- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Kayaks And Canoes Sports Equipment Market, Report, 2030GVR Report cover

![U.S. Kayaks And Canoes Sports Equipment Market Size, Share & Trends Report]()

U.S. Kayaks And Canoes Sports Equipment Market Size, Share & Trends Analysis Report By Sports, By Product (Apparel, Footwear), By Price Range, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-315-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

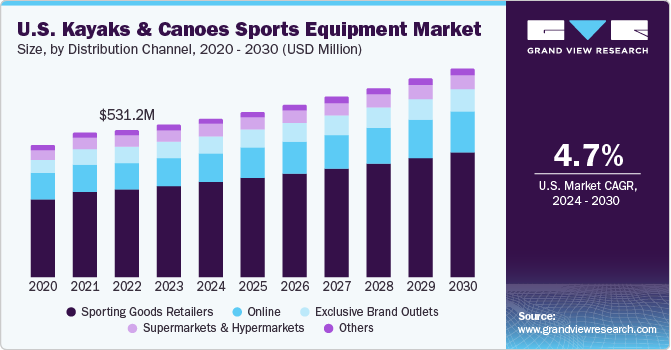

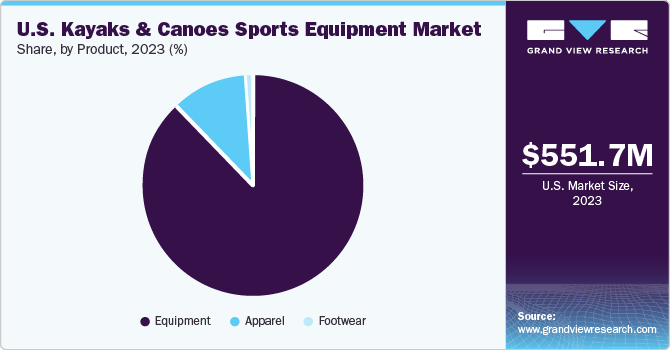

The U.S. kayaks and canoes sports equipment market size was estimated at USD 551.7 million in 2023 and is expected to grow at a CAGR of 4.7% from 2024 to 2030.The market is primarily driven by increasing interest in water sports, rising awareness of health benefits associated with kayaking and canoeing, technological advancements in equipment, availability of diverse product ranges, and effective promotion strategies by outdoor retailers.

The growing popularity of water sports activities, including kayaking and canoeing, among Americans has significantly boosted the demand for kayaks and canoes in the U.S. This rise in interest is driven by a combination of factors such as a desire for outdoor recreational activities, fitness trends, and an increased focus on healthy lifestyles. The surge in paddle sports in the U.S. is evident in the 2022 Outdoor Participation Trends Report, where kayaking is identified as the top-ranking water sport. The Outdoor Foundation's 2021 Outdoor Participation Report also highlighted kayaking as the fastest-growing water sport, experiencing a significant 32% increase in participation over the past five years.

As more people become aware of the physical and mental health advantages of these water sports, there is a greater inclination towards participating in such activities, leading to an increased demand for kayaks and canoes in the U.S. According to the 2022 Outdoor Participation Trends Report released by the Outdoor Foundation, the philanthropic arm of the Outdoor Industry Association, more than half (54%) of Americans aged six and over participated in at least one outdoor activity in 2021. The report highlights that the outdoor recreation participant base grew by 2.2% during 2021, reaching 164.2 million participants, marking the highest level ever recorded. This increase continued the trend observed since the beginning of the COVID-19 pandemic in early 2020, with the outdoor participant base increasing by 6.9% since then. The report further underscores the importance of outdoor activities for mental and physical health, job creation, economic growth, and increased stewardship of lands and waters.

Technological advancements in materials and manufacturing have enabled the production of durable yet cost-effective kayaks and canoes, further fueling this trend. For instance, in January 2022, there were significant ownership changes in the paddle sports industry, with new CEOs and companies taking over established brands such as Hobie, Jackson Kayak, and Confluence Watersports. Pelican International Inc. acquired Confluence Outdoor, making it the largest paddle sports company with a wide range of products. Other notable acquisitions include Jackson Kayaks and Hobie Cat Co. by new ownership groups. These changes reflect confidence in the industry's growth potential and aim to capture new customers while maintaining quality.

Moreover, manufacturers in the U.S. offer a wide range of kayaks and canoes catering to different skill levels, preferences, and purposes. This diverse product range appeals to a broad spectrum of consumers, from beginners to experienced paddlers, contributing to the overall expansion of the market. In February 2022, in partnership with professional sailing teams, Mustang Survival Corp. developed the EP Ocean Racing Spray Smock, delivering protection against wetness while out on the water. The suit features Glideskin Neoprene wrist seals that provide a waterproof barrier, ensuring the user remains dry.

The presence of outdoor retailers, sporting goods stores, online platforms, and specialized kayak/canoe shops across the U.S. plays a crucial role in promoting this water sports equipment. Marketing efforts by retailers to showcase new products, offer discounts, and organize events or training sessions further stimulate consumer interest and drive sales within the market.

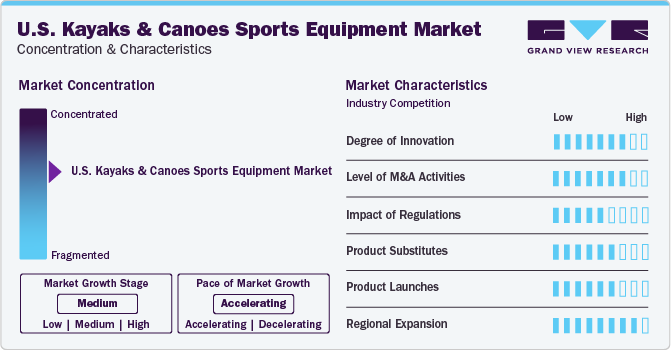

Market Concentration & Characteristics

The U.S. Kayaks & Canoes Sports Equipment Market exhibits a significant degree of innovation driven by various factors such as technological advancements, changing consumer preferences, and competitive dynamics. The market has seen a surge in innovation across product design, materials used, manufacturing processes, and features to meet the evolving needs and demands of consumers.

The market is characterized by a high level of merger and acquisition activities. Companies undergoing mergers and acquisitions are seeking strategic partnerships to enhance their product portfolios, expand their market presence, and leverage each other’s strengths. For instance, in October 2023, Sanborn Canoe Co. announced acquisition of Current Designs Kayaks, known for spearheading sea kayak development since the late 1970s. Sanborn Canoe Co. intends to uphold the legacy of meticulously crafted, high-quality composite kayaks. These kayaks are designed to attract recreational paddlers seeking a polished paddling experience and thrill-seekers looking to navigate and engage in challenging waters.

The impact of regulations on the market is relatively moderate. One of the key impacts of regulations in the U.S. Kayaks & Canoes Sports Equipment Market is ensuring product safety. Regulatory bodies such as the Consumer Product Safety Commission (CPSC) set standards for product safety to protect consumers from potential hazards associated with kayaks and canoes. These regulations may cover aspects such as material quality, buoyancy requirements, labeling for warnings and instructions, and stability criteria to prevent accidents and injuries.

In the U.S. kayaks and canoes sports equipment market, product substitutes include stand-up paddleboards (SUPs), inflatable rafts, and paddle boats. While kayaks and canoes offer traditional watercraft experiences, SUPs provide a similar recreational activity with a standing position and paddle. Inflatable rafts offer versatility and ease of transport, appealing to casual water enthusiasts. Paddle boats provide a family-friendly alternative, particularly for leisurely outings on calm waters. These substitutes cater to diverse preferences and needs within the recreational water sports sector, contributing to a dynamic market landscape.

The level of new product launches in the U.S. kayaks & canoes sports equipment market is in the range of moderate to high due to the competitive nature of the industry and the constant demand for innovation. Manufacturers are continuously introducing new models with improved features and designs to attract consumers and stay ahead of competitors.

The geographical expansion of the U.S. kayaks and canoes sports equipment market has been notable in recent years. Manufacturers, retailers, and rental companies have been expanding their presence across various regions to cater to the growing demand for kayaks and canoes.

Sports Insights

Kayak's equipment market accounted for a revenue share of 85.6% in 2023. Soft adventure sports activities, such as kayaking, are gaining traction among consumers seeking thrilling yet accessible outdoor experiences. This trend fuels the demand for high-quality kayaking equipment that enhances safety and performance. Moreover, Factors such as the rapid growth of the active population, rising disposable incomes, and the increasing popularity of adventure tourism contribute to the overall expansion of the kayaking sports market. These demographic shifts create opportunities for market players to cater to diverse consumer preferences. Kayaking has surged in popularity as a watersport in the U.S., with participation increasing by 87.3% from 2010 to 2022. According to the National Sporting Goods Association (NSGA), recreational kayaking stands out as the most favored form in the U.S. Gender distribution among recreational kayakers is 45% male and 54% female participants.

The canoe sports equipment market is expected to grow at a CAGR of 9.2% from 2024 to 2030. The increasing popularity of water sports, such as canoeing, has led to a surge in the number of enthusiasts participating in these activities. This rise in participation fuels the demand for high-quality equipment, driving growth in the market. According to the National Sporting Goods Association (NSGA) in 2022, young adults, typically aged 25 to 34, are increasingly drawn to both kayaking and canoeing, with 21% and 18%, respectively, with recreational kayaking experiencing a surge in popularity among this demographic. Conversely, older adults, particularly those aged 55 to 64, are showing a growing inclination toward participating in kayaking activities, with 14%. Children between the ages of 7 and 11 are introduced to kayaking through specially designed child-sized kayaks, gradually progressing to larger ones as they mature.

Product Insights

Equipment accounted for a share of 88.5% of U.S. kayaks & canoes sports equipment market revenue and is anticipated to grow at a CAGR of 4.7% in 2023. This can be attributed to advances in kayak materials, design, and manufacturing techniques that contribute to the market growth by offering lighter, more durable, and performance-enhancing equipment. For instance, in April 2023, Mustang Survival Corp. unveiled three Marine Spec Waterproof Breathable Fabrics (MP, SP, BP), after extensive testing of over 800 materials, assessing 12 different properties, and conducting real-world field trials. This achievement was the outcome of a collaborative effort with industry-leading material experts and rigorous testing at the Mustang Waterlife Studio and in real-world scenarios. The Marine Spec Fabrics offer an unmatched blend of superior waterproofing, durability, and breathability, uniquely tailored for marine activities.

Price Range Insights

Mass price range equipment accounted for a share of 80.3% in 2023. With increasing interest in outdoor recreational activities, more individuals are participating in canoeing and kayaking. This surge in participation is driving the demand for equipment for mass-priced equipment.Mass-priced equipment makes canoeing and kayaking more accessible to a broader range of consumers by offering affordable options. As more people can afford to purchase equipment at lower price points, the demand is increasing.

Premium-priced kayaks & canoes equipment market is projected to grow at a CAGR of 6.3% from 2024 to 2030. High-quality materials such as durable plastics, lightweight but strong metals like aluminum or carbon fiber, and advanced fabrics like Gore-Tex are often used in premium canoeing and kayaking equipment. These materials enhance the performance, durability, and overall quality of the products, leading to a higher price point and demand among consumers. Moreover, consumers are increasingly seeking innovative and premium features such as advanced paddle designs, ergonomic seating systems, improved hull designs for better stability and speed, and integrated technology such as GPS tracking systems.

Distribution Channel Insights

Sales of kayaks & canoes sports equipment through the sporting goods retailers market accounted for a revenue share of 61.1% in 2023. The sporting goods retailers often carry a wide range of canoeing and kayaking equipment, including paddles, life jackets, waterproof bags, and specialized clothing. Furthermore, the marketing strategies employed by sporting goods retailers play a crucial role in driving the purchase of canoeing and kayaking equipment. Promotional campaigns that emphasize the outdoor lifestyle, adventure, exploration, and connection with nature resonate with consumers seeking meaningful experiences.

Distribution of kayaks & canoes sports equipment through online channels is expected to grow at a CAGR of 5.9% from 2024 to 2030. Online platforms offer extensive product information, including specifications, reviews, and user experiences. This information helps consumers make informed decisions about which kayak or canoe best suits their needs, contributing to increasing demand for distribution through online channels.

Key U.S. Kayaks And Canoes Sports Equipment Company Insights

Key market players such as Johnson Outdoors Inc., Lifetime Products, Sawyer Station, and The Coleman Company, among others, contribute significantly to the innovation and growth of the market. These companies compete fiercely to maintain their market positions through product innovation, quality offerings, and effective marketing strategies. As outdoor recreational activities gain popularity in the U.S., the demand for kayaks and canoes continues to grow, driving competition among these top players in the market.

Key U.S. Kayaks & Canoes Sports Equipment Companies:

- Johnson Outdoors Inc.

- Lifetime Products

- Sawyer Station

- The Coleman Company

- NRS

- Hobie Cat Company II LLC

- Pelican International

- Sanborn Canoe Co.

- Mustang Survival Corp.

- Werner Paddles

Recent Developments

-

In October 2023, Sanborn Canoe Co. announced its acquisition of Current Designs Kayaks, known for spearheading sea kayak development since the late 1970s. Sanborn Canoe Co. intends to uphold the legacy of meticulously crafted, high-quality composite kayaks. These kayaks are designed to attract recreational paddlers seeking a polished paddling experience and thrill-seekers looking to navigate and engage in challenging waters.

-

In April 2023, Mustang Survival Corp. introduced Gaia foam options for the majority of the PFDs that previously utilized PVC-based foam. Gaia foam, a closed-cell foam based on nitrile butadiene rubber (NBR), is free from PVCs, CFCs, phthalates, as well as halogens (chlorine, astatine, iodine, fluorine, bromine), while still delivering robust buoyancy performance and flexibility. This material enables the elimination of PVC-based foams from the product line without compromising the in-water performance and comfort of the PFDs. It also contributes to reducing the environmental impact during production.

-

In May 2022, Pelican International Inc. acquired GSI Outdoors Inc., which was established in 1985 by the Scott family. GSI Outdoors Inc. consistently focused on innovation to deliver high-quality, eco-conscious products to its clientele. The company is headquartered in Spokane, Washington, and specializes in developing and distributing a comprehensive range of camping cookware and outdoor accessories. This strategic move underscores Pelican International Inc.'s commitment to expansion through diversification.

U.S. Kayaks And Canoes Sports Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 573.8 million

Revenue forecast in 2030

USD 754.2 million

Growth rate

CAGR of 4.7% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sports, product, price range, distribution channel

Key companies profiled

Archer Daniels Midland; Kerry Inc; Cargill Inc; Lonza Group Ltd.; BASF SE; IFF; DSM; Glanbia PLC; Lallemand Inc; Chr. Hansen Holding AS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

U.S. Kayaks And Canoes Sports Equipment Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. kayaks and canoes sports equipment market report based on sports, product, price range, and distribution channel:

-

Sports Outlook (Revenue, USD Million, 2018 - 2030)

-

Kayaking

-

Canoeing

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Footwear

-

Equipment

-

Kayaks & Canoes

-

Paddles

-

Personal Protection Devices

-

Dry Bags

-

Others

-

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. kayaks and canoes sports equipment market size was estimated at USD 551.7 million in 2023 and is expected to reach USD 573.8 million in 2024.

b. The U.S. kayaks and canoes sports equipment market is expected to grow at a compounded growth rate of 4.7% from 2024 to 2030 to reach USD 754.2 million by 2030.

b. The equipment segment accounted for a market share of 88.5% in 2023. The growth of kayaks and canoes equipment in the U.S. is propelled by outdoor recreation trends, accessibility of waterways, technological advances, social media influence, and the rise in eco-tourism, among other factors.

b. Some key players operating in the market include Johnson Outdoors Inc.; Lifetime Products; Sawyer Station; The Coleman Company; NRS; Hobie Cat Company II LLC among others.

b. The U.S. kayaks and canoes sports equipment market is propelled by a combination of factors including the growing popularity of outdoor recreation, heightened awareness of environmental sustainability leading to a preference for eco-friendly leisure activities, increasing participation in adventure tourism, and the allure of water-based sports for fitness and leisure enthusiasts alike.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."