U.S. Hearing Aids Market Size, Share & Trends Analysis Report By Product Type (BTE, Canal Hearing Aids), By Technology (Digital, Analog), By Sales Channel (Retail Stores, E-pharmacy), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-274-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Hearing Aids Market Size & Trends

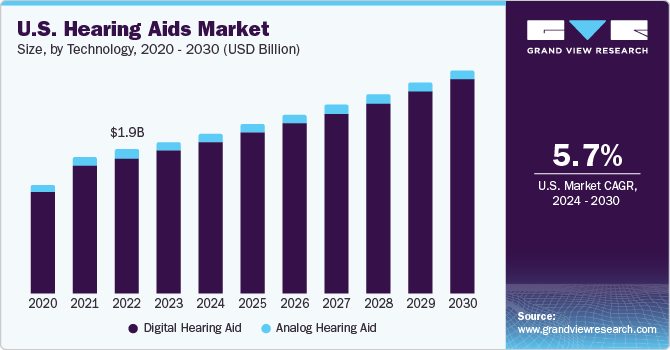

The U.S. hearing aids market size was estimated at USD 2.04 billion in 2023 and is projected to grow at a CAGR of 5.7% from 2024 to 2030. The market is growing due to the increasing adoption of technologically advanced hearing aid devices and the rising prevalence of hearing loss among the geriatric population. According to the Population Reference Bureau, the U.S. is witnessing a significant demographic transformation, with the population aged 65 and above projected to increase from 58 million to 82 million by 2050, constituting 23% of the total population, up from 17%, reflecting a 47% surge, alongside notable median age increases from 30.0 in 1980 to 38.9 in 2022, with approximately one-third of states having median ages surpassing 40, necessitating comprehensive strategies to address associated challenges in healthcare, social services, and labor force dynamics.

Technological advancements significantly influence the market, leading to the emergence of innovative products such as invisible, smart linked, artificial intelligence (AI), and Bluetooth-enabled aids. Companies have been continuously working towards improving the overall patient experience by incorporating new features and technology, which is expected to drive market growth in the foreseeable future.

The healthcare industry was greatly affected by the COVID-19 outbreak. Many clinics and audiology shops had to implement safety measures, causing delays in less severe hearing loss-related procedures. Manufacturers responded to the increased demand by launching new products to improve their portfolio and gain a larger market share.

Untreated hearing loss can lead to speech and language communication delays, academic struggles, and social isolation. Studies show that even infant babble is affected by hearing loss. According to the Centers for Disease Control and Prevention (CDC) and the Hearing Loss Association of America (HLAA), about 48 million (or 14%) of Americans report some degree of hearing loss.

Market Concentration & Characteristics

The industry is highly fragmented, with many market players holding market share. Market growth is medium, and the pace of the market is accelerating. To maintain their position in the market, market players are actively participating in various strategies, such as mergers, acquisitions, collaborations, innovation, product expansions, partnerships, and regional expansions. Similarly, the global hearing aids market is being driven by factors, including the increasing prevalence of hearing impairments due to factors like aging populations and noise pollution, technological advancements leading to the development of more sophisticated and effective hearing aids, growing awareness about hearing health and the availability of treatment options, expanding healthcare infrastructure in emerging markets, and favorable reimbursement policies for hearing aids in many regions.

The industry is characterized by a high degree of innovation due to rapid technological advancements and increasing demand for hearing aids devices. As a result, direct streaming capabilities and sound processing algorithms have been integrated to optimize the quality and clarity of sound, thus leading to improved hearing outcomes. For instance, in February 2024, Oticon, Inc. introduced a hearing aid featuring 4D Sensor technology to cater to individual listening preferences by understanding users' intentions in various sound environments. The intent hearing aid utilizes user-intent sensors to capture personalized communication needs, providing tailored support for optimal hearing experiences, particularly in complex listening situations. This technology departs from traditional hearing aids, which offer standard support regardless of individual requirements.

Manufacturers have incorporated features like Bluetooth connectivity, rechargeable batteries, noise reduction algorithms, and smartphone compatibility into these tiny devices. For Instance, in February 2023, Starkey announced Genesis AI, featuring a new processor, sound, industrial design, fitting software, and improved patient experience. Moreover, other technologies, such as smartphone compatibility and remote programming, are also being utilized to enhance the overall hearing experience further.

The industry is also characterized by the leading players' high level of merger and acquisition (M&A) activity. Companies are involved in strategic initiatives and business expansion to strengthen their presence. For instance, in 2022, EssilorLuxottica acquired Nuance Hearing, an Israel-based start-up. This acquisition is expected to help EssilorLuxottica expand in the hearing aids business by developing lenses fitted with acoustic technology.

The industry is facing increasing regulatory scrutiny. The U.S. Food and Drug Administration (FDA) has established regulations for over-the-counter (OTC) hearing aids. These regulations aim to make hearing aids more accessible and affordable for adults with mild to moderate hearing loss. OTC hearing aids are designed for individuals who do not require a prescription and can be bought online or from physical stores. The FDA's final rule on OTC hearing aids came into effect on October 17, 2022, creating a separate category from prescription hearing aids. Manufacturers who sell OTC hearing aids must comply with FDA regulations to ensure their safety and effectiveness.

Product substitutes in the market encompass a variety of alternatives that offer varying levels of hearing assistance. Traditional hearing aids, including behind-the-ear (BTE), in-the-ear (ITE), and invisible-in-canal (IIC) devices, face competition from over-the-counter (OTC) hearing aids, which have gained traction due to recent regulatory changes. In addition, personal sound amplification products (PSAPs) and smartphone-based hearing augmentation apps provide alternatives to traditional hearing aids, offering customizable amplification and sound enhancement features. For instance, in May 2021, WS Audiology A/S introduced its Augmented Xperience (AX) hearing aid platform, designed to enhance sound clarity by intelligently and automatically processing audio regardless of the listening environment. Unlike conventional hearing aids that amplify all sounds uniformly, AX employs advanced algorithms to discern and prioritize relevant sounds while relegating others to the background. This innovative approach ensures listeners consistently hear clearly, adapting to various acoustic settings with precision and effectiveness.

End-user concentration in the market refers to the dominance of a few major manufacturers preferred by consumers, often due to brand loyalty and the influence of healthcare professionals. In addition, the influence of hearing healthcare professionals in recommending specific brands contributes to concentrated end-user preferences. This concentration can limit competition, potentially resulting in higher prices and less innovation while impacting consumer choice and access to a diverse range of hearing aid options.

Technology Insights

Based on technology, the segment is further categorized into digital hearing aids and analog hearing aids. The digital hearing aid segment dominated the market with the largest market share in 2023. Digital hearing aids offer superior sound quality, expanded features like noise cancellation and Bluetooth connectivity, and enhanced comfort and durability. The introduction of digital signal processing (DSP) has revolutionized hearing aid technology. DSP allows for more precise amplification of specific frequencies, leading to better speech understanding and overall sound quality.

The analog hearing aid segment will likely grow at a moderate CAGR during the forecast period. These devices amplify sound waves to make the wearer's hearing easier. They have become a common choice for individuals due to their cost-effectiveness, simple use, long battery life, and durability. For instance, in November 2023, Analog Hearing Labs reintroduced FDA-registered analog hearing aids to the market with the launch of its new product, the TrueEQ. Emphasizing sound quality and fidelity, the TrueEQ represents a modernization of analog technologies, promising fuller, richer sound quality, free from digital distortion, and designed to be more easily accepted by both ears and the brain, distinguishing it from its digital counterparts.

Product Type Insights

The behind-the-ear (BTE) hearing aids segment accounted for the largest revenue share of 39.94%. BTE hearing aids are designed to fit comfortably behind the ear in a small, curved case. These devices can be modified to connect to external sound sources like infrared listening systems and auditory training equipment. There are various BTE models available on the market that are Bluetooth compatible, which provides better wireless connectivity and more convenience to users. For instance, in 2021, WSAudiology (WSA) initiated a project to develop next-generation hearing aid devices integrating Bluetooth connectivity, leveraging support from Comarch SA, which provided expertise in firmware development using C++ and Python, along with a comprehensive test framework for Bluetooth modules, enabling WSA to achieve its objectives and aspire to lead the market.

The canal hearing aids segment is expected to grow at the fastest CAGR of 9.4% over the forecast period. Canal hearing aids are a discreet and effective solution for hearing loss. As the microphone is closer to the eardrum, canal aids can provide a more natural sound quality, allowing for better sound reception. The custom-fit design of canal hearing aids ensures a comfortable and secure fit in the ear canal. These factors contribute to the market growth.

Sales Channel Insights

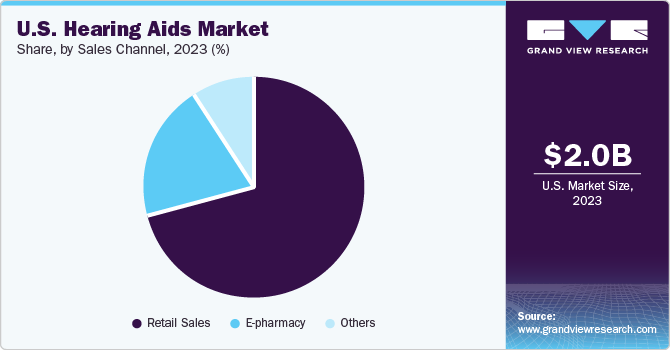

The retail stores segment accounted for the largest market share in 2023. This growth is attributed to the initiatives of many manufacturing companies opting to open their stores to expand their business quickly and provide better customer experience. Retail stores are divided into two categories: company-owned and independent retail stores. Independent retail stores hold most of the market share due to the ease of entry for new retail outlets, the potential for high profit margins, and the opportunity for more direct customer interaction. For instance, in October 2023, Eargo, Inc. announced its partnership expansion with Best Buy, growing its in-store presence to over 500 locations.

The E-pharmacy segment is expected to witness a moderate CAGR during the forecast period. The internet has become crucial for purchasing hearing aids and obtaining information about them, especially for young adults and millennials. Online platforms facilitate hearing loss screening and inform users about the latest technology. These websites allow users to compare products and prices, which helps them make informed decisions when buying hearing aids. Additionally, online sales channels like e-pharmacies make hearing aids more affordable and accessible in the market.

Key U.S. Hearing Aids Company Insights

Some of the key players operating in the U.S. hearing aids market include Sonova; Audicus; Starkey Laboratories, Inc.; Audina Hearing Instruments, Inc; and Eargo Inc.

-

Eargo Inc. is a company offering innovative hearing aid technology. Its products are discreet, comfortable, and virtually invisible, and they are designed to provide high-quality sound for individuals with hearing loss.

-

Sonova is a global company providing innovative and advanced hearing care solutions, including highly effective hearing aids, life-changing cochlear implants, and cutting-edge wireless communication systems.

GN Store Nord A/S; MDHearing; WS Audiology A/S; and Horentek Hearing Diagnostics are other market participants in the U.S. hearing aids market.

Key U.S. Hearing Aids Companies:

- Sonova

- Audicus

- Starkey Laboratories, Inc.

- Audina Hearing Instruments, Inc

- Eargo, Inc.

- GN Store Nord A/S

- MDHearing

- WS Audiology

- Horentek Hearing Diagnostics

Recent Developments

-

In January 2024, Amplifon acquired the business of one of the leading Miracle-Ear franchisees in the U.S., helping Amplifon to strengthen its presence in the U.S.

-

In January 2023, Eargo, Inc. launched Eargo 7, which features new sound adjustment features in loud environments, water-resistant technology, and rechargeability.

-

In September 2023, InComm Healthcare and MDHearing partnered to offer hearing aids as a benefit under health plans.

-

In January 2022, Sonova Holding AG acquired U.S.-based hearing aids-producing company Alpaca Audiology, doubling Sonova Holding AG’s network in the U.S.

-

In September 2020, the American Cochlear Implant (ACI) Alliance launched its new initiative, the Cochlear Implant Consumer Advocacy Network (CI CAN), enabling CI CAN members to work directly with policymakers and guide them in public policy making and assisting policymakers in understanding patient needs and improving clinical care quality.

U.S. Hearing Aids Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 3.01 billion |

|

Growth rate |

CAGR of 5.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, technology, sales channel |

|

Country scope |

U.S. |

|

Key companies profiled |

Sonova; Audicus; Starkey Laboratories, Inc.; Audina Hearing Instruments, Inc; Eargo, Inc.; GN Store Nord A/S; MDHearing; WS Audiology; Horentek Hearing Diagnostics |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Hearing Aids Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hearing aids market report based on product type, technology, and sales channel:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-the-ear Hearing Aids

-

Receiver-in-the-ear Hearing Aids

-

Behind-the-ear Hearing Aids

-

Canal Hearing Aids

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital Hearing Aid

-

Analog Hearing Aid

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Sales

-

Company Owned

-

Independent Retail

-

-

E-pharmacy

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. hearing aids market size was estimated at USD 2.04 billion in 2023 and is expected to reach USD 2.15 billion in 2024.

b. The U.S. hearing aids market is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2030 to reach USD 3.01 billion by 2030.

b. In terms of technology, the digital hearing aid segment dominated the market with the largest share of 95.1% in 2023. This high share is attributable to the increasing penetration and awareness of technologically advanced hearing aid devices.

b. Some key players operating in the U.S. hearing aid market include Sonova, Audicus; Starkey Laboratories, Inc.; Audina Hearing Instruments, Inc; Eargo, Inc.; GN Store Nord A/S; MDHearing; Signia; WS Audiology; and Horentek Hearing Diagnostics.

b. Key factors driving the market growth are the increasing adoption of technologically advanced hearing aid devices and the rising prevalence of hearing loss among the geriatric population.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."