- Home

- »

- Medical Devices

- »

-

U.S. Healthcare Training And Education Services Outsourcing Market Report, 2030GVR Report cover

![U.S. Healthcare Training And Education Services Outsourcing Market Size, Share & Trends Report]()

U.S. Healthcare Training And Education Services Outsourcing Market Size, Share & Trends Analysis Report By Service (Training and Development, Assessment & Evaluation), By Delivery Mode (Online, Offline), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-328-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

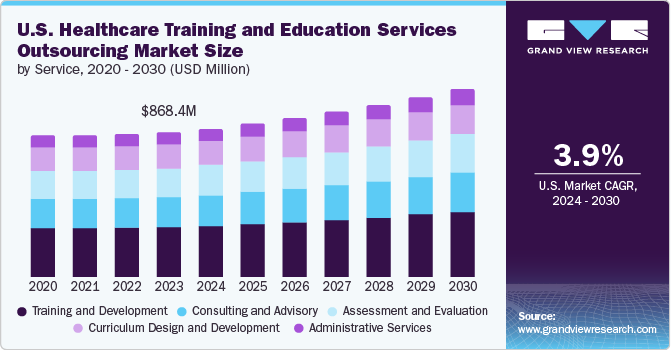

The U.S. healthcare training and education services outsourcing market size was estimated at USD 868.40 million in 2023 and is projected to grow at a CAGR of 3.93% from 2024 to 2030. The market growth is primarily attributed to ongoing technological advancements, the growing need for cost reduction, and regulatory changes. Increasing outsourcing trends for several training and education programs such as clinical training, technical training, compliance training, and soft skills development services in the healthcare industry are anticipated to propel U.S. market revenue growth. As, outsourcing training and education services assist healthcare organizations to reduce operational costs by eliminating the need for in-house training infrastructure and resources.

Training and education include quality systems management, ICD-10, GMP/GDP training, regulatory/compliance training, CAPA systems training, technology training, auditing training, and quality control. The training and education programs are implemented through the didactic method. This method provides learners with the required theoretical knowledge. This training supports basic soft skills, which is expected to drive the segment’s growth. Moreover, training and education of industry employees significantly benefit the organization and is expected to witness lucrative growth over the forecast period. The uncertain nature of regulatory, political, and economic scenarios makes the industry extremely dynamic and presents difficulty for personnel to keep up to date with the changes. Hence, outsourcing such services is likely to boost market demand.

Increasing integration of advanced technologies such as AI, big data and analytics, and cloud computing among others to enhance productivity and efficiency is a major factor driving overall market growth. Growing adoption of e-learning and digital platforms such as Virtual Learning Environments (VLEs), and mobile learning for online training and education, providing tools for creating, delivering, and managing course content will offer tremendous market growth opportunities. Moreover, apps and mobile-optimized websites offer convenience and flexibility for healthcare professionals to access training materials. Analytics platforms assist to track and measure the effectiveness of training programs, providing actionable insights to optimize training strategies. Big data allows for the continuous improvement of training content based on performance metrics and feedback.

Increased need for regular training programs on Affordable Care Act (ACA) compliance, driving the demand for outsourcing these services to specialized providers. The ACA mandates several training requirements for healthcare professionals to ensure compliance with patient care standards and insurance protocols. Moreover, the Health Insurance Portability and Accountability Act (HIPAA) requires healthcare organizations to train their staff on the importance of patient data privacy and security. Thus, continuous demand for updated HIPAA training modules leads to increased outsourcing to safeguard compliance and avoid penalties. As the increase in the adoption of telehealth, the U.S. FDA imposed new regulations that require additional training programs for healthcare providers on remote care delivery. Furthermore, the surge in government funding and investment by healthcare companies for training and development programs for regulatory compliance is likely to boost industry growth potential in the upcoming years.

Healthcare organizations are outsourcing training functions to access specialized training providers with advanced knowledge and experience in various healthcare domains, including clinical procedures, healthcare management, and soft skills development. This allows healthcare providers to maintain high-quality, up-to-date training without the need for extensive in-house resources. Additionally, outsourcing training and education enable healthcare organizations to concentrate on their core competencies, such as drug development, commercialization, and clinical services, leading to operational efficiency.

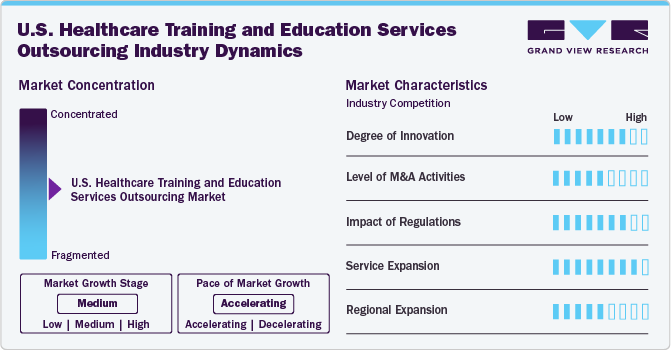

Market Concentration & Characteristics

The U.S. healthcare training and education services outsourcing market’s growth stage is medium, and pace of the growth is accelerating. The market is characterized by a degree of innovation. Level of M&A activities, impact of regulations, service expansions, and regional expansions.

The U.S. healthcare training and education services outsourcing market is characterized by a high degree of innovation. Technological advancements such as AI, machine learning, VR, and AR are paving new avenues to the training and development market landscape. These innovations enable personalized learning experiences, enhance engagement, and improve training outcomes, thereby accelerating market growth potential.

The marketis also characterized by a significant level of merger and acquisition (M&A) activity by leading players to expand their capabilities, service offerings, and client base. As companies seek to expand their service offerings and market reach. Larger firms are acquiring smaller, specialized providers to integrate advanced technologies and expertise into their portfolios. This trend is driving market consolidation, leading to the emergence of a few dominant players with comprehensive service offerings. For instance, In February 2024, Novo Holdings announced the acquisition of Catalent, Inc. This acquisition fits with Novo Holdings' investing strategy in strong, long-term potential established life science companies.

TheU.S. market for healthcare training and education services outsourcing is characterized by a high impact of regulations. Healthcare organizations must adhere to stringent training requirements set by federal and state regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) and the Occupational Safety and Health Administration (OSHA) standards. Outsourcing training services to specialized providers ensures compliance with these regulations, as these providers are well-versed in the latest requirements and standards. Additionally, regulatory changes often drive demand for updated training programs, further fueling market growth.

The market is characterized by a high impact on service expansion. Several service providers continuously broadening their offerings to include a wide range of training modules. These expansions often encompass clinical training, compliance training, soft skills development, technical training, and continuing education. The diversification of services enables providers to cater to the evolving needs of healthcare organizations and enhances their competitive edge. For example, the introduction of telehealth training programs has been a recent addition to many providers' service portfolios, reflecting the growing adoption of telehealth practices.

Themarket is characterized by a considerable impact of regional expansion. As numerous service providers extending their reach to new geographic areas to tap into unmet market demand. While the market demand in well-established organizations, there is a growing focus on expanding services to low and medium-scaled companies to cater high-quality training and education. Service providers are leveraging digital platforms to overcome geographic barriers, making training accessible to a broader customer base.

Service Insights

The training and development segment accounted for the largest share of over 34.40% of the overall revenue size in 2023 and is estimated to maintain its position over the forecasted timeframe. The high segment growth is owing to the adoption of e-learning platforms to cater to flexibility and accessibility, and the growing emphasis on soft skills training including communication, empathy, and teamwork. These platforms provide online courses, webinars, and virtual simulations that healthcare professionals can access at their convenience. Moreover, compliance with federal and state regulations necessitates continuous training for healthcare professionals. Outsourcing these services ensures that training programs meet regulatory standards, reducing the risk of non-compliance, thereby driving the segment’s growth.

The consulting and advisory segment is anticipated to grow at the fastest CAGR over the forecast period. The segment growth potential can be attributed to the increasing need for customized training strategies to cater specific needs of healthcare organizations. Moreover, increasing outsourcing trend among healthcare organizations due to complications in compliance with federal and state regulations. As service providers cater adequate guidance to adhere to regulatory standards such as HIPAA, OSHA, and the Centers for Medicare & Medicaid Services (CMS) requirements.

Delivery Mode Insights

The offline segment accounted for the largest market share in 2023.The offline delivery mode encompasses traditional in-person training methods such as classroom-based instruction, workshops, seminars, hands-on training sessions, and simulations conducted at healthcare facilities or dedicated training centers. High adoption of offline training and education to enhance productivity, ease of learning, enhanced knowledge transfer, and skill enhancement. Moreover, increasing demand for CMC-compliant services leads to the growing need for Offline CME activities such as conferences and workshops, enabling professionals to stay updated with the latest advancements in medical science and practice. The aforementioned factors are anticipated to boost segmental demand.

The online segment is anticipated to grow at the fastest CAGR over the forecast period. The segmental growth is owing to continuous technological advancements, integration of advanced analytics tools, and availability of digital platforms, among others. A significant increase in the adoption of e-learning platforms for training and education within healthcare organizations will boost segmental demand in the future. Several service providers offer modern e-learning platforms interactive features such as quizzes, videos, and case studies, which enhance engagement and knowledge retention among healthcare professionals, thereby accelerating segmental growth opportunities.

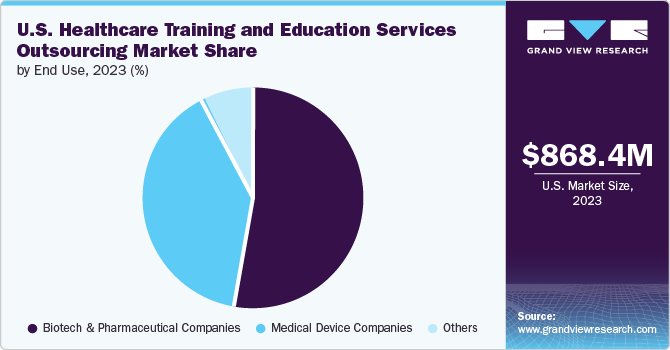

End Use Insights

The biotech & pharmaceutical companies segment dominated the U.S. market in 2023 and is anticipated to witness a CAGR of 4.01 % over the forecast period. These companies require specialized training programs to keep their workforce updated on the latest scientific advancements, regulatory requirements, and paramount practices in drug development and manufacturing. The growing complexity and highly regulated nature of the biotech and pharmaceutical industries in the U.S. are propelling demand for outsourcing service providers for effective and compliant training.

Moreover, training in clinical trial design, execution, and monitoring is a critical component of the biopharma industry. Outsourced service providers offer specialized programs that cover all aspects of clinical research, from protocol development to data analysis, thereby boosting segmental demand.

On the other hand, the medical device companies segment is expected to witness the fastest revenue growth over the forecast period. Medical device companies often lack the internal resources and expertise required to develop comprehensive training programs. Thus, outsourcing training and education services to specialized providers to enhance technical expertise and regulatory standards. Further, there is an increasing emphasis on Continuous Professional Development (CPD) among healthcare professionals using medical devices. As service providers offer ongoing training programs that keep professionals updated on the latest advancements and best practices, to ensure optimal device utilization and patient care, witnessing overall market demand.

Country Insights

South Healthcare Training and Education Services Outsourcing Market Trends

The healthcare training and education services outsourcing market in the South U.S. dominated with the largest share of over 33.60% of the overall revenue in 2023. The strong presence of healthcare companies and service providers in the region is a major factor driving regional market growth. Moreover, rise in the number of academic research institutions in the South region fosters collaboration between outsourcing providers and academia. This collaboration enhances the development of cutting-edge training programs that integrate academic research and clinical expertise.

Midwest Healthcare Training and Education Services Outsourcing Market Trends

The healthcare training and education services outsourcing market in the Midwest region is expected to witness lucrative growth opportunities in the near future. Growing preference for geographic locations such as Illinois, Indiana, Michigan, Ohio, and Wisconsin among healthcare companies will bolster demand for high-quality training and education services. Moreover, the increasing competitive landscape among healthcare companies requires cutting-edge technologies and related skilled workforce with reduced operational cost, thereby accelerating overall market growth potential in the Midwest region.

Key U.S. Healthcare Training And Education Services Outsourcing Company Insights

The key industry participants operating across the market, implement several strategic initiatives such as acquisitions, mergers, service launch, collaborations, partnerships and agreements, expansion, etc. to enhance market reach and gain a competitive edge in the market. For instance, in January 2024, Evotec collaborated with the Crohn’s & Colitis Foundation to advance drug discovery for ulcerative colitis and inflammatory Bowel Disease (IBD). Through this collaboration, Evotec gains access to industry partners and academic researchers for research and advanced knowledge transfer.

Key U.S. Healthcare Training And Education Services Outsourcing Companies:

- Parexel International Corporation

- Thermo Fisher Scientific, Inc.

- IQVIA

- Medpace

- LabCorp

- Charles River Laboratories

- ICON plc.

- Syneos Health

- Lonza

- Catalent Inc.

Recent Developments

-

In April 2024, Parexel and Palantir announced a multiyear strategic collaboration to leverage AI to help its biopharmaceutical customers enhance and accelerate the delivery of clinical trials.

-

In September 2023, ICON plc announced a partnership with the U.S. Biomedical Advanced Research and Development Authority (BARDA) for the initiation of a clinical trial designed for the evaluation of the effectiveness of next-gen COVID-19 vaccine candidates.

-

In March 2023, Charles River launched Apollo, a cloud-based platform that assists drug developers in accessing study data, study milestones, documents, cost estimates, and program planning tools.

U.S. Healthcare Training And Education Services Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 889.9 million

Revenue forecast in 2030

USD 1,121.4 million

Growth rate

CAGR of 3.93% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, delivery mode, end use, region

Region scope

Northeast; Midwest; South; West

Key companies profiled

Parexel International Corporation;, Thermo Fisher Scientific, Inc.; IQVIA; Medpace; LabCorp; Charles River Laboratories; ICON plc.; Syneos Health; Lonza; Catalent Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional and segment scope.

U.S. Healthcare Training And Education Services Outsourcing Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. healthcare training and education services outsourcing market report based on service, delivery mode, end use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Training and Development

-

Technical Training

-

Compliance Training

-

Clinical Training

-

Soft Skills Training

-

-

Assessment and Evaluation

-

Curriculum Design and Development

-

Consulting and Advisory

-

Administrative Services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotech & Pharmaceutical Companies

-

Medical Device Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Northeast

-

Midwest

-

South

-

West

-

Frequently Asked Questions About This Report

b. The U.S. healthcare training and education services outsourcing market size was estimated at USD 868.40 million in 2023 and is expected to reach USD 889.90 million in 2024.

b. The U.S. healthcare training and education services outsourcing market is expected to grow at a compound annual growth rate of 3.93% from 2024 to 2030 to reach USD 1,121.4 million by 2030.

b. Training and development segment dominated the U.S. healthcare training and education services outsourcing market with a share of 34.40% in 2023 owing to technological advancements, regulatory compliance requirements, and the need for specialized expertise.

b. Some key players operating in the U.S. healthcare training and education services outsourcing market are Parexel International Corporation, Thermo Fisher Scientific, Inc., IQVIA, Medpace, LabCorp, Charles River Laboratories, ICON plc., Syneos Health, Lonza, Catalent Inc.

What are the factors driving the U.S. healthcare training and education services outsourcing market?b. Key factors that are driving the U.S. healthcare training and education services outsourcing market growth include ongoing technological advancements, growing need for cost reduction, and regulatory changes. Increasing outsourcing trends for several training and education programs such as clinical training, technical training, compliance training, and soft skills development services among healthcare industry is anticipated to propel U.S. market revenue growth in near future.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."