U.S. In Vitro Fertilization Market Size, Share & Trends Analysis Report By Instrument (Disposable Devices, Capital Equipment) By Procedure Type (Fresh Donor, Frozen Donor) By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-278-5

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. In Vitro Fertilization Market Trends

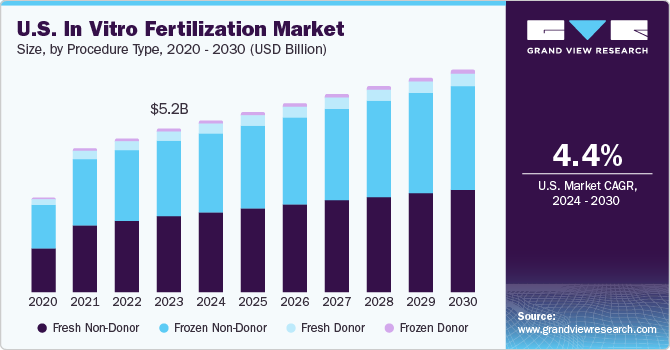

The U.S. in vitro fertilization market size was estimated at USD 5.28 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The rising prevalence of infertility among couples is driving the growth of the U.S. IVF market. According to the CCRM Fertility article published in June 2022, over 10% of women and around 9% of men suffer from infertility issues. Over 10% of females falling in the age group of 15 to 45 in the U.S. face infertility.

Approximately, 12% of couples have problems in conceiving a child when women are aged 30 and below. The percentage increases when women are aged 30 to 40. Factors such as delayed childbearing, lifestyle changes, environmental factors, and medical conditions contribute to the increasing incidence of infertility. As more individuals face challenges in conceiving naturally, they turn to assisted reproductive technologies including IVF to fulfill their desire for parenthood.

The American Pregnancy Association states that male infertility accounts for 30% of overall infertility cases and contributes to about one-fifth of all infertility instances in the U.S. The usual age for marriage and firstchildbirth is increasing, leading to more women seeking IVF treatment. Additionally, several women freeze their eggs to focus on their careers and have children later. The increasing reliance on fertility treatments is expected to drive market growth, supported by the availability of funds leading to a rise in the adoption of IVF procedures.

Evolving societal trends, including increasing acceptance of non-traditional family structures, and a growing emphasis on career development before starting a family, have contributed to the expanding demand for IVF services. As societal norms shift and more individuals opt for assisted reproduction to achieve their family-building goals, the demand for IVF continues to rise.

Technological advancements in reproductive medicine have significantly improved the success rates of IVF procedures. Innovations such as preimplantation genetic testing, time-lapse embryo imaging, and vitrification techniques have enhanced the efficiency and outcomes of IVF treatments. These advancements attract more patients seeking advanced fertility solutions, thereby driving the growth of the IVF market in the U.S.

Improved insurance coverage for fertility treatments, including IVF, has made these services more accessible to a broader population. As more insurance plans include fertility benefits or offer financial assistance programs for IVF procedures, individuals and couples are more likely to pursue treatment options, thereby boosting the market for IVF services in the U.S. As per KFF, approximately half of childbirths in the U.S. are funded by Medicaid, and the platform funds the major publicly funded family planning services.

Market Concentration & Characteristics

Industry growth stage is moderate, and pace of the industry growth is accelerating. Developments, such as time lapse imaging and pre-implantation genetic testing (PGT) to screen embryos for inherited irregularities prior to they are transferred to the uterus, have made IVF more effective and accessible for couples struggling with infertility.

The U.S. IVF market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the increasing demand for fertility treatments, technological advancements in the field of assisted reproductive technology, and the desire of companies to expand their market presence and offerings.

The U.S. IVF industry is also subject to increasing regulatory scrutiny. This is due to concerns about the procedure that involves multiple steps, including ovarian stimulation, egg retrieval, fertilization, and embryo transfer. The U.S. FDA regulates drugs and devices used in IVF, followed by the implementation of the Fertility Clinic Success Rate and Certification Act by the CDC. Moreover, semen analysis and sperm function tests are high-complexity tests regulated by the Clinical Laboratory Improvement Amendments of 1988 (CLIA '88) in the U.S. Strict compliance with standards and on-site inspections are essential.

The U.S. IVF market is witnessing growth due to the increasing demand for infertility treatments and the advancement of technology. Several players are offering new services and techniques to serve different requirements of patients. Services including Intracytoplasmic Sperm Injection (ICSI), Preimplantation Genetic Testing (PGT) and products including incubators and culture media, and sperm separation technologies offer to cater to the diverse needs of patients.

Instruments Insights

The culture media segment dominated the market and accounted for a share of around 40% in 2023. This can be attributed to factors such as availability of funding and an increase in research activities to improve culture media. For instance, in July 2022, FUJIFILM Irvine Scientific introduced Heavy Oil for Embryo Culture. The new product is a sterile mineral oil that deals with major concerns in IVF methods, such as osmolality changes, media preservation, and pH due to its standard weight viscosity.

Disposable devices are expected to grow at the fastest CAGR over the forecast period. The growth is attributed to the introduction of disposable devices, including needles, chambers, and slides, by industry players to comply with sterility and regulatory standards. These advancements are anticipated to boost the adoption of disposable IVF devices. Recent innovations in the market include disposable slides for sperm counting, an imaging-based system for tracking and isolating the best motile sperm, and the utilization of disposable microchips.

Procedure Type Insights

The fresh non-donor segment accounted for the largest market share in 2023. Fresh cycles are often perceived as more cost-effective due to potentially requiring fewer treatment cycles to achieve a successful pregnancy. Additionally, some insurance plans may cover fresh cycles further driving demand for fresh non-donor IVF. According to the National ART Summary report 2020, over 1,400 ART cycles were performed using fresh donors, with nearly 54.0% of transfers resulting in live-birth deliveries in the U.S. Although, (Higher Education Financing Agency (HEFA) does not provide assurance for sperm donation services, as they are unlicensed. Consequently, HEFA has updated its guidelines to require fresh sperm to undergo a 180-day quarantine period for HIV screening. The NHS allocates a smaller percentage of funding for fertility treatments involving donated gametes to individuals who are homosexual or single parents.

Frozen donors are expected to register the fastest CAGR during the forecast period owing to the convenience and flexibility offered by them. Advances in egg freezing technology have significantly improved the success rates of using frozen donor eggs in IVF procedures. As a result, more fertility clinics are offering frozen donor egg options to their patients. The use of frozen donor eggs has expanded the pool of potential donors available to recipients. With frozen eggs, recipients have access to a wider selection of donors from different geographic locations, ethnic backgrounds, and phenotypes. This diversity allows recipients to find a suitable donor match more easily, increasing their chances of a successful pregnancy.

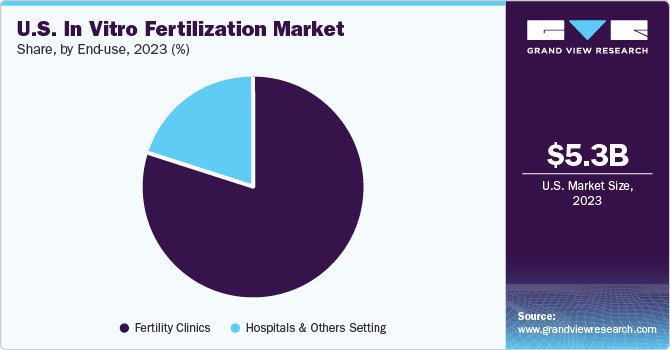

End-use Insights

The fertility clinics segment dominated the market in 2023 and is expected to grow at the fastest CAGR over the forecast period. This is attributable to the increasing demand for ART treatments which has led to a significant rise in the number of fertility clinics and ART centers. In February 2022, IVF FLORIDA Reproductive Associates introduced its full-service fertility clinic that is focused on providing a broad range of family forming choices for couples, individuals, and other communities.

Hospitals and other settings segments are expected to grow at a significant CAGR over the forecast period. The cost of providing In-vitro Fertilization (IVF) treatments in hospitals is higher compared to fertility clinics due to the presence of highly skilled physicians and staff for performing these complex procedures.

Key U.S. In Vitro Fertilization Company Insights

Some of the key players operating in the market include Merck & Co., Inc., FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation), Vitrolife and others.

-

Merck & Co., Inc., plays a significant role by providing a range of products and services that cater to the needs of fertility clinics and hospitals.

-

FUJIFILM Irvine Scientific specializes in providing innovative cell culture media and reagents for the assisted reproductive technology (ART) field, particularly in vitro fertilization (IVF). The company plays a crucial role in the U.S. IVF market by offering a wide range of products and services that support various stages of the IVF process.

Key U.S. In Vitro Fertilization Companies:

- Bayer AG

- Cook Medical LLC

- EMD Serono, Inc.

- Ferring B.V.

- FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation)

- Genea Biomedx

- EMD Serono, Inc. (Merck KGaA)

- Merck & Co., Inc.

- The Cooper Companies, Inc.

- Thermo Fisher Scientific, Inc.

- Vitrolife

- Nova IVF

- RMA Network (Reproductive Medicine Associates)

- U.S. Fertility

Recent Developments

-

In January 2024, IVI RMA announced the acquisition of North American Operations of Eugin Group comprising of the Toronto-based TRIO and Boston IVF fertility network. The strategy is aimed to provide evidence-based fertility solutions along with assuring success to large number of patients.

-

In April 2023, U.S. Fertility & Ovation announced a partnership agreement with the objective to become the renowned fertility organization in the U.S. The partnership is aimed to propel growth and invention, implementing industry best practices to enhance accessibility, patient satisfaction, and health outcomes.

-

In October 2022, U.S Fertility launched a Research Division with the objective to innovate and develop medical and scientific research in the field of reproductive medications. U.S. Fertility has announced to publish and conduct prime research findings to enhance the field of reproductive medicine to deliver more efficient care to patients in the future.

-

In October 2022, Alife launched a new AI technology with the aim to facilitate fertility clinics optimize & establish clinical policymaking throughout significant phases of the IVF procedure.

-

In June 2022, Center for Reproductive Medicine (CCRM) Fertility announced that it has acquired The Institute for Reproductive Medicine & Sciences (IRMS). The integration of IRMS into CCRM Fertility’s operations enhances its growth and extends its proprietary reproductive medicine knowledge to IRMS offices and patients. As a result, CCRM Fertility now caters to 11 significant metropolitan areas, spanning across 34 locations in U.S.

-

In March 2022, California Fertility Partners announced that it has been acquired by Pinnacle Fertility. The acquisition is aimed at offering easily accessible treatments and unique conclusions to people requiring genomic services and fertility.

U.S. In Vitro Fertilization Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.58 billion |

|

Revenue forecast in 2030 |

USD 7.24 billion |

|

Growth rate |

CAGR of 4.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Instruments, Procedure Type, and End-use |

|

Country scope |

U.S. |

|

Key companies profiled |

Bayer AG; Cook Medical LLC; EMD Serono, Inc.; Ferring B.V.; FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation); Genea Biomedx; EMD Serono, Inc. (Merck KGaA); Merck & Co., Inc.; The Cooper Companies, Inc.; Thermo Fisher Scientific, Inc.; Vitrolife |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. In Vitro Fertilization Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. in vitro fertilization market report based on instrument, procedure type, and end-use.

-

Instrument Outlook (Revenue, USD Billion, 2018 - 2030)

-

Disposable Devices

-

Culture Media

-

Cryopreservation Media

-

Embryo Culture Media

-

Ovum Processing Media

-

Sperm Processing Media

-

-

Capital Equipment

-

Sperm Analyzer Systems

-

Imaging Systems

-

Ovum Aspiration Pumps

-

Micromanipulator Systems

-

Incubators

-

Gas Analyzers

-

Laser Systems

-

Cryosystems

-

Sperm Separation Devices

-

IVF Cabinets

-

Anti-vibration Tables

-

Witness Systems

-

Other

-

-

-

Procedure Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fresh Donor

-

Frozen Donor

-

Fresh Non-Donor

-

Frozen Non-Donor

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fertility Clinics

-

Hospitals & Others Setting

-

Frequently Asked Questions About This Report

b. The U.S. in vitro fertilization market size was valued at USD 5.28 billion in 2023 and is expected to reach USD 5.58 billion in 2024.

b. The U.S. in vitro fertilization market is projected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030 to reach USD 7.24 billion by 2030.

b. The culture media segment dominated the U.S. IVF market and accounted for a share of around 40% in 2023 attributed to factors such as availability of funding and an increase in research activities to improve culture media.

b. Some of the key players operating in the U.S. IVF market include Microsoft Corporation; Merck & Co., Inc., FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation), and Vitrolife, among others.

b. The rising prevalence of infertility among couples is one of the primary drivers for the growth of the U.S. IVF market. According to the CCRM Fertility article published in June 2022, over 10% of women and around 9% of men suffer with infertility issues. Over 10% of females falling in the age group of 15 to 45 in the U.S. faces infertility.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."