- Home

- »

- Medical Devices

- »

-

U.S. Hemodialysis Vascular Grafts Market, Industry Report, 2030GVR Report cover

![U.S. Hemodialysis Vascular Grafts Market Size, Share & Trends Report]()

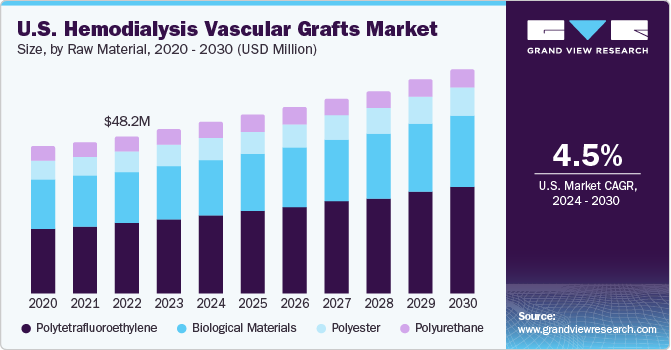

U.S. Hemodialysis Vascular Grafts Market Size, Share & Trends Analysis Report By Raw Material (Polyester, Polytetrafluoroethylene), By Region (West, Midwest), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-286-1

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

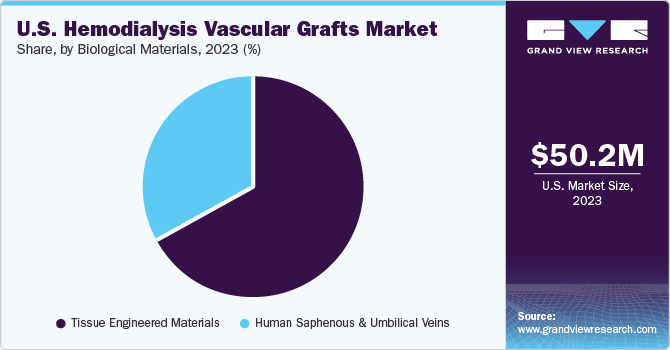

The U.S. hemodialysis vascular grafts market size was estimated at USD 50.2 million in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030. This can be attributed to the increasing prevalence of end-stage renal disease (ESRD), technological advancements, healthcare expenditure trends, reimbursement policies, awareness initiatives, and strategic collaborations between market players. According to the U.S. Renal Data System (USRDS), in 2021, around 786,000 people in the country were living with ESRD, and this number is anticipated to reach 886,000 by 2030.

The rising incidence of chronic kidney disease leading to end-stage renal disease (ESRD) is a significant factor propelling the demand for hemodialysis vascular grafts. As the population ages and the prevalence of conditions such as diabetes and hypertension increases, more individuals require hemodialysis, driving the market for vascular grafts. Ongoing advancements in hemodialysis vascular graft technology have led to the development of more durable and biocompatible graft materials. Innovations such as improved graft designs, enhanced surface modifications, and the use of advanced biomaterials contribute to the market’s growth by enhancing graft performance and longevity.

The growing healthcare expenditure in the U.S., particularly in chronic disease management, including renal care, plays a crucial role in driving the market growth. According to the National Health Expenditure 2022, U.S. healthcare spending grew 4.1% and reached USD 4.5 trillion. Investments in healthcare infrastructure, reimbursement policies, and insurance coverage for dialysis treatments also impact the market positively. Reimbursement policies by government healthcare programs and private insurance companies significantly influence the adoption of hemodialysis vascular grafts. Favorable reimbursement schemes make these procedures more accessible to patients, thereby boosting market growth.

According to the Centers for Disease Prevention and Control (CDC), in 2021, over 38.0% of people aged 65 and above suffered from chronic kidney disease in the U.S. Increased awareness about kidney diseases, dialysis treatment options, and the importance of vascular access among both patients and healthcare providers contribute to the expansion of the market. Education programs promoting early detection and appropriate management further drive market growth.

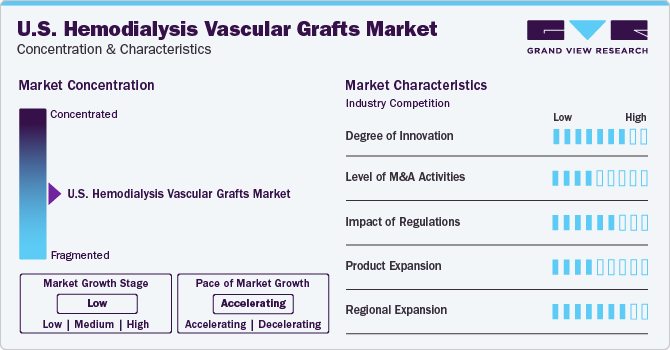

Market Concentration & Characteristics

The market growth stage is low, and the pace of the market growth is accelerating. The level of innovation in hemodialysis vascular graft technology in the U.S. has been substantial, with advancements aimed at improving biocompatibility, reducing complications, and enhancing patient outcomes. These innovations continue to drive progress in the field of vascular access for hemodialysis patients, offering improvements in the future. Collaborations between key players in the healthcare industry, including medical device manufacturers, hospitals, research institutions, and regulatory bodies, foster innovation and drive market growth. Partnerships aimed at developing novel technologies or expanding market reach play a vital role in shaping the U.S. hemodialysis vascular grafts market landscape.

A moderate level of M&A activity characterizes the U.S. hemodialysis vascular graft industry. This activity has been driven by various factors, including the need for companies to expand their product portfolios, gain access to new technologies, and increase their market share.

The industry is also subject to increasing regulatory scrutiny by the U.S. Food and Drug Administration (FDA). The FDA classifies hemodialysis vascular grafts as Class II medical devices, which means they are subject to unique controls to ensure their safety and effectiveness. These controls may include premarket notification (510(k)) requirements, which demonstrate that the device is substantially equivalent to a legally marketed device, and post-market surveillance to monitor the device’s performance and identify any potential risks.

One of the key opportunities for product expansion in the market lies in technological advancements. Companies invest in research and development to create innovative graft materials that offer improved biocompatibility, reduced infection rates, and enhanced durability. For instance, developing grafts with antimicrobial coatings or bioactive surfaces could help address common complications associated with hemodialysis access, such as infection and thrombosis.

The regional expansion of hemodialysis vascular grafts in recent years has been significant. The increasing prevalence of chronic kidney disease and the growing demand for dialysis services drive the expansion. The presence of key players in the U.S., coupled with favorable reimbursement policies, has contributed to the growth of the market.

Raw Material Insights

Polytetrafluoroethylene dominated the market with a share of 45.5% in 2023 and is also expected to grow at the fastest CAGR during the forecast period. The associated benefits, such as biocompatibility, low thrombogenicity, durability, ease of handling during implantation, and resistance to infection, drive polytetrafluoroethylene (PTFE) use in the market. These properties collectively contribute to improved patient outcomes and long-term success rates of vascular access for hemodialysis patients.

The polytetrafluoroethylene (PTFE) hemodialysis vascular grafts are synthetic tubes made of PTFE material used in hemodialysis to provide blood access to patients with kidney failure. Technological advancements in the design of PTFE and government initiatives such as reimbursement policies for hemodialysis procedures are driving the growth of this market. In May 2023, Xeltis presented six-month data from their first-in-human (FIH) aXess vascular graft experiment. According to the experiment, in six months, this graft for hemodialysis exhibited a 0% infection rate, minimal re-intervention rates, and good patency rates. The graft demonstrated promising outcomes compared to the existing care measurements, which often exhibit a higher risk of rejection or infection and lower patency rates.

Key U.S. Hemodialysis Vascular Grafts Company Insights

Some of the key companies operating in the market include Getinge, Becton, Dickinson and Company (C.R. Bard), Medtronic, and W. L. Gore & Associates

-

Getinge is a global medtech company that specializes in cardiovascular and surgical solutions. Their Atrium Medical division focuses on developing, manufacturing, and marketing innovative medical devices used in interventional vascular procedures and critical care. This includes their prominent hemodialysis vascular grafts, which are widely used in the U.S. market.

-

Medtronic, a global healthcare solutions company, offers a range of vascular grafts for hemodialysis access, designed to provide reliable and long-lasting solutions for patients with end-stage renal disease (ESRD).

Key U.S. Hemodialysis Vascular Grafts Companies:

- Getinge

- Medtronic

- W. L. Gore & Associates

- LeMaitre

- CryoLife

- Merit Medical Systems

- C. R. Bard, Inc.

- Vascudyne, Inc.

Recent Developments

-

In February 2024, Healionics, a Seattle-based company, secured funding of USD 5.5 million to finish a human study, get regulatory approval, and market its artificial blood vessel for dialysis patients. For years, the company has been developing the STARgraft vascular graft to provide dialysis patients with dependable vascular access.

-

In June 2023, Merit Medical System Inc. acquired a catheter system from Bluegrass Vascular for USD 32.5 million and followed it up with a larger USD 100 million asset purchase from AngioDynamics.

-

In May 2022, Medtronic announced the collaboration with DaVita to enhance patient outcomes and drive innovation in kidney care devices. The two companies revealed their joint venture to establish a new medical device company specifically dedicated to kidney care. This new entity will concentrate on advancing hemodialysis practices and enhancing the overall patient treatment experience in kidney care.

U.S. Hemodialysis Vascular Grafts Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 52.5 million

Revenue forecast in 2030

USD 68.5 million

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, region

Key companies profiled

Getinge; Medtronic; W. L. Gore & Associates; LeMaitre Vascular; CryoLife; Merit Medical Systems; C.R. Bard, Inc.; Vascudyne Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hemodialysis Vascular Grafts Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hemodialysis vascular grafts market report based on raw material and region:

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyester

-

Polytetrafluoroethylene

-

Polyurethane

-

Biological Materials

-

Human Saphenous & Umbilical Veins

-

Tissue Engineered Materials

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. hemodialysis vascular grafts market size was estimated at USD 50.2 million in 2023 and is expected to reach USD 52.5 million in 2024

b. The U.S. hemodialysis vascular grafts market is expected to grow at a compound annual growth rate of 4.5% from 2024 to 2030 to reach USD 68.5 million by 2030

b. Polytetrafluoroethylene dominated the market with a share of around 45% in 2023 and is also expected to grow at the fastest CAGR during the forecast period. The associated benefits, such as biocompatibility, low thrombogenicity, durability, ease of handling during implantation, and resistance to infection, drive polytetrafluoroethylene (PTFE) use in the hemodialysis vascular grafts market.

b. Some of the key companies operating in the market include Getinge, Becton, Dickinson and Company (C.R. Bard), Medtronic, and W. L. Gore & Associates, among others.

b. The U.S. hemodialysis vascular grafts market growth can be attributed to the increasing prevalence of end-stage renal disease (ESRD), technological advancements, healthcare expenditure trends, reimbursement policies, awareness initiatives, and strategic collaborations between market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."