- Home

- »

- Pharmaceuticals

- »

-

U.S. Inflammatory Bowel Disease Treatment Market, Industry Report, 2030GVR Report cover

![U.S. Inflammatory Bowel Disease Treatment Market Size, Share & Trends Report]()

U.S. Inflammatory Bowel Disease Treatment Market Size, Share & Trends Analysis Report By Type, By Drug Class, By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-286-7

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

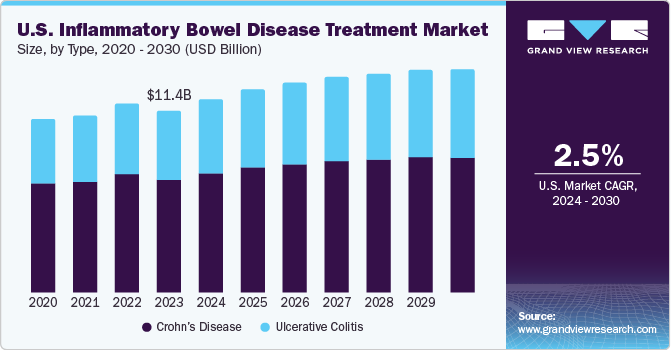

The U.S. inflammatory bowel disease treatment market size was estimated at USD 11.4 billion in 2023 and is projected to grow at a CAGR of 2.5% from 2024 to 2030. The global incidence of inflammatory bowel diseases (IBD), which includes Crohn's disease and ulcerative colitis, is increasing, primarily due to changes in lifestyle, dietary habits, and environmental factors. According to an article published in 2023, inflammatory bowel disease is a relatively common chronic condition affecting >0.7% of Americans and is most prevalent in the Northeastern region. This growing patient population needs advanced treatment options, driving the market growth.

Major pharmaceutical companies invest in research and development for IBD treatments, acquiring smaller companies or forming strategic partnerships to expand their product portfolios. In October 2023, Sanofi and Teva collaborated to deliver therapy for inflammatory bowel diseases (TEV’574, currently in the 2b Phase of clinical trials for treating ulcerative colitis and Crohn's Disease). This collaboration supported Sanofi’s immunology strategy of exploring novel mechanisms of action for these diseases.

According to the Gastroenterology and Endoscopy news, the prevalence of inflammatory bowel diseases in 2023 in the U.S. is among the highest in the world. Governments and private insurers worldwide are recognizing the importance of managing these diseases effectively to reduce long-term healthcare costs and improve the quality of life of patients. This has led to increased healthcare spending on inflammatory bowel disease treatments, further driving market growth.

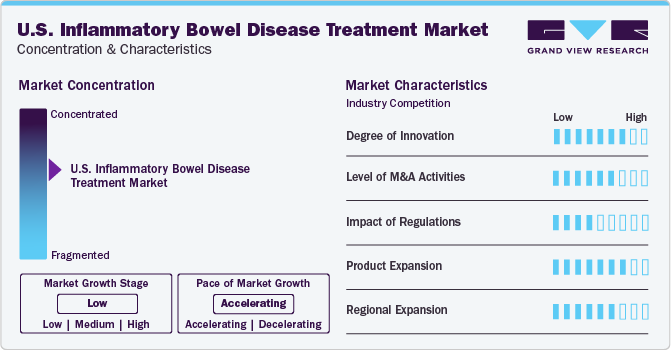

Market Concentration & Characteristics

The market growth stage is low but has an accelerating pace. The development of new, targeted therapies has expanded the treatment options available for these patients. These innovative treatments, such as biologics and biosimilars, have shown promising results and have contributed to the growth of the U.S. market.

The market for U.S. inflammatory bowel disease treatment is also characterized by the leading players' high level of merger and acquisition (M&A) activity. In October 2023, Roche entered into an agreement to acquire Telavant, which included rights to a novel TL1A antibody (RVT-3101) for treating inflammatory bowel disease. This agreement included the development, manufacturing, and commercialization rights in the U.S. for the directed antibody.

National regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), play a crucial role in overseeing the approval process for new treatments. These agencies ensure that the drugs and therapies are safe, effective, and of high quality before making them available to patients. These trials are conducted according to strict protocols and guidelines to ensure the validity of the results. In 2023, the U.S. FDA approved the first oral treatment for moderate-to-severe active Crohn's disease. Independent ethics committees and institutional review boards monitor these trials to protect the participants' rights, safety, and well-being. Regulatory authorities also play a role in determining the cost and accessibility of inflammatory bowel disease treatments. They may set price controls or negotiate with pharmaceutical companies to ensure affordable and equitable patient treatment access.

As more regions adopt and expand the availability of these treatments, patients in the U.S. are expected to have better access to cutting-edge therapies, improving their overall quality of life and treatment outcomes. Moreover, the increase in regulatory approvals in the country creates more scope for expanding the market. In September 2023, Takeda announced the FDA acceptance of the biologics license application (BLA) for the subcutaneous administration of ENTYVIO (vedolizumab) for the treatment of Crohn's disease.

Type Insights

Crohn’s disease dominated the market in 2023 with a revenue share of 62.3%. Crohn's disease requires more treatment options and advancements due to its chronic inflammatory nature that affects the gastrointestinal tract, causing symptoms such as abdominal pain, diarrhea, weight loss, and fatigue. Crohn's disease often has periods of remission followed by relapses, making it difficult to manage in the long term. More effective treatments are needed to help patients maintain remission and improve their overall health. In October 2023, Eli Lilly and Company announced that mirikizumab (an investigational interleukin-23p19 antagonist) achieves safety and efficacy in treating adults with Crohn's disease. Crohn's disease has an increased prevalence due to its variability in response to treatment, limited understanding of the disease, recurrence and remission challenges, potential complications, and the impact on patients' quality of life.

The ulcerative colitis segment is anticipated to register the fastest CAGR over the forecast period. Untreated or poorly managed ulcerative colitis can lead to complications such as severe bleeding, increased risk of colon cancer, and life-threatening inflammation known as toxic megacolon. The complex and unpredictable nature of ulcerative colitis, along with the need for ongoing management to maintain quality of life and prevent complications, makes it a condition that requires more extensive treatment.

Drug Class Insights

In terms of drug class, the TNF inhibitors segment held the largest market revenue share in 2023. Tumor Necrosis Factor (TNF) inhibitors are in high demand for treating inflammatory bowel diseases (IBD) due to their effectiveness in managing the symptoms and reducing inflammation. Inflammatory bowel diseases, such as Crohn's disease and ulcerative colitis, are chronic conditions characterized by inflammation in the gastrointestinal tract. This inflammation can lead to abdominal pain, diarrhea, weight loss, and other complications. The demand for TNF inhibitors in this treatment is high due to their proven efficacy in managing symptoms, inducing and maintaining remission, and improving patients' overall quality of life.

The JAK inhibitors segment is anticipated to register the fastest CAGR during the forecast period. The segment's expansion is anticipated due to the growing endorsement of innovative JAK inhibitors and potent pipeline medications. According to the Gastroenterology & Endoscopy news, in 2022, the FDA approved Rinvoq for treating ulcerative colitis. This increase in the number of regulatory approvals, in turn, leads to market growth.

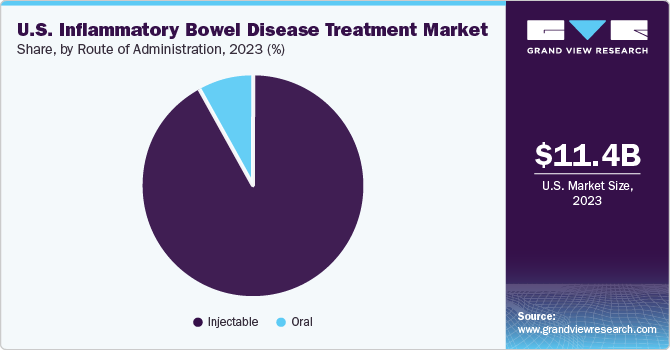

Route of Administration Insights

The injectable segment dominated the market in 2023 in terms of revenue share. Injectable medications, such as biologics and biosimilars, are designed to target specific proteins or cells involved in the inflammatory process of inflammatory bowel disease. This targeted approach allows for more efficient and effective treatment than traditional oral or topical medications, which may have broader side effects. Injectables can provide systemic treatment; they circulate throughout the body and reach affected areas more effectively than local treatments, which may only address the symptoms at the application site.

The oral segment is projected to grow at the fastest CAGR over the forecast period. Oral medications can be easily swallowed and taken with water, making them more convenient for patients than other administration routes, such as injections or infusions. This is particularly important for long-term management of chronic conditions such as IBD. Oral medications can be combined with other treatments, such as biologics or immunosuppressants, to enhance their effectiveness in managing these diseases. This approach can help improve treatment outcomes and reduce the risk of complications. In October 2023, the U.S. FDA approved Pfizer’s VELSIPITY, an oral treatment for adults with active ulcerative colitis (UC).

Distribution Channel Insights

The hospital pharmacies segment held the largest revenue share in 2023. The inflammatory bowel diseases, including Crohn's disease and ulcerative colitis, require a complex and tailored treatment approach. Patients often need a combination of medications, including immunosuppressants, biologics, and anti-inflammatory drugs. Hospital pharmacies have the expertise and resources to manage such intricate medication regimens.

The online pharmacies segment is expected to register the fastest CAGR during the forecast period. Online pharmacies offer a convenient way for patients to access medications without leaving their homes. This is particularly beneficial for individuals with IBD, who may experience periods of increased symptoms or flare-ups, making it difficult for them to visit a physical pharmacy.

Key U.S. Inflammatory Bowel Disease Treatment Company Insights

Some of the key companies operating in the U.S. marketinclude AbbVie, Inc.; Takeda Pharmaceutical Company Limited, Pfizer, Inc.; and Novartis AG.

Key U.S. Inflammatory Bowel Disease Treatment Companies:

- Biogen

- Novartis AG

- Eli Lilly and Company

- UCB S.A.

- Celltrion Inc.

- Merck & Co., Inc.

- Johnson & Johnson Services, Inc

Recent Developments

-

In October 2023, the FDA approved Novartis Cosentyx. It was the first new biologic treatment option for hidradenitis suppurativa in adult patients.

-

In May 2023, Amgen and Tscan Therapeutics collaborated to identify the integration of the novel targets in Crohn’s disease. It created a platform that offered target discovery and improved Amgen's inflammation therapeutic expertise and capabilities.

-

In December 2021, Novartis announced that the U.S. FDA approved Cosentyx for the treatment of active enthesitis-related arthritis. These regulatory trials helped the market to expand its share.

-

In April 2021, the U.S. FDA approved Bristol Myers Squibb’s Zeposia (ozanimod), an oral treatment for adults with active ulcerative colitis.

U.S. Inflammatory Bowel Disease Treatment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 14.1 billion

Growth rate

CAGR of 2.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, drug class, route of administration, distribution channel, region

Country scope

U.S.

Key companies profiled

Biogen; Novartis AG; Eli Lilly and Company; UCB S.A.; Celltrion Inc.; Merck & Co., Inc.; Johnson & Johnson Services, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Inflammatory Bowel Disease Treatment Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. inflammatory bowel disease treatmentmarket report based on type, drug class, route of administration, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Crohn's Disease

-

Ulcerative Colitis

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Aminosalicylates

-

Corticosteroids

-

TNF inhibitors

-

IL inhibitors

-

Anti-integrin

-

JAK inhibitors

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. inflammatory bowel disease treatment market size was valued at USD 11.4 billion in 2023.

b. The U.S. inflammatory bowel disease treatment market is projected to grow at a compound annual growth rate (CAGR) of 2.5% from 2024 to 2030 to reach USD 14.1 billion by 2030

b. Crohn’s disease dominated the market and accounted for a share of 62.3% in 2023. Crohn's disease requires more treatment options and advancements due to its chronic inflammatory nature that affects the gastrointestinal tract, causing symptoms such as abdominal pain, diarrhea, weight loss, and fatigue. Crohn's disease often has periods of remission followed by relapses, making it difficult to manage long-term. More effective treatments are needed to help patients maintain remission and improve their overall health.

b. Some of the key companies operating in the U.S. inflammatory bowel disease treatment market include AbbVie, Inc.; Takeda Pharmaceutical Company Limited, Pfizer, Inc.; and Novartis AG, among others.

b. The global incidence of inflammatory bowel diseases (IBD), which includes Crohn's disease and ulcerative colitis, is increasing, primarily due to changes in lifestyle, dietary habits, and environmental factors. According to an article published in 2023, inflammatory bowel disease is a relatively common chronic condition affecting >0.7% of Americans and is most prevalent in the Northeastern region. This growing patient population needs advanced treatment options, driving the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."