- Home

- »

- Medical Devices

- »

-

U.S. Intravenous Infusion Pumps Market, Industry Report, 2030GVR Report cover

![U.S. Intravenous Infusion Pumps Market Size, Share & Trends Report]()

U.S. Intravenous Infusion Pumps Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Volumetric, Insulin, Syringe, Enteral, Ambulatory), By Disease Indication (Diabetes,Chemotherapy,Hematology), And Segment Forecasts

- Report ID: GVR-4-68040-280-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

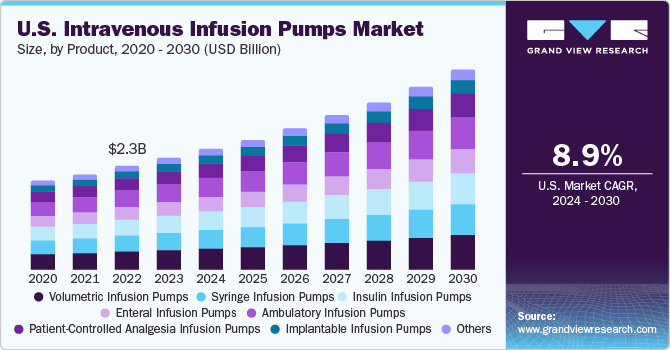

The U.S. intravenous infusion pumps market size was valued at USD 2.6 billion in 2023 and is estimated to grow at a CAGR of 8.9% from 2024 to 2030. This is attributed to several benefits provided by infusion pumps and higher demand due to high disease prevalence among the population across the U.S. Intravenous infusion pumps are in extensive use in clinical settings such as hospitals, nursing homes, and in the home. The pump is operated by a trained operator by programming the rate and duration of fluid delivery using built-in software. Intravenous infusion pumps can deliver nutrients, hormones, antibiotics, chemotherapy drugs, and pain relievers.

COVID-19 pandemic had a positive impact on the home infusion market and the technique of home infusion was the need of the hour as healthcare settings were burdened with increasing COVID-19 patients. The regional and country-wide lockdowns significantly affected operations and supply chains, but the market grew considerably in 2020. For instance, Baxter announced operational sales growth of 6% (3.2 billion) in Q3 2021 as compared to 3.0 billion in Q3 2020, reflecting the steady impact of the pandemic recovery.

In addition, the U.S. intravenous infusion pump market accounted for about 57.0% in the global intravenous infusion pump market. This is due to increasing prevalence of chronic diseases causing disability and death. As per the latest statistics of CDC, approximately 6 in 10 adults in the U.S. are suffering from chronic disease. These chronic diseases comprise chronic respiratory diseases, stroke, diabetes, cancer, and cardiovascular diseases. Moreover, a surge in disease prevalence among children and adolescents across the U.S. is anticipated to fuel the market growth. According to the UN, 130 million children are born each year, and some of them are affected by abnormalities due to parental genetics, chromosomal problems, infections, etc. Such factors further contribute to the escalated demand for intravenous infusion pumps.

Dehydration is becoming common among individuals with sedentary lifestyles. According to an article published by Drip Drop Hydration, nearly 75% of Americans are chronically dehydrated. Dehydration is known to impair cognitive functions and leads to reduced productivity. Moreover, chronic dehydration results in impaired kidney, gastrointestinal, and heart functions. Severe dehydration may also result in death.

The introduction of smart infusion pumps or next-generation intravenous pumps is imparting greater growth opportunities for the overall pump market. Such advancements in infusion pump devices bring value to hospitals, allow wireless data collection, and help avert errors during treatment. Many companies manufacturing infusion pumps such as Baxter International, Medtronic, and B. Braun Melsungen AG have developed smart pumps, which are in high demand because of safety, ease, automation, and dependability.

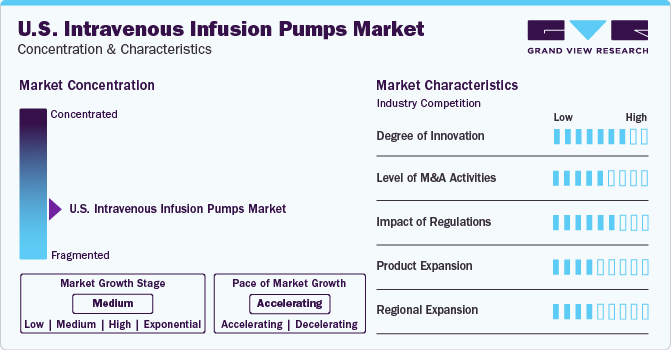

Market Concentration & Characteristics

The U.S. intravenous infusion pump market is fragmented due to the involvement of more small companies, leading to accelerating market growth. In addition, these companies are actively engaged in a high degree of innovation, the impact of regulations, mergers and acquisitions, and regional expansion.

Several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies. Moreover, the launch of different products and facilities at several locations helps to expand its presence geographically and capture a larger market share. For instance, in May 2022, Fresenius Kabi announced the acquisition of Ivenix to expand its portfolio in the U.S. market.

Companies in U.S. intravenous infusion pump market undertake this strategy to strengthen their product portfolios and offer diverse technologically advanced and innovative products to customers. This strategy is the most prominently adopted strategy by companies that help in attracting more customers. For instance, in May 2021, Medtronic introduced an extended infusion set in certain European countries, allowing diabetes patients to use the infusion pump therapy for 7 days without frequent insertions and interruptions.

Several market players are entering into partnerships & collaborations to grow, innovate & improve their presence by combining the expertise and efforts of different organizations. For instance, in May 2021, Smiths Medical announced the exclusive partnership with Ivenix, Inc. for offering a comprehensive suite of infusion management solutions across the care continuum in the U.S. This collaboration also enhances the company's significant presence in the high-volume infusion device sector.

Regulatory bodies such as the U.S. FDA support key companies with the approvals, thereby fulfilling market demand and gaining new clients. For instance, in August 2023, ICU Medical, Inc. received FDA clearance for Plum DuoTM Infusion Pump and LifeShield software. This approval would showcase the company’s long-term vision of bringing customers the best devices with a shared platform and user experience.

Product Insights

Based on product, volumetric infusion pumps dominated the market with a share of about 17.0% in 2023. The market growth can be attributed to the capability of delivering continuous and very specific amounts of fluids at a very slow pace. According to NCBI, volumetric infusion pumps are medical devices that employ electronic peristaltic pressure, capable of continuous and specific delivery of fluids coupled with a high level of accuracy, thereby increasing the efficiencies of drug administration. These pumps can be administered in hospitals, home care settings, ambulatory care settings, and outpatient infusion centers, as well as help deliver nutrients or medications, such as hormones, antibiotics, chemotherapy drugs, & pain relievers in large volumes, thereby increasing their demand in the market.

The insulin infusion pumps segment is expected to grow at the fastest CAGR of 9.3% from 2024 to 2030. This is likely due to the higher prevalence of diabetes across the U.S. As per the National Diabetes Statistics report, approximately 38.4 million people have diabetes which accounts for 11.6% of the US population. Insulin infusion pumps are increasingly valuable for individuals’ managing diabetes, offering a computerized device that delivers continuous short-acting insulin through a thin tube, eliminating the need for multiple daily injections. Increased prevalence of diabetes, accurate records of insulin usage, and ease of administration are factors likely to boost segment growth in coming years.

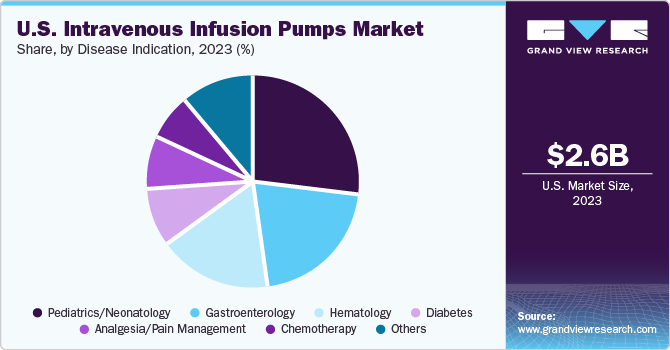

Disease Indication Insights

Based on disease indication, pediatrics/neonatology segment dominated the market with a share of about 27.0% in 2023. This growth is driven by rising disease prevalence in children due to parental genetics, chromosomal problems, & infections and is expected to drive the market growth over the forecast period. As per 2022 review of Comprehensive Clinical Psychology released by NIH, approximately 27.0% children and adolescents are affected with chronic diseases in the U.S. Neonatology is a branch of medicine that deals with infants born in/with acute conditions, including prematurity, low birth weight, intrauterine growth restriction, congenital malformations (birth defects), sepsis, pulmonary hypoplasia, or birth asphyxia.

According to WHO, 15 million babies are born preterm, which is a leading cause of newborn deaths in the world. The number of babies born preterm can be reduced by nearly three quarters with feasible, cost-effective care and proper nutrition in the initial stages after birth. Such high disease prevalence among the young population of U.S. further enhances growth of this segment over the forecast years.

The chemotherapy segment is anticipated to expand at the fastest CAGR of 10.1% from 2024 to 2030. Cancer is highly prevalent across U.S and according to American Society of Cancer, in U.S., 1.7 million new cancer cases were diagnosed with a five-year relative survival rate in 2019. Currently, 30.0% to 50.0% of cancer cases can be prevented by avoiding risk factors, timely diagnosis, and efficient treatment. Chemotherapy is majorly administered intravenously or through capsules to patients. The dosage depends on severity of cancer, and thus, requires calculated drug delivery in a controlled manner via intravenous infusion pumps. The increase in prevalence of cancer is expected to propel the overall market for intravenous infusion pumps.

Key U.S. Intravenous Infusion Pumps Company Insights

The key companies in U.S. Intravenous infusion pumps market include Baxter, Smiths Medical, Boston Scientific Corporation, and CareFusion Corporation.

The market includes multiple small companies that are primarily involved in extensive growth strategies, including forming partnerships, enhancing product diversification, and expanding their product portfolios to secure a larger market share.

Key U.S. Intravenous Infusion Pumps Companies:

- Baxter

- Smiths Medical

- Boston Scientific Corporation

- CareFusion Corporation

- B. Braun Melsungen AG

- Medtronic

- Micrel Medical Devices SA

- CareFusion Corporation

- Fresenius Kabi

- Smith's Medical

- ICU Medical, Inc.

Recent Developments

-

In February 2024, Hikma Pharmaceuticals PLC announced the launch of COMBOGESIC® IV (acetaminophen and ibuprofen) injection in the US. COMBOGESIC® IV presents healthcare providers with an innovative non-opioid method for pain management, blending active drug ingredients with diverse mechanisms of action into one formula.

-

In August 2022, Baxter announced U.S. FDA clearance of the Novum IQ Syringe Infusion Pump with dose IQ software. This innovative technology for medication delivery would support the company’s innovation aspects. The company would further fully integrate this technology in hospital electronic medical records through Baxter’s IQ Enterprise connectivity model.

-

In July 2023, BD (Becton, Dickinson, and Company) received FDA 510(k) Clearance approval for Updated BD Alaris™ Infusion System. BD's FDA-cleared Alaris infusion system in the U.S. enables remediation and full commercial operations, following significant investments to enhance manufacturing, supply chains, and regulatory compliance.

U.S. Intravenous Infusion Pumps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.8 billion

Revenue forecast for 2030

USD 4.6 billion

Growth Rate

CAGR of 8.9% from 2024 to 2030

Actual estimates/Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, disease indication

Country Scope

U.S.

Key companies profiled

Baxter; Smiths Medica; Boston Scientific Corporation

CareFusion Corporation; B. Braun Melsungen AG

Medtronic; Micrel Medical Devices SA; CareFusion Corporation; Fresenius Kabi; Smith's Medical; ICU Medical Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Intravenous Infusion Pump Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. intravenous infusion pump market based on product, and diseases indication:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Volumetric Infusion Pumps

-

Syringe Infusion Pumps

-

Insulin Infusion Pumps

-

Enteral Infusion Pumps

-

Ambulatory Infusion Pumps

-

Patient-Controlled Analgesia Infusion Pumps

-

Implantable Infusion Pumps

-

Other

-

-

Disease Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Diabetes

-

Chemotherapy

-

Gastroenterology

-

Analgesia/Pain Management

-

Pediatrics/Neonatology

-

Hematology

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. intravenous infusion pumps market size was estimated at USD 2.6 billion in 2023 and is expected to reach USD 2.8 billion in 2024.

b. The U.S. intravenous infusion pumps market is estimated to grow at a compound annual growth rate (CAGR) of 8.9% from 2024 to 2030 to reach USD 4.6 billion by 2030.

b. Pediatrics/neonatology segment dominated the market with a share of about 27.0% in 2023. This growth is driven by rising disease prevalence in children due to parental genetics, chromosomal problems, & infections and is expected to drive the market growth over the forecast period.

b. The key companies in the U.S. Intravenous infusion pumps market include Baxter, Smiths Medical, Boston Scientific Corporation, and CareFusion Corporation.

b. The introduction of smart infusion pumps or next-generation intravenous pumps is imparting greater growth opportunities for the overall pump market. Such advancements in infusion pump devices bring value to hospitals, allow wireless data collection, and help avert errors during treatment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.