U.S. Imaging Services Market Size, Share & Trends Analysis Report By Modality (Mammography, Nuclear Medicine Scans, Ultrasound, X-rays), By End-use (Hospitals, Diagnostic Imaging Centers), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-625-7

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

U.S. Imaging Services Market Size & Trends

The U.S. imaging services market size was estimated at USD 150.2 billion in 2024 and is expected to grow at a CAGR of 4.3% from 2025 to 2030. The major factors attributed to the growth include the increasing prevalence of cancer and cardiac disorders coupled with growing awareness about medical imaging technology. For instance, according to the International Agency for Research on Cancer, in 2022, about 2,380,189 new cancer cases were reported in the U.S. The number is further estimated to reach 7,845,698 in the next 5 years. In addition, developing various technologies for enhancing medical imaging services is anticipated to boost market growth during the forecast period.

Medical imaging is the preferred diagnostic technique, providing vital information with speed, safety, and accuracy. Imaging services involve different imaging modalities such as X-ray, ultrasound, nuclear medicine scans, MRI, and CT scans, which are non-invasive techniques that can be used to diagnose various diseases easily. In addition, these imaging services help in the early diagnosis of the disease, which leads to positive treatment outcomes. The development of various technologies for enhancing medical imaging services is anticipated to boost market growth in the coming years. Furthermore, the rapidly increasing aging population and high cancer incidence are factors expected to drive market growth. Growing funding to support ongoing research activities and rising private-public initiatives related to medical imaging are factors likely to propel overall market growth.

Medical imaging helps with the early and accurate diagnosis of diseases, which helps in providing effective disease treatment. Therefore, to control the growing disease burden, a large number of medical professionals are using medical imaging devices in imaging services before performing surgeries. The growing prevalence of cancer and cardiovascular diseases is expected to drive the need for medical imaging services. According to the Centers for Disease Control and Prevention (CDC), one person dies from cardiovascular disease every 33 seconds, with a total of 702,880 deaths recorded in 2022, which is equivalent to one in every five deaths.

In interventional radiology, healthcare professionals use medical imaging systems to guide minimally invasive surgical procedures that treat, diagnose, and cure several conditions. Imaging modalities include CT, fluoroscopy, ultrasound, and MRI. Minimally invasive surgeries offer numerous benefits, such as faster recovery time, smaller incisions, reduced scarring and pain, increased accuracy, and shorter hospital stays compared to open surgery techniques, which are expected to fuel the market.

Market Characteristics & Concentration

The industry growth stage is moderate, and the pace of the growth is accelerating. The U.S. imaging services industry is characterized by a low to moderate degree of growth. Key driving factors include the increasing prevalence of chronic disorders, rising awareness about medical imaging techniques, and a growing number of outpatient settings with imaging services. However, the high cost of medical imaging services and the dearth of skilled radiologists operating medical imaging equipment may hamper industry growth in the forecast period.

The key players in the U.S. imaging services industry are utilizing strategies such as new product launches, mergers & acquisitions, business expansion, partnerships & collaborations, and implementing another effective strategy to maintain their position in the industry. For instance, In April 2023, Unilabs partnered with SmartSoft Healthcare to enhance the lumbar spine MRI reading and reporting. This partnership demonstrated the expansion of AI in the field of diagnostic imaging services for improving efficiency and accuracy,

The degree of innovation in the U.S. imaging services industry constantly evolves as new technologies and techniques are developed and adopted. The industry has seen significant growth in recent years due to the increasing demand for diagnostic imaging services and the implementation of advanced imaging technologies such as MRI, CT, and PET-CT. Furthermore, there has been a rise in the use of artificial intelligence and machine learning algorithms in medical imaging, which is expected to enhance the industry's degree of innovation further.

The U.S. imaging services industry is witnessing a high level of partnerships and collaboration. Companies are considering expanding their service offerings and reaching wide customers through this strategy. Companies can combine their strengths and expertise to provide better customer solutions and services. Moreover, partnerships and collaborations can help companies to reduce costs and increase efficiency, as they can share resources and knowledge. Due to the rising demand for imaging services, more partnerships and collaborations are expected. For instance, in November 2022, RadNet, Inc. acquired a majority stake of 75% in Heart & Lung Imaging Limited. This London-based company aims to enhance the outcomes of lung cancer patients through early detection and precise diagnosis.

Stringent regulations control the U.S. imaging services industry to ensure patient safety, privacy, proper handling, and disposal of medical equipment. Regulatory authorities such as the Food and Drug Administration (FDA) and the Centers for Medicare and Medicaid Services (CMS) play a significant role in the imaging services industry. Laws such as the Affordable Care Act and the Medicare Access and CHIP Reauthorization Act (MACRA) also impact the industry by promoting value-based care and driving the adoption of new technologies. The U.S. imaging services industry operates in a heavily regulated environment, with numerous laws and regulations impacting the industry at the federal and state levels.

The U.S. medical imaging services industry has a low threat from direct substitutes. However, services such as telemedicine and remote monitoring offer convenient and cost-effective options for patients who are not able to undergo traditional medical imaging procedures. The industry is highly competitive, with companies competing on factors such as price, quality of services, and geographic coverage.

In terms of geographical expansion, several imaging centers in the U.S. have been expanding to other states and regions to cater to a larger patient population. For instance, in April 2023, MetroHealth's Lumina Imaging and Siemens Healthineers established a strategic Value Partnership to expand affordable outpatient imaging services across the U.S. Siemens Healthineers will exclusively supply MRI and CT equipment for all future Lumina sites, supporting both corporate-owned and franchise locations. This expansion has helped improve access to imaging services and provide better patient care.

Modality Insights

Nuclear medicine scans held the largest share of 24.31% in 2024. Rising awareness levels among physicians and clinical researchers regarding the benefits of nuclear imaging scans, coupled with increasing application areas, such as cases in oncology and neurological diseases, are the factors driving the market. Moreover, increasing partnerships and collaborations between market players further contribute to this growth. For instance, in October 2024, Jubilant Radiopharma and Simplified Imaging Solutions formed a strategic partnership to enhance nuclear medicine services across U.S. healthcare facilities. This collaboration offers a comprehensive, cost-effective solution by integrating radiopharmacy networks with diagnostic services, streamlining operations, and reducing administrative burdens for nuclear labs.

Moreover, the magnetic resonance imaging segment is expected to grow at the highest CAGR of 4.7% over the forecast period, owing to factors such as the increasing geriatric population, technological advancements such as the introduction of hybrid MRI equipment, high-field MRI, superconducting (SC) magnets, and installation of software, availability of universal health coverage, and growing burden on chronic diseases are fueling market growth.

End-use Insights

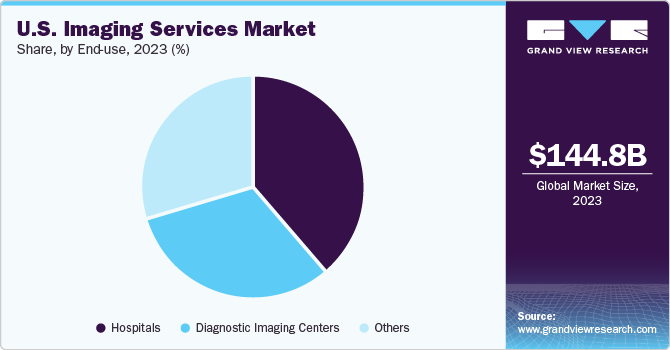

Hospitals held the largest share of 38.56% in 2024, owing to the increasing prevalence of various conditions such as cancer and cardiac disorders. The availability of multiple imaging modalities in a single facility and reimbursement policies for the imaging procedures are also expected to impact the overall market growth. Moreover, rising efforts to increase the presence of hospitals offering imaging services in the country further contribute to segment growth. For instance, in June 2023, Inspira Health Network, Atlantic Medical Imaging (AMI), and Regional Diagnostic Imaging (RDI) formed a joint venture to operate nine imaging centers in New Jersey. This partnership aims to enhance patient access, expedite scheduling, and expand services across multiple locations, rebranding six centers as "AMI at Inspira Health."

Diagnostic imaging centers are expected to witness segment growth in the market due to the increasing demand for outpatient imaging services. The shift toward value-based healthcare and cost-reducing measures has led healthcare providers to prefer outpatient settings, offering lower costs and greater patient convenience. In addition, advancements in imaging technology, such as AI-assisted diagnostics and portable imaging solutions, enable diagnostic centers to provide faster and more accurate results. Many imaging centers are also expanding their service offerings to include advanced modalities such as PET-CT and 3D mammography, attracting a larger patient base and increasing their market presence.

Key U.S. Imaging Services Company Insights

The U.S. market is highly competitive and has several key players. The major market players are focused on forming partnerships to enhance imaging services and patient care, taking advantage of important cooperation activities, and exploring mergers & acquisitions. For instance, in March 2023, Medtronic and NVIDIA stated that they have partnered to accelerate the expansion of AI in the healthcare system and convey new AI-based solutions into patient care. Also, apart from Medtronic, the company is aiming for more such AI or metaverse-driven partnerships to advance medical imaging & medical devices, as per NVIDIA's GTC 2023 conference.

Key U.S. Imaging Services Companies:

- Radnet, Inc.

- Alliance Medical

- Inhealth Group

- Sonic Healthcare

- Dignity Health

- Medica Group

- Global Diagnostics

- Novant Health

- Concord Medical Services Holdings Limited

- Center for Diagnostic Imaging, Inc.

- Unilabs

- Healius Limited

- Simonmed Imaging

Recent Development

-

In October 2024, IKS Health partnered with Radiology Partners to enhance radiology services using its AI-powered Care Enablement Platform. This collaboration aims to streamline workflows, reduce administrative burdens, and improve imaging access, allowing over 3,900 radiologists to dedicate more time to patient care.

-

In July 2024, Rayus Radiology partnered with AI startup Ezra to introduce whole-body MRI services in Seattle, aiming to detect early-stage cancers and over 500 other conditions across 13 organs. This collaboration addresses the growing demand for comprehensive disease monitoring.

-

In April 2024, Ezra Health partnered with RAYUS Radiology to offer AI-enabled full-body MRI scans at 150 RAYUS locations across the U.S. Ezra's technology monitors for over 500 conditions in 13 organs, aiming to detect diseases early. Their Ezra Flash software, FDA-approved in 2023, enhances MRI efficiency and image quality.

-

In February 2023, Radnet, Inc. introduced an enhanced breast cancer detection program in New Jersey and New York. This imaging service network will benefit patients with an enhanced screening mammography service for cancer detection.

U.S. Imaging Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 156.1 billion |

|

Revenue forecast in 2030 |

USD 192.9 billion |

|

Growth Rate |

CAGR of 4.3% from 2025 to 2030 |

|

Historical period |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Modality, end-use |

|

Regional scope |

U.S. |

|

Key companies profiled |

Radnet, Inc.; Alliance Medical; Inhealth Group; Sonic Healthcare; Dignity Health; Medica Group; Global Diagnostics; Novant Health; Concord Medical Services Holdings Limited; Center for Diagnostic Imaging, Inc.; Unilabs; Healius Limited; Simonmed Imaging |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Imaging Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. imaging services market report based on modality and end-use:

-

Modality Outlook (Revenue, USD Billion, 2018 - 2030)

-

X-rays

-

CT scans

-

Nuclear medicine scans

-

MRI scans

-

Ultrasound

-

Mammography

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Diagnostic imaging centers

-

Others

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include growing prevalence of cardiac disorders and cancer, growing number of outpatient settings with imaging services, and growing awareness of medical imaging.

b. The U.S. imaging services market size was estimated at USD 150.2 billion in 2024 and is expected to reach USD 156.1 billion in 2025.

b. The global U.S. imaging services market is expected to grow at a compound annual growth rate of 4.32% from 2025 to 2030 to reach USD 192.9 billion by 2030.

b. The nuclear medicine modality segment dominated the U.S. imaging services market with a share of 24.31% in 2024. This is attributable to the growing usage of x-ray for diagnosing various conditions due to its cost-effective nature and accurate results.

b. Some key players operating in the U.S. imaging services market include Radnet, Inc., Novant Health, Alliance Medical, Inhealth Group, Sonic Healthcare, Dignity Health, Medica Group, Global Diagnostics, Healthcare Imaging Services Pty Ltd., Concord Medical Services Holdings Limited, Alliance HealthCare Services, Inc., Center for Diagnostic Imaging, Inc., Unilabs, Healius Limited, and Simonmed Imaging.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Modality

1.1.2. End-Use

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. GVR’s internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.1.1. Approach 1: Commodity flow approach

1.6.2. Volume price analysis (Model 2)

1.6.2.1. Approach 2: Volume price analysis

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

1.9.1. Objective 1

1.9.2. Objective 2

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.2.1. Modality outlook

2.2.2. End-use outlook

2.3. Competitive Insights

Chapter 3. U.S. Imaging Services Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Reimbursement framework

3.4. Market Dynamics

3.4.1. Market driver analysis

3.4.1.1. Increasing prevalence of cancer and cardiac disorders

3.4.1.2. Growing number of outpatient settings with imaging services

3.4.1.3. Growing awareness of medical imaging

3.4.2. Market restraint analysis

3.4.2.1. High cost of MRI services

3.4.2.2. Side effects of imaging modalities

3.5. U.S. Imaging Services Market Analysis Tools

3.5.1. Industry Analysis - Porter’s

3.5.1.1. Supplier power

3.5.1.2. Buyer power

3.5.1.3. Substitution threat

3.5.1.4. Threat of new entrant

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Technological landscape

3.5.2.3. Economic landscape

Chapter 4. U.S. Imaging Services Market: Modality Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. U.S. Imaging Services Modality Market Movement Analysis

4.3. U.S. Imaging Services Market Size & Trend Analysis, by Modality, 2018 to 2030 (USD Million)

4.3.1. X-rays

4.3.1.1. X-rays market estimates and forecast 2018 - 2030 (USD Billion)

4.3.2. CT scans

4.3.2.1. CT scans market estimates and forecast, 2018 - 2030 (USD Billion)

4.3.3. Nuclear medicine scans

4.3.3.1. Nuclear medicine scans market estimates and forecast, 2018 - 2030 (USD Billion)

4.3.4. MRI scans

4.3.4.1. MRI scans market estimates and forecast, 2018 - 2030 (USD Billion)

4.3.5. Ultrasound

4.3.5.1. Ultrasound market estimates and forecast, 2018 - 2030 (USD Billion)

4.3.6. Mammography

4.3.6.1. Mammography market estimates and forecast, 2018 - 2030 (USD Billion)

Chapter 5. U.S. Imaging Services Market: End Use Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. U.S. Imaging Services End Use Market Movement Analysis

5.3. U.S. Imaging Services Market Size & Trend Analysis, by End Use, 2018 to 2030 (USD Million)

5.3.1. Hospitals

5.3.1.1. Hospitals market estimates and forecast, 2018 - 2030 (USD Billion)

5.3.2. Diagnostic imaging centers

5.3.2.1. Diagnostics Imaging Centers market estimates and forecast, 2018 - 2030 (USD Billion)

5.3.3. Others

5.3.3.1. Others market estimates and forecast, 2018 - 2030 (USD Billion)

Chapter 6. Competitive Landscape

6.1. Recent Developments & Impact Analysis, By Key Market Participants

6.2. Company/Competition Categorization

6.3. Key company market share analysis, 2024

6.4. Company Position Analysis

6.5. Company Categorization (Emerging Players, Innovators and Leaders)

6.6. Company Profiles

6.6.1. Radnet, Inc.

6.6.1.1. Company overview

6.6.1.2. Financial performance

6.6.1.3. Product benchmarking

6.6.1.4. Strategic initiatives

6.6.2. Sonic Healthcare

6.6.2.1. Company overview

6.6.2.2. Financial performance

6.6.2.3. Product benchmarking

6.6.2.4. Strategic initiatives

6.6.3. Dignity Health

6.6.3.1. Company overview

6.6.3.2. Financial performance

6.6.3.3. Product benchmarking

6.6.3.4. Strategic initiatives

6.6.4. Novant Health

6.6.4.1. Company overview

6.6.4.2. Financial performance

6.6.4.3. Product benchmarking

6.6.4.4. Strategic initiatives

6.6.5. Alliance Medical

6.6.5.1. Company overview

6.6.5.2. Financial performance

6.6.5.3. Product benchmarking

6.6.5.4. Strategic initiatives

6.6.6. Inhealth Group

6.6.6.1. Company overview

6.6.6.2. Financial performance

6.6.6.3. Product benchmarking

6.6.6.4. Strategic initiatives

6.6.7. Medica Group

6.6.7.1. Company overview

6.6.7.2. Financial performance

6.6.7.3. Product benchmarking

6.6.7.4. Strategic initiatives

6.6.8. Global Diagnostics

6.6.8.1. Company overview

6.6.8.2. Financial performance

6.6.8.3. Product benchmarking

6.6.8.4. Strategic initiatives

6.6.9. Concord Medical Services Holdings Limited

6.6.9.1. Company overview

6.6.9.2. Financial performance

6.6.9.3. Product benchmarking

6.6.9.4. Strategic initiatives

6.6.10. Center for Diagnostic Imaging, Inc.

6.6.10.1. Company overview

6.6.10.2. Financial performance

6.6.10.3. Product benchmarking

6.6.10.4. Strategic initiatives

6.6.11. Unilabs

6.6.11.1. Company overview

6.6.11.2. Financial performance

6.6.11.3. Product benchmarking

6.6.11.4. Strategic initiatives

6.6.12. Healius Limited

6.6.12.1. Company overview

6.6.12.2. Financial performance

6.6.12.3. Product benchmarking

6.6.12.4. Strategic initiatives

6.6.13. Simonmed Imaging

6.6.13.1. Company overview

6.6.13.2. Financial performance

6.6.13.3. Product benchmarking

6.6.13.4. Strategic initiatives

List of Tables

Table 1 List of secondary sources

Table 2 List of abbreviations

Table 3 U.S. imaging services market, by modality, 2018 - 2030 (USD Billion)

Table 4 U.S. imaging services market, by end use, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 U.S. imaging services systems: market outlook

Fig. 9 U.S. imaging services market competitive insights

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Penetration and growth prospect mapping

Fig. 13 Industry value chain analysis

Fig. 14 U.S. imaging services market driver impact

Fig. 15 U.S. imaging services market restraint impact

Fig. 16 U.S. imaging services market strategic initiatives analysis

Fig. 17 U.S. imaging services market: modality movement analysis

Fig. 18 U.S. imaging services market: modality outlook and key takeaways

Fig. 19 X-ray market estimates and forecast, 2018 - 2030

Fig. 20 CT scans market estimates and forecast, 2018 - 2030

Fig. 21 Nuclear medicine scans market estimates and forecast, 2018 - 2030

Fig. 22 MRI scans market estimates and forecast, 2018 - 2030

Fig. 23 Ultrasound market estimates and forecast, 2018 - 2030

Fig. 24 Mammography market estimates and forecast, 2018 - 2030

Fig. 25 U.S. imaging services: end-use movement analysis

Fig. 26 U.S. imaging services: end-use outlook and key takeaways

Fig. 27 Hospitals estimates and forecast, 2018 - 2030

Fig. 28 Diagnostic imaging centers estimates and forecast, 2018 - 2030

Fig. 29 Others estimates and forecast, 2018 - 2030

Fig. 30 Participant categorization - U.S. imaging services market

Fig. 31 Market share of key market players - U.S. imaging services market

Market Segmentation

- U.S. Imaging Services Modality Outlook (Revenue, USD Billion, 2018 - 2030)

- X-rays

- CT scans

- Nuclear medicine scans

- MRI scans

- Ultrasound

- Mammography

- U.S. Imaging Services End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospitals

- Diagnostic imaging centers

- Others

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Country market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Country market size and forecast for application segments up to 2030

- Company financial performance

Research Methodology

Grand View Research employs comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For comprehensive understanding of the market, it is essential to understand the complete value chain and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.

Technical issues and trends are obtained from surveys, technical symposia and trade journals. Technical data is also gathered from intellectual property perspective, focusing on white space and freedom of movement. Industry dynamics with respect to drivers, restraints, pricing trends are also gathered. As a result, the material developed contains a wide range of original data that is then further cross-validated and authenticated with published sources.

Statistical model

Our market estimates and forecasts are derived through simulation models. A unique model is created customized for each study. Gathered information for market dynamics, technology landscape, application development and pricing trends is fed into the model and analyzed simultaneously. These factors are studied on a comparative basis, and their impact over the forecast period is quantified with the help of correlation, regression and time series analysis. Market forecasting is performed via a combination of economic tools, technological analysis, and industry experience and domain expertise.

Econometric models are generally used for short-term forecasting, while technological market models are used for long-term forecasting. These are based on an amalgamation of technology landscape, regulatory frameworks, economic outlook and business principles. A bottom-up approach to market estimation is preferred, with key regional markets analyzed as separate entities and integration of data to obtain global estimates. This is critical for a deep understanding of the industry as well as ensuring minimal errors. Some of the parameters considered for forecasting include:

• Market drivers and restrains, along with their current and expected impact

• Raw material scenario and supply v/s price trends

• Regulatory scenario and expected developments

• Current capacity and expected capacity additions up to 2030

We assign weights to these parameters and quantify their market impact using weighted average analysis, to derive an expected market growth rate.

Primary validation

This is the final step in estimating and forecasting for our reports. Exhaustive primary interviews are conducted, on face to face as well as over the phone to validate our findings and assumptions used to obtain them. Interviewees are approached from leading companies across the value chain including suppliers, technology providers, domain experts and buyers so as to ensure a holistic and unbiased picture of the market. These interviews are conducted across the globe, with language barriers overcome with the aid of local staff and interpreters. Primary interviews not only help in data validation, but also provide critical insights into the market, current business scenario and future expectations and enhance the quality of our reports. All our estimates and forecast are verified through exhaustive primary research with Key Industry Participants (KIPs) which typically include:

• Market leading companies

• Raw material suppliers

• Product distributors

• Buyers

The key objectives of primary research are as follows:

• To validate our data in terms of accuracy and acceptability

• To gain an insight in to the current market and future expectations

Data Collection Matrix

|

Perspective |

Primary research |

Secondary research |

|

Supply side |

|

|

|

Demand side |

|

|

Industry Analysis Matrix

|

Qualitative analysis |

Quantitative analysis |

|

|

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."