U.S. Hydrogen Energy Storage Market Size, Share & Trends Analysis Report By Technology (Compression, Liquefaction), By Physical State (Solid, Liquid, Gas), By Application (Residential, Commercial), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-233-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

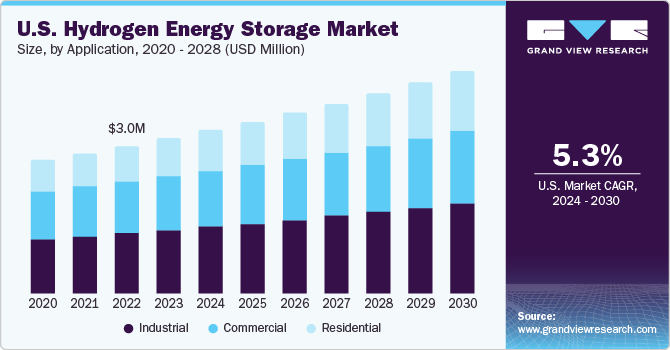

The U.S. hydrogen energy storage market size was estimated at USD 3.17 billion in 2023 and is anticipated to grow at a CAGR of 5.3% from 2024 to 2030. This growth is attributed to the rapid industrialization in the country and the growing popularity of alternate energy sources. Due to ongoing research and development as well as the building of large-scale storage projects, the U.S. market is anticipated to grow significantly over the forecast period.

Large amounts of hydrogen are stored in a technology called hydrogen energy storage. Solution-mined salt domes, excavated rock caves, and other spaces are used for storage. The transportation, metallurgy, general industrial, chemical, stationary, and other sectors are the main uses for hydrogen storage. Globally growing renewable energy installations are increasing greenhouse gas emissions, which will drive up demand for hydrogen storage energy systems. Hydrogen storage systems are also employed in the refining of oil and utilities.

Hydrogen finds widespread industrial use in processes such as glassmaking, fertilizer production, metal refining, and more, which in turn drives up demand for hydrogen energy storage systems. Many companies have largely chosen to employ alternative fuels such as hydrogen. A hybrid melting technology in conjunction with electrical furnace boosting is used to reduce dangerous emissions. Thus, the market is growing as a result of the growing use of hydrogen in numerous industrial sectors.

The U.S. is one of the world's pioneers in the use of renewable energy technologies for its industrial, transportation, and power generation industries. To take advantage of the possible assistance that H2USA could receive from the National Laboratories, the U.S. Department of Energy started a project. The National Renewable Energy Laboratory (NREL) and Sandia National Laboratories collaborated on the H2USA project to address any technical issues with the infrastructure that produces hydrogen. Based on current and emerging technologies at national laboratories, the Fuel Cell Technologies Office launched the Hydrogen Fueling Infrastructure Research and Station Technology (H2FIRST) project. Developing and building energy-efficient and reasonably priced hydrogen stations around the nation is one of the main goals the government has set for itself. The market for hydrogen energy storage is anticipated to grow in the United States as a result of all these factors.

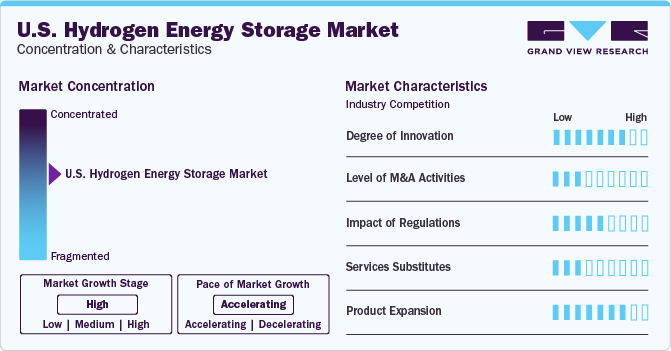

Market Concentration & Characteristics

The U.S. Hydrogen Energy Storage Market is marked by a high degree of innovation. Since hydrogen storage systems are still a relatively new technology, extensive research and development is being done to improve storage efficiency, lower costs, and integrate hydrogen storage systems with renewable energy sources. Hydrogen energy storage options are being developed due to advances in materials science, electrolysis technology, and storage techniques.

The level of merger and acquisition activities in the market tends to be low. The market is still in its initial stages, and many small and medium-sized businesses are working on solutions for hydrogen storage. Although partnerships and collaborations are typical for research and pilot projects, the market's varied range of technologies and applications limits the scope of big competitors' merger and acquisition activity.

The market is moderately impacted by regulations. The development and application of hydrogen technologies are encouraged by policies and incentives, while market dynamics are influenced by regulatory frameworks of hydrogen storage, transportation, and safety. Updates to codes and standards and other regulatory changes may have an impact on the uptake and scalability of hydrogen energy storage solutions.

The product expansion in the market is high. The variety of storage technologies and system configurations available is expanding in tandem with the increased interest and investment in hydrogen as a clean energy carrier. Innovative storage solutions are being developed by businesses for a range of uses, such as off-grid power production, industrial operations, transportation, and grid-scale storage. The market's expansion and uptake are fueled by this variety of product options.

Application Insights

The Industrial segment led the market and accounted for the largest revenue share of 40.56% in 2023. This growth is attributed to an increase in carbon emissions from the burning of oil and gas, raising environmental concerns that have led to the usage of hydrogen as fuel in industrial applications. Many industrial processes, including the manufacture of methanol, the refining of petroleum, and the treatment of metals, need hydrogen. Hydrogen is needed in huge quantities by petroleum refiners to reduce the sulfur content of fuels. It is anticipated that an increasing variety of industrial applications will significantly accelerate market expansion.

The commercial segment held a substantial market share in 2023. Hydrogen refueling stations and micro-CHP fuel cell-based installations for commercial use are included in the commercial application segment. In addition, the residential segment witnessed significant growth in 2023 as a result of the creative product introductions of hydrogen energy storage systems for use in homes.

Physical State Insights

The Solid segment dominated the market and accounted for the largest market share of 51.43% in 2023. In the market, one of the newest segments is the storage of hydrogen in solid form, or another material. A variety of approaches utilizing a material's ability to absorb or adsorb hydrogen are used to store hydrogen in solid form. Alkanates and magnesium combine to form some of the most promising materials of today. At the moment, the main drawback of solid hydrogen storage is the limited amount of hydrogen that can be retained in these materials. Solid-state hydrogen storage is anticipated to become appropriate for large-scale hydrogen storage throughout the projection period as a result of ongoing research and development.

The Liquid segment held a significant market share in 2023 owing to its cutting-edge method for storing the most hydrogen in a limited container and turning hydrogen gas into liquid hydrogen by chilling it to an extremely low temperature, the liquid category had a sizable market share in 2023. Liquid hydrogen storage is only being used for specific, high-tech purposes, such as space travel and industrial bulk storage.

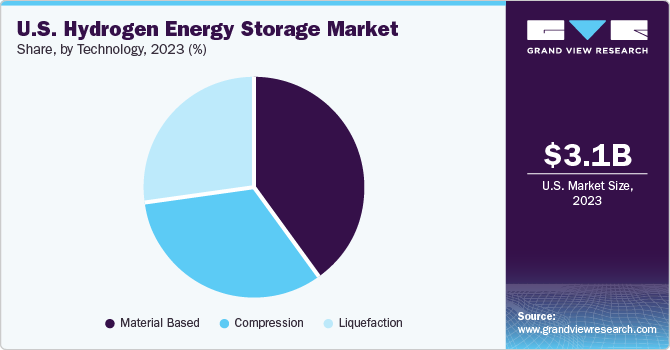

Technology Insights

The material-based segment accounted for the largest market share of 40.15% in 2023. This growth is attributed to the technique that has a higher volumetric storage density than other storage technologies and includes surface storage systems, liquid hydrogen carriers, and hydride storage systems. Many businesses employ hydrides, a metallic powder that absorbs and stores a large amount of hydrogen at ambient temperature and low pressure.

The compression segment accounted for a significant revenue share in 2023, due to the widespread use of compressed hydrogen across industries. Applications for compressed hydrogen include fuel cell vehicles used in road transportation, hydrogen filling stations, and on-site stationary power generation. Hydrogen is also stored in cylinders using compression technology, which has industrial uses in the chemical and manufacturing sectors.

The liquefaction segment registered a substantial revenue share in 2023 due to its preference by bulk industrial gas suppliers such as Linde, Air Liquide, and Air Products & Chemicals Inc. to transport hydrogen in bulk to industrial end users such as the oil and gas and chemical sectors. Liquefaction technology is the preferred choice for industrial end users who need hydrogen in quantity for industrial processes.

Key U.S. Hydrogen Energy Storage Company Insights

The U.S. hydrogen energy storage market is fragmented. Although well-known corporations and academic institutes are working on hydrogen storage technologies, the industry is made up of a diverse range of businesses at different phases of development. The market's dynamic character as it moves from research and development to commercial deployment, as well as the variety of approaches to hydrogen storage, are reflected in the fragmentation.

Key players in the market include Cummins Inc.; Steelhead Composites, INC.; and Air Products Inc.

-

Cummins Inc. manufactures, distributes, and provides services for diesel and natural gas generator sets. Other fuel systems, emission controls, and electrical power generation systems are also included in its product line. The engine, power systems, distribution, components, and new power operational segments are the company's five complementary business divisions.

-

Steelhead Composites, INC. produces strong and light cylinders for use in fuel and energy storage applications that are sensitive to weight, such as hydrogen energy storage. In addition, the company specializes in aluminum liners, accessories, portable CNG fuel transport and storage, lightweight bladder accumulators, and gas bottles. In addition, it offers testing, metal spin forming, design and engineering, machining, and composite production services.

Plug Power, Inc.; American Clean Power Association; and Bloom Energy Corp. are other participants operating in the U.S. Hydrogen Energy Storage market.

- Bloom Energy Corp. manufactures and markets solid oxide fuel cells to produce electricity on-site. Bloom's green hydrogen fuel cells offer a clean energy generation from hydrogen that doesn't require combustion. With no additional risk of carbon emissions, these fuel cells offer constant reliability and operate on pure, green hydrogen. Furthermore, the company has deployed its solid oxide fuel cells numerous times to produce energy from green hydrogen that does not require combustion or emissions.

Key U.S. Hydrogen Energy Storage Companies:

- Cummins Inc.

- Chart Industries

- Steelhead Composites, INC.

- Air Products Inc.

- Plug Power, Inc.

- Worthington Industries

- American Clean Power Association

- Genh2 discover hydrogen

- FuelCell Energy Inc.

- Bloom Energy Corp.

Recent Developments

-

In March 2024, and Shell inked agreements to explore prospects for creative, large-scale, renewable hydrogen energy projects. Bloom's collaboration with Shell will further DE carbonization prospects for developing SOEC technology. With this technology, there may be an opportunity to decarbonize several challenging industrial sectors. To supplement or replace the current fossil fuel-powered "grey" hydrogen supply produced at refineries by the highly carbon dioxide-emitting steam-methane reformation process, Bloom's SOEC technology can produce clean hydrogen at scale. By producing clean, or "green," hydrogen through water electrolysis and the utilization of renewable energy, greenhouse gas emissions are virtually eliminated.

-

In February 2024, Plug Power Inc. and Uline, announced that they were expanding their partnership to include the installation of Plug's hydrogen infrastructure and fuel cell solutions at Uline's new campus in Kenosha, Wisconsin. As part of this extended collaboration, four distribution centers on campus will have 17 hydrogen dispensers and an 18,000-gallon hydrogen storage tank installed as part of the on-site hydrogen infrastructure. As part of the collaboration, 250 fuel cell forklifts will be added, and they will run on hydrogen produced locally using Plug's cutting-edge infrastructure.

-

In June 2023, Cummins Inc. (NYSE: CMI) announced that it would acquire Air Liquide's 19% stake in Hydrogenics Corporation. In 2019, Cummins bought Hydrogenics, expanding its portfolio with important fuel cell and electrolyzer technology. The acquisition by Cummins demonstrates the company's dedication to these technologies and the growing role they will play in generating value for all parties involved and reducing carbon emissions in the environment. With this action, the rapidly increasing demand for hydrogen technology may be met with continuing investment and growth.

U.S. Hydrogen Energy Storage Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.33 billion |

|

Revenue forecast in 2030 |

USD 4.53 billion |

|

Growth rate |

CAGR of 5.3% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, physical state, application. |

|

Key companies profiled |

Cummins Inc.; Chart Industries; Steelhead Composites, INC.; Air Products Inc.; Plug Power, Inc.; Worthington Industries; American Clean Power Association; Genh2 discover hydrogen; FuelCell Energy Inc.; Bloom Energy Corp. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Hydrogen Energy Storage Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hydrogen energy storage market report based on technology, physical state, and application.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Compression

-

Liquefaction

-

Material Based

-

-

Physical State Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid

-

Liquid

-

Gas

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. hydrogen energy storage market was valued at USD 3.17 billion in the year 2023 and is expected to reach USD 3.33 billion in 2024.

b. The U.S. hydrogen energy storage market s expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 4.53 billion by 2030.

b. The solid segment dominated the market and accounted for the largest market share of 51.43% in 2023. It one of the newest segments is the storage of hydrogen in solid form, or another material.

b. The key market player in the U.S. hydrogen energy storage market includes Cummins Inc.; Chart Industries; Steelhead Composites, INC.; Air Products Inc.; Plug Power, Inc.; Worthington Industries; American Clean Power Association; Genh2 discover hydrogen; FuelCell Energy Inc.; Bloom Energy Corp.

b. The key factors that are driving the U.S. hydrogen energy storage market include, the rapid industrialization in the country and the growing popularity of alternate energy sources. Due to ongoing research and development as well as the building of large-scale storage projects, the U.S. market is anticipated to grow significantly.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."