- Home

- »

- Medical Devices

- »

-

U.S. Hemostasis & Tissue Sealing Agents Market, Industry Report, 2030GVR Report cover

![U.S. Hemostasis & Tissue Sealing Agents Market Size, Share & Trends Report]()

U.S. Hemostasis & Tissue Sealing Agents Market Size, Share & Trends Analysis Report By Product (Topical Hemostat, Adhesive & Tissue Sealant), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-242-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

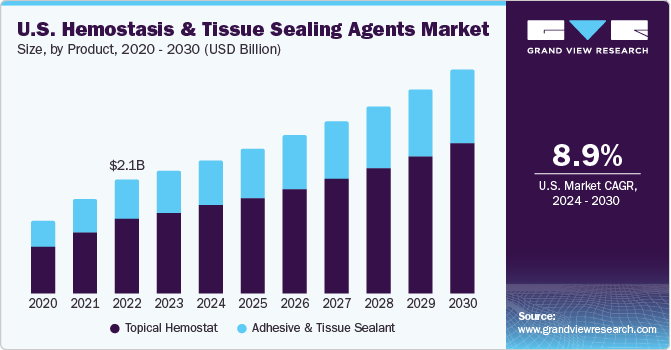

The U.S. hemostasis & tissue sealing agents market size was valued at USD 2.28 billion in 2023 and is anticipated to grow at a CAGR of 8.95% from 2024 to 2030. Drivers responsible for growth include the growing obese & geriatric population and rising demand for sealants to avoid postoperative risk of bleeding. Other factors responsible for market growth are regular product launches, increasing applications of such devices in surgeries and other medical fields, and escalating demand for an increased wound healing speed.

U.S. accounted for 29.0% of the global hemostasis and tissue sealing agents market in 2023. The interest of market players is growing in the underpenetrated hemostasis and tissue sealing agents market, which is driving innovation and the development of new products in this market. The major factor responsible for the large market share is the aggressive marketing of such devices in this country.

Preventive surgeries to curb the number of chronic diseases are being performed on a very large scale in the U.S. Hemostasis devices and tissue sealants are used for preventing blood loss in various conditions, such as mild injuries and burns, and for managing neurosurgical conditions. The highest demand for hemostatic and tissue-sealing agents is in cardiovascular conditions, followed by general surgeries. The high use of these products in cardiovascular diseases can be attributed to better clinical results than other wound closure techniques.

Using sealants and hemostats together reduces treatment time, resulting in minimal scarring and quicker recovery. Furthermore, they are also used for controlling bleeding in neuro and spinal surgeries. The increase in the aging population, which is prone to cardiovascular, neurological, and musculoskeletal diseases, is expected to propel the growth of the hemostasis and tissue-sealing market over the forecast period.

Market Concentration & Characteristics

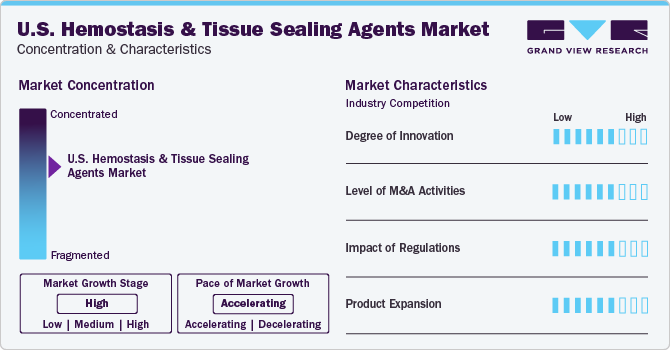

The industry is showcasing a high growth stage with accelerated growth owing to surgical technique advancements, increasing minimally invasive procedures, and growing awareness of the benefits of using these agents in various medical specialties among healthcare professionals.

There is increased demand for innovative products, which is supported by increased R&D spending. Technological advancements such as the development of elastic sealants are expected to drive the adoption of these products, thereby contributing to the market's growth. Moreover, rising R&D and increasing funding by private and government organizations are anticipated further to fuel industry growth in the upcoming years.

Mergers & acquisitions (M&A), strategic partnerships, and collaborations are major initiatives, leading to high competition in this market. The level of M&A activities in the market is rising due to the need for R&D synergies. For instance, in August 2023, HemoSonics received a technology contract award from Viziant, Inc., for its Quantra Hemostasis System. Such strategic collaborations allow companies to achieve competitive advantages in a rapidly evolving market landscape.

The development of hemostat and tissue sealing agents falls under the regulation of medical device manufacturing of Class II and III, which demand higher control and monitoring. Class II devices need premarket notification, whereas Class III needs Premarket Approval from the regulatory bodies. Labeling requirements, manufacturing plant-established registration, medical device listing, quality systems regulation, and Medical Device Reporting (MDR) must also be taken care of. It is essential to ensure compliance with regulations related to labeling, registration of manufacturing plants, listing of medical devices, quality systems, and Medical Device Reporting (MDR). These requirements need to be fulfilled with utmost care and attention.

Product Insights

The topical hemostat segment held the largest market share of 65.58% in 2023. These are generally used along with conventional treatment procedures to provide minimal tissue reactivity, quick & easy absorbability of the hemostatic agent, non-antigenicity, and cost-efficiency. Topical hemostats are further classified into mechanical, active, and flowable hemostats and include agents such as polyethylene glycols, porcine gelatin, cellulose, and collagen.

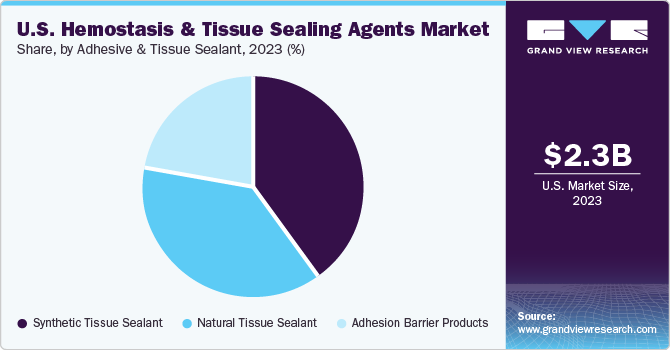

The adhesive and tissue sealant segment is expected to grow at a substantial rate during the forecast periodas itplays a prominent role in controlling blood loss during surgeries.These are further sub-segmented into synthetic, natural, and adhesion barrier products.Factors promoting their demand for sutures are faster procedure rate, minimal invasion, reduced postsurgical infections, and prevention of exudation of other body fluids.

Key U.S. Hemostasis & Tissue Sealing Agents Company Insights

Some prominent U.S. hemostasis and tissue sealing agent market companies include Johnson and Johnson, CryoLife, Inc., Advanced Medical Solution (AMS) Group Plc, Cohera Medical Inc., Integra Life Science Corporation, C.R.Bard, and Smith & Nephew. Liberal regulatory requirements for using such medical devices and rising investments by key players such as Pfizer, Inc. and CryoLife, Inc., fuel the growth of the hemostasis and tissue sealing aagents’ market in this country.

The level of industry rivalry is expected to be highly intense. The integrated nature of the market is the main reason for such high competition. Various companies are moving forward with collaborative strategies to sustain their growth. Small-scale players signing agreements for distribution and marketing globally are also likely to intensify competition. Over the forecast period, the buying power is expected to rise due to increasing competition within the market players.

Key U.S. Hemostasis & Tissue Sealing Agents Companies:

- Johnson & Johnson

- CryoLife Inc

- Advance Medical Solution (AMS) Group Plc.

- Cohera Medical Inc.

- Integra Life Sciences Corporation

- Pfizer Inc.

- BD

- Baxter

- HyperBranch Medical Technology

- Biomet Inc

- B Braun Medical Inc

- Smith & Nephew

Recent Developments

-

In March 2023, Advamedica’s Ax-Surgi surgical hemostat received FDa 510(k) clearance. It is a biopolymer-based device, used for controlling severe surgical bleeding

-

In December 2022, Integra LifeSciences announced the successful acquisition of Surgical Innovation Associates (SIA) intending to become a global leader and reinforce its commitment to bringing advancements in surgical innovation

U.S. Hemostasis & Tissue Sealing Agents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.48 billion

Revenue forecast in 2030

USD 4.15 billion

Growth Rate

CAGR of 8.95% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

U.S.

Key companies profiled

Johnson & Johnson; CryoLife Inc.; Advance Medical Solution (AMS) Group Plc.; Cohera Medical Inc.; Integra Life Sciences Corporation.; Pfizer Inc.; BD.; Cohesion Technologies Inc.; HyperBranch Medical Technology.; Biomet Inc.; Braun Medical Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hemostasis & Tissue Sealing Agents Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hemostasis & tissue sealing agents market report based on product:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical Hemostat

-

Active

-

Mechanical

-

Flowable

-

-

Adhesive & Tissue Sealant

-

Synthetic Tissue Sealant

-

Natural Tissue Sealant

-

Adhesion Barrier Products

-

-

Frequently Asked Questions About This Report

b. The U.S. hemostasis & tissue sealing agents market size was estimated at USD 2.29 billion in 2023 and is expected to reach USD 2.48 billion in 2024.

b. The U.S. hemostasis & tissue sealing agents market is expected to grow at a compound annual growth rate of 8.9% from 2024 to 2030 to reach USD 4.15 billion by 2030.

b. Topical hemostat dominated the U.S. hemostasis and tissue sealing agents market with a share of 65.8% in 2023. This is attributable to the rising prevalence of cardiovascular disorders, diabetes, and cancer in the country.

b. Some key players operating in the U.S. hemostasis & tissue sealing agents market include CryoLife, C. R. Bard, B. Braun, and Advance Medical Solutions Group

b. Key factors that are driving the U.S. hemostasis & tissue sealing agents market growth include growth in geriatric population and prevalence of chronic conditions

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."