- Home

- »

- Clinical Diagnostics

- »

-

U.S. Hemoglobinopathies Market Size, Industry Report 2030GVR Report cover

![U.S. Hemoglobinopathies Market Size, Share & Trends Report]()

U.S. Hemoglobinopathies Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Thalassemia, Sickle Cell Disease), By Diagnosis (Thalassemia, Sickle Cell Disease), By Therapy, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-295-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Hemoglobinopathies Market Trends

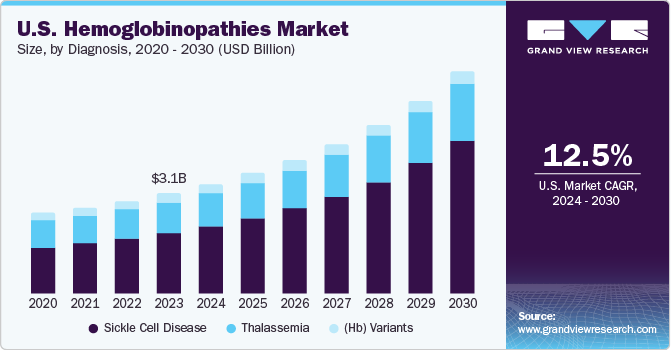

The U.S. hemoglobinopathies market size was estimated at USD 3.09 billion in 2023 and is projected to grow at a CAGR of 12.5% from 2024 to 2030. The market growth is driven by the rising prevalence of conditions such as sickle cell disease (SDC) and thalassemia, as well as a robust product pipeline focused on treating these disorders. According to Centers for Disease and Prevention (DCD) estimates, SDC affects around 100,000 individuals in the U.S. One out of every 16,300 Hispanic American births reports SDC disorders. At least 1 in 13 African American infants are born with sickle cell conditions.

The market is witnessing substantial growth owing to various factors, with a prominent trend being the advancement and commercialization of innovative therapies, such as gene editing and gene therapies. These novel approaches target the fundamental genetic anomalies in hemoglobinopathies, thereby expanding the market. For instance, in August 2022, the U.S. Food and Drug Administration (FDA) approved the first cell-based gene therapy, Zynteglo (betibeglogene autotemcel), for treating adult and pediatric patients suffering from Beta-thalassemia. This groundbreaking approval marks a significant milestone in gene therapy and offers a promising treatment option for patients with this genetic blood disorder.

Moreover, in May 2020, Vertex Pharmaceuticals and CRISPR Therapeutics Incorporated received the Regenerative Medicine Advanced Therapy designation from the U.S. FDA for CTX001, an investigational gene-edited hematopoietic stem cell therapy used to treat transfusion-dependent beta-thalassemia and sickle cell disease.

The market is observing a notable trend of increased research and development (R&D) investment within the pharmaceutical sector. This surge in financial commitment is primarily driven by the persistent pursuit of innovation and the unyielding quest to discover and enhance advanced treatment methodologies. For instance, in October 2022, Pfizer announced the acquisition of Global Blood Therapeutics, a biopharmaceutical company specializing in researching, developing, and distributing life-altering therapies. These therapies offer expectations to underserved patient communities, beginning with those who have sickle cell disease (SCD).

The growing initiatives taken by companies and organizations with the objective to make people aware about hemoglobinopathies is further accelerating the market growth in the U.S. For instance, in September 2022, National Institute for Children’s Health Quality joined the SCD Association of America (SCDAA) campaign themed Sickle Cell Maters, with the aim to create awareness about the research and treatment of SDC and highlight the variety of resources accessible to health care professionals.

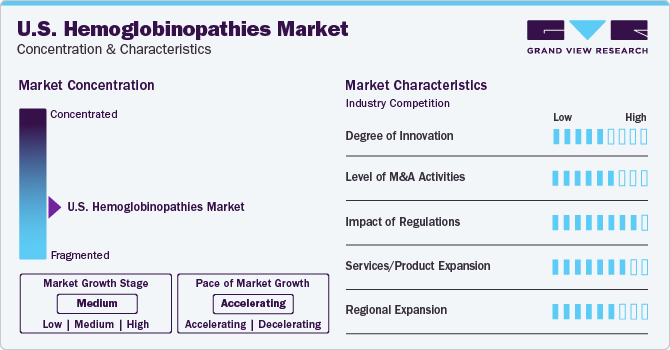

Market Concentration & Characteristics

The market growth stage is high, and the industry growth is accelerating. The industry is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as the development of novel therapies, including gene therapy and gene editing technologies, has significantly improved the treatment landscape for hemoglobinopathies. Rising awareness about hemoglobinopathies and the importance of early detection through screening programs contributes to expanding the market as more patients seek treatment.

The hemoglobinopathies market is also characterized by the leading players' high level of merger and acquisition (M&A) activity. According to a report by EvaluatePharma, the top five companies in the market accounted for 85% of the market share in 2020. This concentration level is expected to continue over the next few years, with these same companies projected to maintain their dominance in the market.

The regulation of the market in the U.S. is primarily overseen by several key regulatory bodies, including the FDA and the Centers for Medicare & Medicaid Services (CMS). The FDA plays a crucial role in evaluating and approving new drugs and therapies for hemoglobinopathies through its rigorous review process to ensure their safety and efficacy. Additionally, CMS regulates reimbursement policies for these treatments, impacting market access and affordability for patients.

There are a limited number of direct product substitutes for hemoglobinopathy. However, the availability of blood transfusions and iron chelation therapy may reduce the demand for curative therapies, including gene therapy or stem cell transplantation. On the other hand, emerging substitutes such as gene therapy and stem cell transplantation may disrupt the market by offering long-term solutions to hemoglobinopathies. Factors such as efficacy, safety, cost, and accessibility will determine the adoption rate of these substitutes and their overall impact on the market.

Type Insights

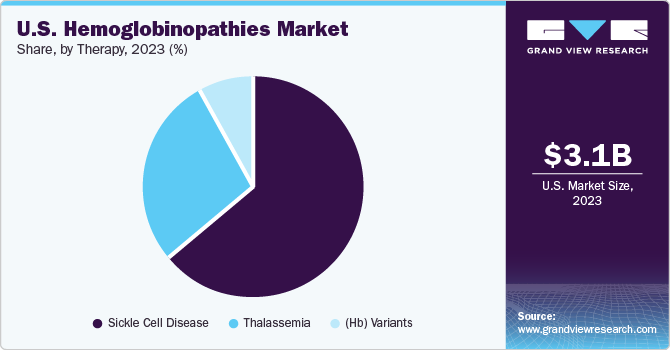

Sickle cell disease dominated the market and accounted for a share of 60.1% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Growing Initiatives of biopharmaceutical companies and nonprofit organizations drives improved access to Sickle Cell Disease (SCD) Treatment. Awareness campaigns focused on disease diagnosis play a crucial role in driving the market’s growth. For instance, in the U.S., promoting early diagnosis and providing support for those affected by sickle cell disease is a priority for various organizations. Two prominent organizations leading these efforts are the Sickle Cell Disease Association of America (SCDAA) and local chapters, which organize educational events, community workshops, and health fairs to raise awareness and improve early detection of sickle cell disease.

Furthermore, scientific trials are evaluating the safety and efficacy of potential therapies for hemoglobinopathies. These studies involve testing new drugs or treatments on patients to determine their benefits, risks, and optimal usage. By generating robust data on the effectiveness of various treatment options, scientific trials help inform clinical decision-making and regulatory approval processes. Thus, all the above factors together drive the segment growth in the country.

Diagnosis Insights

Sickle cell disease accounted for the largest market revenue share in 2023and is expected to grow at the fastest CAGR over the forecast period. In recent years, there has been a significant trend in the sickle cell disease diagnosis market towards developing and adopting innovative diagnostic technologies. These advancements include genetic testing methods such as next-generation sequencing and molecular diagnostics, which have greatly improved the accuracy and efficiency of identifying sickle cell disease and its variants. Point-of-care testing (POCT) devices and rapid diagnostic kits have become increasingly popular in various healthcare settings. These tools enable rapid and convenient screening, facilitating quicker decision-making and potentially improving patient outcomes.

There has been a notable surge in the focus on newborn screening programs for hemoglobinopathies, which are genetic disorders affecting the structure of hemoglobin. This heightened emphasis aims to ensure early detection of these disorders, enabling medical professionals to initiate timely interventions and improve patient outcomes. By incorporating advanced screening methods into newborn care, healthcare providers can more effectively identify and manage hemoglobinopathies such as sickle cell disease and thalassemia. As a result, the affected infants have a higher chance of receiving appropriate treatment and leading healthier lives.

Therapy Insights

The sickle cell disease segment dominated the market in 2023 and is anticipated to grow at fastest CAGR over the forecast period. The advancement and approval of innovative therapies, such as gene therapies and targeted treatments designed to modify genetic abnormalities or address disease symptoms, plays a significant role in propelling market growth. Stem cell transplantation, especially from matched unrelated donors, is increasingly being recognized as a viable curative option. Moreover, there is a rising emphasis on supportive care strategies like pain management, infection prevention, and hydroxyurea therapy. The shift towards personalized medicine approaches and patient-centered care models is gaining momentum to enhance treatment outcomes for individuals with sickle cell disease.

Blood transfusions are a primary treatment method for hemoglobin disorders, including thalassemia and other related conditions. These transfusions are particularly crucial for patients with thalassemia, who often require more frequent transfusions than those with other hemoglobinopathies. The primary goal of these transfusions is to maintain normal levels of blood components and alleviate the symptoms associated with the disorder. Generally, blood transfusions are administered every 3 to 4 weeks.

Bone marrow transplant (BMT) therapy is poised for significant growth in the upcoming period. It is a treatment of choice when conventional therapies like blood transfusions prove ineffective. BMT demonstrates efficacy particularly in the early stages of disease progression, offering a solution for patients struggling to produce an adequate number of healthy cells. By introducing healthy stem cells into the patient’s body, BMT aims to replace diseased or damaged bone marrow. This procedure is increasingly utilized in the management of severe cases of sickle cell disease and thalassemia.

Key U.S. Hemoglobinopathies Company Insights

Some of the key players operating in the market include Global Blood Therapeutics, Inc., bluebird bio, Inc., Emmaus Life Sciences Inc., Pfizer, Inc., Novartis AG.

-

bluebird bio. focuses on developing gene therapies for severe genetic diseases, including hemoglobinopathies like sickle cell disease and beta-thalassemia. Bluebird bio has been at the forefront of innovative treatments for these conditions, offering potentially curative therapies that aim to address the underlying genetic causes of hemoglobinopathies.

-

Pfizer, Inc. is a leading pharmaceutical company that has a significant presence in the market. Hemoglobinopathies are a group of genetic disorders characterized by abnormalities in the structure or production of hemoglobin, the protein in red blood cells that carries oxygen throughout the body. These disorders include sickle cell disease and thalassemia, among others..

Key U.S. Hemoglobinopathies Companies:

- Sangamo Therapeutics, Inc.

- Global Blood Therapeutics, Inc.

- bluebird bio, Inc.

- Emmaus Life Sciences Inc.

- Pfizer, Inc.

- Novartis AG

- Prolong Pharmaceuticals, LLC

- Bioverativ Inc.

- Celgene Corp.

Recent Developments

-

In December 2023, the FDA granted approval for bluebird bio’s lovotibeglogene autotemcel (lovo-cel), known as Lyfgenia, for the treatment of sickle cell disease (SCD) in individuals aged 12 years and above.

-

In September 2022, CRISPR & Vertex Pharmaceuticals Inc. announced that Vertex received a clearance from U.S. FDA for exagamglogene autotemcel (exa-cel). The treatment is helpful in transfusion-dependent beta thalassemia (TDT) and SCD.

U.S. Hemoglobinopathies Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.38 billion

Revenue forecast in 2030

USD 6.85 billion

Growth rate

CAGR of 12.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, diagnosis, therapy, region

Country scope

U.S.

Key companies profiled

Sangamo Therapeutics, Inc.; Global Blood Therapeutics, Inc.; bluebird bio, Inc.; Emmaus Life Sciences Inc.; Pfizer, Inc.; Novartis AG; Prolong Pharmaceuticals, LLC; Bioverativ Inc.; Celgene Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hemoglobinopathies Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hemoglobinopathies market report based on type, diagnosis, therapy, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Thalassemia

-

Sickle Cell Disease

-

Other Hemoglobin (Hb) Variants

-

-

Diagnosis Outlook (Revenue, USD Million, 2018 - 2030)

-

Thalassemia

-

Alpha

-

Blood Test

-

Genetic Test

-

Prenatal Genetic Test

-

Pre-implantation Genetic Diagnosis

-

Electrophoresis

-

Others

-

-

Beta

-

Blood Test

-

Genetic Test

-

Prenatal Genetic Test

-

Pre-implantation Genetic Diagnosis

-

Electrophoresis

-

Others

-

-

-

Sickle Cell Disease

-

Blood Test

-

Genetic Test

-

Prenatal Genetic Test

-

Electrophoresis

-

Others

-

-

(Hb) Variants

-

Blood Test

-

Genetic Test

-

Prenatal Genetic Test

-

Electrophoresis

-

Others

-

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Thalassemia

-

Alpha

-

Blood Transfusion

-

Iron Chelation Therapy

-

Bone Marrow Transplant

-

Others

-

-

Beta

-

Blood Transfusion

-

Iron Chelation Therapy

-

Bone Marrow Transplant

-

Others

-

-

-

Sickle Cell Disease

-

Blood Transfusion

-

Hydroxyurea

-

Bone Marrow Transplant

-

Others

-

-

(Hb) Variants

-

Blood Transfusion

-

Hydroxyurea

-

Bone Marrow Transplant

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. hemoglobinopathies market size was valued at USD 3.19 billion in 2023 and is expected to reach USD 3.38 billion in 2024.

b. The U.S. hemoglobinopathies market is projected to grow at a compound annual growth rate (CAGR) of 12.5% from 2024 to 2030 to reach USD 6.85 billion by 2030.

b. Sickle cell disease dominated the market and accounted for a share of 60.0% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Growing Initiatives of Biopharmaceutical Companies and Nonprofit Organizations Driving Improved Access to Sickle Cell Disease (SCD) Treatment. Awareness campaigns focused on disease diagnosis play a crucial role in driving the market’s growth.

b. Some of the key players operating in the market include Global Blood Therapeutics, Inc., Bluebird bio, Inc., Emmaus Life Sciences Inc., Pfizer, Inc., and Novartis AG.

b. The market is propelled by the rising prevalence of conditions such as sickle cell disease (SDC) and thalassemia, as well as a robust product pipeline focused on treating these disorders.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.