U.S. Hyperspectral Imaging Systems Market Size, Share & Trends Analysis Report By Product (Camera, Accessories), By Technology (Snapshot, Push Broom), By Application (Military Surveillance, Remote Sensing), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-233-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

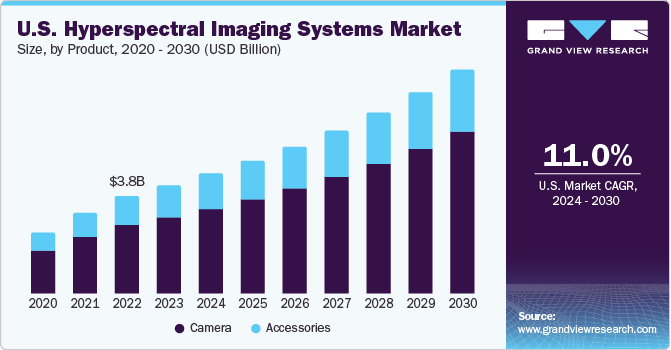

The U.S. hyperspectral imaging systems market size was estimated at USD 4.25 billion in 2023 and is expected to grow at a CAGR of 11.0% from 2024 to 2030. Rising military expenditure, growing adoption of advanced technologies, and heavy investments in various fields, such as agriculture, aerospace, healthcare, and machine vision, are expected to fuel the market growth over the forecast period. Moreover, the presence of technologically advanced healthcare infrastructure, increasing healthcare expenditure, growing adoption of novel technologies, and the presence of several market players are expected to fuel the market growth in the region. In addition, increasing funding for R&D has boosted research activities in the region.

The U.S. accounted for over 30.1% of the global hyperspectral imaging systems market in 2023. The increasing defense expenditure and the broad range of applications for hyperspectral imaging systems are key factors. The Office of Management and Budget reports that the U.S. spent USD 766 billion on national defense in the fiscal year 2022, accounting for 12% of federal spending. This substantial allocation of funds towards defense by lawmakers underscores the importance they place on national security in their budget. Relative to its economic size, the U.S. dedicates a larger portion of its budget to defense than any other G7 member.

The increasing use of hyperspectral imagery systems across diverse sectors like research and development, healthcare, defense, food industry, night vision, and remote sensing is expected to drive market demand. Furthermore, advancements in technology, including sensor design, enhanced spectral resolution, improved spatial resolution, and the development of compact and lightweight devices, are anticipated to stimulate the adoption of these products at a larger base. For instance, in November 2022, Pixxel, a notable player in the field, launched its third hyperspectral imaging satellite using the Polar Satellite Launch Vehicle (PSLV).

The evaluation of hyperspectral imaging systems involves examining various performance aspects, capabilities, and specifications. This typically encompasses factors such as spectral range, spectral resolution, temporal resolution, and more. Hyperspectral imaging, which combines digital imaging with spectroscopy, offers enhanced sensitivity and differencing capability compared to conventional imaging and detection methods. The increasing use of this technology is largely due to its accuracy and clarity. In addition, hyperspectral imaging devices provide several significant advantages, including the ability to analyze spectral data at each point without prior knowledge, and comprehensive information for image analysis and processing. These benefits attract investments from numerous companies. However, the high cost of hyperspectral imaging systems and the lack of standardization and interoperability may impede market growth.

The growing range of hyperspectral imaging applications, including the identification of rock minerals, crop disease diagnosis, diagnostic imaging, and the detection of foreign toxins in food processing, is predicted to enhance its adoption. Furthermore, the use of hyperspectral imaging is notably increasing in disease diagnosis and image-guided surgeries. The market is expected to experience substantial growth, as hyperspectral imaging holds considerable potential for disease screening, detection, and diagnosis, owing to its capacity to identify biochemical changes caused by disease progression, such as alterations in cancer cell metabolism.

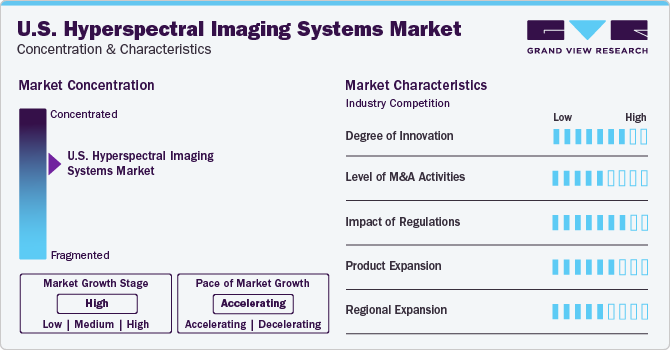

Market Characteristics & Concentration

The U.S. hyperspectral imaging systems companies are strengthening their position through product innovation, mergers, acquisitions, and regional expansion. The industry is expanding due to the wide-ranging applications of these systems in various sectors including healthcare, agriculture, defense, aerospace, and mining. Hyperspectral imaging systems, which perform detailed spectral analysis across a wide range of wavelengths, provide valuable insights and solutions for different applications. In healthcare, they enhance patient care and outcomes by enabling precise diagnosis, tissue characterization, and surgical guidance.

Hyperspectral imaging systems have seen substantial innovation due to impressive technological advancements, making them a leading technology in various sectors like healthcare, agriculture, defense, aerospace, mining, and more. Features such as high spectral resolution, sensor design, high spatial resolution, and lightweight & compact devices are anticipated to increase the adoption of these systems. For instance, In January 2023, Imec showcased a system that merges a Visible and Near Infrared (VIS-NIR) spectral camera with high-resolution RGB imaging for data acquisition at video rate. It can offer support in highly dynamic scenarios, including medical situations like image-assisted surgeries.

Several market players are entering into partnerships and collaborations to enhance their growth, innovation, and competitiveness by pooling the skills and efforts of various organizations. Manufacturers are progressively pursuing integration through mergers and acquisitions. This strategic method seeks to enhance technological abilities, expand market presence, and maintain competitiveness in the swiftly changing healthcare landscape. For instance, in April 2023, Photonis, a producer of highly differentiated technology for defense and industrial markets, announced a definitive agreement to acquire Telops.

The Food and Drug Administration (FDA) is the primary regulatory authority overseeing medical devices. Hyperspectral imaging devices intended for medical use typically fall under the FDA's jurisdiction. Manufacturers are required to comply with the regulatory pathways set by the FDA, such as the Premarket Approval (PMA) process or the 510(k) clearance, depending on the level of risk associated with the device. In addition, current Federal Aviation Administration (FAA) regulation distinguishes between commercial and recreational drones, resulting in separate bodies of rules that govern American airspace. The rule for operating unmanned Aircraft Systems (UAS) or drones under 55 pounds in the National Airspace System (NAS) is 14 CFR Part 107, referred to as the Small UAS Rule. Part 107 serves as the default regulation for drones weighing less than 55 pounds, encompassing nearly all nonrecreational drone flights.

Several market players are launching various new products and upgrading already existing products, seeking government approvals to strengthen their product portfolios. This strategy enables companies to increase their customer reach, expand their product portfolios, and improve their offerings.For instance, in November 2023, Specim, Spectral Imaging Ltd. announced the launch of the upgraded Specim FX50 Middle-wave Infrared (MWIR) hyperspectral camera. The Specim FX50 is the first and only push-broom hyperspectral camera covering the full MWIR spectral range of 2.7 - 5.3 μm. This enhanced version marks a significant milestone for Specim and its customers. The initial release of the camera occurred in 2019. This allowed the market player to expand the product to a different range of customer bases.

Companies are broadening their geographical reach in industry to leverage the region’s robust healthcare facilities, substantial healthcare expenditure, use of state-of-the-art technologies, and considerable research funding. For instance, in March 2021, Surface Optics Corporation announced the expansion of its main facility in San Diego, California. The completed construction, now totaling 20,000 square feet, represents a significant upgrade, offering the necessary infrastructure for the company to capitalize on its current momentum and growing sales in both the U.S. & international markets.

Product Insights

Camera dominated the market and held the largest revenue market share of over 70.8% in 2023 and is also expected to grow at the fastest CAGR during the forecast period, due to technological innovations such as the creation of small, mobile cameras and the advancement of manufacturing technologies. Hyperspectral cameras, which capture light intensity across a broad spectrum, allow each pixel in an image to have a continuous spectrum. This aids in the precise and detailed identification of objects. Moreover, various firms and manufacturers are joining forces with industry stakeholders to bring innovative cameras to the market. Therefore, the introduction of hyperspectral cameras into the industry through collaborations among industry players is expected to propel the growth of this sector in the coming years.

Accessories is expected to witness a lucrative growth of CAGR 10.6% during the forecast period. Accessories for hyperspectral imaging systems include sensors, lenses, a tripod, and a scanning stage, among other components. The demand for these accessories is expected to significantly increase with the rising adoption of hyperspectral imaging in various industries such as healthcare, agriculture, environment, food, and mining. Furthermore, the availability of accessories from major companies such as Corning Incorporated, Specim, Spectral Imaging Ltd., and Headwall Photonics is anticipated to boost the segment growth over the forecast period.

Technology Insights

Snapshot dominated the market and held the largest share of 49.2% in 2023 and is expected to grow at the fastest CAGR during the forecast period. Snapshot technology in hyperspectral monitoring is set to grow significantly due to its ability to capture high-resolution, real-time spectral data using a matrix detector. This technology, which differs from standard forms, doesn’t require spatial or spectral scanning. Its benefits include simpler image generation, less impact of moving artifacts, and simultaneous capture of all locations and channels. It can acquire three-dimensional data with a single sensor reading, eliminating the need for image combination to form the hyperspectral cube.

Push broom is expected to witness considerable growth of CAGR 10.6% during the forecast period, due to their benefits like uniform low dispersion, high efficiency, and cost-effectiveness. Their demand is expected to rise in the future. Studies, like one published by MDPI in 2022, have found that these sensors can capture their entire spectral range in a single flight, requiring less processing time than snapshot sensors. These findings are likely to further boost the adoption of push broom technology. Moreover, the rapid launches of products by key players using push broom technology are expected to propel the segment growth in the coming years. Major industry participants are introducing push broom technology-based products.

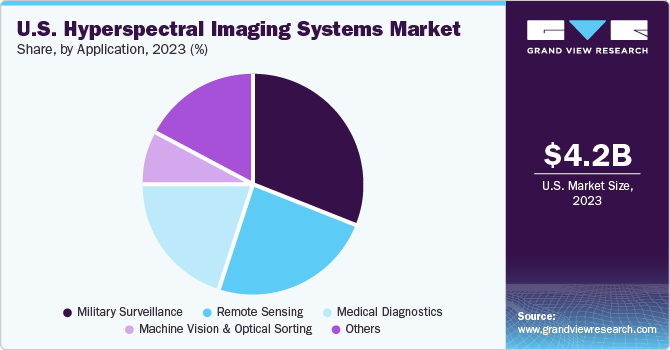

Application Insights

Military surveillance dominated the market with the largest share of 31.5% in 2023. The dominance of the segment is due to advancements in data management and component fabrication techniques. Hyperspectral imaging systems are used in military surveillance to identify and detect hazardous materials. The rapid launch of hyperspectral imaging satellites by numerous government organizations is expected to propel the segment growth.Moreover, the wide utility of hyperspectral imaging for various purposes, such as identifying hidden targets, biological & chemical agents, and explosives, is anticipated to support the segment growth over the forecast period. Furthermore, the country's government, companies, and defense organizations are undertaking efforts to protect & defend their territory utilizing hyperspectral imaging.

Medical diagnostics is expected to grow at a fastest CAGR of 12.0% from 2024 to 2030. Hyperspectral imaging provides a means to diagnose problems associated with the morphology, structure, and physiology of tissues. As a disease progresses, there are changes in the tissue’s fluorescence, scattering, and absorption. Therefore, tissue imaging methods have a significant role in diagnosing tissue pathology. Moreover, hyperspectral imaging techniques are widely used in various fields including ophthalmology, injury analysis, digestive system procedures, fluorescence microscopy, cell biology, and cardiovascular systems. The accuracy and clarity of hyperspectral imaging technology, along with continuous innovation and technological advancements, are anticipated to create growth opportunities for the medical diagnostics sector.

Key U.S. Hyperspectral Imaging Systems Company Insights

The U.S. hyperspectral imaging systems companies are working to enhance their product range. These players often focus on diversifying their product lines and expanding into new geographical markets to maintain growth. Major players are focusing on strategic initiatives such as new product launches, partnerships, acquisitions, mergers, government approvals, and improvements in current products & technologies to strengthen their market presence & expand their business portfolios. For instance, in June 2023, Headwall Photonics introduced Hyperspec MV.C NIR & MV.C VNIR, a sophisticated system that sets new standards for capturing images with exceptional spatial and spectral resolution.

Key U.S. Hyperspectral Imaging Systems Companies:

- Corning Inc.

- Specim, Spectral Imaging Ltd.

- Resonon Inc.

- Headwall Photonics

- Telops

- Norsk Elektro Optikk

- Surface Optics Corporation

- BaySpec, Inc.

- XIMEA GmbH

- imec

Recent Developments

-

In January 2024, Specim, Spectral Imaging Ltd., introduced the Specim FX120, a sophisticated long-wave infrared hyperspectral camera with a full LWIR spectral range of 7.7 to 12.3 µm. This rapid push-broom thermal hyperspectral camera is set to revolutionize chemical imaging capabilities in challenging environments, functioning seamlessly both day and night.

-

In January 2024, Headwall Photonics took over inno-spec GmbH, which is in Nuremberg, Germany. Known for manufacturing industrial hyperspectral imaging systems, inno-spec GmbH’s products are widely used in applications such as large-scale recycling, industrial categorization, and quality inspection.

-

In May 2023, Specim, Spectral Imaging Ltd. announced the launch of the next-generation near-infrared line-scan hyperspectral camera, the Specim GX17, tailored for advanced machine vision applications. This new addition complements Specim’s highly successful FX camera series, which were the first hyperspectral cameras specifically designed for industrial use.

-

In June 2022, Resonon Inc. launched Pika IR-L and IR-L+ hyperspectral cameras (925 - 1700 nm). These instruments boast impressive spectral and spatial resolution, which, when combined with their compact size and lightweight, render them ideal for UAV-based remote sensing applications.

U.S. Hyperspectral Imaging Systems Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 8.8 billion |

|

Growth rate |

CAGR of 11.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, application |

|

Country scope |

U.S. |

|

Key companies profiled |

Corning Inc.; Specim, Spectral Imaging Ltd.; Resonon Inc.; Headwall Photonics; Telops; Norsk Elektro Optikk; Surface Optics Corporation; BaySpec, Inc.; XIMEA GmbH; imec |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Hyperspectral Imaging Systems Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hyperspectral imaging systems market based on product, technology, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Camera

-

Accessories

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Snapshot

-

Push Broom

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Military Surveillance

-

Remote Sensing

-

Medical Diagnostics

-

Machine Vision & Optical Sorting

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. hyperspectral imaging systems market size was estimated at USD 4.25 billion in 2023 and is expected to reach USD 4.70 billion in 2024.

b. The U.S. hyperspectral imaging systems market is expected to grow at a compound annual growth rate of 11.0% from 2024 to 2030 to reach USD 8.8 billion by 2030.

b. The camera segment held the largest market share of over 70% in 2023 owing to its technological advancements, such as high-speed and low-cost circuits, advanced manufacturing technologies, and novel signal-processing methods in sensor development, have contributed to the segment growth.

b. Some key players operating in the U.S. hyperspectral imaging systems market include Corning Inc.; Specim; Spectral Imaging Ltd.; Resonon Inc.; Headwall Photonics; Telops; Norsk Elektro Optikk; Surface Optics Corp.; BaySpec, Inc.; HAIP Solutions GmbH; XIMEA GmbH; imec

b. Key factors that are driving the market growth include rising adoption of hyperspectral imagery systems in various sectors, such as R&D, healthcare, defense, food industry, night vision, and remote sensing, is anticipated to create high demand in the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."