U.S. Home Healthcare Market Size, Share & Trends Analysis Report By Component (Equipment, Service), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-922-1

- Number of Report Pages: 154

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

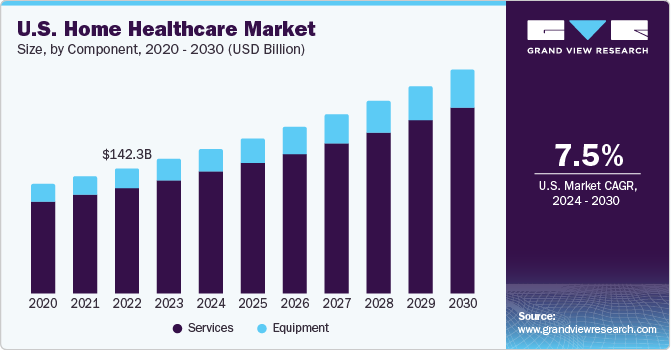

The U.S. home healthcare market size was valued at USD 142.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.48% from 2023 to 2030. The Growing geriatric population and increasing prevalence of chronic diseases along with favorable reimbursement for home healthcare equipment are key drivers for the U.S. market. The recent advancements in technology & cost-effectivity of home healthcare services are likely to drive growth during the forecast period.

The U.S. geriatric population has been growing rapidly over the past decade. As per the U.S. Census Bureau, 54 million adults in the U.S. are aged 65 years & above, accounting for 16.5% of the country’s population. The geriatric population typically prefers to stay at home as they age instead of a medical facility. Moreover, older patients opt for home healthcare services following surgery or treatment at the hospital to reduce their hospital stay, resulting in higher demand for home healthcare services. Administration of medications at home for chronic disorders offers benefits, such as faster recovery, better experience, fewer complications, and reduced cost, which is boosting the demand for homecare services in the U.S.

Medicare provides reimbursement for home health services such as intermittent skilled nursing care, care provided by a home health aide, and therapy under either Part A or Part B, depending on the circumstances. However, government organizations are taking measures to get service providers to focus more on the clinical characteristics of the patients, to eliminate the use of therapy service thresholds. For instance, a major change to the reimbursement system in decades is the Patient-Driven Groupings Model (PDGM) that was implemented in January 2020, which is reshaping the reimbursement of home healthcare services.

The initial phase of the pandemic witnessed complete shutdowns and movement restrictions leading to a shortage of medical equipment for use at homes as well as hospitals. Restrictions on healthcare services and fear of COVID-19 infection resulted in increased adoption of home health services across the nation, as it helped treat patients with professional support at home itself, avoiding the risk of infection. Healthcare facilities are providing care programs such as hospital-at-home and SNF-at-home that is reducing the stress on facilities and saving healthcare expenditure for patients. The U.S Government is undertaking initiatives to expand access to home healthcare.

The concept of home healthcare has evolved over the years and is likely to play an integral role in future healthcare systems in the U.S. Over the past few years, there have been rapid advancements in technologies used by home healthcare providers. Electronic visit verification is an upcoming technology, that facilitates verification of caregiver appointments, scheduling, & cancellation, avoiding no-show home appointments. The verification includes information about the patient and home healthcare professional, including the location, date, and time of service required. According to the social services department, by 2023, all home healthcare service providers in the U.S. must implement electronic visit verification, as per recent regulations.

Component Insights

The segment is categorized into equipment and services. The services segment held the largest market share in terms of revenue during 2022, especially due to the increasing adoption of long-term care services and recurring costs incurred by the patients as compared to the one-time purchase cost of equipment. The increasing focus of manufacturers on introducing innovative equipment, availability of reimbursement, and increasing at-home treatment/diagnostic efficiency are factors expected to contribute to the fastest growth of the equipment segment over the forecast period.

The services segment is broadly classified into skilled home healthcare services and unskilled home healthcare services. The skilled home healthcare services segment accounted for the largest share in terms of market revenue and is expected to register the fastest growth over the forecast period. Increasing home healthcare agencies, rising demand for home healthcare services, and favorable health reimbursement policies are major factors contributing to segment growth. Patients are choosing to recover at home instead of an inpatient facility due to greater comfort and reduced healthcare costs, which has led to a rise in demand for skilled medical care services in the market.

Key Companies & Market Share Insights

The U.S. home healthcare market is consolidated with a few large-scale and multiple medium & small players operating in the market. Baxter International Inc. led the market in terms of the adoption of strategic initiatives for strengthening its market presence. For instance, in December 2021, Baxter International Inc. acquired Hill-Rom. This acquisition will contribute to the company’s expansion into the digital and connected care solutions category.

The introduction of new service models, patient preference for at-home care, and positive reimbursement scenarios present potential benefits to the market players appealing to new players. Existing healthcare organizations are also expanding their service portfolio to include home healthcare services. For instance, in February 2021, Humana Inc. agreed with in-home care provider DispatchHealth to provide its patients with home healthcare in Tacoma and Denver. Some prominent players in the U.S. home healthcare market include:

-

Manufacturers

-

McKesson Medical-Surgical, Inc.

-

NxStage Medical (Fresenius Medical Care)

-

Medline Industries Inc.

-

Medtronic plc

-

3M Healthcare

-

Baxter International Inc.

-

B. Braun Melsungen AG

-

F. Hoffman-La Roche AG

-

Becton, Dickinson and Company

-

-

Service Providers

-

Kindred Healthcare, LLC

-

Brookdale Senior Living Inc.

-

Sunrise Senior Living, LLC

-

Genesis Healthcare, Inc.

-

Sonida Senior Living (Capital Senior Living Corporation)

-

Diversicare Healthcare Services, Inc.

-

Senior Care Center

-

Atria Senior Living, Inc.

-

Amedisys, Inc.

-

Home Instead, Inc.

-

U.S. Home Healthcare Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 152.9 billion |

|

Revenue forecast in 2030 |

USD 253.4 billion |

|

Growth rate |

CAGR of 7.48% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component |

|

Regional scope |

U.S. |

|

Key companies profiled |

McKesson Medical-Surgical, Inc.; NxStage Medical (Fresenius Medical Care); Medline Industries Inc.; Medtronic plc; 3M Healthcare; Baxter International Inc.; B. Braun Melsungen AG; F. Hoffman-La Roche AG; Becton, Dickinson and Company; Kindred Healthcare, LLC; Brookdale Senior Living Inc.; Sunrise Senior Living, LLC; Genesis Healthcare, Inc.; Capital Senior Living Corporation (Sonida Senior Living); Diversicare Healthcare Services, Inc.; Senior Care Center; Atria Senior Living, Inc.; Amedisys, Inc.; Home Instead, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Home Healthcare Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. home healthcare market based on component:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Therapeutic Equipment

-

Home respiratory equipment

-

Home IV pumps

-

Home dialysis equipment

-

Insulin delivery

-

Other therapeutic equipment

-

-

Diagnostic Equipment

-

Diabetic care unit

-

BP monitors

-

Multi para diagnostic monitors

-

Apnea and sleep monitors

-

Home pregnancy and fertility kits

-

Holter monitors

-

Heart rate meters

-

Other diagnostic equipment

-

-

Mobility Assist Equipment

-

Wheelchair

-

Home medical furniture

-

Walking assist devices

-

-

-

Service

-

Skilled Home Healthcare Services

-

Nursing care

-

Physician/primary care

-

Hospice & palliative care

-

Physical/occupational/speech therapy

-

Nutritional support

-

Other skilled home healthcare services

-

-

Unskilled Home Healthcare Services

-

-

Frequently Asked Questions About This Report

b. The U.S. home healthcare market size was estimated at USD 142.9 billion in 2022 and is expected to reach USD 152.9 billion in 2023.

b. The U.S. home healthcare market is expected to grow at a compound annual growth rate of 7.48% from 2023 to 2030 to reach USD 253.4 billion by 2030.

b. Service segment dominated the U.S. home healthcare market with a share of 84.4% in 2022. This is attributable to increasing home healthcare agencies, rising demand for home healthcare services, and favorable health reimbursement policies.

b. Some key players operating in the U.S. home healthcare market include McKesson Medical-Surgical, Inc.; NxStage Medical (Fresenius Medical Care); Medline Industries Inc.; Medtronic plc; 3M Healthcare; Baxter International Inc.; B. Braun Melsungen AG; F. Hoffman-La Roche AG; Becton, Dickinson and Company; Kindred Healthcare, LLC; Brookdale Senior Living Inc.; Sunrise Senior Living, LLC; Genesis Healthcare, Inc.; Capital Senior Living Corporation (Sonida Senior Living); Diversicare Healthcare Services, Inc.; Senior Care Center; Atria Senior Living, Inc.; Amedisys, Inc.; Home Instead, Inc.

b. Key factors that are driving the U.S. home healthcare market growth include growing geriatric population, recent advancements in technology, and cost-effectivity of home healthcare services.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."