- Home

- »

- Advanced Interior Materials

- »

-

U.S. HVAC Rooftop Units Market Size, Industry Report, 2033GVR Report cover

![U.S. HVAC Rooftop Units Market Size, Share & Trends Report]()

U.S. HVAC Rooftop Units Market (2026 - 2033) Size, Share & Trends Analysis Report By Capacity (Upto 3 Tons, 3 To 7 Tons, 7 To 15 Tons, 15 To 25 Tons, 25 To 45 Tons), By Distribution Channel (New Installation, Replacement), By Application, By States, And Segment Forecasts

- Report ID: GVR-4-68040-385-5

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. HVAC Rooftop Units Market Summary

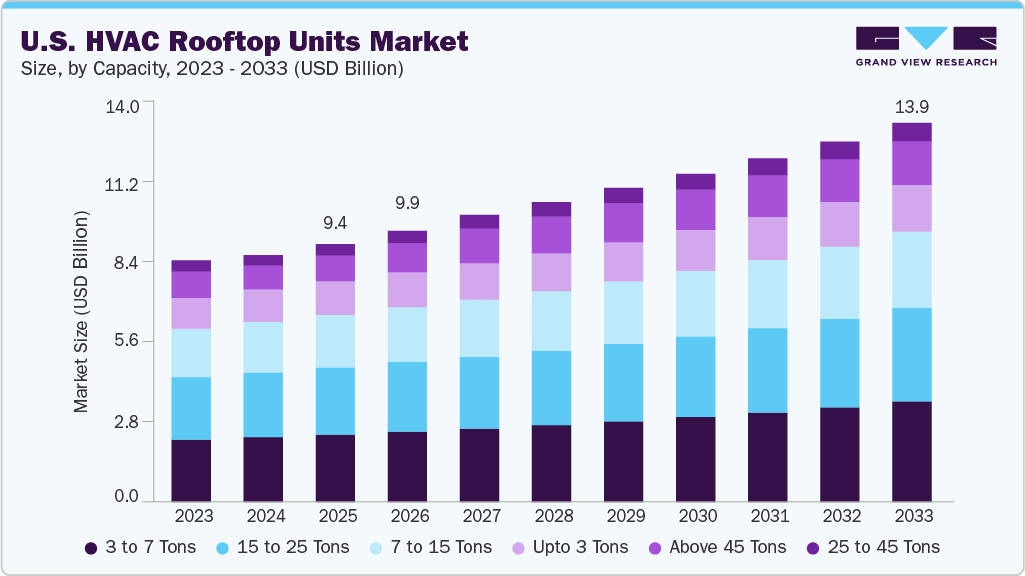

The U.S. HVAC rooftop units market size was estimated at USD 9,427.4 million in 2025 and is projected to reach USD 13,870.1 million by 2033, growing at a CAGR of 4.9% from 2026 to 2033. Growing commercial construction and renovation activity across the U.S. is a key driver for HVAC rooftop units demand.

Key Market Trends & Insights

- By capacity, the 3 to 7 tons segment dominates the U.S. HVAC rooftop units market and accounting for 26.2 % share in 2025.

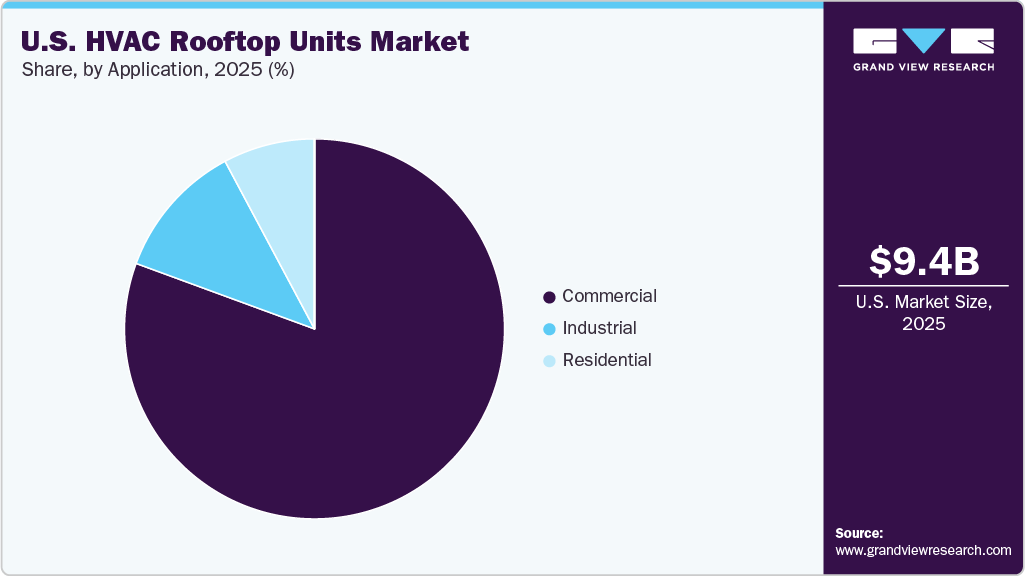

- By application, the commercial segment dominates the U.S. HVAC rooftop units market and accounting for 80.6% share in 2025.

- By distribution channel, the replacement segment dominates the U.S. HVAC rooftop units market and accounting for 70.1% share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 9,427.4 Million

- 2033 Projected Market Size: USD 13,870.1 Million

- CAGR (2026-2033): 4.9%

Expansion of retail stores, offices, warehouses, and mixed-use developments continues to support new installations. Rooftop units are preferred due to lower installation complexity and efficient use of building space. Rising focus on energy efficiency and regulatory compliance is further accelerating market growth. Stricter efficiency standards and replacement of aging HVAC systems are pushing end users toward modern rooftop units with higher SEER and IEER ratings. Businesses are also prioritizing lower operating costs and reduced downtime. This replacement-driven demand provides a stable revenue stream alongside new installations.

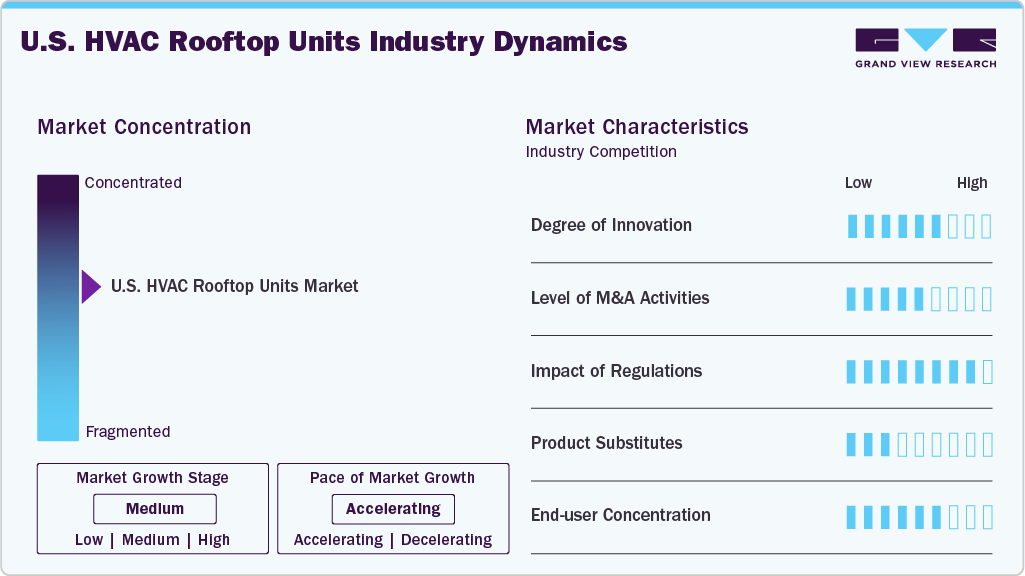

Market Concentration & Characteristics

The U.S. HVAC rooftop units market is moderately concentrated, with a few large OEMs accounting for a significant share of total shipments, while numerous regional manufacturers and system integrators serve niche and local demand. Leading players benefit from strong distribution networks, broad product portfolios, and long-term relationships with commercial contractors. However, smaller manufacturers remain competitive by offering customized units, faster delivery, and price flexibility. This mix of scale-driven leaders and agile regional players keeps competition active and innovation ongoing.

Innovation in the U.S. HVAC rooftop units market is focused on energy efficiency, smart controls, and modular system design. Manufacturers are integrating IoT-enabled monitoring, variable-speed compressors, and advanced heat exchangers to improve performance. Demand for lower lifecycle costs is driving upgrades in diagnostics and predictive maintenance features. Product differentiation increasingly comes from software, controls, and ease of integration with building management systems.

Regulatory standards strongly influence product design and replacement cycles in the market. Federal and state-level energy efficiency requirements push manufacturers toward higher SEER and IEER-rated rooftop units. Emissions rules and refrigerant phase-down policies are accelerating the shift toward low-GWP refrigerants. These regulations raise compliance costs but also create steady replacement demand for newer, compliant systems.

End-user demand is concentrated among commercial customers such as retail chains, office developers, supermarkets, and industrial facilities. Large commercial buyers often procure rooftop units in bulk, giving them strong negotiating power on pricing and service contracts. Small and mid-sized businesses contribute consistent volume through single or limited-unit purchases. This balanced demand base supports both large OEM contracts and regional supplier sales.

Drivers, Opportunities & Restraints

Rising construction of commercial spaces and ongoing renovation of aging buildings continue to drive demand for HVAC rooftop units in the U.S. Market growth is also supported by the preference for packaged systems that reduce installation time and simplify maintenance. Increasing focus on energy-efficient buildings is pushing adoption of high-performance rooftop units. Replacement of older systems remains a steady and predictable source of demand.

Opportunities are expanding through upgrades to smart and connected rooftop units across commercial and industrial buildings. Growing interest in energy management, remote monitoring, and predictive maintenance is creating demand for advanced control-enabled systems. Incentives for high-efficiency HVAC installations further support adoption. Expansion of logistics centers and data-driven facilities also opens new application areas.

High upfront costs of advanced rooftop units act as a restraint, especially for small businesses and budget-sensitive projects. Installation may require structural reinforcement and compliance checks, adding to project timelines. Volatility in construction activity can affect new installation volumes. In addition, supply chain disruptions and skilled labor shortages can delay equipment delivery and commissioning.

Capacity Insights

The 3 to 7 tons segment dominates the U.S. HVAC rooftop units market and accounting for 26.2 % share in 2025, due to its wide use across small and mid-sized commercial buildings. Retail stores, restaurants, and small offices commonly prefer this capacity range for balanced performance and cost efficiency. These units offer easier installation and lower operating costs compared to larger systems. Their suitability for both new construction and replacement projects sustains high volume demand.

The above 45 tons segment is witnessing the fastest growth, driven by demand from large commercial and industrial facilities. Shopping malls, distribution centers, and manufacturing plants increasingly prefer high-capacity rooftop systems to reduce the number of installed units. Growth in large-format retail and logistics infrastructure is accelerating adoption of these systems. Advancements in modular design and high-efficiency technology are making large-capacity rooftop units more attractive.

Distribution Channel Insights

The replacement segment dominates the U.S. HVAC rooftop units market and accounting for 70.1% share in 2025, due to the large installed base of aging commercial systems. Many buildings are upgrading units to meet newer energy efficiency and refrigerant regulations. Replacement projects are often planned and less sensitive to economic cycles. This creates consistent demand driven by lifecycle upgrades and operational cost reduction.

The demand for new installation segment is expected to grow at a fastest CAGR of 5.5% from 2026 to 2033 in terms of revenue. New installation is the fastest growing channel, supported by expansion of commercial construction and industrial facilities. Growth in retail, logistics, and office developments is driving demand for rooftop units in new buildings. Developers prefer packaged rooftop systems for faster project completion and lower upfront complexity. Increasing adoption of energy-efficient designs further accelerates new installation growth.

Application Insights

The commercial segment dominates the U.S. HVAC rooftop units market and accounting for 80.6% share in 2025, due to widespread use across retail, offices, supermarkets, and shopping malls. Rooftop units are preferred in commercial buildings for their space-saving design and ease of maintenance. High replacement rates in existing commercial properties further support demand. Standardized system designs also make rooftop units a cost-effective choice for this segment.

The demand for industrial application segment is expected to grow at a considerable CAGR of 5.2% from 2026 to 2033 in terms of revenue. The industrial segment is the fastest growing, driven by expansion of manufacturing plants, warehouses, and logistics facilities. These buildings require high-capacity systems with robust ventilation and temperature control. Growth in e-commerce and domestic manufacturing is increasing HVAC demand in industrial spaces. Energy-efficient rooftop units are increasingly adopted to reduce operating costs in large facilities.

Country Insights

California HVAC Rooftop Units Market Trends

California dominates the U.S. HVAC rooftop units market due to its large commercial building base and strict energy efficiency regulations. High replacement demand is driven by frequent upgrades to meet evolving state efficiency and refrigerant standards. The presence of extensive retail, office, and industrial infrastructure supports consistent unit installations. Climate diversity across the state further sustains year-round demand for rooftop HVAC systems.

Texas HVAC Rooftop Units Market Trends

Texas is growing significantly in the HVAC rooftop units market, supported by rapid commercial construction and population growth. Expansion of warehouses, offices, retail centers, and industrial facilities is increasing new rooftop unit installations. Extreme summer temperatures drive higher cooling capacity requirements across building types. Favorable business conditions and ongoing urban development continue to accelerate market growth.

Key U.S. HVAC Rooftop Units Company Insights

Some of the key players operating in the market include U.S. HVAC rooftop units market, Carrier, DAIKIN INDUSTRIES, Ltd., and Johnson Controls.

-

Carrier has a strong footprint in the U.S. HVAC rooftop units market through its wide range of packaged rooftop systems tailored for commercial and light industrial use. The company focuses on high-efficiency units that meet evolving U.S. energy standards and replacement demand. Its rooftop portfolio emphasizes advanced controls, integrated diagnostics, and flexible capacity configurations. Carrier’s established contractor network supports high penetration in retrofit and replacement projects.

-

Daikin Industries plays a key role in the U.S. rooftop units market through advanced packaged and variable-speed rooftop solutions. The company leverages inverter technology and low-GWP refrigerant systems to address efficiency and regulatory requirements. Daikin’s rooftop units are increasingly adopted in large commercial and industrial facilities seeking lower lifecycle costs. Its U.S.-based manufacturing and customization capabilities strengthen competitiveness in both new installations and replacements.

Key U.S. HVAC Rooftop Units Companies:

- Carrier

- DAIKIN INDUSTRIES, Ltd.

- Johnson Controls

- LG Electronics.

- Danfoss

- Lennox International, Inc.

- Rheem Manufacturing Company

- Trane

- SAMSUNG

- Mitsubishi Electric Corporation

- Fujitsu

- AAON

Recent Developments

-

In May 2024, Johnson Controls revealed the expansion of its acclaimed YORK Sun Premier commercial rooftop unit (RTU) portfolio, introducing new models ranging from 90 to 150 tons of capacity. Tailored for facilities such as office buildings, hospitals, and educational institutions, these top-tier RTUs aim to diminish carbon emissions and bolster sustainability efforts while cutting down operational and maintenance costs.

-

In May 2024, SAMSUNG announced a Joint Venture with Lennox International, Inc. company for ductless and variable refrigerant flow HVAC systems and provided cooling and heating solutions across the U.S. and Canada. As part of this new partnership, SAMSUNG will hold a 50.1% stake, while Lennox will control the remaining 49.9%

U.S. HVAC Rooftop Units Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 9,916.9 million

Revenue forecast in 2033

USD 13,870.1 million

Growth rate

CAGR of 4.9% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in units and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Capacity, application, distribution channel, region

Region scope

Alabama; Alaska; Arizona; Arkansas; California; Colorado; Connecticut; Delaware; Florida; Georgia; Hawaii; Idaho; Illinois; Indiana; Iowa; Kansas; Kentucky; Louisiana; Maine; Maryland; Massachusetts; Michigan; Minnesota; Mississippi; Missouri; Montana; Nebraska; Nevada; New Hampshire; New Jersey; New Mexico; New York; North Carolina; North Dakota; Ohio; Oklahoma; Oregon; Pennsylvania; Rhode Island; South Carolina; South Dakota; Tennessee; Texas; Utah; Vermont; Virginia; Washington; West Virginia; Wisconsin; Wyoming

Key companies profiled

Carrier; DAIKIN INDUSTRIES, Ltd.; Johnson Controls; LG Electronics.; Danfoss; Lennox International, Inc.; Rheem Manufacturing Company; Trane; SAMSUNG; Mitsubishi Electric Corporation; Fujitsu; AAON

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. HVAC Rooftop Units Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. HVAC rooftop units market on the basis of capacity, application, and distribution channel, and states:

-

Capacity Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Upto 3 Tons

-

3 to 7 Tons

-

7 to 15 Tons

-

15 to 25 Tons

-

25 to 45 Tons

-

Above 45 Tons

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Supermarkets & Hypermarkets

-

Retail Stores

-

Restaurants

-

Workspaces/Office

-

Shopping Malls

-

Other Commercial Applications

-

-

Industrial

-

Residential

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

New Installation

-

Replacement

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2021 - 2033)

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

-

Frequently Asked Questions About This Report

b. The U.S. HVAC rooftop units market size was estimated at USD 9,427.4 million in 2025 and is expected to reach USD 9,916.9 million in 2026

b. The U.S. HVAC rooftop units market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2026 to 2033 to reach USD 13,870.1 million by 2033

b. California dominated the U.S. HVAC rooftop units market, in terms of revenue, in 2025. Growth of the urban population results in a higher concentration of residential and commercial buildings. This has led to the installation of more HVAC systems to meet the heating and cooling needs within these structures

b. Some of the key players operating in the U.S. HVAC rooftop units market include Carrier, DAIKIN INDUSTRIES, Ltd., Johnson Controls, LG Electronics., Danfoss, Lennox International, Inc., among others.

b. The U.S. HVAC rooftop units market is driven by strong replacement demand from an aging installed base across commercial buildings. Rising energy-efficiency regulations are pushing upgrades to modern, high-performance rooftop systems. Continued growth in retail, logistics, and industrial construction further supports steady market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.