaceuticals, and food processing. The benefits of modular automation included lower downtime and capital costs for automation engineering, reduced life cycle management, and faster market entry for adaptable production plants due to the elimination of automation engineering for modifying and duplicating production lines. Moreover, by exchanging individual modules, custom product modifications could be quickly and flexibly executed, equating the production cost of a single batch size with that of mass-produced items.

Total automation systems are anticipated to witness the fastest CAGR over the forecast period. The demand for adaptable automation solutions, designed to provide both quantitative and qualitative data about elemental composition, has been increasing. Progress in automation across various life sciences processes has been a significant factor contributing to the growth of this segment.

End-use Insights

Clinical chemistry analysis dominated the segment in 2023, occupying 28.05% of the total market revenue. The high standards of automation achieved have led to a substantial reduction in analytical errors in clinical chemistry analysis. Clinical chemistry has seen a surge in scientific innovations and technological advancements, which have bolstered the capabilities of laboratories. These advancements also offer crucial support to healthcare professionals, clinicians, and labs, thereby enhancing the quality of treatment and diagnosis.

Immunoassay analysis is anticipated to register the fastest growth from 2024 to 2030 owing to the significant technological advancements. Automation allows for efficient processing of small immunoassay batches, offering users a variety of analysis options. Automated systems range from open and traditional platforms to fully configurable platforms, benchtop workstations, and microfluidic or proprietary cartridge systems. These offer miniaturization, multiplexing, convenience, and improved sensitivity. Automation can transform workflows and boost productivity by freeing up operator time. The use of automated systems in clinical tests will aid the transition of research-based investigations, like biomarker analysis, to clinical settings.

Key U.S. Laboratory Automation Company Insights

The market is marked by a substantial degree of fragmentation, providing a wide array of opportunities for expansion and innovation, numerous competitors vying for higher market shares. Some companies in the U.S. laboratory automation market are QIAGEN; PerkinElmer Inc.; Thermo Fisher Scientific, Inc.; Siemens Healthcare GmbH; and Danaher.

Key market participants strive to outdo each other through product innovation, collaborations, and mergers, reflecting a vibrant and competitive market landscape. For instance, in January 2023, Helix and QIAGEN formed a strategic partnership to develop companion diagnostics for hereditary diseases. The partnership aimed to address health burdens in neuro-degenerative, cardiovascular, and auto-immune diseases.

Key U.S. Laboratory Automation Companies:

- QIAGEN

- PerkinElmer Inc.

- Thermo Fisher Scientific, Inc.

- Siemens Healthcare GmbH

- Danaher

- Agilent Technologies, Inc.

- Eppendorf SE

- Hudson Robotics

- Aurora Biomed Inc.

- BMG LABTECH GmbH

- Tecan Trading AG

- Hamilton Company

- F. Hoffmann-La Roche Ltd

Recent Developments

-

In February 2024, QIAGEN launched an AI-based biomedical knowledge base, QIAGEN Biomedical KB-AI, to expedite data-driven drug discovery. This tool, enriched with over 640 million biomedical relationships, facilitated the identification of novel disease, biological pathway, and molecular interaction relationships.

-

In December 2023, Hudson Robotics, a U.S.-based laboratory automation solutions provider, acquired Tomtec Inc., enhancing its liquid handling capabilities. This acquisition, which included a 96-head automated liquid handler, expanded Hudson’s reach into the bioanalytic segment of life sciences R&D.

-

In February 2022, Hamilton Storage launched the Verso Q50 and Q75 Automated Sample Storage Systems, expanding the Verso Q-Series. These compact systems, offering up to four times the capacity of its previous model, facilitated efficient sample storage and access in labs.

-

In February 2020, QualTex Laboratories, a division of U.S.-based nonprofit BioBridge Global, installed the Abbott Accelerator a3600 Laboratory Automation System. This system enabled QualTex Laboratories to further improve its testing turnaround times and maintain high standards for testing quality.

U.S. Laboratory Automation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 2.18 billion |

|

Revenue forecast in 2030 |

USD 3.18 billion |

|

Growth rate |

CAGR of 5.40% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Process, automation type, end-use |

|

Country scope |

U.S. |

|

Key companies profiled |

QIAGEN; PerkinElmer Inc.; Thermo Fisher Scientific, Inc.; Siemens Healthcare GmbH; Danaher; Agilent Technologies, Inc.; Eppendorf SE; Hudson Robotics; Aurora Biomed Inc.; BMG LABTECH GmbH; Tecan Trading AG; Hamilton Company; F. Hoffmann-La Roche Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Laboratory Automation Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. laboratory automation market report based on process, automation type, and end-use.

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Continuous Flow

-

By Workflow

-

Sequential Processing

-

Parallel Processing

-

-

By Component

-

Consumables

-

Equipment

-

-

-

Discrete Processing

-

By Method

-

Centrifugal Discrete Processing

-

Random Access Discrete Processing

-

-

By Components

-

Consumables

-

Equipment

-

-

By Workflow

-

Dependent Analysis

-

Independent Analysis

-

-

-

-

Automation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Total Automation

-

By Steps

-

Pre-analysis

-

Centrifugation

-

Sample Preparation

-

Sample Sorting

-

-

Transport Mechanisms

-

Liquid Handling

-

Sample Storage

-

Sample Analysis

-

-

-

Modular Automation Systems

-

By Steps

-

Specimen Acquisition & Identification & Labelling

-

Transport Mechanisms

-

Sample Preparation

-

Sample Loading & Aspiration

-

Reagent Handling & Storage

-

Sample Analysis & Measurements

-

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Chemistry Analysis

-

Photometry & Fluorometry

-

Immunoassay Analysis

-

Electrolyte Analysis

-

Other End-uses

-

Frequently Asked Questions About This Report

b. The U.S. laboratory automation market size was estimated at USD 2.18 billion in 2023 and is expected to reach USD 2.77 billion in 2024.

b. The U.S. laboratory automation market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 3.18 billion by 2030.

b. The continuous flow segment dominated the U.S. laboratory automation market with a share of 55.80% in 2023. This is attributable to the increasing use of the process in enabling lab automation and the launch of several new products in this domain.

b. Some key players operating in the U.S. laboratory automation market include F. Hoffmann-La Roche Ltd; QIAGEN; PerkinElmer Inc.; Thermo Fisher Scientific, Inc.; Siemens Healthcare GmbH; Danaher; Agilent Technologies, Inc.; Eppendorf SE; Hudson Robotics; Aurora Biomed Inc.; BMG LABTECH GmbH; Tecan Trading AG.; Hamilton Company

b. Key factors that are driving the market growth include the higher adoption of automated instruments at academic and research institutes to bolster productivity and decrease the time spent on different time-consuming tasks.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."