U.S. In-vitro Fertilization Microscope Market Size, Share & Trends Analysis Report By End-use (Clinical, Academic Research), And Segment Forecast, 2024 - 2030

- Report ID: GVR-4-68040-267-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. IVF Microscope Market Size & Trends

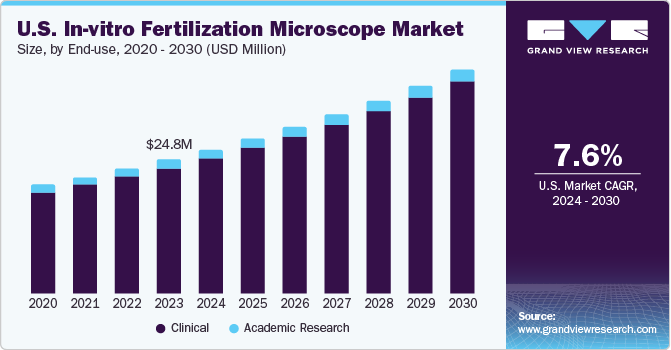

The U.S. in-vitro fertilization microscope market size was estimated at USD 24.8 million in 2023 and is projected to grow at a CAGR of 7.62% from 2024 to 2030. Increasing infertility rates, growing awareness & acceptance of fertility treatments, technological advancements, and increasing healthcare expenditure are some of the key drivers propelling market growth. The rising number of infertility cases is a significant factor driving the demand for in-vitro fertilization (IVF) procedures and related technologies, including advanced microscopes used in IVF laboratories. According to the Centers for Disease Control & Prevention, in the U.S., around 19% of married women aged 15 to 49 years with no prior births are unable to conceive after trying for one year.

Moreover, there has been a notable increase in awareness and acceptance of IVF as a viable option for couples facing infertility issues. This growing acceptance has led to an increase in the number of in-vitro fertilization clinics consequently boosting the demand for specialized equipment like IVF microscopes. For instance, in August 2023, Pinnacle Fertility announced the addition of Oma Fertility's clinics in Atlanta, St. Louis, New York City, and Long Island to its network. The increasing investments in healthcare infrastructure, particularly in fertility clinics and assisted reproduction centers, have fueled the adoption of cutting-edge equipment like IVF microscopes.

According to the Centers for Medicare & Medicaid Services, healthcare spending in the U.S. increased by 4.1 percent in 2022, amounting to a total of USD 4.5 trillion or USD 13,493 per person. As a proportion of the country's Gross Domestic Product, healthcare spending accounted for 17.3 percent. Technological advancements in the field of microscopy have also contributed to the market growth. Newer microscopes offer improved image quality, higher magnification, and better precision, making it easier for embryologists to identify healthy embryos for implantation. In addition, the integration of artificial intelligence (AI) and machine learning (ML) algorithms with microscopes has further enhanced the efficiency of IVF procedures.

Market Concentration & Characteristics

Market growth stage is moderate, and the pace of its growth is accelerating. The market is characterized by a high degree of innovation. The development of digital high-definition microscopy, time-lapse imaging, and automation technologies has significantly improved the efficiency and accuracy of IVF procedures. Moreover, the integration of AI and ML algorithms into IVF microscopes is expected to revolutionize the field by enabling real-time monitoring and analysis of embryo development, thereby increasing the success rates of IVF treatments.

The market is also characterized by a moderate level of merger and acquisition (M&A) activities by key players. This is due to several factors, including the desire of market players to expand product portfolios and gain a larger market share.

The market is subject to regulatory scrutiny, primarily by the Food and Drug Administration (FDA) and the Centers for Disease Control and Prevention (CDC). The FDA classifies IVF microscopes as Class II medical devices and requires manufacturers to meet specific performance standards and submit premarket notifications. The FDA also conducts post-market surveillance and can initiate necessary inspections and recalls. The CDC oversees laboratory practices and guidelines for assisted reproductive technologies.

There are a limited number of direct product substitutes for IVF microscopes. Some potential substitutes for in-vitro fertilization microscopes include other types of microscopes, such as fluorescence microscopes or confocal microscopes, which can be used for imaging and analyzing oocytes and embryos in the IVF process. In addition, some IVF clinics may use mobile devices, such as tablets or smartphones, for imaging and analysis. However, these substitutes may offer a different level of accuracy and precision than dedicated IVF microscopes.

The market is characterized by low end-user concentration. This is primarily due to the specialized nature of IVF procedures and equipment, which are typically utilized by fertility clinics, reproductive endocrinology practices, and assisted reproductive technology laboratories. These end-users require highly specialized equipment like IVF microscopes designed to meet IVF procedures' unique needs.

End-use Insights

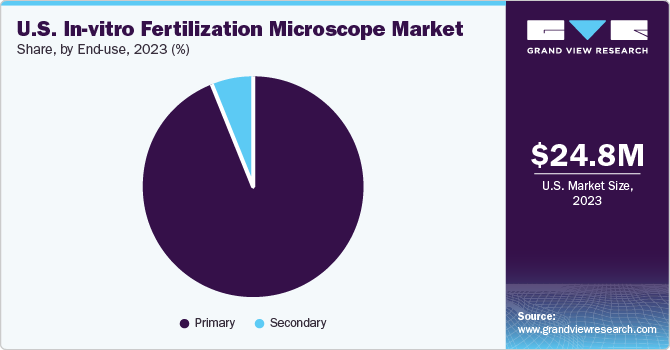

The clinical sector dominated the market and accounted for a share of 93.8% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. This can be attributed to the increasing demand for assisted reproductive technologies, advancements in the field of fertility treatments, and growing awareness about infertility among people. For instance, in April 2023, The Prelude Network and The HelpCureHD Foundation jointly launched a global campaign called "More Than Infertility" in observance of National Infertility Awareness Week (NIAW). The campaign aims to raise awareness and educate people about in vitro fertilization. The expansion and increase in the number of IVF clinics in the U.S. is a significant factor driving the IVF microscope market.

A rise in the number of fertility clinics has led to an increased demand for advanced medical equipment, including IVF microscopes. In January 2024, CCRM Fertility announced the opening of a new clinic in Jersey City, New Jersey. The new clinic will provide patients with increased access to its complete range of fertility treatments and services. The demand for microscopes in clinical settings is expected to increase as IVF microscopes provide superior visualization of eggs and embryos, thereby improving the success rates of IVF procedures. Furthermore, the availability of advanced imaging technologies and the adoption of minimally invasive techniques have also contributed to the growing demand for IVF microscopes in clinical settings.

Key U.S. In-vitro Fertilization Microscope Company Insights

Some of the key companies operating in the market include Leica Microsystems; Olympus Corporation; Zeiss, Sutter Instrument Company; Nikon Corporation; and Hamilton Thorne.

-

Leica Microsystems specializes in manufacturing microscopes and scientific instruments. The company operates in three divisions: life sciences, medical, and industrial

-

Olympus Corp. operates through four distinct segments: therapeutic solutions, endoscopic solutions, scientific solutions, and imaging. The scientific solutions division of the company provides a range of measurement and imaging instruments, microscopes, video scopes, and X-ray analyzers

Key U.S. In-vitro Fertilization Microscope Companies:

- Leica Microsystems

- Olympus Corporation

- Nikon Corporation

- Sutter Instrument Company

- Hamilton Thorne

- Zeiss

- Meiji Techno

- Labomed, Inc.

- Narishige Group

- Eppendorf SE

- Tritech Research, Inc.

Recent Developments

- In December 2023, Hamilton Thorne announced the acquisition of MICROPTIC, a developer of AI-enabled CASA software, image analysis systems, and consumables for the Assisted Reproductive Technology (ART) laboratory markets worldwide

U.S. In-vitro Fertilization Microscope Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 26.7 million |

|

Revenue forecast in 2030 |

USD 41.4 million |

|

Growth rate |

CAGR of 7.62% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

End-use |

|

Key companies profiled |

Leica Microsystems; Olympus Corp.; Nikon Corp.; Sutter Instrument Company; Hamilton Thorne; Zeiss; Meiji Techno; Labomed, Inc.; Narishige Group; Eppendorf SE; and Tritech Research, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. In-vitro Fertilization Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. in-vitro fertilization microscope market report based on end-use:

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinical

-

Academic Research

-

Frequently Asked Questions About This Report

b. The U.S. in-vitro fertilization microscope market size was estimated at USD 24.8 million in 2023 and is expected to reach USD 26.7 million in 2024.

b. The U.S. in-vitro fertilization microscope market is expected to grow at a compound annual growth rate (CAGR) of 7.62% from 2024 to 2030 to reach USD 41.4 million by 2030.

b. The clinical sector dominated the end-use segment with the largest market share of 93.8% in 2023 owing to the increasing demand for assisted reproductive technologies, advancements in the field of fertility treatments, and the growing awareness about infertility among people.

b. Some key players operating in the U.S. in-vitro fertilization microscope market include Leica Microsystems; Olympus Corporation; Nikon Corporation; Sutter Instrument Company; Hamilton Thorne; Zeiss; Meiji Techno; Labomed, Inc.; Narishige Group; Eppendorf SE; and Tritech Research, Inc.

b. Key factors that are driving the market growth include increasing infertility rates, growing awareness & acceptance of fertility treatments, technological advancements, rising demand for handheld and portable microscope, and increasing healthcare expenditure.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."