- Home

- »

- Homecare & Decor

- »

-

U.S. Kids Furniture Market Size, Industry Report, 2030GVR Report cover

![U.S. Kids Furniture Market Size, Share & Trends Report]()

U.S. Kids Furniture Market Size, Share & Trends Analysis Report By Product (Beds, Cots, & Cribs, Mattresses), By Raw Material (Wood, Polymer, Metal), By Application, By Distribution Channel, and Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-250-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Kids Furniture Market Size & Trends

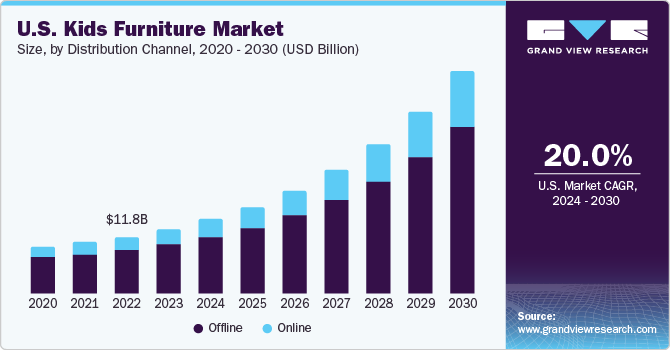

The U.S. kids furniture market size was estimated at USD 13.49 billion in 2023 and is expected to grow at a CAGR of 20.0% from 2024 to 2030. With the rising home prices, consumers are increasingly investing in home improvement or home remodelling projects rather than buying new homes. The growing home values have doubled homeowner equity, indicating a trend of homeowners feeling richer and more disposed toward spending money on home improvement projects.

U.S. kids furniture market accounted for the share of 26.83% of the global kids furniture market in 2023.

The demand rate is growing as the population grows, and at the same time, improving employment rates in emerging nations have enabled a large portion of the population to spend on both necessary and recreational items, which is expected to boost the growth of the kids furniture market. Furthermore, the worldwide population's per capita and disposable income is rising, particularly in developing nations, boosting the expansion of the kids furniture industry. Consumers with a high level of affordability spend wisely in order to increase their standard of living, resulting in the purchase of efficient and versatile consumer goods.

Rising income in the country has generated optimism among parents, which in turn, has driven the demand for and uptake of a wide variety of products for their kids. This growing affordability, coupled with the rising availability of quality products, has been fueling the sales of kids’ furniture, including beds, cots, cribs, tables, chairs, cabinets, dressers, chests, mattresses, and shelves.

Rising consumer awareness about proper parenting needs and the kind of products that are best for kids of varying ages is likely to contribute to market growth. Consumers are increasingly prioritizing their kids’ health and wellness and therefore, spending on products like body care, toys, and furniture items such as beds, cots, cribs, tables, chairs, dressers, cabinets, chests, and mattresses has increased in recent years. This trend is likely to favor the kid’s furniture market.

Market Concentration & Characteristics

The U.S. kids furniture industry is characterized by a high degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. A majority of manufacturers are increasingly focusing on creating environmentally friendly kids' furniture. Several consumers prefer products that improve outer appearance and match the architectural patterns and layout of living spaces and backyards of houses. As a result, manufacturers are increasingly concentrating on providing innovative, luxurious, and aesthetic kids furniture.

The industry is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. Manufacturers are focusing on promotions, advertising, and partnerships in order to expand their customer base. Direct-to-customer is highly lucrative for companies that have customer loyalty and have already invested in advertising campaigns to create a good brand presence and a committed consumer base. Manufacturers of kids furniture are estimated to have medium-to-high gross margins.

End-user concentration is a significant factor in the U.S. kids furniture market.The rising preference for furniture made from durable materials, with multi-functionality, and in bright colors is expected to create growth opportunities for market players. The growing popularity of theme-based interior décor is anticipated to fuel the demand for furniture suitable for such themes. For instance, if consumers choose themes like outer space, sea world, forest, and library, they look for furniture in colors and shapes that are suitable to those themes. Additionally, manufacturers have been developing unique solutions in the kids furniture market that cater to the special wants of end consumers.

Product Insights

Kids beds, cots, and cribs market accounted for a revenue share of more than 32.0% in 2023.Cribs & cots are designed to keep infants and young children comfortable and prevent them from falling on the ground. They also aid in creating a healthy sleep environment and providing peaceful sleep. The demand for these products is expected to grow on account of the increasing need for advanced baby safety products. Apart from this, the rising number of nuclear families is also positively impacting the sales of baby cribs and cots in the country.

Kids mattresses market is expected to grow at a CAGR of 21.6% from 2024 to 2030.The rising demand for the product has been creating a profitable opportunity for the manufacturers. As a result, an increasing number of manufacturers can be seen creating exclusive mattresses for kids. In November 2020, Silentnight launched its first-ever collection of eco-friendly children's mattresses. The product has been created without the use of chemicals to give the right support to little ones as they grow, helping them sleep soundly. These can be fully recycled at the end of their life.

Raw Material Insights

Kid wood furniture market accounted for a revenue share of 62.25% in 2023.Consumers in the U.S. are increasingly opting for kids’ furniture products made from wood as this material is immensely durable and offers a touch of simplicity and elegance. Wooden kids’ furniture in various finishes are swiftly becoming a preferred product in the country owing to their affordable price, robust designs, prints, bright colors, and availability in a large variety of appealing styles.

The growing demand for wooden kids’ furniture has been fueling the overall market. These furniture items are mostly a part of playrooms, study rooms, and daycares. Sprout, a kids’ home and school furniture manufacturer, offers infant shelves, weaning tables & chairs, floor beds, wardrobes, cube shelves, climbing triangles, twin beds, work tables, chairs & seating, shelving, washing stations, maker space, chowki floor tables, and book display shelves for homes and schools of all kinds. These products are available in wooden materials in different shapes, sizes, and colors, providing customers with various options to choose from.

Kids polymer furniture market is expected to grow at a CAGR of 20.7% over the forecast period. Plastic tables and chairs are commonly seen in households, offices, commercial establishments, and even in schools and academic institutions. Compared to metal or wooden furniture, plastic furniture is more affordable. They are also stylish and comfortable to sit on, making it ideal for kids who are required to sit for hours doing homework or other in-home activities. If the parents are on a budget, plastic chairs can be the ideal choice because of their affordability. Plastic chairs are generally sturdy and do not break easily and are hence also suitable for toddlers.

Application Insights

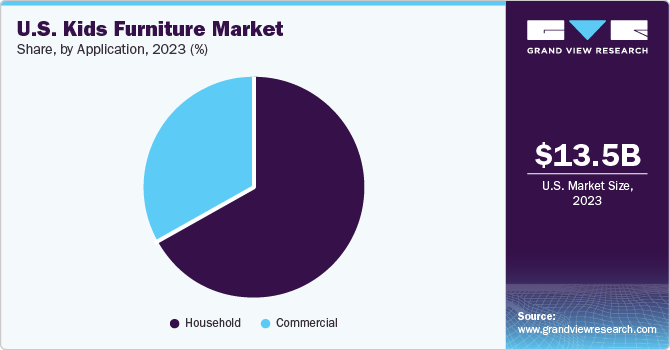

The household application dominated the market with a revenue share of more than 67.15% in 2023. The increasing number of houses being built in the U.S. has been driving the demand for kids’ furniture. Moreover, consumers are increasingly spending on kids’ rooms and décor to elevate their homes and make them more stylish and comfortable at the same time.

According to the U.S. Department of Commerce jointly with the U.S. Department of Housing and Urban Development, the number of new houses sold in February 2021 was estimated to be around 775,000 and the number of new houses made ready for sale was around 312,000. This rapid increase in the construction of residences in the country has been creating significant opportunities for kids’ furniture.

The commercial application segment is expected to grow at a CAGR of 20.5% from 2023 to 2030. According to the U.S. Bureau of Labor Statistics, in 2020, 33.0 million families, or two-fifths of all families, included children under age 18. At least one parent was employed in 88.5 percent of families with children, down from 91.4 percent in the previous year. Among married-couple families with children, 95.3 percent had at least one employed parent in 2020, and 59.8 percent had both parents employed. Among families maintained by fathers, 79.6 percent of fathers were employed, a greater share than the 71.0 percent of mothers who were employed in families maintained by mothers. Such rise in working population influence commercial spaces such as daycare and crèches.

Key U.S. Kids Furniture Company Insights

Some of the key players operating in the market include Williams-Sonoma Inc.;BABYLETTO; andWayfair LLC

-

Williams-Sonoma Inc., founded in 1956 by Chuck Williams in California, U.S., is a multi-channel specialty retailer of cookware, appliances, and home furnishings. It is headquartered in San Francisco, California, U.S.The company sells kids’ furniture under Pottery Barn Kids brand, which exclusively focuses on the kids’ market. The company offers kid's bedding, furniture, chairs, beanbags, baby furniture, toys, gifts, and home decor products.

-

BABYLETTO is a children’s furniture company operating under the parent company Million Dollar Co. The company is a fast-growing baby furniture company based out of Los Angeles, U.S. Million Dollar Baby Co. includes various brands like Babyletto, DaVinci, Nursery Works, Million Dollar Baby Classic, Franklin & Ben, and Ubabub. They design all the furniture in-house and have been featured in Inc. Magazine, Vogue, and Bloomberg. Million Dollar Baby Co. was founded in 1990 by Daniel and Maryann in Los Angeles.

Blu Dot, Casa Kids, and Crate and Barrel (Crate & Kids) are some of the other participants in the U.S. kids furniture market,

-

Blu Dot was founded in 1997 and is headquartered in Minnesota, U.S. The company designs and produces contemporary furniture, with the goal of “bringing good design to as many people as possible.” Blu Dot works with craftspeople from around the world to bring designs to life. A small, family-owned factory in Northern Italy that specializes in metalworking was tasked to manufacture the Hot Mesh collection, which includes a chair, lounge chair, ottoman, stools, and café and bar tables.

-

Casa Kids is a children’s furniture company based in Brooklyn, New York, U.S. It was founded in 1992 by Roberto Gil. The company has embraced a simple approach in its designs - functionality above décor and durability over most everything else. Its furniture is adaptable, for instance, once a child grows out of his or her loft bed, the cabinets underneath can be moved and used as independent pieces.

Key U.S. Kids Furniture Companies:

- Williams-Sonoma Inc.

- BABYLETTO

- Wayfair LLC

- Blu Dot

- Casa Kids

- Crate and Barrel (Crate & Kids)

- Circu Magical Furniture

- Million Dollar Baby Co.

- KidKraft

- Sorelle Furniture

Recent Developments

-

In October, 2023, Pottery Barn Kids, a manufacturer of kid’s furniture bedding, décor and accessories acquired Williams-Sonoma Inc.

-

In November, 2022, Delta Children launched babyGap-branded nursery furniture and baby gear collection in the U.S., in a deal facilitated by Gap’s licensing agency.

U.S. Kids Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.48 billion

Revenue forecast in 2030

USD 46.26 billion

Growth rate

CAGR of 20.0% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, raw material, application

Country scope

U.S.

Key companies profiled

Williams-Sonoma Inc.; BABYLETTO; Wayfair LLC; Blu Dot; Casa Kids; Crate and Barrel (Crate & Kids); Circu Magical Furniture; Million Dollar Baby Co.; KidKraft; Sorelle Furniture

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, & segment scope.

U.S. Kids Furniture Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. kids furniture market report based on product, raw material, application:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Beds, Cots, & Cribs

-

Table & Chair

-

Cabinets, Dressers, & Chests

-

Mattresses

-

Others

-

-

Raw Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Polymer

-

Metal

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Household

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. kids furniture market size was estimated at USD 13.49 billion in 2023 and is expected to reach USD 15.48 billion in 2024.

b. The U.S. kids furniture market is expected to grow at a compounded growth rate of 20.0% from 2024 to 2030 to reach USD 46.26 billion by 2030.

b. Kids beds, cots, and cribs market accounted for a revenue share of more than 32.0% in 2023. Cribs & cots are designed to keep infants and young children comfortable and prevent them from falling on the ground. They also aid in creating a healthy sleep environment and providing peaceful sleep.

b. Some key players operating in the U.S. kids furniture market include Williams-Sonoma Inc.; BABYLETTO; Wayfair LLC; Blu Dot; Casa Kids; Crate and Barrel (Crate & Kids); Circu Magical Furniture; Million Dollar Baby Co.; KidKraft; Sorelle Furniture

b. Key factors that are driving the U.S. kids furniture market growth include the rising home prices, consumers are increasingly investing in home improvement or home remodelling projects rather than buying new homes. The growing home values have doubled homeowner equity, indicating a trend of homeowners feeling richer and more disposed toward spending money on home improvement projects.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."