- Home

- »

- Medical Devices

- »

-

U.S. Hematology Diagnostics Market, Industry Report, 2030GVR Report cover

![U.S. Hematology Diagnostics Market Size, Share & Trends Report]()

U.S. Hematology Diagnostics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Instrument, Consumable), By Test Type, By End-use (Hospital, Diagnostic Lab), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-284-4

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Hematology Diagnostics Market Trends

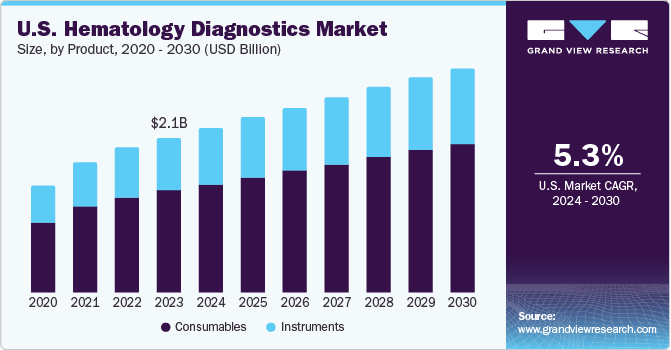

The U.S. hematology diagnostics market size was estimated at USD 2.12 billion in 2023 and is expected to grow at a CAGR of 5.3% from 2024 to 2030. The market growth is attributed to factors such as the rising prevalence of hematological disorders due to aging populations and changing lifestyles necessitating increased diagnostic testing. Technological advancements in flow cytometry, PCR, and NGS enhance diagnostic accuracy and efficiency, driving adoption. As the aging population becomes more susceptible to hematological conditions, there is an increasing demand for diagnostic services to monitor and manage age-related disorders such as myelodysplastic syndromes and thrombocytopenia.

The prevalence of hematological disorders such as anemia, leukemia, lymphoma, and thrombosis are driving the demand for hematology diagnostics in the U.S. According to the American Cancer Society's projections for 2024, approximately 62,770 new cases of leukemia were expected in the U.S., resulting in about 23,670 deaths. Among these cases, approximately 20,800 new instances of acute myeloid leukemia (AML) were anticipated, with the majority occurring in adults and approximately 11,220 deaths from AML, primarily affecting adults. AML, although one of the most common types of leukemia in adults, remains relatively rare, constituting only about 1% of all cancers. Moreover, AML was seen in older individuals, with an average age of diagnosis around 68, although occurrences in children. While AML exhibited a slightly higher incidence among men, both genders face a comparable lifetime risk of approximately 0.5%.

Technological advancements in hematology diagnostic devices and assays enhance their accuracy, sensitivity, and efficiency. Novel technologies such as flow cytometry, polymerase chain reaction (PCR), and next-generation sequencing (NGS) enable more precise diagnosis, leading to increased adoption of these diagnostic tools. For instance, in March 2024, Beckman Coulter Life Sciences, renowned for its expertise in laboratory automation and innovation, DxFLEX Clinical Flow Cytometer was cleared by the FDA and received 510(k) clearance for distribution in the U.S., facilitating access to the widely used benchtop IVD flow cytometry system and expanding testing capabilities.

The increased prevalence of hematological disorders among the aging generation is fueling demand for advanced hematology diagnostics in the U.S. According to the Population Reference Bureau, projected demographic shifts in the U.S. indicated a substantial increase in the population aged 65 and older, rising from 58 million in 2022 to an estimated 82 million by 2050, marking a 47% surge. In addition, the proportion of this age group relative to the total population was expected to climb from 17% to 23%. This trend reflects the aging of the U.S. populace, as evidenced by the median age, which rose from 30.0 to 38.9 between 1980 and 2022. Moreover, approximately one-third of states had a median age surpassing 40 in 2022, indicating a widespread aging trend nationwide.

Market Concentration & Characteristics

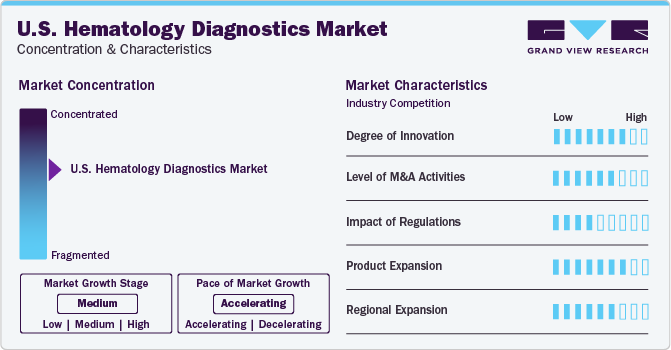

The industry growth stage is medium, and the pace of the global hematology diagnostics market growth is accelerating. The importance of early detection and personalized treatment in managing blood-related disorders has led to a higher demand for hematology diagnostics. This allows healthcare professionals to identify specific conditions and tailor treatments accordingly. Moreover, early detection can help manage symptoms and prevent complications that may negatively impact a patient's daily life.

The U.S. hematology diagnostics industry demonstrates significant innovation through continuous technological advancements such as integrating flow cytometry, PCR, and NGS, alongside developing point-of-care testing devices. These innovations enhance diagnostic accuracy, efficiency, and accessibility.

Ongoing research efforts also contribute to discovering new biomarkers and diagnostic targets, enhancing the market's innovative landscape, and improving the detection and management of hematological disorders. For instance, in June 2023, Premium Sample Preparation System BD FACSDuet was introduced by the BD (Becton, Dickinson and Company), which automates sample preparation for clinical diagnostics using liquid-handling robotics. This system simplifies tasks like cocktailing, washing, and centrifuging, ensuring consistent results. When paired with the BD FACSLyric Clinical Flow Cytometry System, it creates a seamless workflow that reduces manual steps, enhances efficiency, and improves cellular diagnostics.

The U.S. hematology diagnostics industry is also characterized by merger and acquisition (M&A) activities among the leading players. For instance, in February 2020, Medexus Pharmaceuticals, Inc. acquired Aptevo BioTherapeutics LLC. The acquisition was aimed at expanding its product portfolio in the U.S.

The market is also subject to increasing regulatory scrutiny. In the U.S., the FDA regulates the development, manufacturing, and marketing of in vitro diagnostic (IVD) devices, including those used in hematology diagnostics. The FDA ensures that these devices meet safety and performance standards before being approved for market use. The Centers for Medicare & Medicaid Services (CMS) establishes guidelines and payment policies for diagnostic tests and laboratory services, which can influence the adoption and utilization of hematology diagnostic technologies in the U.S.

Product Insights

The consumables segment dominated the market with the largest revenue share of around 65% in 2023 and is expected to grow at the fastest CAGR of 5.4% over the forecast period. The increasing prevalence of hematological disorders and the adoption of advanced diagnostic technologies are driving the demand for consumables products in the U.S. hematology diagnostics industry, as healthcare facilities require a steady supply of reagents, stains, and other consumables to perform tests accurately and efficiently. In addition, the rising aging population and the expansion of healthcare infrastructure contribute to sustained demand for consumables in hematology diagnostics.

In 2022, the U.S. healthcare expenditure surged by 4.1% to USD 4.5 trillion, marking a faster growth rate than the 3.2% increase observed in 2021, yet considerably slower than the 10.6% spike recorded in 2020. This growth primarily stemmed from robust expansions in Medicaid and private health insurance spending, partially offset by ongoing reductions in supplemental funding from the federal government linked to the COVID-19 pandemic.

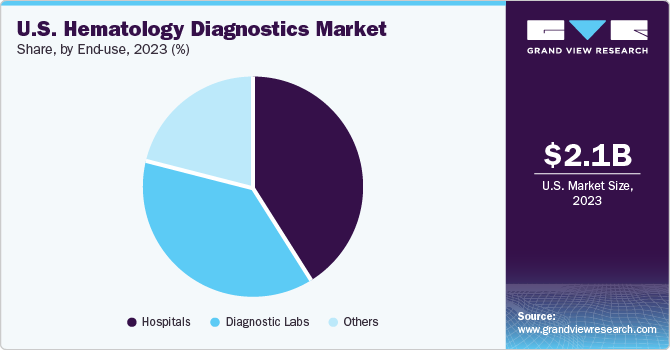

End-use Insights

Based on end-use, the hospitals dominated the market with the largest revenue share in 2023. The increasing demand for diagnostic services due to the rising prevalence of hematological disorders and the expanding healthcare infrastructure, coupled with advancements in technology enabling efficient and accurate diagnostic testing within hospital settings, are expected to propel the market growth.

According to the Leukemia & Lymphoma Society, every 3 minutes, a person in the U.S. receives a diagnosis of lymphoma, leukemia, or myeloma, with an estimated combined total of 184,720 new cases expected in 2023. These hematological malignancies are projected to constitute 9.4% of the approximately 1,958,310 new cancer cases anticipated to be diagnosed in the U.S. in 2023, which highlights the significant impact of these conditions on the healthcare system and underscores the urgent need for effective diagnostic and therapeutic interventions to address them.

The diagnostic labs segment is expected to grow at the fastest CAGR over the forecast period. Advancements in technology enabling automated and high-throughput testing, coupled with the emphasis on early detection and personalized treatment approaches, contribute to the growth of diagnostic labs catering to hematology diagnostics. For instance, in January 2024, HORIBA Medical launched the HELO 2.0 high throughput automated hematology platform, integrating cutting-edge technologies from the Yumizen H2500 and Yumizen H1500 hematology analyzers for superior analytical precision. This platform offers 360-degree sample mixing without needing premixing, advanced data and tube management, efficient waste handling, and digitalization features to optimize turnaround time, space efficiency, and reagent storage. Moreover, it includes an accreditation assistance program in line with ISO-15189 standards to bolster laboratory quality assurance.

Test Type Insights

Based on test type, white blood cells (WBC) test dominated the market with the largest revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. This growth is attributed to factors such as the increasing prevalence of infections, autoimmune disorders, and hematological malignancies necessitating accurate and timely diagnosis of white blood cell counts. According to the National Stem Cell Foundation, autoimmune diseases are the third most common cause of chronic illness in the U.S., impacting 5% to 8% of the population, with a growing prevalence for unclear reasons. Approximately 50 million Americans are affected by autoimmune conditions, costing the nation USD 86 billion annually. These diseases are the fourth largest contributor to disability among women and the eighth leading cause of death for women aged 15 to 64 in the U.S., as reported by the U.S. Department of Health & Human Services (HHS).

Key U.S. Hematology Diagnostics Company Insights

Some of the key companies operating in the U.S. hematology diagnostics market include Beckman Coulter Diagnostics; Siemens Healthineers, Mindray Medical International Limited; and F. Hoffmann-La Roche Ltd., Sysmex Corporation; Beckman Coulter, Inc.; and HORIBA, Ltd.

-

Siemens Healthineers, a technology firm, offers diverse services spanning diagnostic and therapeutic imaging, laboratory diagnostics, molecular medicine, digital health, and enterprise services. Catering to a broad spectrum of healthcare providers, including laboratories, clinics, hospitals, healthcare systems, physicians, public health entities, academic institutions, government agencies, insurance providers, pharmaceutical firms, and research institutes, Siemens Healthineers plays a pivotal role in advancing healthcare delivery and outcomes.

-

Abbott develops, discovers, manufactures, and sells a wide array of healthcare products encompassing diagnostic systems, branded generic pharmaceuticals, tests, and pediatric and adult nutritional products. In addition, Abbott provides a range of medical devices, including devices for electrophysiology, heart failure, vascular rhythm management, structural heart conditions, and neuromodulation.

Key U.S. Hematology Diagnostics Companies:

- Siemens Healthineers AG

- BIOMEDOMICS INC.

- Abbott

- Danaher

- Sysmex Corporation

- Beckman Coulter, Inc.

- F. Hoffmann-La Roche Ltd

- HORIBA, Ltd.

- Bio-Rad Laboratories, Inc.

Recent Developments

-

In January 2024, Agilent Technologies collaborated with Incyte. This collaboration helped in improving expertise in companion diagnostics to support Incyte’s hematology portfolio.

-

In January 2024, HORIBA Medical launched the next- generation fully automated modular hematology solution. The launch used advanced hematology technologies to provide high- quality and throughput results.

-

In December 2023, QScout rapid-result hematology system by Ad Astra Diagnostics (AAD) received 510(k) clearance from the FDA. This system offers rapid point-of-care white blood cell counts (WBCs). Distinguishing between five types of mature WBCs, it provides a neutrophil-to-lymphocyte ratio and immature granulocytes.

-

In August 2023, Abbott's Alinity h-series hematology system obtained U.S. Food and Drug Administration (FDA) approval, enabling laboratories to perform complete blood counts (CBC) using this advanced platform, which comprises the Alinity hq automated hematology analyzer and the integrated slide maker and stainer, Alinityhs.

-

In May 2023, Beckman Coulter Diagnostics announced the launch of immunoassay analyzer. The launch was with the aim of providing speed and reliability in diagnostics.

-

In July 2022, Sysmex Corporation introduced new modules for sample transportation systems that seamlessly integrate with its flagship model, the XR-Series Automated Hematology Analyzer, further advancing its presence in hematology.

U.S. Hematology Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.25 billion

Revenue forecast in 2030

USD 3.07 billion

Growth Rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, test type, end-use, region

Country scope

U.S.

Key companies profiled

Siemens Healthineers AG; BIOMEDOMICS INC.; Abbott; Danaher; Sysmex Corporation; Beckman Coulter, Inc.; F. Hoffmann-La Roche Ltd; HORIBA, Ltd.; Bio-Rad Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hematology Diagnostics Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hematology diagnostics market report based on product, test type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Hematology Analyzers

-

Clinical Laboratory Testing Hematology Analyzers

-

Point-Of-Care Testing Hematology Analyzers

-

-

Flow Cytometers

-

Slide Stainers/Markers

-

-

Consumables

-

Reagents

-

Stains

-

Controls And Calibrators

-

-

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

White Blood Cells (WBC) Test

-

Red Blood Cells (RBC) Test

-

Hemoglobin Test

-

Hematocrit Test

-

Platelet Function

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Labs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. hematology diagnostics market size was estimated at USD 2.12 billion in 2023 and is expected to reach USD 2.25 billion in 2024.

b. The U.S. hematology diagnostics market is expected to grow at a compound annual growth rate (CAGR) of 5.3% over the forecast period 2024 to 2030 to reach USD 3.07 billion by 2030.

b. The consumables segment accounted for the largest market share of around 65% in 2023 and is expected to grow at the fastest CAGR of 5.4% over the forecast period. The increasing prevalence of hematological disorders and the adoption of advanced diagnostic technologies are driving the demand for consumables products in the U.S. hematology diagnostics market.

b. Some of the key companies operating in the U.S. hematology diagnostics market include Beckman Coulter Diagnostics; Siemens Healthineers, Mindray Medical International Limited; and F. Hoffmann-La Roche Ltd., Sysmex Corporation; Beckman Coulter, Inc.; and HORIBA, Ltd.

b. The market growth is attributed to factors such as the rising prevalence of hematological disorders due to aging populations and changing lifestyles necessitating increased diagnostic testing. Technological advancements like flow cytometry, PCR, and NGS enhance diagnostic accuracy and efficiency, driving adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.