- Home

- »

- Medical Devices

- »

-

U.S. Hyaluronic Acid Based Dermal Fillers Market, Industry Report 2030GVR Report cover

![U.S. Hyaluronic Acid Based Dermal Fillers Market Size, Share & Trends Report]()

U.S. Hyaluronic Acid Based Dermal Fillers Market Size, Share & Trends Analysis Report By Application (Wrinkle Removal, Lip Augmentation), By Product (Single Phase Product, Duplex Product), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-273-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

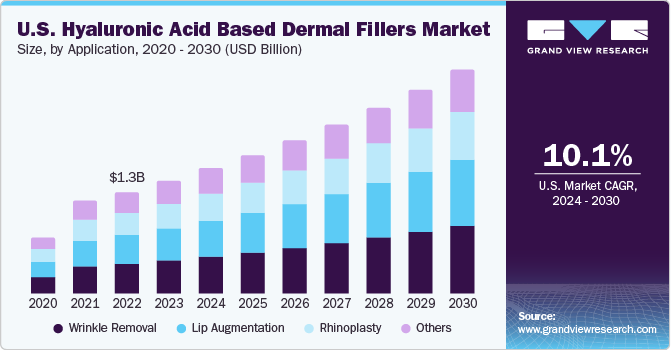

The U.S. hyaluronic acid based dermal fillers market size was estimated at USD 1.41 billion in 2023 and is expected to grow at a CAGR of 10.1% from 2024 to 2030. The market’s expansion is primarily fueled by rising demand for non-invasive cosmetic procedures and a growing awareness of the use of Hyaluronic Acid (HA) in aesthetic industry. Furthermore, the market is being propelled by increasing R&D investments for innovative advancements in dermal products. Moreover, popularity of aesthetic procedures is on a rise among men, with more men becoming concerned about the adverse effects of aging on their looks and facial characteristics, leading to an increased demand for facial dermal fillers.

The U.S. accounted for over 34.6% of the global hyaluronic acid-based dermal fillers market in 2023. The increasing geriatric population is another major factor contributing to this market’s growth. According to the World Health Organization (WHO), the population of people aged 60 years and above is estimated to increase from 1 billion in 2020 to 1.4 billion by 2030. People aged 60 years and over worldwide are estimated to be 2.1 billion by 2050. Growing awareness for anti-aging products and the high prevalence of target diseases are expected to drive market growth over the forecast period.

The market experienced a negative impact during the early stages of the pandemic. Governments and healthcare entities shifted their focus towards supporting diagnostic and treatment methods for COVID-19. This, coupled with disruptions in the supply of products and equipment for aesthetic procedures and restrictions on these procedures, had a significant impact on the market. However, the latter part of 2020 witnessed a resurgence in market demand. Data from the International Society of Plastic Surgery (ISAP) in 2020 suggested an increase in the overall demand for non-surgical procedures, hair removal treatments, and primarily fillers. Post COVID-19 pandemic, the demand rose even further due to the growing importance of aesthetic appearance and a preference for non-invasive procedures.

Technological progress is anticipated to be a key driver for growth and innovation in this market. These developments have transformed aesthetic medicine, leading to treatments that are safer, more effective, and minimally invasive. For example, in May 2023, the U.S. FDA approved SKINVIVE by JUVÉDERM, marking a significant breakthrough in the industry. This was the first approval for a hyaluronic acid intradermal microdroplet injection aimed at enhancing cheek smoothness. Such approvals pave the way for a variety of targeted solutions for individuals looking to enhance their appearance.

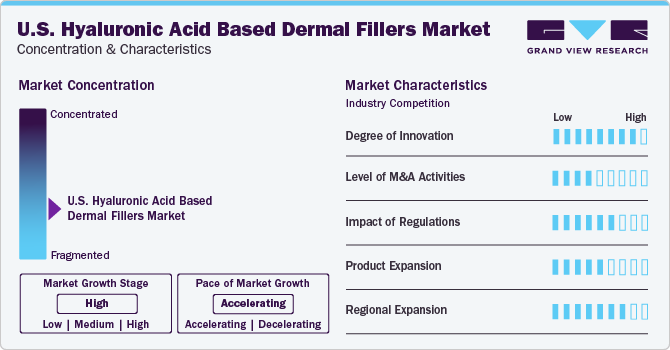

Market Concentration & Characteristics

Companies in U.S. hyaluronic acid-based dermal fillers market are undertaking various strategic initiatives, such as product development, regional expansion, partnerships & collaborations, and mergers & acquisitions, to increase their market share. They adopt this strategy to increase the outreach of their products in the market and enhance the availability of their products & services in diverse geographical areas, increase their production capabilities and promote the outreach of their product offerings.

The market is being transformed by technological advancements. Key market players are committed to developing advanced solutions to gain a competitive advantage in the market. The growing number of new product approvals is creating more market opportunities. For example, in January 2022, RHA Redensity, an innovative dermal filler designed to reduce skin wrinkles, received U.S. FDA approval. RHA Redensity is a gel implant made from sodium hyaluronic acid that is injected into specific areas of the facial tissue to smooth out lines and wrinkles.

Several key players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies. For instance, in May 2020, AbbVie acquired Allergan plc. The initiative aimed to expand & diversify its revenue and complement its existing leadership position in immunology.

The stringent government rules in the U.S. markets are limiting the growth of HA-based products market. These rigorous laws ensure that only high-quality products are used by healthcare facilities, including doctors and other end-users. For instance, a 2018 FDA report stated that Juvederm can only be sold and administered under the guidance of a licensed healthcare provider. The FDA has also advised patients and their doctors to avoid using Juvederm Ultra 2, 3, and 4 as these products have not been approved by the U.S. FDA. This has resulted in limited availability of the latest products.

Major industry leaders utilize product expansion as a strategic approach to boost their manufacturing capabilities and broaden the reach of their product portfolio. Through the consistent introduction of new products, these influential companies seek to improve their production capacity and extend the exposure of their product line. This tactic enables them to remain competitive, attract a larger customer base, and stimulate market growth. For instance, in March 2020, Sinclair launched MaiLi hyaluronic acid-based dermal filler. It is also the first product made with monophasic technology.

The market is witnessing a significant transformation as companies strategically expand their geographic presence. This expansion is poised to have a profound impact on market dynamics, fostering increased competition and innovation within the industry. By broadening their reach, key players are not only enhancing their market share but also contributing to the overall growth of the sector. For instance, in May 2023, Symatese, a French dermal filler manufacturer, entered into an agreement with a U.S.-based distributor to sell its HA-based product line.

Application Insights

Wrinkle removal dominated the market in 2023 with a share of 29.8% and is estimated to have a significant growth during the forecast period. Based on application the market is segmented into wrinkle removal, lip augmentation, rhinoplasty, and others. Wrinkles and folds on the face are initial signs of aging that are noticed. Hyaluronic Acid (HA) fillers are gaining popularity in various antiaging treatments. The rising desire to look young among the baby boomer population has led to technological advancements, resulting in the development of noninvasive procedures for treating wrinkles. Several HA-based dermal fillers are being launched to treat wrinkles. For instance, in August 2020, Revance launched a Resilient Hyaluronic Acid (RHA) range of fillers that blend into wrinkles.

Lip augmentation is anticipated to grow at the fastest CAGR of 10.7% during the forecast period. The growth of this procedure is expected to continue due to rising awareness, an increase in disposable income, lifestyle changes, and a growing demand for fillers. Lip augmentation is a cosmetic process carried out to increase the fullness of the lips by using fillers, which can be either temporary or permanent. Injections of Hyaluronic acid-based dermal fillers are commonly used for enhancing and shaping the lips. Hyaluronic acid contributes to the voluminous look of the lips by binding with the water molecules in the skin. The growth of this segment is also propelled by contributions from key market players.

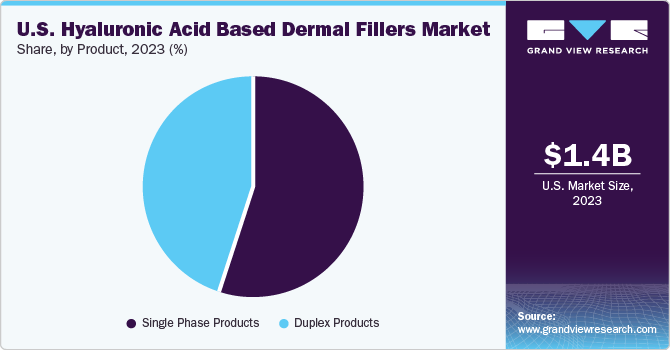

Product Insights

Based on the product, the market is segmented into single-phase & duplex products. The single-phase segment had the highest market share in 2023 with 54.9% and is expected to grow at the fastest CAGR during the forecast period. Single-phase hyaluronic acid (HA)-based dermal fillers includes one phase of HA with a uniform density and polydensity. These single-phase products can be distinguished from duplex products based on their manufacturing process. Unlike duplex products, single-phase products do not go through a sizing technique, which involves breaking down the gel during manufacturing. These products are beneficial in a variety of aesthetic procedures, such as adding volume, hydrating the skin, providing elasticity, treating fine lines and wrinkles, and correcting deeper folds.

The increasing number of aesthetic procedures and the extensive use of these products in a variety of aesthetic treatments are expected to contribute to the growth of this segment. According to 2022 data released by the Aesthetic Plastic Surgery, there was a 14% increase in total aesthetic procedures. Moreover, the Procedural Statistics provided by the American Society of Plastic Surgeons for 2022 reported that approximately 4,883,419 cosmetic minimally invasive procedures used HA fillers, including JUVÉDERM Ultra and Ultra Plus. Therefore, the rising interest in aesthetic procedures is expected to significantly increase the demand for single-phase HA fillers.

Key U.S. Hyaluronic Acid Based Dermal Fillers Company Insights

The market is characterized by a high level of competition and is fragmented. Major players in the market are concentrating on expanding their regional presence and developing new products. In addition, technological progress has led to introduction of longer-lasting fillers, such as hyaluronic acid-based dermal fillers with cross-linking technology. These robust fillers offer long-term results, reducing the need for regular touch-ups. Brands like Galderma’s Restylane and Emervel have become popular in various regions due to their advanced formulations and extended durability. As a result, market leaders are creating training programs for practitioners to promote the use of their products.

Key U.S. Hyaluronic Acid Based Dermal Fillers Companies:

- AbbVie, Inc.

- Galderma

- HUGEL, Inc.

- Laboratories Vivacy

- Revance Therapeutics, Inc.

- Medytox, Inc.

- Sinclair Pharma

- Prollenium Medical Technologies Inc

- Merz Pharma

- Teoxane

Recent Developments

-

In December 2023, Teoxane received Medical Device Regulation (MDR) certification for its product range consisting of TEOSYAL PureSense and TEOSYAL RHA.

-

In June 2023, Galderma received FDA approval for its hyaluronic acid filler, Restylane Eyelight. It is indicated to treat undereye hollows. It improves the appearance of the under-eye area by treating the hollowness, or depression in them.

-

In March 2023, Allergan Aesthetics, a subsidiary of AbbVie, partnered with IFundWomen, a funding marketplace for women-owned businesses, to celebrate International Women’s Day. As part of this collaboration, they launched a grant program to support female entrepreneurs in their business ventures.

-

In July 2021, HUGEL, Inc. inaugurated its factory, which is capable of manufacturing 8 million syringes a year. This completion is expected to boost the company’s overall position in aesthetics value chain.

U.S. Hyaluronic Acid Based Dermal Fillers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.56 billion

Revenue forecast in 2030

USD 2.78 billion

Growth rate

CAGR of 10.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product

Country scope

U.S.

Key companies profiled

AbbVie, Inc.; Galderma; HUGEL, Inc.; Laboratories Vivacy; Revance Therapeutics, Inc.; Medytox, Inc.; Sinclair Pharma; Prollenium Medical Technologies Inc; Merz Pharma; Teoxane

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hyaluronic Acid Based Dermal Fillers Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hyaluronic acid based dermal fillers market based on application, and product:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Wrinkle Removal

-

Lip Augmentation

-

Rhinoplasty

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Phase Products

-

Duplex Products

-

Frequently Asked Questions About This Report

b. The U.S. hyaluronic acid based dermal fillers market size was estimated at USD 1.41 billion in 2023 and is expected to reach USD 1.56 billion in 2024.

b. The U.S. hyaluronic acid based dermal fillers market is expected to grow at a compound annual growth rate of 10.1% from 2024 to 2030 to reach USD 2.78 billion by 2030.

b. Wrinkle removal dominated the market in 2023 with a share of 29.8% and is estimated to have a significant growth during the forecast period.

b. Some key players operating in the U.S. hyaluronic acid based dermal fillers market are AbbVie, Inc.; Galderma; HUGEL, Inc.; Laboratories Vivacy; Revance Therapeutics, Inc.; Medytox, Inc.; Sinclair Pharma; Prollenium Medical Technologies Inc; Merz Pharma; Teoxane

b. The market’s expansion is primarily fueled by rising demand for non-invasive cosmetic procedures and a growing awareness of the use of Hyaluronic Acid (HA) in aesthetic industry. Furthermore, the market is being propelled by increasing R&D investments for innovative advancements in dermal products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."