- Home

- »

- Advanced Interior Materials

- »

-

U.S. Heat Treating Market Size And Share, Report, 2030GVR Report cover

![U.S. Heat Treating Market Size, Share & Trends Report]()

U.S. Heat Treating Market Size, Share & Trends Analysis Report By Material (Steel, Cast Iron), By Process (Case hardening, Annealing), By Equipment, By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-356-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

U.S. Heat Treating Market Size & Trends

The U.S. heat treating market size was valued at USD 22.52 billion in 2023 and is projected to grow at a CAGR of 2.8% from 2024 to 2030. The demand for the heat treating has experienced significant growth in recent years, largely driven by the increasing demand from major industries such as automotive, aerospace, and construction. For instance, in the automotive sector, heat treating is essential for enhancing the strength and durability of metal components like gears, shafts, and bearings, which are critical for vehicle performance and safety.

This process ensures that these components can withstand extreme conditions, contributing to the overall reliability and longevity of the vehicles. As the automotive industry continues to evolve with a shift towards electric and hybrid vehicles, the demand for specialized heat treatment processes has also risen, underscoring the sector's pivotal role in driving the market growth. This trend is reflective of a broader industrial demand for improved material performance and efficiency, positioning the heat treating market for continued expansion in the U.S.

The automotive industry's evolution towards more lightweight and fuel-efficient vehicles has significantly fueled the demand for advanced heat-treating processes. Techniques such as annealing, isothermal annealing, normalizing, spheroidizing, quenching, tempering, and case hardening enhance the microstructure of automotive components, thereby achieving the desired mechanical properties that contribute to overall vehicle performance and efficiency. This necessity for high-performance components is pushing the boundaries of traditional heat treatment methods and encouraging technological advancements in the sector.

Furthermore, the energy consumption of furnaces used in heat treating, with a reliance on conventional gas-fired and fuel-fired systems using fossil oil (FO) and light diesel oil (LDO), presents environmental and efficiency concerns. These methods, while effective, lead to significant heat losses and a higher environmental footprint, posing challenges to industry growth amidst increasing regulatory and societal pressures for sustainability.

Moreover, there's a growing trend towards customization and specialized treatments to meet the peculiar demands of critical industries like aerospace and automotive. These sectors require components with exceptional performance under extreme conditions, further pushing the heat treating market towards innovation. Simultaneously, the rise of additive manufacturing or 3D printing has opened new avenues for the application of heat treatments. As these printed components require post-processing to refine their material properties, this trend presents both a challenge and an opportunity for the heat treating industry to evolve and adapt. Altogether, these dynamics underscore a period of significant transition and opportunity within the heat treating market, with a strong emphasis on efficiency, quality, and environmental sustainability shaping its future.

Drivers, Opportunities & Restraints

The market for heat treating in the U.S. is propelled by various industries such as automotive, aerospace, and construction. The aerospace and automotive sectors, in particular, present robust avenues for expansion, driven by the demand for lightweight, high-strength materials that necessitate sophisticated heat treating solutions. With the automotive industry's shift towards electric vehicles, there is a growing need for heat treated components that can withstand the challenges of electrification, such as battery frames and electric motor components, opening new markets for providers.

The aerospace industry’s push towards more fuel-efficient and environmentally friendly aircraft is increasing the demand for heat-treated parts that offer durability and performance under extreme conditions. The integration of advanced technologies, including IoT and artificial intelligence, offers another growth pathway by enabling more efficient and precise heat treating processes, thus improving quality and reducing costs.

Furthermore, as industries seek more sustainable manufacturing practices, the market for environmentally friendly heat treating processes, such as low-energy-consumption techniques and non-toxic materials, is expanding. This aligns with the global move towards sustainability, positioning the U.S. market for continued growth as it adapts to these evolving industry needs.

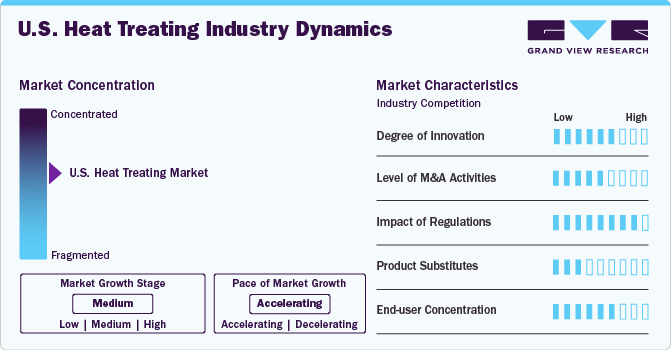

Market Concentration & Characteristics

The industry growth stage is medium, with an accelerating pace. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

The heat treating market is subject to a range of regulations aimed at ensuring safety, quality, and environmental protection. These regulations are enforced by various international and national bodies and can vary significantly from one region to another. In the U.S., for instance, the Environmental Protection Agency (EPA) imposes strict guidelines on emissions and waste management to mitigate the environmental impact of heat treating operations. Moreover, the Occupational Safety and Health Administration (OSHA) sets standards for worker safety, requiring measures to protect against the high temperatures and potential hazards prevalent in heat treating facilities.

Quality standards such as ISO-9001 for quality management systems and specific industry standards like AMS2750 for aerospace or CQI-9 for the automotive sector dictate the operational and procedural compliance for businesses in the heat treating market. These regulations compel companies to invest in cleaner, more efficient technologies and processes while also emphasizing the importance of employee safety and product quality. Compliance not only ensures legal and ethical business operations but can also provide a competitive edge by demonstrating a commitment to excellence and sustainability.

The threat of substitutes for the heat treating market arises from alternative material enhancement technologies and the ongoing innovation in material science. Advancements in materials such as composites and polymers, which may not require traditional heat treatments to achieve desired properties, pose a potential challenge to the market. Moreover, alternative processes like cold working, additive manufacturing, and surface treatment techniques such as physical vapor deposition and chemical vapor deposition can sometimes offer comparable or superior material properties without the need for conventional heat treating. These substitutes not only offer reduced environmental impact but also often lower energy consumption and processing times, appealing to industries focused on efficiency and sustainability.

Process Insights

“The demand for case hardening process segment is expected to grow at a significant CAGR of 3.5% from 2024 to 2030 in terms of revenue.”

The case hardening process segment held the largest share in 2023. The demand for case hardening processes within the market remains strong, driven by industries where enhanced surface hardness and wear resistance of metal components are paramount. In applications such as automotive manufacturing, aerospace, and industrial machinery, case hardening plays a critical role in extending the lifespan and improving the performance of components subjected to heavy wear and friction. The automotive sector, for instance, relies on case hardening to enhance the durability of gears, camshafts, and other critical engine components.

The market demand for annealing processes remains significant, driven by industries that prioritize material refinement, stress relief, and improved mechanical properties. Annealing is widely employed in sectors such as metallurgy, electronics, and manufacturing, where it is instrumental in reducing hardness, enhancing ductility, and relieving internal stresses in metal components. In the electronics industry, annealing is crucial for optimizing the electrical properties of semiconductor materials.

Application Insights

“The demand for automotive application segment is expected to grow at a significant CAGR of 3.2% from 2024 to 2030 in terms of revenue.”

The automotive application is anticipated to show lucrative growth over the forecast period due to the growing EV industry and the increasing demand for greener technologies, which can deliver energy-efficient heat treatment. Moreover, new and advanced equipment required for EVs is expected to propel industry growth. The demand for heat treating in the automotive industry remains robust, driven by the sector's relentless pursuit of lightweight materials, improved mechanical properties, and enhanced durability.

Heat treating plays a pivotal role in the automotive manufacturing process, ensuring the desired hardness, strength, and wear resistance of critical components such as gears, shafts, and engine components. As automotive designs evolve to incorporate advanced materials like high-strength alloys and composites, the need for precise heat treatment processes becomes increasingly vital to optimize the performance and longevity of these components.

The demand for heat treating in the aerospace industry remains high, driven by the stringent requirements for precision, reliability, and material performance in critical aerospace components. Heat treating plays a pivotal role in enhancing the strength, hardness, and structural integrity of materials used in aircraft parts, such as turbine blades, landing gear components, and structural elements. Aerospace manufacturers rely on heat treatment processes to achieve specific metallurgical properties that meet the demanding standards for safety, weight reduction, and performance in extreme operating conditions.

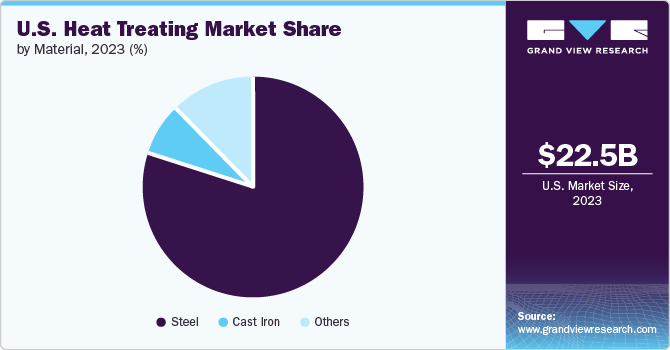

Material Insights

“The demand for steel material segment is expected to grow at a significant CAGR of 2.7% from 2024 to 2030 in terms of revenue.”

The steel material segment led the market with a revenue share of 79.7% in 2023. Growing demand for heat-treated steel parts in the construction industry, is expected to propel the demand for heat treating for steel over the forecast period. Steel is subjected to heat treating to obtain certain mechanical properties including strength, wear properties, and surface hardness. Controlled heating and cooling of steel structures improve machining and formability, along with recovering grain size. The advantages above of heat treating in steel are likely to boost the demand for this segment.

The demand for cast heat treating services remains robust, driven by the persistent growth in industries such as automotive, aerospace, construction, and oil & gas, all of which heavily rely on cast components for various applications. The automotive sector, in particular, continues to expand, fueled by increasing consumer demand and technological advancements, thereby elevating the need for heat-treated castings to enhance component durability and performance.

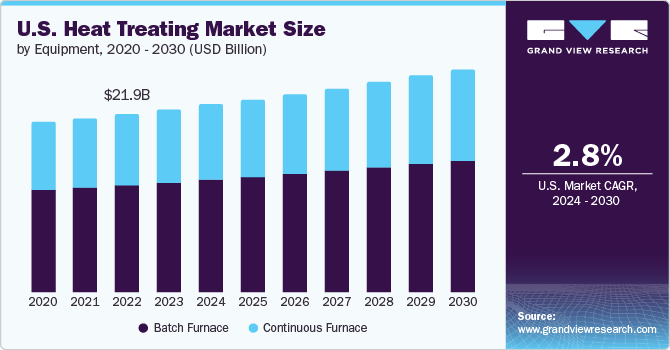

Equipment Insights

“The demand for batch furnace equipment segment is expected to grow at a significant CAGR of 2.6% from 2024 to 2030 in terms of revenue.”

The batch furnace equipment segment held the largest share, 60.1%, in 2023. Batch furnaces, also known as box furnaces, play a crucial role in various heat treatment applications owing to their adaptability and functionality. They feature an insulated compartment designed to hold the materials being processed, thereby ensuring a tightly controlled heating environment. The primary aim of box furnaces is to offer a consistent and controllable heat treatment setting for various processes.

The demand for the continuous furnace equipment segment is expected to grow at a significant revenue CAGR from 2024 to 2030. Continuous furnaces are specialized industrial heat treatment equipment designed to manage an ongoing stream of workpieces. In contrast to batch furnaces, which process workpieces in limited quantities, continuous furnaces facilitate an uninterrupted heat treatment process. This makes continuous furnaces suitable for high-volume production and consistent heat treatment operations.

Key U.S. Heat Treating Company Insights

Some of the key players operating in the market include Bodycote, Blue Thermal, and General Metal Heat Treating.

-

Bluewater Thermal operates 10 different heat treatment & brazing facilities across the U.S., each equipped with unique capabilities and equipment tailored to meet the specific processing requirements of their local markets. Besides offering specialty heat treatment and brazing services, most facilities of the company provide annealing, normalizing, nitriding, carburizing, nitrocarburizing, solution treating, and age hardening, hardening, vacuum heat treatment, stress-relieving, and carbonitriding services. With 12 locations in the U.S., the company serves over 2,000 customers by offering comprehensive thermal processing and metal-joining services.

-

Bodycote provides thermal processing services, which encompass heat treatment, metal joining, hot isostatic pressing, and surface technologies. Its services cater to the requirements of the automotive, aerospace & defense, energy, and general industries. With a global network, the company operates from more than 165 locations worldwide.

HighTemp Furnaces Limited, THERELEK, and AMERICAN METAL TREATING, INC. are some of the emerging market participants.

-

HighTemp Furnaces Limited is a subsidiary of Dowa Thermotech Company Ltd. in Japan. It specializes in offering heat treatment furnaces, atmospheric heat treatment furnace systems, and commercial heat treatment services. The company operates a comprehensive furnace manufacturing facility that covers 110,000-square-foot area. Additionally, the commercial heat treatment divisions of HighTemp Furnaces Limited, situated in industrial clusters in Delhi, Pune, Chennai, and Bangalore, encompass a total area of 650,000 square feet. The global partners of the company are Dowa Thermotech in Japan; AFCHOLCROFT, Hauck Heat Treatment Ltd (formerly TTI Group), Sanken Sangyo Co Ltd, and Pyradia Belfab in Canada; and Italy.

-

THERELEK manufactures custom-engineered industrial heating systems, high-temperature furnaces, and heat treatment systems. It also has a heat treatment facility that carries out processes ranging from vacuum annealing to brazing, hardening, and solutions. The company has served over 200 clients and provided more than 4,500 integrated heating systems and solutions. Moreover, THERELEK has over 20 certifications, including AS 9100D & ISO 9001, ISO 14001- 2015, ISO 9001:2015, etc.

Key U.S. Heat Treating Companies:

- Bluewater Thermal

- AMERICAN METAL TREATING, INC.

- East~Lind Heat Treat, Inc.

- General Metal Heat Treating

- Pacific Metallurgical, Inc.

- Nabertherm GmbH

Recent Developments

-

In January 2024, Bodycote completed the acquisition of Lake City HT, a provider of hot isostatic pressing (HIP) and heat treatment services. With this acquisition, the customer reach of Bodycote in medical market will be significantly increased.

-

In October 2023, Bodycote acquired Stack Metallurgical Group, a specialist technology-focused business. Stack Metallurgical Group is a significant provider of HIP, heat treatment, and metal finishing services, primarily serving the civil aerospace, defense, and energy markets. This acquisition marks the entry of Bodycote into specialist technology businesses. In addition, the company has expanded its footprint in aerospace and medical heat treatment on the West Coast and in Indiana, the U.S.

U.S. Heat Treating Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.11 billion

Revenue forecast in 2030

USD 27.32 billion

Growth Rate

CAGR of 2.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, process, equipment, application

Key companies profiled

Bluewater Thermal; AMERICAN METAL TREATING, INC.; East~Lind Heat Treat, Inc.; General Metal Heat Treating; Pacific Metallurgical, Inc.; Nabertherm GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Heat Treating Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. heat treating market based on material, process, equipment, and application:

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Steel

-

Cast Iron

-

Others

-

-

Process Outlook (Revenue, USD Billion, 2018 - 2030)

-

Case Hardening

-

Hardening & Tempering

-

Annealing

-

Normalizing

-

Others

-

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Batch Furnace

-

Electrically Heated

-

Fuel-fired

-

Others

-

-

Continuous Furnace

-

Electrically Heated

-

Fuel-fired

-

Others

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Machine

-

Construction

-

Aerospace

-

Metalworking

-

Others

-

Frequently Asked Questions About This Report

b. The demand for the U.S. heat treating market has experienced significant growth in recent years, largely driven by the increasing demand from major industries such as automotive, aerospace, and construction. For instance, in the automotive sector, heat treating is essential for enhancing the strength and durability of metal components like gears, shafts, and bearings, which are critical for vehicle performance and safety.

b. The U.S. heat treating market size was estimated at USD 22.52 billion in 2023 and is expected to reach USD 23.11 billion in 2024.

b. The U.S. heat treating market, in terms of revenue, is expected to grow at a compound annual growth rate of 2.8% from 2024 to 2030 to reach USD 27.32 billion by 2030

b. The batch furnace equipment segment held the largest share and 60.1% market share in 2023. Batch furnaces, also known as box furnaces, play a crucial role in various heat treatment applications owing to their adaptability and functionality.

b. Some of the key players operating in the U.S. heat treating market include Bluewater Thermal, AMERICAN METAL TREATING, INC., East~Lind Heat Treat, Inc., General Metal Heat Treating, Pacific Metallurgical, Inc., Nabertherm GmbH, Heat Treating Inc. among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."