- Home

- »

- Consumer F&B

- »

-

U.S. Hot Drinks Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Hot Drinks Market Size, Share & Trends Report]()

U.S. Hot Drinks Market Size, Share & Trends Analysis Report By Type (Coffee, Tea, Other), By Distribution Channel (Hotel & Restaurants, Café, Others), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-361-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Hot Drinks Market Size & Trends

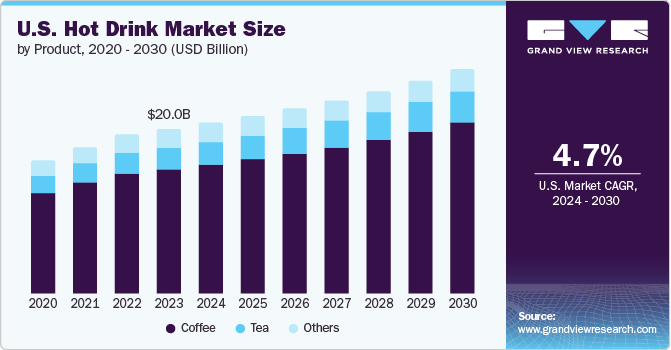

The U.S. hot drinks market size was valued at USD 20.0 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. The hot drinks market in the U.S. is a dynamic and varied industry that meets consumers' diverse preferences. It offers many options, from traditional favorites such as coffee and tea to newer entrants like specialty hot chocolates and herbal infusions. Due to the growing focus on health and wellness, the market has seen an increase in demand for functional hot drinks such as turmeric lattes, matcha teas, and adaptogenic herbal blends. This reflects a shift towards beverages that provide both indulgence and nutritional benefits.

The U.S. hot drinks market has witnessed a surge in demand for premium and artisanal offerings, driven by a growing appreciation for quality, craftsmanship, and unique sensory experiences. Artisanal coffee roasters, specialty tea blenders, and craft hot chocolate makers have gained traction, appealing to consumers who seek distinct, handcrafted beverages beyond mere utility to evoke a sense of indulgence and sophistication.

Moreover, the market has seen an increasing emphasis on health and wellness, with a proliferation of functional hot drinks offering warmth, flavor, and purported health benefits. From antioxidant-rich teas to adaptogenic herbal blends and superfood-infused coffee concoctions, there is a growing convergence of traditional hot drinks with contemporary wellness trends, catering to health-conscious consumers seeking beverages that align with their holistic lifestyles.

The U.S. hot drinks market is also influenced by evolving consumer behaviors and lifestyle choices. With the rise of on-the-go culture, the market has witnessed a surge in demand for convenient, single-serve hot drink options, such as instant coffee, tea pots, and portable hot beverage containers. Additionally, the growing interest in sustainability and ethical sourcing has prompted a shift towards eco-friendly packaging, responsibly sourced ingredients, and transparency in supply chains, reflecting consumers' increasing awareness of environmental and social issues.

Product Insights

Coffee dominated the market and accounted for a market revenue share of 75.6% in 2023. Coffee is pervasive in American culture, with a rich tradition of coffee consumption dating back centuries. According to a 2023 survey by OnePoll, commissioned by BUNN, a beverage equipment manufacturer, more than 80% of the 2000 American respondents consume around 460 coffee cups annually. Artisanal coffee roasters, third-wave coffee shops, and specialty coffeehouses have increased, catering to consumers' heightened appreciation for single-origin beans, unique flavor profiles, and expertly crafted brews.

Tea is expected to register the highest CAGR during the forecast period. Artisanal tea blenders, specialty tea shops, and tea boutiques have gained prominence in the U.S. market, offering consumers a curated selection of high-quality, ethically sourced teas worldwide. This emphasis on quality and provenance has resonated with consumers seeking unique and authentic tea experiences, leading to a shift away from mass-produced, generic tea offerings towards more discerning and personalized choices.

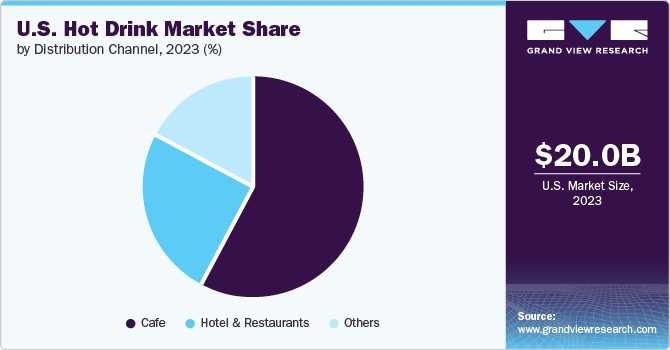

Distribution Channel Insights

Café segment accounted for the largest market revenue share in 2023. Cafés are popular destinations for consumers seeking a variety of hot beverages, including coffee, tea, and specialty drinks. These establishments provide a unique experience by offering a cozy ambiance, social interaction, and convenience for customers to enjoy their favorite hot drinks. With the rise of coffee culture and increasing demand for premium and specialty beverages, cafés have become key players in the hot drinks market. Consumers increasingly seek high-quality, ethically sourced products, which cafés often provide through partnerships with local roasters and suppliers.

Hotels & restaurants is anticipated to grow significantly over the forecast period.Hotels and restaurants have become platforms for promoting ethical and sustainable hot drink practices, with an increasing emphasis on offering responsibly sourced and ethically traded coffee and tea options. This aligns with the broader trend of ethical consumerism, as guests and diners increasingly seek establishments prioritizing environmental stewardship and social responsibility in their hot beverage offerings.

Key U.S. Hot Drinks Company Insights

Some of the key companies in the U.S. hot drink market include Starbucks Coffee Company, PEET'S COFFEE, Caribou Coffee, The Coffee Bean & Tea Leaf, Tim Hortons Inc., Dutch Bros Coffee, Dunn Brothers Coffee, Argo Tea, Baxter's Coffee, and Dunkin Donuts. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Starbucks Coffee Company offers a diverse range of hot drinks, including micro-ground instant coffee, whole-bean coffee, caffe latte, espresso, and full-and loose-leaf teas. The company has also introduced seasonal and locally tailored selections to meet the changing preferences of its customer base and offer a selection of brewed coffee in different roasts and blends, espresso drinks such as lattes, macchiatos, and cappuccinos, as well as hot teas and special seasonal options.

-

Peet's Coffee provides a range of hot drinks for its cafes and grocery outlets. The company offers a curated selection of classic medium roasts, including flavorful favorites like Big Bang, Café Domingo, and Organic Alameda Morning Blend, providing customers with a diverse and engaging hot beverage experience.

Key U.S. Hot Drinks Companies:

- Starbucks Coffee Company

- PEET'S COFFEE

- Caribou Coffee

- The Coffee Bean & Tea Leaf

- Tim Hortons Inc.

- Dutch Bros Coffee

- Dunn Brothers Coffee

- Argo Tea

- Baxter's Coffee

- Dunkin Donuts

Recent Developments

-

In 2021, Nestle introduced new Starbucks Spring coffees in the U.S. These include Starbucks Vanilla Flavored Honey & Madagascar Coffee and Starbucks Spring Day Combination, a blend of black coffee from Africa and Latin America with overtones of chocolate and dried fruits.

U.S. Hot Drinks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.76 billion

Revenue forecast in 2030

USD 27.4 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Starbucks Coffee Company, PEET'S COFFEE, Caribou Coffee, The Coffee Bean & Tea Leaf, Tim Hortons Inc., Dutch Bros Coffee, Dunn Brothers Coffee, Argo Tea, Baxter’s Coffee, Dunkin Donuts

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hot Drinks Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hot drinks market report based on product and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Coffee

-

Tea

-

Herbal/ Fruit

-

Black

-

Green

-

Others

-

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hotel & Restaurants

-

Cafe

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."