- Home

- »

- Advanced Interior Materials

- »

-

U.S. Kaolin Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Kaolin Market Size, Share & Trends Report]()

U.S. Kaolin Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Paper, Ceramics, Paint & Coatings), And Segment Forecasts

- Report ID: GVR-4-68040-254-1

- Number of Report Pages: 82

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Kaolin Market Size & Trends

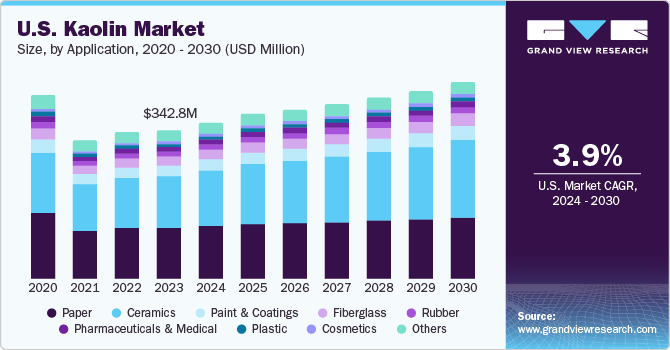

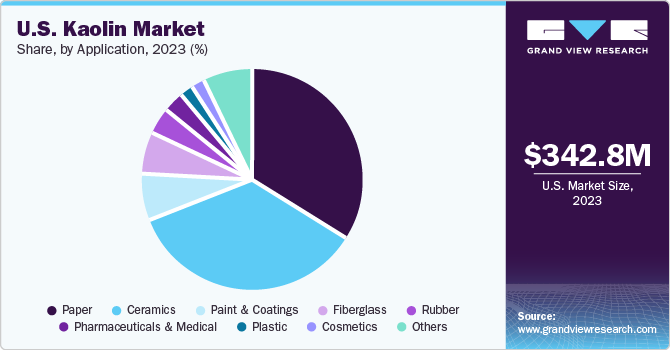

The U.S. kaolin market was valued at USD 342.8 million in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. This growth is attributed to the rising demand from various end-use industries such as paper, rubber, paints and coatings, and ceramics. In these industries, kaolin is a crucial filler due to its durability, high opacity, pigment suspension, and scrub resistance. Another significant factor contributing to the market’s growth is the rise in construction activities. Additionally, the growth of the automotive industry, where kaolin is used in the production of automotive parts, is also propelling the market.

Regulations have a significant impact on the U.S. kaolin market. The extraction and processing of kaolin can lead to environmental impacts, including habitat disruption and water pollution. As a result, heightened environmental regulations and the need for sustainable mining practices can increase production costs and potentially hinder market growth. Moreover, the market is characterized by a low level of merger and acquisition (M&A) activity due to the stringent regulatory process and approvals required for mining licenses and residue management. The approval process is lengthy, and the player concentration is high, leading to a lower than average number of M&As each year compared to other industries.

Market Concentration & Characteristics

The market is characterized by a high degree of innovation to optimize the production process in an environmentally sustainable manner and to manage residue and waste. Manufacturers have been focusing on improving and optimizing the properties of kaolin. For instance, Imerys claims to have developed a kaolin range that delivers improved dispersion and mechanical properties.

The market is also characterized by a low level of merger and acquisition (M&A) activity owing to the stringent regulatory process and approvals required for mining licenses and residue management. There are a number of substitutes for kaolin. Most commonly used are talc, carbonates, ball clay, and fuller clay. These commonly found minerals are considered more cost-effective and conventional and are used as fillers across the paper, plastics, refractories, and fiberglass industries.

Application Insights

The ceramics segment dominated the U.S. market in 2023 with around 35% revenue share. It is also projected to be the fastest-growing segment with a CAGR of 5.9% from 2024 to 2030. The ceramic industry relies heavily on kaolin due to its unique properties, including plasticity, whiteness, and fine particle size. These characteristics make it an ideal raw material for ceramic production. As infrastructure projects continue to expand the demand for ceramic tiles, sanitaryware, and other ceramic products remains robust and kaolin plays a crucial role in meeting these demands.

The paper segment secured the second-largest revenue share in the U.S. kaolin market, in 2023. Kaolin is widely used as a filler in paper production. Its fine particle enhances the paper's opacity, brightness, and printability. Additionally, kaolin acts as a coating agent, improving the surface quality of paper. The surge in e-commerce and packaging demands has fuelled the need for high-quality paper. Kaolin’s role in enhancing paper quality makes it indispensable for the paper industry.

The cosmetics segment is anticipated to register lucrative growth, which is attributed to the increasing demand for natural and safe ingredients in skincare and makeup products. Kaolin is used in cosmetics due to its oil-absorbing properties. As awareness about skincare and beauty grows, the demand for kaolin-based cosmetic products is expected to rise steadily.

Key U.S. Kaolin Company Insights

The U.S. Kaolin market indicates a fairly concentrated structure. On account of the presence of large-scale kaolin deposits in the U.S., many kaolin producers are located in its close vicinity. Some key players operating in this market include BASF SE and Imerys S.A.:

-

BASF SE is a German chemical company that offers a range of products and solutions for the Kaolin industry, including kaolin processing, beneficiation, and applications.

-

Imerys is a French company that specializes in the performance minerals sector, including kaolin. Imerys has been in major player in the U.S. Kaolin market, especially in the paper and packaging industries.

Key U.S. Kaolin Companies:

- BASF SE

- Imerys S.A.

- KaMin LLC

- Sibelco

- Thiele Kaolin Company

- R.T. Vanderbilt Holding Company, Inc

- Active Minerals International

- Covia Holdings LLC

- BariteWorld

- MS Industries II, LLC

Recent Developments

-

In January 2024, Covia Holdings LLC has recently unveiled plans to demerge its Energy and Industrial businesses into two separate entities. The Industrial division will continue to function under the name of Covia Solutions and will also take charge of the kaolin market. The strategic move will allow both companies to pursue their distinct and focused growth strategies.

-

In August 2023, Sibelco announced an investment of USD 200 million to double production capacity in Spruce Pine (USA).

U.S. Kaolin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 360.6 million

Revenue forecast in 2030

USD 454.7 million

Growth rate

CAGR of 3.9% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application

Key companies profiled

BASF SE; Imerys S.A.; KaMin LLC; Sibelco; Thiele Kaolin Company; R.T. Vanderbilt Holding Company, Inc;Active Minerals International; Covia Holdings LLC; BariteWorld; MS Industries II LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Kaolin Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. kaolin market report based on application:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paper

-

Ceramics

-

Paint & Coatings

-

Fiberglass

-

Plastic

-

Rubber

-

Pharmaceuticals & Medical

-

Cosmetics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. kaolin market size was estimated at USD 342.8 million in 2023 and is expected to be USD 360.6 million in 2024.

b. The U.S. kaolin market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 454.7 million by 2030.

b. The ceramics segment dominated the U.S. kaolin market with a revenue share of 93% in 2023, on account of several factors including its unique properties, including plasticity, whiteness, and fine particle size. These characteristics make it an ideal raw material for ceramic production.

b. Some of the key players operating in the U.S. kaolin market include BASF SE; Imerys S.A.; KaMin LLC; Sibelco; Thiele Kaolin Company; R.T. Vanderbilt Holding Company, Inc; Active Minerals International; Covia Holdings LLC; BariteWorld; MS Industries II LLC.

b. Key factors that are driving the U.S. kaolin market growth include rising demand from various end-use industries such as paper, rubber, paints and coatings, and ceramics. In these industries, kaolin is a crucial filler due to its durability, high opacity, pigment suspension, and scrub resistance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.