- Home

- »

- Organic Chemicals

- »

-

U.S. Industrial Gases Market Size And Share Report, 2030GVR Report cover

![U.S. Industrial Gases Market Size, Share & Trends Report]()

U.S. Industrial Gases Market Size, Share & Trends Analysis Report By Product (Nitrogen, Hydrogen, Carbon Dioxide), By Application (Healthcare, Manufacturing), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-158-4

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

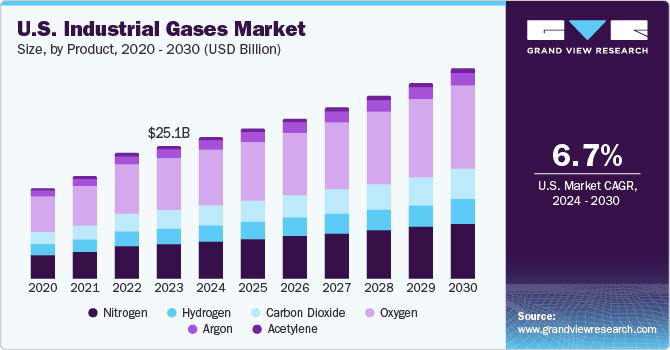

The U.S. industrial gases market size was valued at USD 25.06 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030. Increasing application of these gases in various industries such as healthcare, food and beverage, and manufacturing, is expected to influence the market growth for U.S. industries gases in the coming years. However, environmental regulations and safety concerns related to handling and transport are anticipated to hinder the growth of the market during the forecast period.

Oxygen product segment dominated the product market in terms of volume and revenue, in 2023. The versatility of oxygen makes it a vital component in the healthcare and chemicals industries. In hospitals and health clinics, medical oxygen is essential for a variety of surgeries and therapies. Oxygen is also used for welding, metal cutting, cleaning, and melting applications. Furthermore, oxygen is used to maintain the fresh and natural color of red meat in the food industry.

According to the U.S. Environmental Protection Agency (EPA), air pollution continues to be a major issue in the country. The U.S. emitted approximately 66 million tons of pollutants into the atmosphere in 2022. Thus, increasing pollution in the country has triggered asthma attacks among individuals throughout the U.S. As per the Asthma & Allergy Foundation of America, 42.7% of children in the age group of 18 years or below suffering from asthma had at least one asthma attack in 2020. The increase in threats of lung diseases such as asthma and pneumonia has resulted in a significant rise in the demand for pharmaceutical or healthcare-grade industrial gases in the U.S

The U.S. registered processed food exports worth USD 38 billion in 2022. The surging demand for packaged and processed food in the U.S. can be attributed to the growing inclination of consumers toward ready-to-eat (RTE) food owing to their busy lifestyles and hectic work schedules. The increasing working population, especially working women, is also anticipated to drive the growth of the processed food market in the U.S. Hence, the presence of prominent players in the country, along with the flourishing packaged food market, is considered to be a significant contributor to the growth of the product market.

The major technologies used for manufacturing industrial gases include Cryogenic Air Separation Processes, Non-Cryogenic Air Separation Processes, Pressure Swing Adsorption, Vacuum-Pressure Swing Adsorption, and Natural Gas Reforming. These technologies are used for manufacturing industrial gases such as nitrogen, argon, carbon dioxide, oxygen, hydrogen, and acetylene.

The distribution of industrial gases can be carried out through three primary methods: (i) onsite or tonnage supply, (ii) bulk liquid or merchant supply, and (iii) cylinder or Packaged Gas Supply. Volume and purity requirements, along with the usage pattern and the form in which these gases are to be used (gas or cryogenic liquid) determine the most cost-effective method for supplying them to meet the requirements of customers.

Application Insights

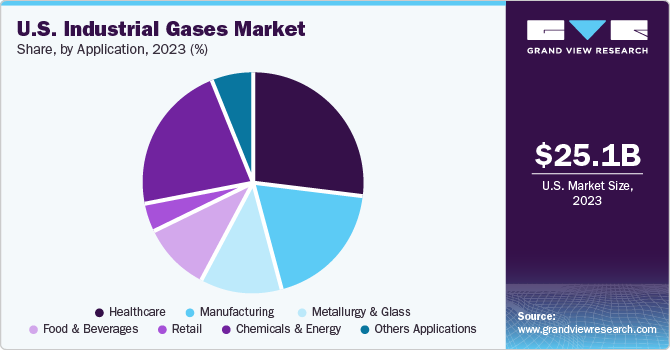

Healthcare applications dominated the market with a revenue share of 26.7% in 2023. Industrial gases are a vital part of the healthcare sector owing to their role in different applications. In medical applications, oxygen is used in respiratory therapy, anesthesia, and life support systems. This is further driving the industrial gas market in the U.S.

Las Vegas has a few of the major hospitals in the U.S., including the Sunrise Hospital and Medical Center, the University Medical Center, and the Valley Hospital Medical Center, which provides different medical services such as specialized treatments, surgeries, and emergency care. Besides this, there are around 70 other hospitals and medical clinics serving the residents and tourists in the city. Industrial gases are a vital part of the healthcare sector owing to their role in different applications. This is further driving the industrial gases market in Las Vegas.

In medical and pharmaceutical industries, nitrogen is used in numerous applications. Cryopreservation utilizes nitrogen at a large scale to preserve blood, blood components, cells, body fluids, and tissue samples for an extended duration. Moreover, nitrogen is useful for surgical procedures carried out by power gas-operated medical devices. In these devices, nitrogen acts as a coolant for carbon dioxide surgical lasers to reduce the damage to adjacent tissues. Nitrogen is utilized in medical imaging applications as well.

Industrial gases such as carbon dioxide and nitrogen are used in a wide range of applications in the food & beverages industry. They are employed for chilling & freezing and modified atmospheric packaging (MAP) applications, as well as for controlling the temperature of food products during their transportation and storage. These gases are mainly used to maintain the quality of food products and increase their shelf life. In addition, industrial gases are used as indicators to ensure that the required quality of food products is maintained during their processing and storage.

Nitrogen is used at a large scale in the electronics industry, the growth of this industry in the U.S. is expected to drive the demand for nitrogen. Moreover, the rising adoption of advanced technologies in different industries in the region has fueled the demand for semiconductors. This, in turn, surges the consumption of nitrogen used for developing semiconductors in the U.S.

Product Insights

Oxygen dominated the market with a revenue share of 37.8% in 2023, owing to its wide range of applications, due to its life-sustaining and oxidizing properties. It plays a critical role in several health applications and medical procedures. Oxygen is used in respiratory treatment and during surgeries. The versatility and essentiality of oxygen make it a vital component in chemical and healthcare industries.

Oxygen is the second-largest constituent of the Earth’s atmosphere, accounting for a share of 20.8% in terms of volume. Although oxygen is used in gaseous form in most applications, it is generally liquefied so that it can be effectively and efficiently transported and stored in large volumes.

Oxygen is used in certain medical devices and apparatuses such as oxygen concentrators and ventilators, which are used for patients with severe respiratory ailments. In addition, it is utilized in certain diagnostic procedures, such as oximetry, to measure the amount of oxygen in the blood of the patients.

Moreover, increasing usage of CO2 in the beverage and medical industries is further anticipated to be a key factor driving the product market. In the food & beverage industry, CO2 is widely used for freezing vegetables, fruits, and meat & poultry products.

The use of CO2 in medical applications is increasingly gaining significance. It is used to minimize invasive surgeries. The surge in research & development investments for the launch of advanced technologies related to enhanced oil recovery (EOR) and carbon capture and storage (CCS) has led to the rising demand for CO2. This, in turn, is anticipated to fuel the growth of the carbon dioxide segment in Las Vegas industrial gases market in the coming years.

Key Companies & Market Share Insights

Players in the U.S. industrial gases market have adopted the strategy of new product launches to enhance their product portfolios and increase their market share by serving more end-use industries in diverse geographical areas. The key market player adopting this inorganic growth strategy is Air Liquide. For instance, in January 2023 Air Liquide signed multiple long-term contracts to provide hydrogen, nitrogen, and oxygen to customers in the expanding markets of metals, glass, secondary electronics, and water purification for its industrial merchant business line.

Key U.S. Industrial Gases Companies:

- Messer North America, Inc.

- Air Products and Chemicals, Inc.

- Linde plc

- Air Liquide

- Matheson Tri-Gas, Inc

- BASF SE

- MESA Specialty Gases & Equipment

- Universal Industrial Gases, Inc.

U.S. Industrial Gases Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 39.38 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Regional scope

U.S.

Key companies profiled

Messer North America, Inc.; Air Products and Chemicals, Inc.; Linde plc; Air Liquide; Matheson Tri-Gas, Inc; BASF SE; MESA Specialty Gases & Equipment; Universal Industrial Gases, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

U.S. Industrial Gases Market Report Segmentation

This report forecasts revenue growth in the U.S. and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Industrial Gases market report based on product, and application.

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Nitrogen

-

Hydrogen

-

Carbon Dioxide

-

Oxygen

-

Argon

-

Acetylene

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Healthcare

-

Manufacturing

-

Metallurgy & Glass

-

Food & Beverages

-

Retail

-

Chemicals & Energy

-

Others Applications

-

Frequently Asked Questions About This Report

b. The U.S. industrial gases market size was estimated at USD 25.06 billion in 2023 and is expected to reach USD 26.59 billion in 2024.

b. The U.S. industrial gases market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 39.38 billion by 2030.

b. Oxygen dominated the U.S. industrial gases market with a share of 37.8% in 2023. This is attributable to its wide range of applications. due to its life-sustaining and oxidizing properties.

b. Some key players operating in the U.S. industrial gases market include Messer North America, Inc., Air Products and Chemicals, Inc., Linde plc, Air Liquide, Matheson Tri-Gas, Inc, BASF SE, MESA Specialty Gases & Equipment and Universal Industrial Gases, Inc.

b. Key factors that are driving the market growth include the increasing end-use application of these gases in various industries such as healthcare, food and beverage, and manufacturing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."