- Home

- »

- Distribution & Utilities

- »

-

U.S. Heat Exchangers Market Size, Industry Report, 2030GVR Report cover

![U.S. Heat Exchangers Market Size, Share & Trends Report]()

U.S. Heat Exchangers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Shell & Tube, Air-Cooled), By Material, By End-use (Food & Beverage, Pulp & Paper), And Segment Forecasts

- Report ID: GVR-4-68040-132-9

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Heat Exchangers Market Size & Trends

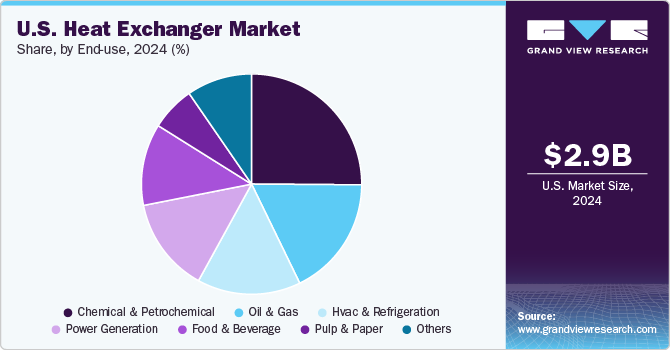

The U.S. heat exchanger market size was estimated at USD 2,905.1 million in 2024 and is anticipated to grow at CAGR of 5.1% from 2025 to 2030. The rising demand for heat transfer solutions across various end-use industries, owing to the robust industrialization growth in the U.S., is one of the driving factors of the market growth over the forecast period. The U.S. government is actively introducing various initiatives and tax exemption schemes to revive domestic production and industrial sector growth. Such initiatives and schemes are expected to boost the participation of various manufacturers to expand their business activities across the U.S. The growth of the various industries is expected to drive the demand for heat exchangers over the forecast period.

The heat exchanger market in the U.S. is projected to experience significant growth driven by increasing demand for energy efficiency across various industries, including HVAC, power generation, and chemical processing. As companies seek to optimize energy consumption and reduce emissions, the adoption of advanced heat exchanger technologies, such as plate and shell-and-tube designs, is on the rise. Furthermore, regulatory support for sustainable practices and the push towards renewable energy sources are expected to enhance market opportunities. Innovations in materials and manufacturing processes also contribute to the sector's expansion, positioning the U.S. as a key player in the global heat exchanger market.

In March 2023, the U.S. Office of Science & Technology Policy (OSTP) announced a proposal for the lobbies for tax breaks related to U.S.-based manufacturing. The industry is targeting subsidies and tax breaks to advance manufacturing innovation in the U.S. Pharmaceutical Research and Manufacturers of America (PhRMA) asked for a 25% tax credit to compensate for the cost of building a new manufacturing facility and enhancing the existing facilities in the U.S. in March 2023. The growth in the manufacturing industry significantly contributes to the increasing demand for heat exchangers in the country. Heat exchangers used for efficient heat transfer are critical in any industrial process, mostly in the power generation, chemical and petrochemical industry, and oil & gas production.

Drivers, Opportunities & Restraints

The heat exchanger market is primarily driven by increasing energy efficiency regulations and the growing emphasis on sustainability across various industries. As companies aim to reduce their carbon footprints and comply with stringent environmental standards, there is a rising demand for advanced heat exchanger technologies that optimize energy use and enhance thermal performance. This trend is particularly prominent in sectors like HVAC, power generation, and chemical processing, where efficient heat transfer is crucial for operational cost savings and environmental compliance.

The heat exchanger market is facing significant restraint that is high initial cost associated with advanced systems. The investment required for state-of-the-art heat exchangers can be substantial, posing challenges for smaller companies or those operating under financial constraints. Additionally, the complexity and maintenance requirements of certain heat exchanger types can deter potential users, as they may necessitate specialized knowledge and resources that are not readily available.

The growing renewable energy sector presents a promising opportunity for the heat exchanger market. As investments in solar, geothermal, and other sustainable energy sources increase, the demand for efficient heat transfer solutions tailored for these applications is expected to rise. Furthermore, the integration of smart technologies and IoT in heat exchangers can enhance monitoring and control, attracting a new wave of customers focused on optimizing their energy management systems. This trend toward innovation and sustainability creates a fertile ground for market growth.

Product Insights

“The demand for the plate & frame heat exchanger segment is expected to grow at a significant CAGR of 5.7% from 2025 to 2030 in terms of revenue.”

The shell & tube heat exchanger product segment led the market and accounted for 35.3% of the global revenue share in 2024. Shell & tube heat exchangers are used in applications that require a wider temperature and pressure range between two fluids. These heat exchangers can handle a variety of fluids, including gases, liquids, and two-phase mixtures. This versatility can make them suitable for use in petrochemical, oil and gas, chemical, power generation, and HVAC applications, fueling their adoption over the forecast period.

Plate & frame-type heat exchangers are used in various industries such as power generation, oil & gas, food & beverage, and chemicals. This type of heat exchanger is mostly used for liquid-liquid heat exchange at low-to-medium pressure. The plate & frame type heat exchanger offers flexibility in terms of adding or removing plates for different types of operation. There are different types, such as brazed plate heat exchangers, gasketed plate heat exchangers, welded plate heat exchangers, etc. The increasing consumption of electricity across various industries, the residential sector, as well as the commercial sector growth in power generation is driving the demand for plate & frame heat exchangers.

Material Insights

“The demand for alloys material segment is expected to grow at a significant CAGR of 5.7% from 2025 to 2030 in terms of revenue.”

The metals material segment led the market and accounted for 63.0% of the global revenue share in 2024. Metals, particularly copper, aluminum, and stainless steel, are widely used in heat exchangers due to their ideal thermal conductivity, corrosion resistance, and mechanical strength. Copper is favoured for its superior heat transfer capabilities, making it ideal for smaller, high-efficiency applications. Aluminum, lightweight and cost-effective, is commonly used in air-cooled heat exchangers and automotive applications.

The demand for specialized alloys in heat exchangers is growing, driven by the need for improved performance in harsh environments. Alloys such as titanium, nickel-based alloys, and duplex stainless steels are increasingly utilized for their exceptional resistance to corrosion and high temperatures. These materials are particularly important in applications involving aggressive fluids, such as seawater in marine heat exchangers or harsh chemicals in petrochemical processes.

End-use Insights

“The demand for the HVAC & refrigeration end-use segment is expected to grow at a significant CAGR of 5.9% from 2025 to 2030 in terms of revenue.”

The chemical end-use segment led the market and accounted for 25.1% of the global revenue share in 2024. With the rapid development in the chemical and petrochemical industries with new processes and products being designed continuously, the demand for various heat exchangers is expected to increase over the forecast period. Moreover, the rising manufacturing and processing industry of chemicals & petrochemicals is likely to drive the growth of the segment over the forecast period.

The HVAC & refrigeration segment is anticipated to register the second-highest growth over the forecast period. The rising construction projects in the residential, commercial, and industrial sectors are anticipated to contribute to the increasing demand for heat exchangers used in HVAC and refrigeration of the building spaces.

Key U.S. Heat Exchangers Company Insights

Some of the key players operating in the U.S. heat exchanger Mersen, Chart Industries, Koch Heat Transfer Company among others.

-

Mersen is a global leader in electrical power and advanced materials, specializing in designing and manufacturing solutions for critical applications in various industries. Founded in France, the company operates across multiple sectors, including energy, electronics, and transport, with a strong emphasis on innovation and sustainability. Mersen’s product portfolio includes heat exchangers, busbars, and components for renewable energy systems, showcasing their commitment to enhancing energy efficiency and reliability. With a presence in over 30 countries, Mersen leverages its expertise in thermal management and electrical solutions to address the evolving needs of its customers worldwide.

-

Chart Industries is a prominent manufacturer of highly engineered equipment that serves the cryogenics, energy, and industrial gases sectors. Established in the United States, the company specializes in providing innovative solutions for liquefied natural gas (LNG), biogas, and other critical applications. Chart’s product range includes heat exchangers, storage tanks, and processing equipment designed to optimize energy efficiency and safety.

-

Koch Heat Transfer Company, part of the Koch Industries family, specializes in the design and manufacture of heat exchangers and related technologies. With a strong emphasis on innovation and quality, Koch Heat Transfer provides a wide range of products, including shell-and-tube, plate, and air-cooled heat exchangers, tailored to meet the specific needs of various industries, such as oil and gas, chemical processing, and power generation. The company leverages decades of engineering expertise to deliver high-performance solutions that enhance energy efficiency and operational reliability.

Mason Manufacturing LLC and HEATTRAN are some of the emerging players in the U.S. heat exchanger market.

-

Mason Manufacturing LLC is a specialized engineering and manufacturing company that provides high-quality thermal management solutions, including heat exchangers and related products. With a commitment to innovation and customer service, Mason Manufacturing serves various industries, including HVAC, refrigeration, and industrial processes. The company prides itself on its ability to customize products to meet specific client needs, utilizing advanced technology and materials to enhance performance and efficiency.

-

HEATTRAN is a leading provider of heat exchanger technologies, known for its expertise in designing and manufacturing a wide variety of heat transfer equipment for industrial applications. The company offers an extensive range of products, including shell-and-tube, plate, and air-cooled heat exchangers, tailored to meet the diverse needs of sectors such as oil and gas, petrochemicals, and power generation.

Key U.S. Heat Exchangers Companies:

- Mersen

- Chart Industries

- Koch Heat Transfer Company

- SHECO Industries, Inc.

- HEATTRAN

- ALFA LAVAL

- Kelvion Holding GmbH

- Xylem

- API Heat Transfer

- Mason Manufacturing LLC

Recent Developments

-

In March 2023, Chart Industries Inc. successfully acquired Howden, a manufacturer of rotary heat exchangers. This strategic acquisition of Howden has provided Chart Industries with access to a wider customer base.

-

In May 2023, Alfa Laval is enhancing its brazed plate heat exchanger capacity to bolster the global energy transition. The establishment of new facilities in Italy, China, Sweden, and the U.S. signifies significant progress in their initiative to advance manufacturing intelligence and efficiency throughout the entire supply chain.

U.S. Heat Exchanger Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,018.0 million

Revenue forecast in 2030

USD 3,861.3 million

Growth Rate

CAGR of 5.1% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-use

Key companies profiled

Mersen; Chart Industries; Koch Heat Transfer Company; SHECO Industries, Inc.; HEATTRAN; ALFA LAVAL; Kelvion Holding GmbH; Xylem; API Heat Transfer; Mason Manufacturing LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Heat Exchanger Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. heat exchanger market based on product, material, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shell & Tube

-

Air-Cooled

-

Plate & Frame

-

Brazed

-

Gasketed

-

Welded

-

Others

-

-

Others

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metals

-

Alloys

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical & Petrochemical

-

Oil & Gas

-

Power Generation

-

HVAC & Refrigeration

-

Food & Beverage

-

Pulp & Paper

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. heat exchanger market size was estimated at USD 2,905.1 million in 2024 and is expected to reach USD 3,018.0 million in 2025.

b. The U.S. heat exchanger market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2030 to reach USD 3,861.3 million by 2030.

b. The shell & tube heat exchanger product segment led the market and accounted for 35.3% of the global revenue share in 2024. These heat exchangers can handle a variety of fluids, including gases, liquids, and two-phase mixtures. This versatility can make them suitable for use in petrochemical, oil and gas, chemical, power generation, and HVAC applications, fueling their adoption over the forecast period.

b. Some of the key players operating in the U.S. heat exchanger market include Mersen; Chart Industries; Koch Heat Transfer Company; SHECO Industries, Inc.; HEATTRAN; ALFA LAVAL; Kelvion Holding GmbH; Xylem; API Heat Transfer; Mason Manufacturing LLC, among others.

b. The rising demand for heat transfer solutions across various end-use industries, owing to the robust industrialization growth in the U.S., is one of the driving factors of the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.