- Home

- »

- Medical Devices

- »

-

U.S. Image-guided Therapy Systems Market, Industry Report, 2030GVR Report cover

![U.S. Image-guided Therapy Systems Market Size, Share & Trends Report]()

U.S. Image-guided Therapy Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (CT, Ultrasound, MRI, X-ray, PET, Endoscopes, And SPECT), By Application (Cardiac Surgery, Neurosurgery, Orthopedic Surgery), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-232-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

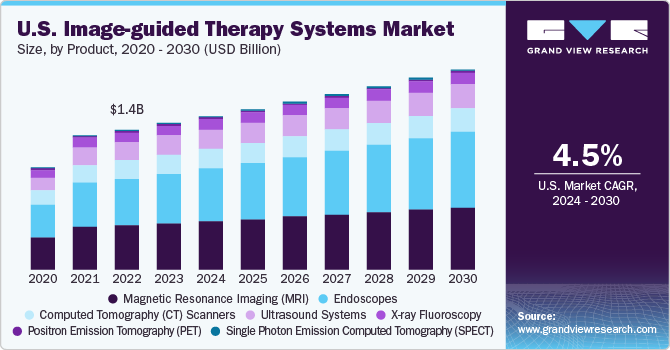

The U.S. image-guided therapy systems market size was estimated at USD 1.50 million in 2023 and is expected to grow at a CAGR of 4.5% from 2024 to 2030. The rising number of elderly individuals, coupled with a surge in chronic disease prevalence, is expected to stimulate market growth. In addition, the increasing initiatives aimed at cancer radiotherapy is anticipated to further propel this growth. Technological advancements have led to an increased preference for minimally invasive surgeries, which is another factor contributing to the market’s expansion. However, the steep costs associated with image-guided therapy systems pose a significant challenge, potentially impeding market growth. Despite these obstacles, the overall market outlook remains positive, given the numerous factors driving demand for these advanced therapeutic solutions.

The U.S. accounted for over 30.9% of the global image-guided therapy systems market in 2023. The market is being propelled by several factors, including an increase in the elderly population, a growing preference for less invasive surgical procedures, and advancements in imaging technology. The prevalence of chronic illnesses like cancer, along with an increase in cancer radiotherapy initiatives, is also contributing to market growth. For instance, the International Agency for Research on Cancer reported approximately 19,292,789 new cancer cases worldwide in 2020.

According to estimates by the Population Reference Bureau, the U.S. elderly population is projected to rise from 46 million in 2016 to about 98 million by 2060. The prevalence of chronic diseases like hypertension, arthritis, and diabetes is driving the use of image-guided therapy systems for various interventions. Key systems include Innova IGS 520, Innova IGS 530, Optima IGS 320, and Optima IGS 330. Initiatives like the Image-guided Therapy Program by Brigham and Women’s Hospital are combining therapy advancements and imaging to develop minimally invasive techniques, boosting the market. Key players include GE Healthcare, Brainlab, and Medtronic.

During the COVID crisis, market players were concentrating on creating remote solutions like virtual machine-based cloud training to offer patients remote assistance and guidance. For instance, in November 2020, Royal Philips collaborated with LeQuest to provide online training for healthcare providers on the Philips Ultrasound Affiniti system. The deferral of non-emergency surgical procedures has had a detrimental effect on image-guided therapy procedures.

The World Health Organization reports that the leading causes of death are shifting from infectious diseases to chronic conditions, such as high cholesterol, hypertension, cancer, and heart diseases. This shift is likely to increase the demand for image-guided therapy systems to treat these conditions in the future. The market is also being driven by a growing preference for minimally invasive therapies. A national survey conducted by Johns Hopkins Medicine found that using minimally invasive surgeries for certain common procedures can reduce complications after surgery and help manage healthcare costs. Therefore, the demand for minimally invasive image-guided therapies is expected to increase, which will drive market growth.

Market Concentration & Characteristics

Companies in the U.S. image-guided therapy systems industry are highly competitive. The industry is concentrated in the presence of key players such as Koninklijke Philips N.V., Siemens Healthineers, and GE Healthcare, accounting for majority of the market share. To increase their share in the industry, companies are resorting to effective strategies such as mergers and acquisitions, launching new products, and expanding their presence in various country. These players are also actively participating in product innovation to strengthen their position in the market.

Various initiatives undertaken to promote cancer radiotherapy and increasing investments by private companies to develop advanced image-guided therapy systems are contributing to the research and development sector and thus has led to a spike in innovation. For instance, in December 2020, GE Healthcare launched Allia IGS 7 angiography system. The system was anticipated to help improve user experience, enhance workflow efficiency, and facilitate adoption of advanced image guidance in routine practice.

Mergers and acquisitions in the industry are crucial for fostering innovation, enhancing competitiveness, expanding product offerings, accessing new industries, and driving overall growth within the industry. For instance, in May 2022, Brainlab acquired medPhoton GmbH, a company developing and manufacturing robotic imaging solutions for image-guided radiation therapy and surgery.

Regulations are essential in the industry to uphold safety standards, ensure device effectiveness, classify devices based on risk levels, improve patient care quality, and promote compliance and accountability within the industry.

Product expansion is vital in the industry to meet the increasing demand for advanced, precise, and minimally invasive medical solutions driven by technological advancements and evolving healthcare needs. Some of the key factors that contributed to this are improvements in healthcare infrastructure, high adoption of technologically advanced products, and growth in the preference for minimally invasive surgeries to curb healthcare spending. For instance, in August 2023, Stryker announced the launch of a new surgical guidance system that is fully autonomous and designed for use in cranial and spinal surgery applications. This innovative product boasts a proprietary camera, denoted by FP8000, that enables faster navigation than its competitors. It is reported to be four times faster than Medtronic's StealthStation, and an impressive 16 times faster than Globus Medical's ExcelsiusGPS.

Geographical expansion allows companies to access new areas, broaden their customer base, and increase their identity. It also offers the advantage of diverse patient populations, healthcare systems, and regulatory environments, promoting product innovation and adaptation to meet country needs. Finally, entering new country enhances opportunities for collaboration with local healthcare providers and institutions, aiding R&D for improved image-guided therapy systems. In June 2022, Stryker announced the launch of Global Technology Centre, a new R&D facility, at Gurgaon, India. This facility is expected to support the company's objective to improve healthcare by promoting innovation.

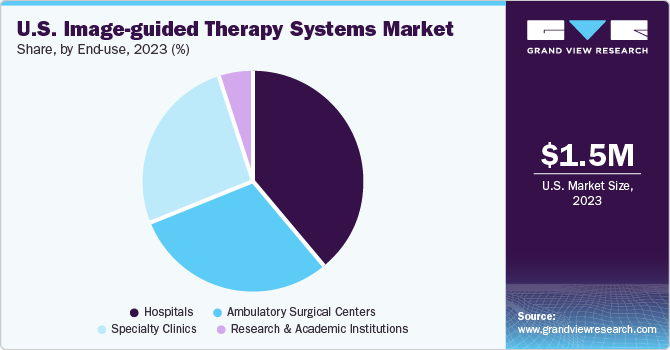

End-use Insights

Hospitals dominated the market and is expected to account for the largest revenue share of 38.9% in 2023. Increase in pressure to cut down costs, adopt value-based care, as well as increase in the need for workflow management are among the factors driving the demand for image-guided therapy systems at hospitals. The number of surgeries undertaken at hospitals is higher than any other health system owing to favorable reimbursement structure and availability of hospitals for primary care in several states.

Ambulatory Surgical Centers (ASC) segment is anticipated to grow at the fastest CAGR during the forecast period. ASC provides superior outcomes in a cost-effectively. Dependence on ASCs has increased owing to an increase in the pressure for cost reduction. Image-guided surgeries performed at ASCs cost significantly less than those performed at other healthcare facilities. Increase in preference for minimally invasive surgeries has positively impacted the growth of ASCs. Thus, increase in preference for minimally invasive surgeries such as radiotherapy, growth in the prevalence of chronic diseases, the availability of technologically advanced imaging devices, and increase in the adoption of robot-assisted surgeries is expected to propel the demand for image-guided therapies at ASCs.

Product Insights

Endoscope dominated the market and accounted for the largest share of 33.7% in 2023. This segment is also anticipated to grow at the fastest CAGR during the forecast period. The market for endoscope guided therapy systems is primarily driven by a growing preference for minimally invasive therapies, technological advancements, and the introduction of endoscopic ultrasound-guided therapies. The EVIS EXERA III platform by Olympus Corporation and the da Vinci Surgical System by Intuitive Surgical are examples of such systems. The rise in cancer and gastrointestinal diseases has increased the demand for these systems. The introduction of new endoscopic suturing systems is also expected to contribute to market growth.

Magnetic Resonance Imaging (MRI)-guided therapy system accounted for the second-largest revenue market share and is expected to grow at a lucrative phase. Technological advancements and extensive applications of MRI-guided therapies in treatment planning, localization & delivery, and treatment response assessment are some of the key factors responsible for the market growth. Extensive utilization of MRI for radiation therapy is one of the key factors driving the development of MRI-guided therapies. MRI-guided systems have major applications in areas such as radiation oncology, neurology, and trauma care. Various supportive initiatives undertaken by stakeholders are anticipated to positively boost the market growth.

Application Insights

Cardiac surgery dominated the market and accounted for the largest revenue share of 30.9% in 2023. High prevalence of cardiac diseases is a key factor driving the demand for image-guided cardiac surgeries. Increase in preference for minimally invasive heart surgeries is also a key factor responsible for market growth. Cardiovascular surgeries require clear visibility and anatomical details on a real-time basis. Thus, advancements in live image guidance, imaging systems, and interventional tools are further expected to boost the market growth. Azurion 7 C12 and Azurion 7 C20 are some of the examples of image-guided systems developed by Koninklijke Philips N.V. for cardiovascular interventions.

Neurosurgery and urology segments are both anticipated to grow at the fastest CAGR of 5.5% during the forecast period. The rise in the number of accidents and trauma cases, along with the widespread occurrence of neurological disorders, are the primary drivers for this sector. The growth of the sector is further propelled by the increasing partnerships among leading companies to develop new image-guided therapy systems. These systems are predominantly used in urological applications for diagnosis, planning treatments, and assessing treatment outcomes. The sector is expected to be driven by the ongoing research aimed at developing innovative systems using 3D and 4D imaging, robot-assisted image-guided therapies, and molecular imaging.

Key U.S. Image-Guided Therapy Systems Company Insights

The market is dominated by a few key players who collectively hold most of the market share. These companies maintain their market positions through strategies such as product launches, strategic acquisitions, and continuous innovation. In December 2020, Royal Philips entered into a partnership with InSightec to develop an MR-guided focused ultrasound, a significant advancement in non-invasive neurosurgery. Furthermore, in September 2020, Philips introduced its next-generation image-guided therapy platform, Philips Azurion. This platform, equipped with a single touchscreen, allows clinicians to perform multiple tasks simultaneously, further enhancing their efficiency.

Key U.S. Image-Guided Therapy Systems Companies:

- Koninklijke Philips N.V.

- Medtronic

- Siemens Healthineers

- Analogic Corporation

- GE Healthcare

- Varian Medical Systems, Inc.

- Brainlab AG

- Olympus Corporation

- Stryker

Recent Developments

-

In April 2022, GE Healthcare entered into a partnership with Unilabs, a leading European diagnostic services provider, to provide advanced imaging equipment and digital technology in Portugal.

-

In February 2022, Stryker acquired Vocera Communications, Inc., a leader in digital care coordination and communication. This acquisition is expected to provide the company with significant opportunities to advance innovations and accelerate digital aspirations.

-

In April 2021, Medtronic announced partnership with Surgical Theater to interface its SyncAR Augmented Reality (AR) technology with Medtronic's StealthStation S8 surgical navigation system. This allows surgeons to further leverage the advantages of AR. For the first time, they can view a comprehensive 360° AR image that is superimposed on the actual surgical site during brain operations.

U.S. Image-guided Therapy Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.6 billion

Revenue forecast in 2030

USD 2.1 billion

Growth rate

CAGR of 4.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Country scope

U.S.

Key companies profiled

Koninklijke Philips N.V.; Medtronic; Siemens Healthineers; Analogic Corporation; GE Healthcare; Varian Medical Systems, Inc.; Brainlab AG; Olympus Corporation; Stryker

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Image-guided Therapy Systems Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. image-guided therapy systems market based on product, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Computed Tomography (CT) Scanners

-

Ultrasound Systems

-

Magnetic Resonance Imaging (MRI)

-

Endoscopes

-

X-ray Fluoroscopy

-

Positron Emission Tomography (PET)

-

Single Photon Emission Computed Tomography (SPECT)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac Surgery

-

Neurosurgery

-

Orthopedic Surgery

-

Urology

-

Oncology Surgery

-

Gastroenterology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

Research & Academic Institutions

-

Frequently Asked Questions About This Report

b. The U.S. image-guided therapy systems market size was estimated at USD 1.50 billion in 2023 and is expected to reach USD 1.6 billion in 2024.

b. The U.S. image-guided therapy systems market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 2.1 billion by 2030.

b. Cardiac surgery dominated the market and accounted for the largest revenue share of 30.9% in 2023. High prevalence of cardiac diseases is a key factor driving the demand for image-guided cardiac surgeries.

b. Some key players operating in the U.S. image-guided therapy systems market include Koninklijke Philips N.V.; Medtronic; Siemens Healthineers; Analogic Corporation; GE Healthcare; Varian Medical Systems, Inc.; Brainlab AG; Olympus Corporation; Stryker

b. Key factors that are driving the market growth include rising number of elderly individuals, coupled with a surge in chronic disease prevalence, is expected to stimulate market growth. In addition, the increasing initiatives aimed at cancer radiotherapy is anticipated to further propel this growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.