- Home

- »

- Medical Devices

- »

-

U.S. Intracranial Aneurysm Market, Industry Report, 2030GVR Report cover

![U.S. Intracranial Aneurysm Market Size, Share & Trends Report]()

U.S. Intracranial Aneurysm Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Surgical Clipping, Endovascular Coiling, Flow Diverters), By End-use (Hospitals, Clinics), And Segment Forecasts

- Report ID: GVR-4-68040-284-6

- Number of Report Pages: 95

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Intracranial Aneurysm Market Trends

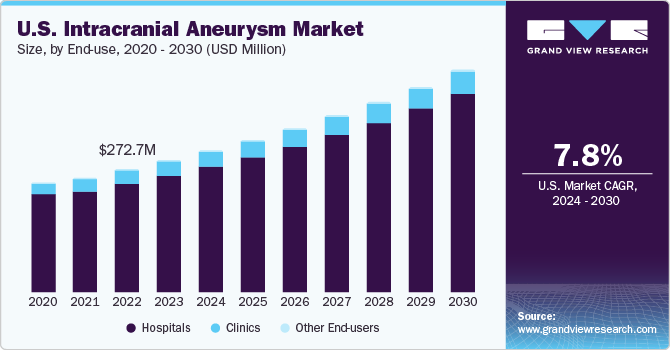

The U.S. intracranial aneurysm market size was estimated at USD 293.15 million in 2023 and is expected to grow at a CAGR of 7.80% from 2024 to 2030. Stressful lifestyles, hypertension, unhealthy diets, and smoking among adults older than 40 years are major factors contributing to market growth. According to the Brain Aneurysm Foundation, approximately 6.7 million Americans, or 1 in 50 people, have an unruptured brain aneurysm. Ruptured aneurysms can cause subarachnoid hemorrhages, increasing the mortality risk to 50%.

The U.S. intracranial aneurysm market accounted for 23.10% of the global intracranial aneurysm market in 2023. This is attributable to the increasing prevalence of brain aneurysm, rising demand for minimally invasive procedures and adoption of technologically advanced products. In addition, favorable reimbursement policies and various government initiatives are a few more factors contributing to market growth. In the U.S., approximately 30,000 people experience a brain aneurysm rupture each year, translating to one rupture every 18 minutes. The prevalence of brain aneurysms increases with age, with most cases occurring in people between 35 and 60 years old. Among those, women face a higher risk of developing brain aneurysms than men.

Factors such as stressful lifestyles, hypertension, unhealthy diets, and smoking can aggravate the risk, with hypertension weakening blood vessel walls and unhealthy diets leading to hypertension and obesity. Smoking damages blood vessels and raises blood pressure. As these risk factors become more prevalent, particularly in the older adult population, brain aneurysm cases are likely to rise. Emphasizing preventive measures and addressing these lifestyle factors is crucial to combat this trend.

Increasing occurrence of brain aneurysms in the U.S. has spurred the emergence of advanced treatment techniques for intracranial aneurysms. Key methods include endovascular coiling, surgical clipping, and flow diverters. As the healthcare industry strives to address this growing health concern, the demand for innovative and effective treatments is on rise. Consequently, the market is anticipating the introduction of more sophisticated products and technologies in the future and foresees substantial growth.

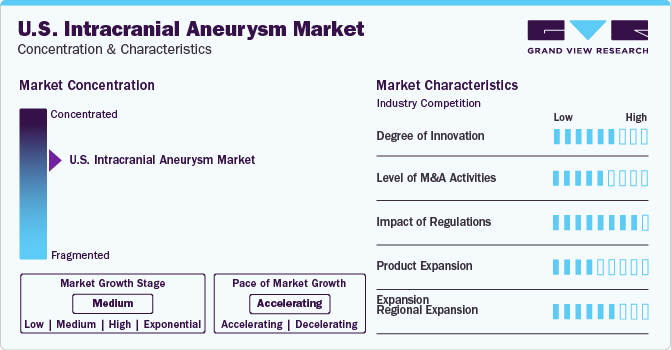

Market Concentration & Characteristics

The U.S. intracranial aneurysm industry is growing due to innovations in neurovascular devices, imaging, and minimally invasive procedures. These advancements improve diagnosis accuracy and treatment outcomes, benefiting patients and healthcare providers.

The industry is witnessing a high level of merger and acquisition activity. For instance, Stryker, a leading medical technology company, completed the acquisition of Cerus Endovascular in May 2023. Cerus specializes in neurointerventional devices for intracranial aneurysm treatment. This acquisition expanded Stryker’s portfolio, addressing the growing need for one-and-done intrasaccular aneurysm therapy.

The U.S. FDA governs the stringent regulatory framework surrounding neurological medical devices. Changes in regulatory standards and reimbursement policies can significantly affect manufacturers’ strategies and operations within the industry. Favorable initiatives undertaken by private and public sectors in developed countries related to intracranial aneurysm are likely to boost the industry.

The industry is growing due to the development of innovative treatments like endovascular coiling, surgical clipping, and flow diverters. These product advancements provide patients with effective, minimally invasive options, improving overall care. For instance, in April 2021, Medtronic and Surgical Theater integrated SyncAR AR tech with Medtronic’s StealthStation S8 system, enabling neurosurgeons to use AR for enhanced visualization and planning in complex cranial procedures.

To cater to a broader patient base, access new industries, and capitalize on the available opportunities for growth, companies are expanding their reach geographically within the country. For instance, Rapid Medical‘s expansion of its portfolio in the U.S. in November 2022 through collaborations with MicroPort NeuroTech exemplifies regional expansion in the industry.

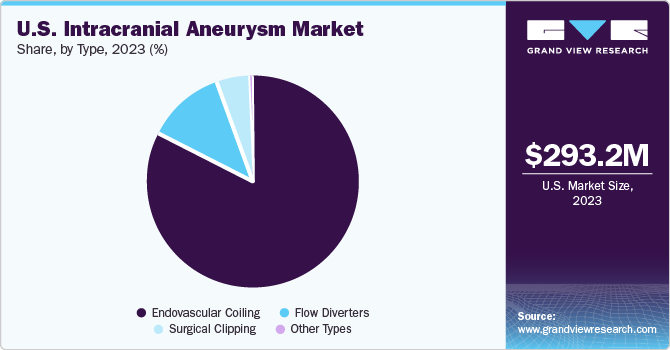

Type Insights

Endovascular coiling led the market with over 80% in 2023. The segment growth is positively impacted due to the minimally invasive procedures offered by endovascular coils that result in shorter bed rest periods compared to surgical clipping. This method also reduces the initial risk of surgical fatality. Furthermore, advancements in products designed for the treatment of neurological disorders by industry key companies significantly contribute to market growth.

Flow diverters are expected to experience the highest growth rate during the forecast period, primarily due to their capacity to alter hemodynamics at the parent vessel interface, which leads to gradual aneurysm thrombosis. In addition, when flow diverters are used in fusiform aneurysms in continuation with the parent artery, they aid in reconstructing a smooth, endothelial-covered channel.

End-use Insights

The U.S. intracranial aneurysm devices market segmented by end-users includes hospitals, clinics, and others. Hospitals dominate as the largest and fastest-growing segment due to intracranial aneurysm procedures being highly critical and complex, requiring advanced, high-quality, and durable equipment found in hospitals. Furthermore, hospitals are better equipped to manage post-operative complications and provide facilities for physical rehabilitation after surgeries.

The clinics segment is anticipated to experience significant growth from 2024 to 2030. The rising number of clinics providing diagnosis and treatment for intracranial aneurysms is expected to drive market growth. Furthermore, the increasing adoption of technologically advanced devices, such as flow diverters, for treating intracranial aneurysms will contribute to market expansion. For example, the Brain Aneurysm Institute at Beth Israel Deaconess Medical Center, Boston, offers cutting-edge endovascular and surgical treatments for brain aneurysms and other vascular issues.

Key U.S. Intracranial Aneurysm Company Insights

The U.S. intracranial aneurysm market has a relatively consolidated landscape, with major companies holding substantial market shares. Medtronic plc; Stryker Corporation; MicroPort Scientific Corporation; Johnson & Johnson Services, Inc.; MicroVention Inc.; and B. Braun Melsungen AG are some of the key companies.

These companies invest in continuous innovation to improve their treatment offerings, thereby gaining a competitive edge. By enhancing their products and services, they aim to serve patients and healthcare providers better while maintaining their leading positions in the industry.

Key U.S. Intracranial Aneurysm Companies:

- Medtronic plc

- Stryker Corporation

- MicroPort Scientific Corporation

- Johnson & Johnson Services, Inc.

- MicroVention Inc.

- B. Braun Melsungen AG

- Integra LifeSciences

- Terumo Corporation

- Delta Surgical

- Rapid Medical

- Mizuho Medical Incorporation

- Evonos GmbH & Co. KG

Recent Developments

-

In July 2023, MicroVention Inc., a neurovascular company, published 5-year follow-up data for its WEB Aneurysm Embolization System and introduced two new sizes at the SNIS, San Diego.

-

In May 2023, CERENOVUS, a Johnson & Johnson MedTech company, introduced the CEREPAK Detachable Coils in the U.S., aiding the intracranial aneurysm market. These innovative coils offer diverse shapes and sizes for improved brain aneurysm embolization.

-

In April 2021, Medtronic received FDA approval for Pipeline Flex Embolization Device with Shield Technology, featuring surface-modified implants reducing thrombogenicity.

-

In August 2020, Stryker Corporation received FDA approval for an expanded indication of its Neuroform Atlas Stent System, becoming the first and only adjunctive stent approved for use in the posterior circulation.

U.S. Intracranial Aneurysm Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 494.65 million

Growth rate

CAGR of 7.80% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, end-use

Country scope

U.S.

Key companies profiled

Medtronic plc; Stryker Corporation; MicroPort Scientific Corporation; Johnson & Johnson Services, Inc.; MicroVention Inc.; B. Braun Melsungen AG; Integra LifeSciences; Terumo Corporation; Delta Surgical; Rapid Medical; Mizuho Medical Incorporation; Evonos GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Intracranial Aneurysm Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. intracranial aneurysm market report based on type and end-use.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Clipping

-

Endovascular Coiling

-

Flow Diverters

-

Other Types

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Other End-users

-

Frequently Asked Questions About This Report

b. The U.S. intracranial aneurysm market size was estimated at USD 293.15 million in 2023 and is expected to reach USD 368.55 million in 2024.

b. The U.S. intracranial aneurysm market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 494.65 million by 2030.

b. The endovascular coiling segment led the market with the largest revenue share of 80% in 2023, the endovascular coiling technique is a minimally invasive procedure that employs a catheter to identify and treat aneurysms in the brain.

b. Some key players operating in the U.S. intracranial aneurysm market Medtronic; Stryker; MicroPort Scientific Corporation.; Johnson & Johnson Services, Inc.; MicroVention Inc.; B. Braun Melsungen AG; Integra LifeSciences; RAUMEDIC AG; Terumo Corporation; Delta Surgical.

b. Increasing incidence of neurological diseases is a major factor contributing to the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.