- Home

- »

- Medical Devices

- »

-

U.S. Healthcare Third-party Logistics Market Report, 2030GVR Report cover

![U.S. Healthcare Third-party Logistics Market Size, Share & Trends Report]()

U.S. Healthcare Third-party Logistics Market Size, Share & Trends Analysis Report By Industry (Biopharmaceutical, Pharmaceutical, Medical Device), By Supply Chain, By Service Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-087-7

- Number of Report Pages: 96

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. healthcare third-party logistics market size was valued at USD 80.53 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.04% from 2023 to 2030. The market has been growing significantly due to the expanding e-commerce sector. Healthcare companies are using online platforms to sell their products because they lack the resources to provide their own logistics services, which has increased the demand for third-party logistics. Increasing technological advancements in the domain is expected to create growth opportunity for the market. The adoption of advanced technologies such as real-time tracking systems, the Internet of Things (IoT), and blockchain is becoming more accepted in healthcare logistics. These technologies support shipment tracking, visibility enhancement, and product integrity, which improve supply chain management and increase customer experience.

A complex regulatory environment related to pharmaceutical and medical devices is further expected to provide this market with growth opportunities. Storage, handling, and transportation of drugs and medical devices are all subject to stringent regulations and compliance standards in the healthcare industry. The third-party logistics entities offer expertise in navigating regulatory frameworks that can aid healthcare companies ensure compliance and avoid penalties. Safety measures and quality control requirements are often part of regulatory compliance. Third-party logistic entities help their clients maintain and implement these standards throughout the supply chain.

The COVID-19 pandemic significantly impacted the market. The COVID-19 pandemic resulted in increased demand for medical supplies such as ventilators, personal protective equipment, and other crucial products. As a result, several companies in the market adopted the changing needs of the healthcare business to meet the demand. Moreover, the COVID-19 pandemic contributed to increased partnerships between healthcare entities with third-party logistics companies to operate in a growing and changing demand.

Industry Insights

The biopharmaceutical segment dominated the overall market with a revenue share of over 60.0% in 2022. This dominance is attributed to an increase in the number of biosimilar introductions and pharmaceutical companies' focus on their distribution network.Technological advances have increased the use of temperature management logistic services. Furthermore, the growing trend of medical companies outsourcing logistics to strengthen their distribution system is also expected to boost the segment’s growth.

The medical device segment is expected to witness the fastest growth over the forecast period. Supply chains in the medical device sector are complex and involve the sourcing of raw materials, manufacturing procedures, quality control, and distribution. 3PL providers offer expertise in enhancing productivity, cutting costs, and streamlining supply chains. They can help with order fulfillment, inventory management, shipping, and warehousing, guaranteeing a smooth supply chain from the point of production to the end-user.

Supply Chain Insights

The non-cold chain logistics segment generated the largest revenue share of over 60% in 2022.This is due to the rising sales of pharmaceuticals through distributors. Scalability, reduced operational costs, higher profits, and fewer risks are all features of logistic services. Due to all these advantages, third-party logistic providers have become an essential component of the pharmaceutical business.

Cold chain logistics is expected to showcase a significant market share in the coming years. There is increasing demand for temperature-sensitive biologics, pharmaceuticals, vaccines, and other healthcare products in the U.S. This demand is driven by factors such as the introduction of advanced therapies, an aging population, and the need for effective disease control. These pharmaceutical products need strict temperature control throughout the supply chain, resulting in raised dependence on cold chain logistics.

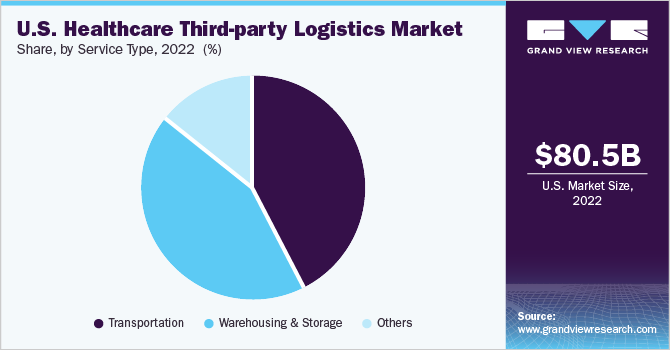

Service Type Insights

The warehousing and storage segment dominated with the largest revenue share of over 40.0% in 2022.In the healthcare industry, efficient inventory management is essential to ensuring the availability and prompt delivery of drugs and medical supplies. Warehousing and storage entities offer services such as stock rotation, and inventory tracking to simplify the supply chain processes. These services assist healthcare facilities in minimizing stockouts, increasing operational effectiveness, and optimizing inventory levels. Such advantages are expected to boost the segment growth.

The other services segment is expected to register the fastest CAGR during the forecast period.This segment includes custom & duty management, packaging, procurement services, and a few other value-added services.Procurement services are one of the crucial services of healthcare logistics. To ensure that production costs do not exceed a company's budget objectives, procurement and logistics management must coexist and function together efficiently.

Regional Insights

The Midwest region dominated the overall market share of over 25.0% in 2022. Pharmaceutical and biotechnology companies are largely concentrated in the Midwest. These companies produce a wide variety of healthcare products, such as pharmaceuticals, biologics, medical equipment, and diagnostics. Third-party logistics services, such as warehousing, shipping, and distribution, are in high demand in the area as a result of the presence of these firms, which contributes to the Midwest's dominant position in the market.

The Northeast region is expected to show significant growth in the forecast period. The Northeast region is expected to show significant growth in the forecast period. The Northeast region has a well-established healthcare infrastructure, including clinics, hospitals, healthcare networks, and research institutions. Healthcare providers in the area rely on effective supply chain and logistics solutions for the efficient availability of equipment, drugs, and medical supplies.

Key Companies & Market Share Insights

The key entities in the market entered into various strategic initiatives, such as new service launches, partnerships, and mergers & acquisitions, to expand their position in the market. For instance,in February 2022, DHL Supply Chain invested around USD 400 million to expand its network for distributing pharmaceutical and medical devices in the U.S. DHL Supply Chain's latest investment includes six additional U.S. sites by the end of 2022 with the ultimate goal of bringing essential healthcare supplies closer to business partners and patients. Some prominent players in the U.S. healthcare third-party logistics market include:

-

ShipMonk

-

DHL International

-

Cardinal Health

-

MCKESSON CORPORATION

-

Kuehne+Nagel

-

AmerisourceBergen Corporation

-

C.H. Robinson

-

CEVA Logistics

-

Promptus, LLC

-

FedEx

U.S. Healthcare Third-party Logistics Market Report Scope

Report Attribute

Details

The revenue forecast in 2030

USD 160.80 billion

Growth Rate

CAGR of 9.04% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Industry, supply chain, service type, region

Country scope

U.S.

Key companies profiled

ShipMonk; DHL International; Cardinal Health; MCKESSON CORPORATION; Kuehne+Nagel; AmerisourceBergen Corporation; C.H. Robinson; CEVA Logistics; Promptus, LLC; FedEx

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

U.S. Healthcare Third-party Logistics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. healthcare third-party logistics market report based on industry, supply chain, service type, and region:

-

Industry Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biopharmaceutical

-

Pharmaceutical

-

Medical Device

-

-

Supply Chain Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cold Chain

-

Non-cold Chain

-

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transportation

-

Air Freight

-

Sea Freight

-

Overland Transportation

-

-

Warehousing And Storage

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Northeast

-

Southwest

-

West

-

Southeast

-

Midwest

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."