- Home

- »

- Medical Devices

- »

-

U.S. Intravenous Solutions Market Size, Share, Report, 2030GVR Report cover

![U.S. Intravenous Solutions Market Size, Share & Trends Report]()

U.S. Intravenous Solutions Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (TPN, PPN), By Nutrients (Carbohydrates, Vitamins & Minerals), By End-use (Home, Hospitals), And Segment Forecasts

- Report ID: GVR-4-68040-286-4

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Intravenous Solutions Market Trends

The U.S. intravenous solutions market size was estimated at USD 5.03 billion in 2024 and is projected to grow at a CAGR of 7.8% from 2025 to 2030. The market is driven by an aging population needing medical interventions, a surge in chronic diseases requiring advanced treatments, and enhancements in healthcare technology that elevate patient care. This sector's growth reflects the critical need for innovative healthcare solutions to address the complex demands of modern medicine.

As individuals age, they often experience a range of health issues that require medical intervention, including chronic diseases such as diabetes, cardiovascular disorders, and renal failure. For instance, in January 2024, the Population Reference Bureau had projected that the American population aged 65 and over would expand from 58 million in 2022 to 82 million by 2050, reflecting a 47% increase. In addition, it was anticipated that the share of the total population belonging to this age bracket would grow from 17% to 23%. Older adults are easily susceptible to infectious diseases and need hospital treatment by administering parenteral nutrition (PN), which helps maintain strength, energy, and hydration.

The rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders contributes to market growth. These conditions require long-term treatment regimens that include IV therapies for hydration, nutrition, and medication administration. In May 2024, the National Cancer Institute projected an estimated incidence of 2.1 million new cancer diagnoses in the U.S., with 611,720 deaths resulting from the disease. Breast, lung, bronchus, prostate, and colorectal cancers are the most common cancers in the U.S. The compromised immunity in cancer disease boosts the need for parenteral nutrition products containing glutamine, phospholipids, glucose, and amino acids.

The emergence of 503A and 503B pharmacies has significantly influenced the growth of the U.S. intravenous solutions market by enhancing the availability and customization of compounded sterile preparations. 503A pharmacies focus on patient-specific prescriptions, allowing for tailored IV solutions that meet individual patient needs, thus driving demand in clinical settings. Meanwhile, 503B pharmacies, which can produce larger batches of compounded products, have increased supply efficiency and reduced shortages of essential intravenous solutions. This dual approach ensures a steady flow of personalized and bulk IV products, catering to diverse healthcare requirements across hospitals and outpatient facilities.

List of pharmacies operating under sections 503 A and 503 B in the U.S.

Sr. No

503 A

503 B

1

AnazaoHealth

Annovex Pharma, Inc.

2

Stokes Pharmacy

Apocus, Inc.

3

Olympia Pharmacy

Apollo Care

4

Empower Pharmacy

Atlas Pharmaceuticals, LLC

5

EC3Health

BayCare Integrated Service Center, LLC

6

Vertisis Custom Pharmacy

Belcher Pharmaceuticals, LLC

The expansion of hospitals, outpatient facilities, and specialized clinics has increased the capacity for administering IV therapies. Enhanced healthcare facilities are better equipped with modern technology and trained personnel who can provide effective intravenous treatments. In October 2024, Baxter increased U.S. IV fluid allocations for direct customers to 60% and for distributors to 60%, effective from Oct. 9. They are boosting allocations for certain high-demand products, aiming for 90%-100% by year-end. Specifically, children's hospitals will receive 100% allocations for IV solutions and nutrition products, highlighting their commitment to vulnerable patients while balancing the growing product demand.

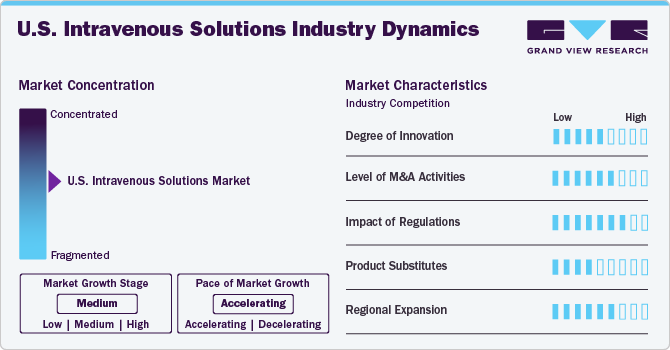

Market Concentration & Characteristics

The market growth stage is medium, with an accelerating pace. The innovations and new developments in the nutritional solution formulations and delivery systems contribute to the industry’s growth. The availability of advanced healthcare facilities and the wide presence of hospitals and ambulatory surgical centers across the country facilitate industry growth. Moreover, an increase in the number of intravenous (IV) solutions infusion centers and med spas providing products and services to patients with chronic diseases, along with the treatment for mental health disorders, has been observed over the past years.

The degree of innovation in the U.S. intravenous (IV) solutions market is moderate. This sector has seen technological advancements, particularly with the development of smart IV pumps and improved formulations for IV solutions that enhance patient safety and efficacy. Companies increasingly focus on research and development to create more effective, safer products. In January 2024, Takeda announced that the FDA approved GAMMAGARD LIQUID (10% Immune Globulin Infusion) for intravenous treatment, aimed at improving neuromuscular function in adults with chronic inflammatory demyelinating polyneuropathy (CIDP). It is suitable for both induction therapy with an initial dose and subsequent maintenance doses.

The level of merger and acquisition (M&A) activities and partnerships within the U.S. market is high. The market witnessed significant consolidation as larger companies acquired smaller firms to expand their product portfolios, enhance distribution networks, and leverage them in manufacturing processes. In March 2024, B. Braun Medical Inc. announced a partnership with Orlando Health to create innovative solutions to improve patient and clinician access to care. This collaboration focuses on gathering early feedback from clinicians to identify needs and develop effective solutions in the pharmacy and infusion therapy sectors.

The impact of regulations on the U.S. market is high. Regulatory bodies such as the Food and Drug Administration (FDA) impose stringent guidelines on the manufacturing, labelling, and marketing of IV solutions to ensure patient safety. For instance, In August 2024, B. Braun Medical Inc. announced a recall of 63,444 units of its 0.9% sodium chloride injection due to potential particulate contamination and leaks. Classified as a Class I recall by the FDA, the use of these products could lead to severe health risks, including stroke, organ damage, or even death, especially if the particulates are non-sterile.

The presence of product substitutes in the market is moderate. While alternative therapies are available for certain conditions treated with IV solutions-such as oral rehydration solutions or enteral feeding options-the specific applications for IV therapy necessitate its use due to immediate absorption rates and effectiveness in critical care settings. However, ongoing developments in alternative treatment modalities could pose a challenge.

The regional expansion within the U.S. market is high. With increasing healthcare needs driven by an aging population and rising chronic diseases, there is a growing demand for IV therapies across various regions. Companies actively explore opportunities to penetrate underserved markets or expand their geographic reach through strategic partnerships or localized production facilities.

Product Insights

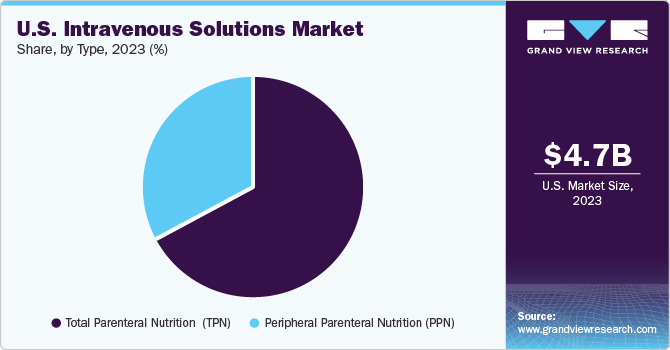

The market is categorized into total parenteral nutrition (TPN) and peripheral parenteral nutrition (PPN) segments. The TPN segment held the largest market share of over 67.14% in 2024 and is expected to grow at the fastest CAGR of 8.0% over the forecast period. Total parenteral nutrition is administering a complete range of nutrients directly into the bloodstream through an intravenous (IV) technique. TPN solutions are more concentrated than peripheral parenteral nutrition solutions and are commonly used in surgical intensive care units (ICUs). According to the Society of Critical Care Medicine, more than 5 million patients are admitted to ICUs annually in the U.S.

In addition, a research article published by MDPI highlights the advantages of administering peripheral parenteral nutrition (PPN) early to colorectal surgery patients. The combination of PPN supplementation with compliance to Enhanced Recovery After Surgery (ERAS) protocols markedly diminishes the rate of post-surgical complications. Individuals who were administered PPN experienced fewer complications than those who underwent standard fluid therapy. Moreover, PPN has been shown to reduce the potential for complications to escalate or evolve into more serious conditions.

The peripheral parenteral nutrition (PPN) segment is anticipated to grow at a significant rate over the forecast period due to its ability to provide essential nutrients to patients who cannot consume food orally or through enteral feeding. PPN is particularly advantageous for patients with short-term nutritional needs, as it can be administered via peripheral veins, reducing the risk of complications associated with central venous catheters. A June 2024 article in the American Journal of Health-System Pharmacy discussed methods to enhance parenteral nutrition (PN) practices. The article reviewed PN formulations, intravenous lipid emulsions' benefits, multi-chamber PN bags' role, and strategies to address global PN product shortages.

Nutrients Insights

Based on nutrient type, the single dose amino acid solution segment dominated the market with the largest share in 2024. Different studies suggest that single-dose amino acids provide a complete protein source and can be easily customized with other parenteral formulations for administration. For instance, B. Braun Medical Inc. supplies a Pharmacy Bulk Pack (PBP) of Plenamine 15% Amino Acids Injection. This preparation is a sterile, transparent blend of both essential and nonessential amino acids intended for intravenous infusion as part of a parenteral nutrition regimen, following suitable dilution.

The vitamins and minerals segment (salt and electrolyte) is expected to grow at the fastest CAGR over the forecast period. Vitamins play a crucial role in the formation of red blood cells, blood clotting, and maintaining mucus membranes. Their deficiency can lead to various conditions such as anaemia, beriberi, pellagra, and chronic mental disorders. Treatment for such deficiencies involves either parenteral or enteral nutrition.

Minerals are organic chemicals that are essential for regulating metabolic pathways, such as β-carotene, sodium chloride, magnesium, potassium, and phosphorous. Lack of minerals can lead to weak bones, a weakened immune system, and fatigue due to poor mineral absorption. Parental nutrition (PN) therapies can be used for such deficiencies. In July 2024, Amneal Pharmaceuticals, Inc. received FDA approval for its ready-to-use potassium phosphates in 0.9% sodium chloride IV bags. This innovation simplifies administration by eliminating compounding steps and is intended for treating hypophosphatemia in adults and pediatric patients over 40 kg.

End-use Insights

Based on end use, hospitals held the largest share of over 46.0% in 2024 due to their critical role in patient care, particularly for those requiring hydration, medication delivery, and nutritional support. The high volume of patients admitted for various medical conditions necessitates a consistent supply of IV solutions for treatments such as chemotherapy, surgery recovery, and emergency care. For instance, in April 2024, The Definitive Healthcare HospitalView product monitors 7,378 active hospitals in the U.S. These facilities are compiled from almost 40 diverse public, private, and proprietary sources. These institutions depend on intravenous solutions for various surgical interventions and care after surgery, stimulating demand in this area. The practicality of establishing home care services has simplified the process for patients to utilize IV drips at home instead of in hospital settings.

Home segment is expected to grow at the fastest CAGR over the forecast period due to the growing trend towards outpatient care and patient preference for receiving treatment in a familiar environment. Advances in technology have made it feasible for patients to manage their IV therapy at home, which is often more convenient and cost-effective than prolonged hospital stays. Conditions such as dehydration, infections requiring antibiotics, or chronic illnesses that necessitate long-term IV nutrition can be managed effectively at home with proper training and support from healthcare professionals and in May 2024, The New York Times discussed the rising trend of intravenous drip therapy, presenting it as a method for boosting the immune system and aiding recovery from various procedures. This therapy involves the infusion of saline, vitamins, and electrolytes and has become increasingly popular for its health benefits, including alleviating jet lag.

Key U.S. Intravenous Solutions Company Insights

Some of the key players operating in the market include Fresenius Kabi AG, Pfizer Inc., Baxter, JW Life Science, ICU Medical, Inc., Grifols USA, LLC, B. Braun Medical Inc, Amphastar Pharmaceuticals, Inc., Athenex, Inc., Rockwell Medical, Inc., Exela Pharma Sciences, LLC, among others

-

Baxter International holds a diversified product portfolio in renal care, nutrition, respiratory care, hospital beds, and connected care, with a strong presence in intravenous solutions and therapies.

-

Fresenius Kabi AG is an infusion therapy and clinical products company offering medicines for various diseases, including oncology, anaesthesia, analgesia, anti-infectives, parenteral nutrition, IV solutions, and many critical care therapies.

Key U.S. Intravenous Solutions Companies:

- Fresenius Kabi AG

- Pfizer Inc.

- Baxter

- JW Life Science

- ICU Medical, Inc.

- Grifols USA, LLC

- B. Braun Medical Inc

- Amphastar Pharmaceuticals, Inc.

- Athenex, Inc.

- Rockwell Medical, Inc.

- Exela Pharma Sciences, LLC

Recent Developments

-

In October 2024, B. Braun Medical announced plans to increase its IV saline fluids production by 20% at its facilities in Irvine, California, and Daytona Beach, Florida. This expansion will raise its annual IV set production by over 30 million units. It will also include a boost in the production of associated infusion therapy components like valves and connectors.

-

In October 2024, the U.S. Department of Health and Human Services enhanced access to intravenous (IV) fluids to support hospitals. As a result, hospitals have 50% more product available, with over 450 truckloads distributed and additional imports being processed. The FDA expedited the importation of 23 IV fluids globally. Supply availability is expected to reach 90%-100% of historical levels by year-end.

-

In February 2024, B. Braun Medical Inc., a key player in smart infusion therapy and pain management, unveiled its Heparin Sodium 2,000 units in 0.9% Sodium Chloride Injection, 1,000 mL (2 units/mL). This product is the fifth Heparin premixed bag in its lineup, bolstering its offerings for healthcare facilities and patients requiring this critical medication.

U.S. Intravenous Solutions Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 5.43 billion

Revenue forecast in 2030

USD 7.91 billion

Growth rate

CAGR of 7.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nutrients, end-use

Country scope

U.S.

Key companies profiled

Fresenius Kabi AG, Pfizer Inc., Baxter , JW Life Science, ICU Medical, Inc., Grifols USA, LLC, B. Braun Medical Inc., Amphastar Pharmaceuticals, Inc., Athenex, Inc., Rockwell Medical, Inc., Exela Pharma Sciences, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Intravenous Solutions Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. intravenous solutions market report based on product, nutrients, and end-use:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Total Parenteral Nutrition

-

Peripheral Parenteral Nutrition

-

-

Nutrients Outlook (Revenue, USD Billion, 2018 - 2030)

-

Carbohydrates

-

Vitamins & Minerals

-

Single-dose Amino Acids

-

Parenteral Lipid Emulsion

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home

-

Hospitals

-

Infusion Center

-

Frequently Asked Questions About This Report

b. The U.S. intravenous solutions market size was estimated at USD 5.03 billion in 2024 and is expected to reach USD 5.42 billion in 2025.

b. The U.S. intravenous solutions market is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2025 to 2030 to reach USD 7.91 billion by 2030.

b. In terms of product, total parenteral nutrition (TPN) dominated the market with the largest share of 67.14% in 2024. This high share is attributable to the increased number of surgeries in the U.S.

b. Some key players operating in the U.S. intravenous solutions market include Fresenius Kabi AG, Pfizer Inc., Baxter, ICU Medical, Option Care Health Inc., and B. Braun Medical Inc.

b. Key factors driving the market growth are the rising prevalence of diseases, the rising number of geriatric population susceptible to non-communicable diseases, the increasing number of surgeries, and the growing number of hospitals and ambulatory surgical centers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.