U.S. Hospital And Nursing Home Probiotics Market Size, Share & Trends Analysis Report By Channel (Hospital, Nursing Home), By Function (Gut Health, Immunity, Wellness, Others), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-119-1

- Number of Report Pages: 60

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

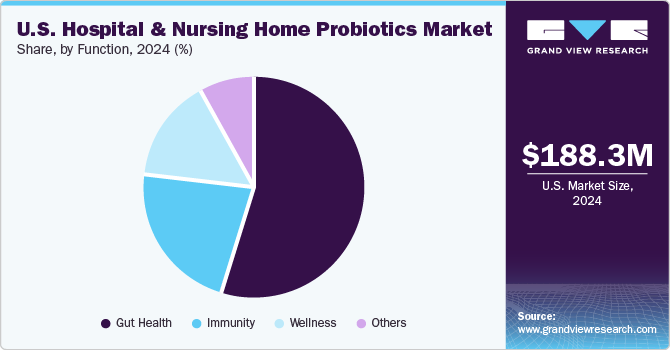

The U.S. hospital and nursing home probiotics market size was valued at USD 188.3 million in 2024 and is projected to grow at a CAGR of 8.7% from 2025 to 2030. The rapid shift in consumer preference toward a healthier lifestyle and a consequent rise in demand for preventive healthcare are anticipated to drive substantial expansion of this market in the country. Moreover, the popularity of advanced supplements offering high nutritional value has increased among American citizens, aided by the growing awareness regarding nutritional products. Probiotics and supplements are widely utilized to improve gut health, immunity, and overall wellness, driving competition in the U.S. hospital and nursing home probiotics industry.

The increase in the prevalence of diseases such as irritable bowel syndrome (IBS), gastroesophageal reflux disease (GERD), celiac disease, and peptic ulcers drive the growth of the U.S. hospital and nursing home probiotics industry. According to a report by the International Foundation for Gastrointestinal Disorders (IFFGD), IBS impacts around 25 to 45 million people in the country, with 2 out of 3 impacted being female. On the other hand, 1 out of 133 Americans are diagnosed with celiac disease, while around 83% of people are stated to remain undiagnosed or misdiagnosed. Probiotics have been indicated to offer benefits such as improving gut flora balance, reducing inflammation, supporting intestinal healing (celiac disease), and regulating bowel movements (IBS). The use of probiotics in hospitals and nursing homes across the United States has become more common in recent years, particularly as research into their benefits has expanded.

Rising concerns regarding increasing mortality rates due to gastrointestinal diseases are forcing policymakers to promote the use of probiotics and supplements in nursing homes and hospitals. A report by medRxiv published in 2023 stated that digestive diseases were responsible for 126 million ambulatory care visits, 41 million emergency department visits (2018), and 472,000 deaths (2019) annually in the U.S. Probiotics are often considered for individual patients based on specific health needs. For instance, patients with compromised immune systems may not be given probiotics due to infection risks, while those recovering from antibiotics or surgeries may benefit from their usage. The use of probiotics results in substantial cost savings for hospitals due to a reduction in various hidden costs. The indirect benefits of using probiotics products allow healthcare institutions to improve their brand image by making the hospital stay more comfortable and reducing patient stay duration.

Channel Insights

The hospital segment accounted for a larger revenue share of 55.7% in the U.S. hospital and nursing home probiotics industry in 2024. Increasing patient admission rates in hospitals across the country to treat gut health-related disorders, coupled with constant improvements in hospital infrastructure and services, have enabled market expansion. These facilities use probiotics in several contexts, mainly related to gastrointestinal (GI) health, infectious diseases, and immune function. For instance, Clostridioides difficile (C. difficile) infections, which can lead to severe diarrhea and colitis, are a significant concern in hospital settings, particularly after the use of antibiotics. Probiotics such as Lactobacillus and Saccharomyces boulardii may be administered to prevent or reduce the recurrence of C. difficile infections. They may also help restore gut microbiota balance in patients who have been critically ill, especially those in intensive care units (ICUs) who may have been on antibiotics, experienced gastrointestinal dysfunction, or underwent surgery.

The nursing homes segment is expected to grow at the highest CAGR from 2025 to 2030. The rising admission rates of older adults with chronic illnesses and weakened immune systems in these institutes have driven the use of probiotics to manage various health conditions. As per data from the National Center for Health Statistics, as of 2020, there were around 1.3 million residents across 15,300 nursing homes in the country. Older individuals in nursing homes are frequently prescribed antibiotics, which increases the risk of developing antibiotic-associated diarrhea (AAD). Probiotics are sometimes used as a preventive measure to help maintain gut health and reduce the incidence of diarrhea, particularly when antibiotics are necessary. Moreover, this demographic has weakened immune systems, and probiotics support immune function, reducing the likelihood of infections and improving overall health.

Function Insights

The gut health segment accounted for the largest revenue share in the U.S. hospital and nursing home probiotics industry in 2024. The gut microbiome plays a vital role in digestion, immune function, and overall well-being; thus, maintaining a healthy balance of gut bacteria is essential for optimal health. Probiotics may help support the gut microbiota and improve symptoms of various gastrointestinal (GI) conditions, which drives their adoption. Health issues such as IBS, Crohn’s disease, ulcerative colitis, leaky gut syndrome, and constipation can all be addressed through the administration of probiotics via proper strain selection and appropriate dosage.

The immunity segment is expected to advance at the fastest CAGR during the forecast period. Probiotics are increasingly being considered for their potential to support immune function, particularly in healthcare settings such as hospitals and nursing homes in the country. Residents and patients in these settings are often at higher risk for infections due to weakened immune systems, chronic illnesses, or intensive medical treatments. ICU patients in hospitals are often immunocompromised and may benefit from probiotics that help support gut integrity, reduce inflammation, and potentially reduce infections such as ventilator-associated pneumonia (VAP). Probiotics are considered to help strengthen the body’s defense mechanisms, making it easier to resist infections. Healthcare institutions are required to ensure that they are using high-quality and clinically studied probiotics to drive consistent results among patients.

Key U.S. Hospital And Nursing Home Probiotics Company Insights

Some of the notable companies involved in the U.S. hospital and nursing home probiotics industry include Bio-K+, Probi, and Chr. Hansen, among others.

-

Bio-K+ is part of the Kerry Group, which develops nutritional products such as probiotics, capsules, powders, and drinks that offer bowel support, immunity support, and stress support, among other functions. The company’s products are developed by leveraging three proprietary probiotic strains: the LACTICASEIBACILLUS CASEI LBC80R, the LACTICASEIBACILLUS RHAMNOSUS CLR2, and the LACTOBACILLUS ACIDOPHILUS CL1285. These strains have been specifically studied for their effectiveness in supporting gut health, reducing inflammation, and restoring balance in the gut microbiome.

-

PROBI is a multinational company specializing in developing, producing, and commercializing probiotics. The company conducts extensive research and clinical trials to optimize the efficacy of its products, further selling them to consumers and healthcare providers. PROBI develops solutions that address mental health, digestive health, immunity, metabolic health, and oral health through dietary supplements and food & beverage items. The company’s proprietary strain, Weizmannia coagulans GX-1, is a spore-forming ingredient that can be used to create probiotic foods and beverages.

Key U.S. Hospital And Nursing Home Probiotics Companies:

- Bio-K+, a Kerry company

- American Lifeline Inc.

- Rising Pharmaceuticals

- BD

- Dietary Pros, Inc.

- Dr. Joseph Mercola

- i-Health, Inc.

- Probi

- Lallemand Inc.

- Chr. Hansen A/S, part of Novonesis

- Biocodex

- Probiotical S.p.A.

- Protexin

Recent Developments

-

In October 2024, Probi announced the launch of the ‘Metabolic Health by Probi’ probiotic concept at the SupplySide West 2024 event held in Las Vegas. The product supports metabolic health, weight management, and cardiovascular health by targeting the key markers of metabolic syndrome, which is a condition linked to an increased risk of diabetes and cardiovascular diseases. The solution uses two proprietary strains, the Lactiplantibacillus plantarum 299v (LP299V) and the Lacticaseibacillus paracasei 8700:2, to address these issues while also promoting gut health.

-

In May 2024, Bio-K Plus introduced its line of vegan, gluten-free, and shelf-stable probiotic capsules that cater to specific consumer health requirements. This novel specialized wellness range features the company’s proprietary strains and scientifically proven added ingredients to support immunity, reduce stress, and address women’s health and bowel support. Products include Extra Immune Health with Wellmune (yeast beta glucan), Extra Stress Support with Sensoril, Advanced Bowel Support (ABS), and Women’s Health probiotic capsules.

U.S. Hospital and Nursing Home Probiotics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 201.1 million |

|

Revenue forecast in 2030 |

USD 305.2 million |

|

Growth rate |

CAGR of 8.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Channel, function |

|

Key companies profiled |

Bio-K+, a Kerry company; American Lifeline Inc.; Rising Pharmaceuticals; BD; Dietary Pros, Inc.; Dr. Joseph Mercola; i-Health, Inc.; Probi; Lallemand Inc.; Chr. Hansen A/S, part of Novonesis; Biocodex; Probiotical S.p.A.; Protexin |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Hospital And Nursing Home Probiotics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hospital and nursing home probiotics market report based on channel and function:

-

Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Number of Beds

-

1-199

-

200-299

-

300-499

-

500+

-

-

Payer

-

Medicare

-

Medicaid

-

Self-pay

-

Private

-

Others

-

-

Location

-

Rural

-

Urban

-

-

-

Nursing Home

-

Number of Beds

-

Less than 50

-

50-99

-

100-199

-

199+

-

-

Payer

-

Medicare

-

Medicaid

-

Dual

-

-

Ownership

-

Government

-

Profit

-

Non-profit

-

-

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Gut Health

-

Immunity

-

Wellness

-

Others

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."