- Home

- »

- Medical Devices

- »

-

U.S. Home Durable Medical Equipment Market, Industry Report, 2030GVR Report cover

![U.S. Home Durable Medical Equipment Market Size, Share & Trends Report]()

U.S. Home Durable Medical Equipment Market Size, Share & Trends Analysis Report By Region (West, Midwest, Northeast, Southwest, Southeast), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-281-7

- Number of Report Pages: 65

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

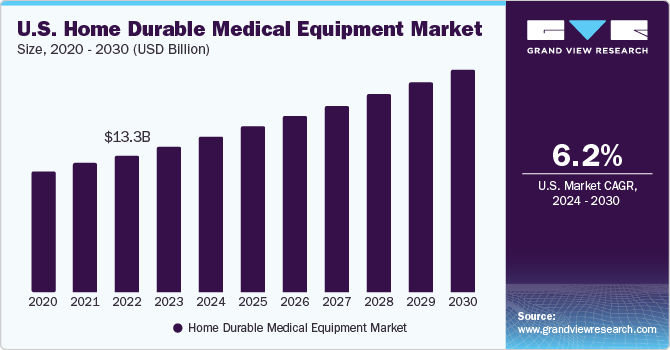

The U.S. home durable medical equipment market size was estimated at USD 13.33 billion in 2023 and is projected to grow at a CAGR of 6.2% from 2024 to 2030. The rising demand for home healthcare equipment and the growing burden of the geriatric population are major factors driving the market growth. The U.S. is witnessing a significant shift in the country’s demography with the rise in geriatric population. According to the Population Reference Bureau (PRB), the population of the U.S. aged above 65 years is expected to reach 82 million by 2050 from 58 million in 2022. This increase in the geriatric population, vulnerable to several diseases, is expected to drive market growth.

The high prevalence of chronic diseases such as stroke, heart disease, cancer, and diabetes is further driving the demand for home durable medical equipment (DME) in the country. According to the National Association of Chronic Diseases Directors (NACDD) report on Chronic Disease Prevention in 2022, approximately 60% of all Americans have at least one chronic disease. Moreover, more than 2/3rd of all deaths in the country occur due to one or more of the five major chronic diseases. Chronic conditions such as chronic obstructive pulmonary disease (COPD), asthma, and other chronic conditions require home-durable medical equipment such as nebulizers, oxygen concentrators, inhales, wheelchairs, and many other equipment for pain relief and impact control. The high prevalence of these diseases is contributing to the market growth.

The growing emphasis of patients and healthcare professionals on home healthcare owing to more convenience, ease of treatment, and lesser treatment costs contribute to the demand for home durable medical equipment in the U.S. The country's treatment or hospital stay costs have significantly risen in recent years, making home healthcare a convenient option for patients. It eliminates the need to visit facilities, and professional assistance can be monitored and scheduled as required.

The development and adoption of advanced, portable, and durable devices is also one of the major factors contributing to the growth of home-durable medical equipment in the country. The general population's advanced healthcare infrastructure and awareness favor developing and adopting advanced home durable medical equipment. For instance, in August 2023, Inogen, Inc. introduced the Rove 6 portable oxygen concentrator in the U.S. The company claimed the battery life of the concentrator to be eight years, which makes it one of the highest battery life 6-setting portable oxygen concentrators. Launching such innovative and advanced products is expected to contribute to the growth of home durable equipment in the U.S.

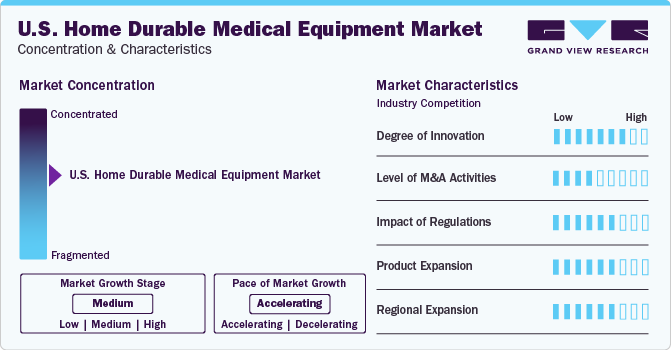

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The U.S. home durable medical equipment industry is characterized by a high degree of innovation owing to the regular advancements and innovative modification by the market players. The wide range of home durable medical equipment offers a vast range of innovative opportunities for market players.

The market is characterized by a medium level of merger and acquisition (M&A) activity by the leading players. This is due to the efforts of market players to use this strategy to increase their customer base. Moreover, M&A activities further enhance the company's product portfolio, which increases the company's offerings to patients. For instance, in April 2023, Viemed Healthcare Inc. announced that the company has agreed to acquire Home Medical Products, Inc., a home medical solution provider. This acquisition was anticipated to assist the company in expanding patient care and launching its acquisition growth initiatives.

The market is also subject to increasing regulatory scrutiny. This is due to the increasing focus of regulatory bodies such as the Food and Drug Administration (FDA) on patient safety. The regulatory requirements to enter the market are challenging but crucial for market entry. Moreover, product listing and FDA approval are required to commercialize equipment to ensure compliance with regulations and safety. In October 2023, Neurovalens announced that the company had received the U.S. FDA clearance for its Modius Sleep device to treat Modius insomnia. This device sends an electronic pulse to the patient’s brain before bed and helps in nighttime awakenings.

These equipment are developed and designed to improve the patient’s quality of life and offer long-term patient care by repetitive use. The wide range of these products offers solutions for several challenges faced by patients suffering from different conditions in home care settings.

Key U.S. Home Durable Medical Equipment Company Insights

Some of the key players operating in the market include Compass Health Brands, Invacare Corporation, and Rotech Healthcare Inc.

-

Compass Health Brands is a consumer medical company in the U.S. that offers a wide range of home durable medical equipment in the categories of disinfections, bath safety, mobility, patient rooms, and personal care. The company aims to improve lives with its product portfolios.

-

Invacare Corporation is a long-term care and home equipment-focused company offering innovative long-term care products. The company aims to deliver breakthrough innovation to provide patients with better comfort, value, and quality.

Key U.S. Home Durable Medical Equipment Companies:

- Compass Health Brands

- Invacare Corporation

- Rotech Healthcare Inc.

- Medline Industries, LP

- Masimo

- ResMed

Recent Developments

-

In January 2023, QHM Holdings Inc., one of the leading companies in the home medical equipment industry, acquired the Durable Medical Equipment (DME) business of Great Elm Healthcare, LLC. This acquisition aimed to increase the company's enterprise-scale and strengthen its position as a provider of home medical equipment.

-

In January 2023, BOOM HOME MEDICAL, a home medical product company, was launched in the U.S. with a mission to revolutionize the home medical equipment in the country. The company was launched with Loona, its first product that offers a solution for women with a medical condition such as nocturia that increases the urge to urinate at night.

-

In October 2021, Movair announced the U.S. launch of Luisa, an advanced ventilator for portable application in invasive and non-invasive ventilation at home, hospitals, and institutions. Luisa offers eight adjustable comfort settings to provide tailored, personalized therapy to patients and offer them a mobile and active lifestyle.

-

In November 2021, Intuity Medical, Inc. launched its POGO Automatic blood glucose monitoring system for diabetes patients in the U.S. This system offers users a single-step glucose monitoring experience using its ten-test cartridge technology.

U.S. Home Durable Medical Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 20.39 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country Scope

U.S.

Key companies profiled

Compass Health Brands; Invacare Corporation; Rotech Healthcare Inc.; Medline Industries, LP; Masimo; ResMed

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Home Durable Medical Equipment Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. home durable medical equipment market report based on region:

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

-

Frequently Asked Questions About This Report

b. The U.S. home durable medical equipment market size was valued at USD 13.3 billion in 2023.

b. The U.S. home durable medical equipment market is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030 to reach USD 20.39 billion by 2030.

b. The U.S. home durable medical equipment market is anticipated to reach USD 20.4 billion by 2030.

b. Some of the key players operating in the market include Compass Health Brands, Invacare Corporation, Rotech Healthcare Inc., Rotech Healthcare Inc., and Masimo, among others.

b. The rising demand for home healthcare equipment and the growing burden of the geriatric population are major factors driving the growth of the home durable medical equipment market in the U.S.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."