- Home

- »

- Next Generation Technologies

- »

-

U.S. Industrial Internet Of Things Market, Industry Report, 2030GVR Report cover

![U.S. Industrial Internet Of Things Market Size, Share & Trends Report]()

U.S. Industrial Internet Of Things Market Size, Share & Trends Analysis Report By Component (Hardware, Solution, Services, Platform), By End-use, By Software, By Connectivity Technology, By Device & Technology, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-210-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

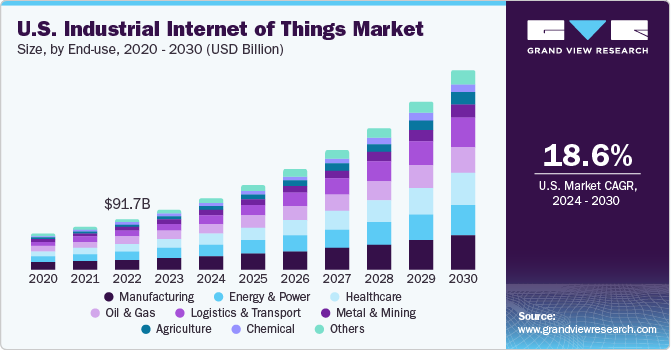

The U.S. industrial internet of things market size was valued at USD 108.58 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 18.6% from 2024 to 2030. Industrial Internet of Things (IIoT) has a strong rate of implementation across various industries. There has been a significant rise in real-time data and information, which has been boosted due to the wide availability and accessibility of real-time sensors and technologies. Industrial internet of things is helping drive the society toward a connected digital and human workforce by creating immense opportunities within the industry field.

In 2023, the U.S. accounted for over 27% of the industrial internet of things (IIoT) market. Advantages associated with IIoT such as automated quality assurance monitoring, large-scale profit margins through improvement in power efficiency, productivity improvement, and efficiency of the manufacturing industry are anticipated to drive the market growth. IIoT helps industries reduce operating costs, assure workers’ safety, and increase throughput. By offering measurable outcomes apart from selling solutions, companies are progressively building new product and service hybrids to strengthen their position and generate new revenue streams.

The adoption of IoT is rising owing to technological advancements in wireless network technologies and strong penetration of Wi-Fi connectivity for machine sensors in factories. Furthermore, the development of smart cities along with smart transportation leads to increased adoption of IoT, which is expected to propel the growth of the industrial IoT industry in the coming years.

Industries have now begun aligning toward introducing new products and services to enable new revenue streams and offer assessable deliverables. Industrial IoT technology is significant in granting easy, real-time, and close control of machines and devices. Companies such as Hitachi Ltd., Intel Corporation, General Electric Company, and IBM Corporation are the industry leaders who offer IIoT solutions and blueprints.

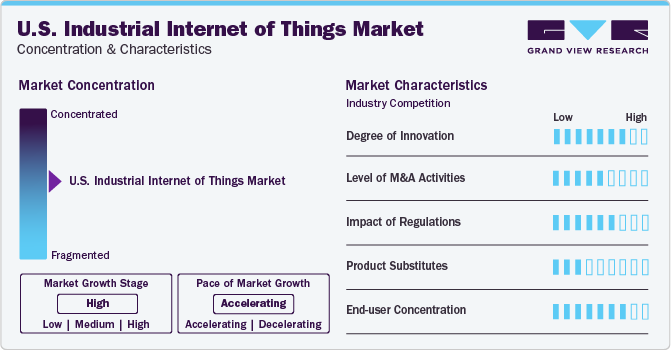

Market Concentration & Characteristics

The industrial IoT industry is characterized by a high degree of innovation, owing to the increasing availability of affordable processors and sensors that can process real-time data and help companies make informed decisions. For instance, in March 2022, Intel Corporation launched the 12th generation Intel Core processors to get extreme business performance. The company has launched this in industrial IoT to increase the business class experience.

The IIoT industry is also characterized by a high level of merger and acquisition activities by the leading market players. The industry players are expanding their portfolios by investing in product research & development and incorporating the latest technologies, which increases market growth. For instance, in July 2023, Honeywell acquired SCADAfence. This acquisition aligns with Honeywell’s emphasis on digitalization, sustainability, and OT cyber security SaaS solutions.

Due to concerns related to data protection, cybersecurity regulations, and environmental regulations, the market is subject to increasing regulatory scrutiny. For instance, the Federal Communications Commission (FCC) of the U.S. regulates the IoT radio frequency (RF) devices used in industrial sectors as per FCC Title 47. The FCC also monitors and regulates internet security at the network layer and asks the OEMs to implement security by design.

There are a limited number of substitutes for IIoT technology. Technologies such as Industry 4.0, SCADA (Supervisory Control and Data Acquisition), and edge computing serve similar purposes or address specific aspects of industrial IoT. These mediums can be used as an alternative to IIoT, however they typically address specific aspects of industrial connectivity, automation, and data analysis.

End-user concentration is a significant factor in the IIoT market, as a number of industry verticals are adopting various IIoT solutions. The rising demand for IIoT solutions, including remote monitoring, data management, and analytics, among others, creates opportunities for companies that focus on evolving IIoT solutions for these industries.

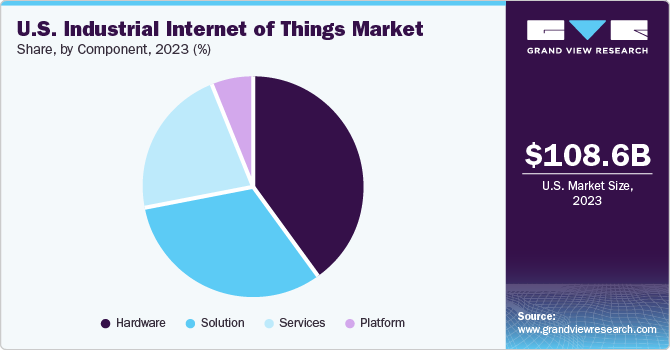

Component Insights

Based on components, the solution segment accounted for the largest revenue share of over 52.0% in 2023 and is likely to dominate the market over the forecast period. A major factor attributing to the growth of the segment is the increasing demand of IIoT solutions among enterprises as it improves the safety of the operating system, allows accurate tracking, predicts machine failure, and provides real-time data to prevent catastrophes and enhances overall productivity. The segment can further be classified into remote monitoring, data management, analytics, security solutions, and others.

The service segment is projected to grow at the highest CAGR from 2024 to 2030. This is due to a significant rise in the number of connected devices, which produce an enormous amount of data. The primary factor supporting the growth of this segment is the wide adoption of professional IIoT services, such as deployment & integration services, consulting services, and support & maintenance services, among enterprises.

End-use Insights

The manufacturing segment accounted for the largest market share in 2023 and is predicted to lead the market over the forecast period. This is due to the fact that IIoT provides numerous solutions for manufacturers, such as connected factories, facility management, production flow monitoring, and inventory management. Moreover, connected devices in manufacturing facilities generate terabytes of data that manufacturers can access from the industrial IoT platforms and extract valuable insights to optimize their business and manufacturing processes. This helps manufacturers to identify new revenue streams by developing innovative service offerings focused on how products and customers interact in the ecosystem.

The logistics & transport segment is expected to grow with the highest CAGR over the forecast period. IIoT solutions in this sector, such as automated vehicle location & tracking, real-time order management, and inventory management, are gaining immense popularity. This asset intelligence enables the organization to increase its efficiency by providing them with real-time data across its supply chain.

Key U.S. Industrial Internet Of Things Company Insights

Some of the key players operating in the market include General Electric Company (GE), Siemens AG, ABB Ltd., Microsoft Corporation, and Intel Corporation.

-

General Electric’s industrial internet of things (IIOT) helps to combine manufacturing systems with the digital world to obtain optimized results. The company produces industrial IOT services that unlock new possibilities and digital link devices with analytical tools and people at work.

-

IBM provides a wide range of industrial IOT services, like infrastructure (SaaS), platform as a service (PaaS), cybersecurity and privacy, automation and control technologies, etc.

-

ABB, ARM Holding, and Rockwell are some other participants in the U.S. industrial IoT industry.

-

Rockwell Automation is engaged with other private companies to develop and integrate digital technologies, AI, and robotics. The company uses data from industrial IOT to create a next-generation manufacturing system.

-

Siemens plays an essential role in industrial IOT services as a strategic advisor and implementation partner in the industrial internet of things and digital transformation. It offers a digital industry platform and comprehensive product range in automation systems.

Key U.S. Industrial Internet Of Things Companies:

- ABB Ltd.

- ARM Holding Plc

- Atmel Corporation

- Cisco Systems, Inc.

- General Electric Company (GE)

- Honeywell International Inc.

- Intel Corporation

- Microsoft Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

Recent Developments

-

In February 2023, Cisco launched new cloud services within its IoT Operations Dashboard to enhance visibility into industrial assets, offering secure management capabilities from any location. It facilitates a seamless transition for IoT customers toward cloud automation, specifically catering to Operational Technology (OT) teams.

-

In February 2022, Ericsson AB launched IoT Accelerator Connect, to offer easier connectivity in IoT with plug-and-play access to cellular IoT connectivity. It helps in instant onboarding and connecting devices to simplify and increase the successful application of enterprise IoT projects.

U.S. Industrial Internet Of Things Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 358.42 billion

Growth rate

CAGR of 18.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end-use, software, connectivity technology, device & technology

Regional scope

U.S.

Key companies profiled

ABB Ltd.; ARM Holding Plc; Atmel Corporation; Cisco Systems, Inc.; General Electric Company (GE); Intel Corporation; Rockwell Automation, Inc.; Siemens AG; Microsoft Corporation; Schneider Electric SE; Honeywell International Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Internet of Things Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. industrial internet of things market report based on component, end-use, software, connectivity technology, and device & technology:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Solution

-

Remote Monitoring

-

Data Management

-

Analytics

-

Security Solutions

-

Others

-

-

Services

-

Professional

-

Managed

-

-

Platform

-

Connectivity Management

-

Application Management

-

Device Management

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aviation

-

Metal & Mining

-

Chemical

-

Manufacturing

-

Energy & Power

-

Smart Grids

-

Oil & Gas

-

Healthcare

-

Logistics & Transport

-

Intelligent Signaling System

-

Video Analytics

-

Incident Detection System

-

Route Scheduling Guidance System

-

-

Agriculture

-

Precision Farming

-

Livestock Monitoring

-

Smart Greenhouses

-

Fish Farming

-

-

Retail

-

Point of Sales

-

Interactive Kiosks

-

Self-Checkout Systems

-

Others

-

-

-

Software Outlook (Revenue, USD Billion, 2018 - 2030)

-

Product Lifecycle Management

-

Manufacturing Execution Systems

-

SCADA

-

Outage Management Systems

-

Distribution Management Systems

-

Remote Patent Monitoring

-

Retail Management Software

-

Visualization Software

-

Transit Management Systems

-

Farm Management Systems

-

-

Connectivity Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wired Technology

-

Ethernet

-

Modbus

-

Profinet

-

CC-Link

-

-

Foundation Fieldbus

-

-

Wireless Technology

-

Wi-Fi

-

Bluetooth

-

Cellular Technologies

-

4G/LTE

-

5G

-

-

Satellite Technologies

-

-

-

Device & Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sensors

-

Radio Frequency Identification (RFID)

-

Industrial Robotics

-

Distributed Control Systems

-

Condition Monitoring

-

Smart Meters

-

Electronic Shelf Labels

-

Cameras

-

Smart Beacons

-

Interface Boards

-

Yield Monitors

-

Guidance & Steering

-

GPS/GNSS

-

Flow & Application Control Devices

-

Networking Technology

-

Frequently Asked Questions About This Report

b. The U.S. industrial internet of things market size was estimated at USD 108.58 billion in 2023 and is expected to reach USD 128.6 billion in 2024

b. The U.S. industrial internet of things market is expected to grow at a compound annual growth rate of 18.6% from 2024 to 2030 to reach USD 358.42 billion by 2030

b. The manufacturing segment accounted for the largest market share in 2023. It can be attributed to the implementation of IIoT solutions across applications such as connected factories, facility management, production flow monitoring, and inventory management.

b. Some of the key players operating in the U.S. industrial IoT market include General Electric Company (GE), Siemens AG, ABB Ltd., Microsoft Corporation, and Intel Corporation.

b. Real-time data and information, remote monitoring, data management, and productivity improvement are the key factors driving the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."