- Home

- »

- Advanced Interior Materials

- »

-

U.S. Industrial Fasteners Market Size & Share Report, 2030GVR Report cover

![U.S. Industrial Fasteners Market Size, Share & Trends Report]()

U.S. Industrial Fasteners Market (2023 - 2030) Size, Share & Trends Analysis Report By Raw Material (Metal, Plastic), By Product (Externally Threaded, Internally Threaded), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-115-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The U.S. industrial fasteners market size was estimated at USD 16.75 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 2.9% from 2023 to 2030. This growth can be attributed to the fact that industrial fasteners are considered a vital part of all the major industries including automotive, electronics, aerospace, heavy equipment, marine, shipbuilding, and industrial machinery. Furthermore, fasteners have the ability to fasten or bond a wide range of products including plastic, wood, and even metal parts in a very effective manner. Fasteners are an essential component of the automotive industry and are available in numerous shapes and sizes. The common products used in this industry include nuts, bolts, screws, rivets, studs, bits, and anchors. Automotive is the largest application and the production trends in the U.S. automotive industry directly impact the market.

Fasteners play a vital role in defining the structural integrity, longevity, and design philosophy of various metallic aircraft structures. The rising demand for aerospace bolts, rivets, screws, and studs is expected to boost the market growth in the U.S. As fasteners find a wide range of applications in the aerospace industry, the growth of the aerospace sector is expected to boost product demand in the U.S. over the forecast period.

Fasteners are manufactured using metals such as bronze, cast iron, stainless steel, nickel & aluminum superalloys, and titanium. The key application of metal fasteners is the bonding of two structures. Therefore, metal quality and strength are important factors in terms of the selection of raw materials for industrial fasteners to limit corrosion and prevent cracking under extreme operational conditions as observed in the automotive and aerospace industries.

The market is characterized by intense technological developments to produce advanced lightweight products that find use in automotive and other industrial applications. Key fastener companies in the market are majorly focusing on sourcing high-quality raw materials and simple designs & structures that are easier to assemble.

The industrial fastener industry is characterized by intense technological improvements aimed at producing superior and lightweight goods used in automotive and other industrial applications. Commercial car and LCV manufacturers are continuously striving to reduce the overall vehicle weight and improve reliability, reduce wear, and maintain vehicle strength. Various benefits such as reduced cost, lower weight, and excellent chemical & corrosion resistance offered by plastic fasteners provide them a competitive edge over their counterparts in automotive applications.

Raw Material Insights

In terms of raw material, metal and plastic industrial fasteners are among the most prominent types. The metal industrial fasteners segment dominated the industry in 2022 with a revenue share of 88.9%. However, due to its high corrosion resistance and lightweight features, the product is anticipated to expand at a slower rate than its counterpart, owing to the rising penetration of plastic in applications such as aerospace and automotive.

The metal fasteners industry is dominated by small and medium-scale fastener manufacturing companies spread across the U.S. as the metal fasteners offer high mechanical strength and impact resistance and are less susceptible to harsh conditions such as high temperature and pressure. A key concern for metal fastener manufacturers is that the metal often tends to corrode when exposed to water, which impairs its performance and durability in end-use applications.

The plastic industrial fasteners segment is anticipated to register the fastest-growing CAGR of 3.9% over the forecast period. As of 2022, plastic raw material account for a very small share of the overall market. However, the product is expected to gain increasing importance, especially from the automotive, electronics, and aerospace industries owing to its lightweight, improved mechanical properties, and low cost as compared to metal fasteners.

Plastic material is primarily used in the automotive industry. Automotive plastic fasteners are generally non-threaded and used in applications such as wire harnessing, electronics, and car interiors. These fasteners help in maintaining the aesthetic appeal of cars as they are available in various sizes, shapes, and colors.

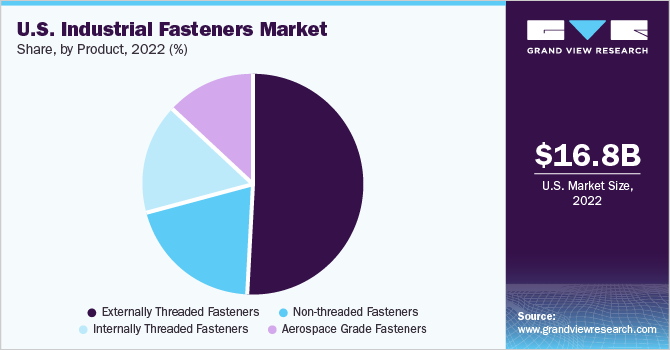

Product Insights

In terms of product, the industrial grade fasteners have been broadly classified based on their design into four major segments, namely externally threaded, internally threaded, non-threaded, and aerospace grade fasteners. In 2022, the externally threaded segment held the largest market share of 51.3% owing to their wide application in the automotive, building & construction, railway, marine, and shipbuilding industries.

Internally threaded fasteners are mostly nuts and inserts. Nuts predominate in internally threaded segments and are typically utilized in opposition to bolts to connect two more sections of the construction. The most often used nuts are hexagonal, and they are widely utilized in construction, industrial machinery, trains, automobiles, and motorcycle manufacturing.

Over the projected period, the non-threaded segment is anticipated to register the fastest CAGR of 3.6% over the forecast period. Pins, washers, rivets, hooks, grommets, O-rings, clamps, cable ties, and nails are examples of non-threaded fasteners. These devices are used to fasten pipe fittings in the automotive and construction industries, as well as for cable management and wire harnesses. Due to its low cost and low weight, plastic non-threaded fasteners are anticipated to fuel high demand in various application areas.

Over the projection period, the aerospace grade segment is anticipated to grow at a CAGR of 3.2%. The aircraft industry employs a wide range of fasteners, including pins, rivets, bolts, screws, and collars. Aerospace grades are distinguished from other industrial fasteners by their excellent quality. Aerospace grades must be exceptionally durable to sustain extremely high pressures and temperatures. Furthermore, the weight of aerospace-grade fasteners is a major consideration for their selection, as lightweight fasteners with great endurance are sought for aircraft applications.

Application Insights

In terms of application, the automotive segment is one of the key applications of the market. The segment held a major market share of over 27% in 2022. High production volumes of vehicles in the U.S. have been a key factor driving the growth of the automotive industry in the country over the past few years. According to the International Organization of Motor Vehicle Manufacturers (OICA), approximately 10.1 million automobiles were produced in the U.S. in 2022, witnessing an increase of 9.7% compared to that in 2021.

In the automotive industry, fasteners are used for two basic functions, namely, bonding, and for preventing noise, vibration, and harshness (NVH). The parts of passenger cars and light commercial vehicles are manufactured separately and then assembled to develop a unit. This process requires various bonding components such as adhesives, tapes, sealants, and fasteners.

Aerospace has been a major application segment of the market as it consumes high volumes of prime-grade fasteners. The products used in aerospace applications are primarily divided into four categories, namely, screws and bolts; nuts; expansion fasteners, including bolts, rivets, pins, nails, hooks, and rings. These fasteners are either used in permanent or temporary aerospace applications.

The increasing popularity of gardening in the U.S. is expected to propel the demand for various lawn and garden products, including cultivators, mini tractors, and irrigation sprinklers. Fasteners form essential components of these machines as they hold their different equipment parts together. The mechanization of gardening, which enables the use of electric equipment instead of handheld products, is anticipated to have a positive impact on the growth of the lawns and gardens segment of the market from 2023 to 2030.

Key Companies & Market Share Insights

The U.S. industrial fasteners industry is highly competitive owing to the presence of a large number of manufacturers. Although fasteners account for a very tiny portion of total costs in the automotive or electrical & electronics industries, their prices play a significant impact in calculating replacement cost and replacement duration as they are consumed in large numbers.

Competition faced by the suppliers is primarily due to a large number of players across the U.S. To preserve their dominance in the industrial fasteners market, prominent suppliers are working on obtaining optimal operational costs, maximizing the efficiency of production facilities, achieving shorter lead times, and improving product quality.

In June 2023, Fastener Supply announced the acquisition of Northern States Supply to gain more market share. In addition, the acquisition is also expected to help the company provide high-quality products and services to various end-users such as automotive, construction, and industrial machinery. Some prominent players in the U.S. industrial fasteners market include:

-

Arconic Fastening Systems and Rings

-

Hilti Corporation

-

Illinois Tool Works, Inc.

-

Acument Global Technologies, Inc.

-

ATF, Inc.

-

MW Industries, Inc.

-

Birmingham Fastener and Supply, Inc.

-

SESCO Industries, Inc.,

-

Elgin Fastener Group LLC

-

Slidematic

U.S. Industrial Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.23 billion

Revenue forecast in 2030

USD 21.14 billion

Base year for estimation

2022

Growth rate

CAGR 2.9% from 2023 to 2030

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

U.S.

Segments covered

Raw material, product, application

Key companies profiled

Arconic Fastening Systems and Rings; Hilti Corporation; Illinois Tool Works, Inc.; Acument Global Technologies, Inc.; ATF, Inc.; MW Industries, Inc.; Birmingham Fastener and Supply, Inc.; SESCO Industries, Inc.; Elgin Fastener Group LLC; Slidematic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Industrial Fasteners Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. industrial fasteners market report based on raw material, product, and application:

-

Raw Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Metal

-

Plastic

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Externally Threaded Fasteners

-

Internally Threaded Fasteners

-

Non-threaded Fasteners

-

Aerospace Grade Fasteners

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Aerospace

-

Building and construction

-

Industrial Machinery

-

Home appliances

-

Lawns and Gardens

-

Motors and Pumps

-

Furniture

-

Plumbing Products

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. industrial fasteners market size was estimated at USD 16.75 billion in 2022 and is expected to reach USD 17.23 billion in 2023.

b. The U.S. industrial fasteners market is expected to grow at a compound annual growth rate of 2.9% from 2023 to 2030 to reach USD 21.14 billion by 2030.

b. Metal industrial fasteners accounted for the largest share in terms of revenue with 88.9% in 2022 as they offer high mechanical strength, impact resistance, and are less susceptible to harsh conditions such as high temperature and pressure.

b. Some of the key players operating in the U.S. industrial fasteners market include Arconic Fastening Systems and Rings, Hilti Corporation, Illinois Tool Works, Inc., Acument Global Technologies, Inc., ATF, Inc., and MW Industries, Inc.

b. The key factor driving the U.S. industrial fasteners market is rising automotive production and growing construction activities due to rapid urbanization and industrialization across the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.