U.S. Knife Sharpening Service Market Trends

The U.S. knife sharpening service market size was valued at USD 89.2 million in 2024 and is expected to grow at a CAGR of 7.3% from 2025 to 2030. The increasing popularity of cooking shows such as MasterChef and Hell’s Kitchen has renewed interest in home cooking, leading to higher demand for sharp knives. Additionally, the rise in the number of hotels, restaurants, cafes, and other food establishments has contributed to the need for professional knife-sharpening services. The growing trend of home improvement and the willingness of consumers to invest in high-quality kitchen tools also play a significant role. Furthermore, the emphasis on food safety and hygiene has heightened the importance of maintaining sharp knives in the food industry.

End-use Insights

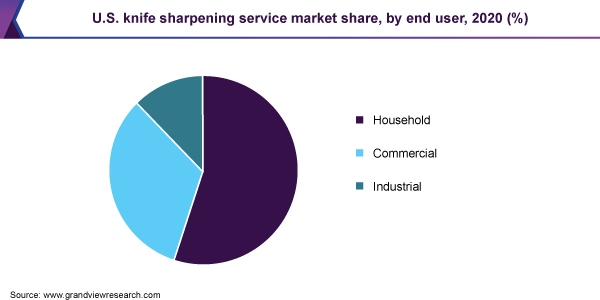

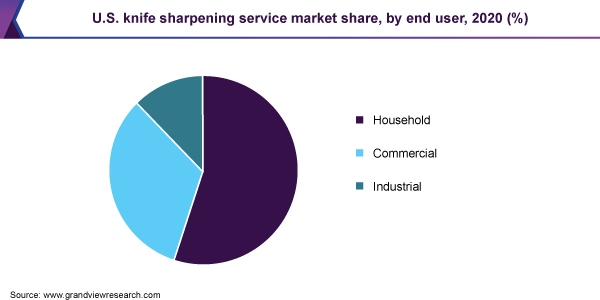

The industrial segment dominated the market with the largest revenue share of 34.8% in 2024. The industrial sector, which includes food processing plants, meat packing facilities, and large-scale commercial kitchens, relies heavily on sharp, well-maintained knives for efficient operations. The demand for professional knife sharpening services in these settings is high, as it ensures the longevity and performance of the knives, which are critical for maintaining productivity and safety standards. Additionally, the increasing focus on food safety and hygiene regulations requires businesses to ensure that their knives are always in optimal condition, further driving the demand for sharpening services. The rise in the number of food processing and manufacturing facilities also contributes to the growth of the industrial segment in the knife-sharpening service market.

The commercial segment is expected to grow at the fastest CAGR of 7.7% over the forecast period. The increasing number of food service establishments, including restaurants, cafes, and catering services, is a major driver, as these businesses require well-maintained knives for efficient operation and food safety. The rise in popularity of high-end and specialty restaurants, which often use premium knives that need professional sharpening, also contributes to market growth. Additionally, the growing trend of culinary arts and the emphasis on gourmet cooking in commercial kitchens are boosting the demand for professional knife sharpening services. The need for consistency and precision in food preparation makes regular knife maintenance essential in the commercial sector. Furthermore, the expansion of chain restaurants and franchises, which require standardized and reliable services, supports the robust growth of the commercial segment in the knife-sharpening service market.

Country Insights

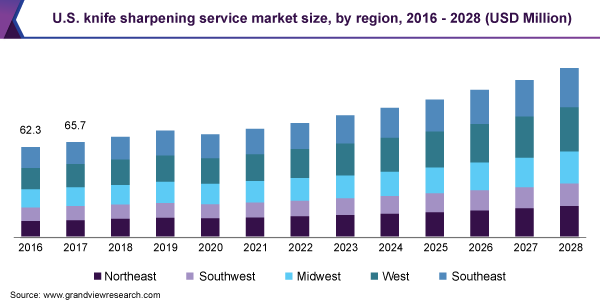

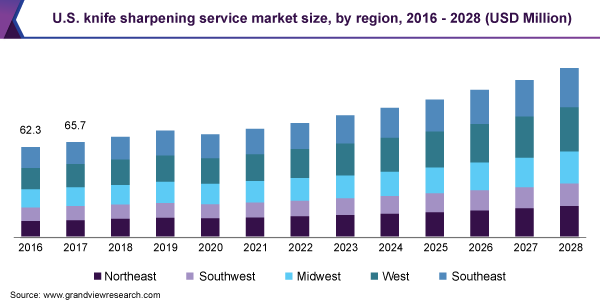

The West U.S. knife sharpening service industry dominated the U.S. market with the largest revenue share of 26.5% in 2024. The region is home to a high concentration of restaurants, cafes, and food establishments, particularly in major cities such as Los Angeles, San Francisco, and Seattle, which heavily rely on sharp and well-maintained knives for efficient operations. Additionally, the strong emphasis on culinary arts and the presence of numerous culinary schools and institutions in the West U.S. contribute to the demand for professional knife sharpening services. The region's vibrant food culture, with a focus on gourmet and artisanal cuisine, further boosts the need for top-notch knife maintenance. Furthermore, the high disposable income levels and the willingness of consumers to invest in premium kitchen tools and services support the growth of the knife sharpening service industry in the west U.S.

The Midwest U.S. knife sharpening service industry held a considerable share in 2024. The Midwest region is home to numerous food processing and manufacturing facilities, which require regular and professional knife sharpening services to maintain operational efficiency and ensure food safety. Additionally, the region's rich agricultural and culinary heritage, with a significant number of restaurants, cafes, and food establishments, drives the demand for well-maintained knives. The emphasis on local and artisanal food production also contributes to the need for high-quality knife sharpening services. Furthermore, the growing trend of home cooking and the popularity of DIY culinary activities among residents in the Midwest support the demand for professional knife maintenance.

The Northeast U.S. knife sharpening service industry is expected to grow at a significant CAGR of 7.6% over the forecast period. The region is home to a large number of restaurants, cafes, and catering services, particularly in major metropolitan areas such as New York City and Boston, which require well-maintained knives for efficient operation and food safety. The North East's rich culinary scene, with its emphasis on gourmet and artisanal cuisine, further boosts the demand for professional knife sharpening services. Additionally, the increasing trend of farm-to-table dining and the popularity of local, organic food production in the region contribute to the need for high-quality knife maintenance. The rise of culinary schools and institutions also plays a role, as they require sharp knives for their training programs.

Key U.S. Knife Sharpening Service Company Insights

Some key U.S. knife sharpening service market companies are Carter Cutlery, American Cutting Edge, Cozzini Bros, Florida Knife Company, Town Cutler, Eversharp Knives, and others.

Key U.S. Knife Sharpening Service Companies:

- Carter Cutlery

- American Cutting Edge

- Cozzini Bros

- Florida Knife Company

- Town Cutler

- Eversharp Knives

- John’s Sharpening Service & Cutlery World, LLC

- Market Grinding Inc.

- National Sharpening

- RodsSharpening.com

U.S. Knife Sharpening Service Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 95.2 million

|

|

Revenue forecast in 2030

|

USD 135.9 million

|

|

Growth rate

|

CAGR of 7.3% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

End-use, country

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Carter Cutlery; American Cutting Edge; Cozzini Bros; Florida Knife Company; Town Cutler; Eversharp Knives; John’s Sharpening Service & Cutlery World, LLC; Market Grinding Inc.; National Sharpening; RodsSharpening.com

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Knife Sharpening Service Market Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. knife sharpening service market report based on end-use and country :

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

Industrial

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Northeast

-

Southwest

-

Midwest

-

West

-

Southeast