- Home

- »

- Clinical Diagnostics

- »

-

U.S. Immunoassay Market Size, Industry Report, 2030GVR Report cover

![U.S. Immunoassay Market Size, Share & Trends Report]()

U.S. Immunoassay Market Size, Share & Trends Analysis Report By Product (Reagent & Kits, Analyzers/Instruments), By Technology (RIA, ELISA), By Application, By Specimen, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-285-5

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Immunoassay Market Size & Trends

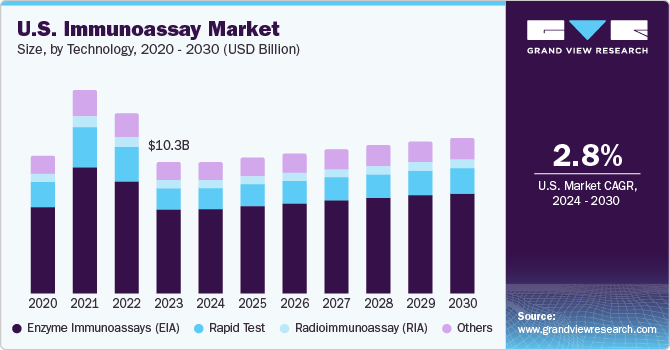

The U.S. immunoassay market size was estimated at USD 10.31 billion in 2023 and is projected to grow at a CAGR of 2.8% from 2024 to 2030. This can be attributed to technological advancements in immunoassay techniques, rising demand for early disease detection and diagnosis, growing adoption of immunoassay tests in clinical diagnostics and research laboratories, rising geriatric population, and increased prevalence of chronic and infectious diseases. As per the information published by the Centers for Disease Control and Prevention, six out of ten Americans are affected by at least one chronic illness, such as diabetes, cancer, heart disease, or stroke.

Ongoing advancements in immunoassay technologies have enhanced their performance, speed, and multiplexing capabilities. Innovations such as automated platforms, high-throughput systems, and improved assay sensitivity contribute to market growth by making immunoassays more efficient and cost-effective.

The increasing awareness of the importance of early disease detection and diagnosis, coupled with the growing prevalence of chronic diseases, is driving the demand for immunoassays in the U.S. healthcare market. For instance, in November 2023, Roche announced the launch of Elecsys HBeAg quant. This immunoassay measures the amount and presence of the hepatitis B e antigen (HBeAg) in human plasma and serum. The launch enabled patients to receive confirmation of their hepatitis B (HBV) status and the degree of their infection, along with treatment monitoring, using a single test.

The rising geriatric population is another key driver for the market growth. Older adults are more susceptible to chronic diseases such as diabetes, heart disease, and cancer. As a result, there is an increasing demand for early disease detection and diagnosis in this population. In addition, older adults often require more frequent diagnostic testing due to their complex medical histories and multiple comorbidities. This has led to an increasing demand for immunoassays in long-term care facilities and hospitals. According to the Population Reference Bureau, it is anticipated that the number of Americans 65 and older is expected to rise from 58 million in 2022 to 82 million in 2050 (a 47% increase), and that their proportion of the overall population is projected to rise from 17% to 23%.

The growing adoption of immunoassay tests in clinical diagnostics and research laboratories is driving market growth due to their accuracy, wide range of applications, rapid results, automation capabilities, and cost-effectiveness. For instance, in July 2023, Siemens Healthineers launched Atellica CI Analyser for immunoassay and clinical chemistry testing.

Market Concentration & Characteristics

The market growth stage is low, and the pace is accelerating. The U.S. market is characterized by a high degree of innovation driven by technological advancements, increasing demand for personalized medicine, and the need for more sensitive and specific diagnostic tools. Immunoassays are increasingly being integrated with digital health technologies such as artificial intelligence and data analytics to enhance diagnostic accuracy and predictive capabilities.

The immunoassay market is also characterized by a high level of merger and acquisition (M&A) activity by the market players. This can be attributed to various factors, including the increasing competition and the need for companies to expand their product portfolios and market presence. In addition, the rapid pace of technological advancements in immunoassay technologies has led players to seek opportunities for strategic partnerships or acquisitions to access new technologies or enhance their existing product offerings. In January 2024, Roche declared that it had finalized a deal to acquire LumiraDx’s point of care (POC) technology. The acquisition offers them a broad range of clinical chemistry and immunoassay.

The market is also subject to increasing regulatory scrutiny to ensure that only safe and effective medical devices reach patients while maintaining quality standards and reimbursement policies within the healthcare system. The primary regulatory bodies overseeing the U.S. market are the Food and Drug Administration (FDA) and the Centers for Medicare & Medicaid Services (CMS).

The market has high product expansion due to technological advancements, partnerships, and collaborations by market players. For instance, in July 2023, Beckman Coulter unveiled the DxI 9000 Access Immunoassay Analyzer, in response to clinical laboratory needs for speed, dependability, reliability, quality, and menu expansion, The DxI 9000 Analyzer has demonstrated the ability to create tests that are more sensitive and pertinent to clinical settings.

The U.S. market is characterized by a moderate level of regional expansion. Market players are adopting geographical expansion strategies to capitalize on this growth and increase their market share.

Product Insights

The reagents and kits led the market with the largest revenue share of 65.82% in 2023 and is expected to grow at the fastest CAGR over the forecast period. The rising incidence of autoimmune and infectious disorders is a major drivers for market growth. In addition, introduction and approval of innovative immunoassay kits are anticipated to support segment growth. For instance, in February 2023, Charles River Laboratories International, Inc. introduced its first enzyme-linked immunosorbent assay kit for the quantitation and detection of residual host cell proteins in CHO-based bio therapeutics.

The software and services segment is expected to grow at a significant CAGR during the forecast period. This can be attributed to the rising demand and expanded availability of affordable automated immunoassay systems. For instance, in August 2023, at the 2023 Clinical Lab Expo and meeting of the American Association of Clinical Chemistry (AACC), Fapon unveiled the Shine i8000/9000, its new chemiluminescence immunoassay system. It is a completely automated and fast analyzer that can process a very high volume of data, conducting around 900 tests per hour.

Technology Insights

Based on technology, the enzyme immunoassays (EIA) segment led the market with the largest revenue share of 63.49% in 2023 and is expected to grow at a significant CAGR over the forecast period, due to its frequent use in the detection of food allergies, drug addiction, and chronic and infectious disorders, among other uses. This approach has a number of benefits over immunoelectrophoresis and immunodiffusion, such as a shorter experiment period, quantifiable results, and a lower antisera quantity required for analysis.

The increased research activities are anticipated to offer lucrative opportunities during the forecast period. For instance, researchers at the University of Central Florida are creating a screening technique that can find cancer biomarkers 300 times more frequently than current techniques. This method is likely to increase the sensitivity of ELISA by using nanoparticles with platinum-rich shells and nickel-rich cores.

Application Insights

Based on application, the infectious diseases testing segment led the market with the largest revenue share of 29.55% in 2023. The rising incidence of infectious diseases such as HIV, hepatitis, influenza, and COVID-19 has fueled the demand for immunoassays for early detection and monitoring of these conditions. In addition, ongoing advancements in immunoassay technologies have led to the development of more sensitive, specific, and automated platforms, enhancing their utility in diagnosing infectious diseases. According to the Center for Disease Control and Prevention, by March 2024, there were 6,866,673 hospital admission cases due to COVID-19 infection.

The oncology segment is expected to grow at the fastest CAGR over the forecast period. One of the key drivers of market expansion is the increased incidence of cancer. According to estimates from the American Cancer Society, there were about 1.96 million new instances of cancer reported in 2023, and 609,820 people lost their lives to the disease. Therefore, effective diagnostic procedures are required for the early identification and management of cancer. Immunoassays and analyzers are becoming more and more popular among market participants due to the previously mentioned aspects, with an increasing emphasis on the development of new goods and the introduction of affordable variants.

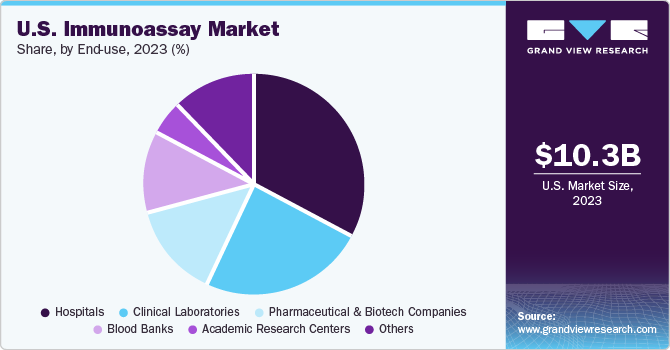

End-use Insights

Based on end-use, the hospital segment led the market with the largest revenue share of 33.01% in 2023.Hospitals and clinics serve as primary care facilities for the diagnosis and management of illnesses. For the diagnosis, treatment, and management of illnesses, a sizable portion of the diverse population depends on these long-standing facilities. In addition, there is a growing demand for hospitals offering better diagnostic services due to ongoing changes in the healthcare sector. Increased healthcare expenditure has also contributed to the segment growth significantly. As per the information published by the Centers for Medicare & Medicaid Services, in 2022, healthcare spending in the U.S. increased by 4.1%, amounting to a total of USD 4.5 trillion or USD 13,493 per person. As a proportion of the country's gross domestic product, healthcare spending accounted for 17.3%.

The clinical laboratories sector is expected to register at the fastest CAGR during the forecast period. Growth in the immunoassay solutions market is anticipated to be primarily driven by consumers' growing preference for diagnostic laboratories as a quick and affordable source of testing services.

Specimen Insights

Based on specimen, the blood segment led the market with the largest revenue share of 43.19% in 2023, owing to technological advancements and the rise in the occurrence of diseases, which drives demand for different blood testing procedures, supporting segment growth. In March 2022, Rika, the innovative plasma collection system created by Terumo Blood and Cell Technologies (Terumo BCT), received approval from the U.S. Food and Drug Administration (FDA). Rika is an automated technology of the future that focuses on the experience of donors and staff at plasma centers.

The urine specimen segment is expected to register at the fastest CAGR during the forecast period. The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and infectious diseases necessitates regular monitoring of biomarkers in bodily fluids including urine. Immunoassays offer a reliable and cost-effective method for detecting these biomarkers, driving their adoption in healthcare settings.

Key U.S. Immunoassay Company Insights

Some of the key companies operating in the U.S. market include F. Hoffmann-La Roche AG; Abbott Laboratories and Siemens Healthineers,

-

F. Hoffmann-La Roche AG has a significant presence in the U.S. Roche’s immunoassay product portfolio in the U.S. which includes a variety of diagnostic tests and platforms that cater to different medical needs. It offers immunoassay products such as Cobas e 801 Immunoassay Analyzer, Elecsys Immunoassay Tests, Cobas e 602 Immunoassay Module, Elecsys BRAHMS Procalcitonin (PCT) Assay, among others

-

Abbott’s immunoassay portfolio is a comprehensive suite of diagnostic tests that help detect and measure a wide range of proteins, hormones, and other substances in the human body. It includes Abbott Architect, ARCHITECT i1000SR. SARS-COV-2 IMMUNOASSAYS , ARCHITECT i2000SR among others

Key U.S. Immunoassay Companies:

- F. Hoffmann-La Roche AG

- Abbott Laboratories

- Siemens Healthineers

- Danaher Corporation

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Sysmex Corporation

- DiaSorin

- Agilent Technologies

Recent Developments

-

In October 2023, Lucent Diagnostics announced the addition of the highly accurate p-Tau 217 blood test for Alzheimer's disease, named LucentAD p-Tau 217, to its expanding LucentAD product line. This lab-developed test represents a significant advancement in the use of scalable immunoassay-based blood biomarker tests for evaluating amyloid pathology in patients presenting with memory problem

-

In July 2023, VerséaOphthalmics, LLC launched its T-POC TOTAL IgE Immunoassay, a point-of-care test that is based on tears for the detection and treatment of diseases of the ocular surface

-

In May 2023, Beckman Coulter Diagnostics announced the global launch of the DxI 9000 Access Immunoassay Analyzer, designed to address demands for quality, reliability, speed, reproducibility, and menu expansion.

U.S. Immunoassay Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.34 billion

Revenue forecast in 2030

USD 12.25 billion

Growth rate

CAGR of 2.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, specimen.

Key companies profiled

F. Hoffmann-La Roche AG; Abbott Laboratories; Siemens Healthineers; Danaher Corporation; Thermo Fisher Scientific; Bio-Rad Laboratories; Sysmex Corporation; DiaSorin; Agilent Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Immunoassay Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. immunoassay market report based on product, technology, application, end-use, specimen, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents & Kits

-

ELISA Reagents & Kits

-

Rapid Test Reagents & Kits

-

ELISPOT Reagents & Kits

-

Western Blot Reagents & Kits

-

Other Reagents & Kits

-

-

Analyzers/Instruments

-

Open Ended Systems

-

Closed Ended Systems

-

-

Software & Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Radioimmunoassay (RIA)

-

Enzyme Immunoassays (EIA)

-

Chemiluminescence Immunoassays (CLIA)

-

Fluorescence Immunoassays (FIA)

-

-

Rapid Test

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic Drug Monitoring

-

Oncology

-

Cardiology

-

Endocrinology

-

Infectious Disease Testing

-

Autoimmune Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Blood Banks

-

Clinical Laboratories

-

Pharmaceutical and Biotech Companies

-

Academic Research Centers

-

Others

-

-

Specimen Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood

-

Saliva

-

Urine

-

Other Specimens

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. immunoassay market size was valued at USD 10.31 billion in 2023 and is expected to reach USD 10.34 billion in 2024

b. The U.S. immunoassay market is projected to grow at a compound annual growth rate (CAGR) of 2.8% from 2024 to 2030 to reach USD 12.25 billion by 2030

b. The enzyme immunoassays (EIA) segment accounted for the largest market revenue share in 2023 and is expected to grow significantly over the forecast period due to its frequent use in the detection of food allergies, drug addiction, and chronic and infectious disorders, among other uses.

b. Some of the key companies operating in the U.S. immunoassay market include F. Hoffmann-La Roche AG; Abbott Laboratories, and Siemens Healthineers, among others.

b. The U.S. immunoassay market growth can be attributed to technological advancements in immunoassay techniques, rising demand for early disease detection and diagnosis, growing adoption of immunoassay tests in clinical diagnostics and research laboratories, rising geriatric population, and increased prevalence of chronic and infectious diseases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."