U.S. Industrial Pump Market Size & Trends

The U.S. industrial pump market size was estimated at USD 5.14 billion in 2024. It is expected to expand at a CAGR of 3.4% from 2025 to 2030. This growth is attributed to infrastructure modernization and stringent environmental regulations are significant contributors, as they necessitate advanced and efficient pumping solutions. In addition, the booming oil and gas sector, particularly with increased exploration activities, also fuels demand for specialized pumps. Furthermore, technological advancements in energy-efficient pumps also play a crucial role, helping industries reduce operational costs and comply with sustainability goals.

Industrial pumps are essential for dewatering and removing excess water, and they are widely used across various industries to transport different fluids. These pumps come in numerous shapes, sizes, and capacities, tailored to specific industrial needs. They are integral in sectors such as power generation, mining, refineries, and petrochemicals. Each industry utilizes different types of pumps based on their unique requirements.

The pump industry serves various applications, including oil and gas, agriculture, metal and mining, water and wastewater treatment, textiles, chemicals, construction, and manufacturing. In the oil and gas sector, industrial pumps are crucial at every production stage, facilitating the movement of process fluids from one location to another.

Moreover, the demand for industrial pumps is rising due to increasingly stringent regulations on wastewater treatment. Governments worldwide are implementing new laws and guidelines for wastewater discharge, necessitating advanced pumping solutions. Effluent guidelines set the standards for wastewater discharged into surface waters and municipal sewage treatment plants, driving the need for efficient and compliant industrial pumps.

Product Type Insights

Centrifugal pump led the market and accounted for the largest revenue share of 67.6% in 2024. This growth is attributed to increasing infrastructure development, urbanization, and the need for efficient water management solutions. In addition, these pumps are essential in various industries, including agriculture, chemicals, and oil and gas, due to their ability to handle a wide range of fluids. Furthermore, technological advancements, such as 3D-printed impellers and AI-based monitoring, enhance pump performance and reliability, further boosting market demand.

Moreover, centrifugal pumps are further categorized into axial, radial, and mixed flow pumps. The axial flow pump dominated the segment and accounted for the largest revenue share in 2024. This growth is attributed to the increasing demand for energy-efficient solutions and the expansion of water and wastewater treatment infrastructure. In addition, rising industrial activities and the need for effective fluid handling in power generation and chemical industries contribute significantly to the market's expansion.

The positive displacement pump market is expected to grow at a CAGR of 3.8% over the forecast period. This growth is driven by rising environmental awareness and stringent regulations on wastewater treatment. These pumps are crucial in industries such as oil and gas, chemicals, and pharmaceuticals because they can handle highly viscous fluids and maintain a constant flow rate. Furthermore, the recovery of the oil and gas sector and increasing industrial activities are significant growth drivers.

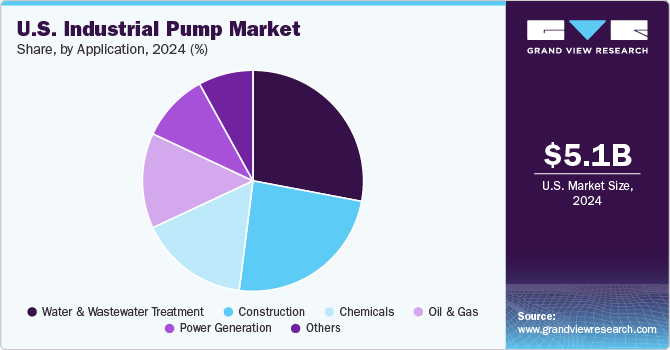

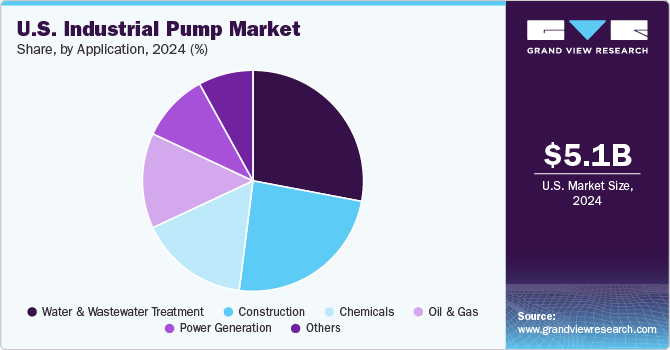

Application Insights

Water and wastewater treatment dominated the market and accounted for the largest revenue share in 2024. This growth is driven by increasing urbanization and industrialization, which lead to higher wastewater generation. In addition, stringent environmental regulations and government initiatives for clean water supply further boost demand. Furthermore, technological advancements in pump efficiency and reliability are crucial in ensuring effective water management and treatment.

The chemical segment is expected to grow at a CAGR of 3.9% from 2025 to 2030, owing to the need for precise fluid handling and transfer of corrosive and hazardous materials in the chemical industry. In addition, the expansion of chemical manufacturing and processing facilities, coupled with advancements in pump technology for enhanced safety and efficiency, significantly drives market growth. Furthermore, the rise in global chemical production and stringent safety regulations also contribute to this demand.

Key U.S. Industrial Pump Company Insights

Some of the key companies in the market include Grundfos, Flowserve Corporation, Xylem, and others. These companies adopt various strategies, such as strategic collaborations to enhance technological capabilities, mergers and acquisitions to expand market presence, and launching innovative products to meet evolving industry demands and improve efficiency.

-

Xylem specializes in the design and manufacture of innovative pumping solutions. The company offers various products, including centrifugal, submersible, and positive displacement pumps, tailored for water and wastewater treatment applications, industrial processes, and building services. The company’s extensive portfolio addresses the needs of various sectors, ensuring efficient and reliable fluid management.

-

Sulzer Ltd. manufactures industrial pumps and provides advanced solutions for fluid engineering. The company produces diverse centrifugal and positive displacement pumps, mixers, and agitators. Its products are widely used in industries such as oil and gas, power generation, water treatment, and chemical processing, offering high performance and durability for demanding applications.

Key U.S. Industrial Pump Companies:

- Gardner Denver

- Grundfos

- Flowserve Corporation

- Xylem

- ITT INC.

- SPX Flow

- Sulzer Ltd.

- Saniflo

- EBARA International Corporation

- Iwaki America Inc.

- Franklin Electric

Recent Developments

-

In April 2024, Saniflo launched the Sanipit 24 GR CB, a ready-to-install sewage grinder pump system perfect for new setups. This pump has a powerful grinder motor, an external control and alarm system, and an air-pressure mechanism. Everything is encased in a sturdy 24-inch HDPE basin, making it easy to maintain and reliable. This new product is designed to offer a high-performance and efficient solution for homes and businesses dealing with sewage ejection.

-

In April 2023, Sulzer and Siemens Large Drives Applications (LDA) announced a digital collaboration to enhance the performance of large centrifugal pumps. By integrating Sulzer's BLUE BOX and Siemens' SIDRIVE IQ IoT platforms, the partnership aims to improve equipment reliability and reduce operational costs. This collaboration provides industrial pump operators with comprehensive data for better decision-making and predictive maintenance. The initiative is expected to deliver significant savings and efficiency improvements, aligning with environmental, social, and governance (ESG) goals.

U.S. Industrial Pump Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 5.28 billion

|

|

Revenue forecast in 2030

|

USD 6.25 billion

|

|

Growth Rate

|

CAGR of 3.4% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product type, application

|

|

Key companies profiled

|

Gardner Denver; Grundfos; Flowserve Corporation; Xylem; ITT INC.;SPX Flow; Sulzer Ltd.; Saniflo; EBARA International Corporation; Iwaki America Inc.; Franklin Electric

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Industrial Pump Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. industrial pump market report based on product type and application.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Application Outlook (Revenue, USD Million, 2018 - 2030)