U.S. Healthcare Professional Training Market Size, Share & Trends Analysis Report By Mode Of Education (Offline, Online), By Organization Type, By End-user, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-105-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The U.S. healthcare professional training market size was estimated at USD 230.6 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030.The demand for healthcare professionals, including physicians, nurses, pharmacists, and other allied health practitioners, has been consistently rising due to factors such as population growth, aging demographics, and advancements in medical treatments and technology. This has led to a need for more healthcare training programs. The healthcare system in the U.S. comprises private and public, for-profit, and non-profit insurers and providers.

The federal government supports the national Medicare program for persons 65 and over, along with certain people with disabilities, and programs for veterans and low-income people, such as Medicaid and the Children's Health Insurance Program. The federal government makes significant investments in the education, and training of healthcare professionals, and these programs provide the federal government another opportunity to influence quality and safety. For instance, the (SAMHSA) Substance Abuse and Mental Health Services Administration is an organization under the U.S. Department of Health and Human Services (HHS) for leading public health efforts to improve the nation's behavioral health.

The emergence of COVID-19 and growing internet penetration have increased the demand for medical education. Several schools and institutes throughout the country are embracing online education to provide more flexibility in learning. Students continue their medical education online post the shutdown, as online courses have various advantages. For example, these courses can be accessed anytime and from any location. They are inexpensive and can be customized to the student's preferred learning style.

Several hospitals and ambulatory surgery centers provide hybrid medical education, combining classroom and online learning options. According to the National Library of Medicine (NCBI), approximately 78% of medical schools successfully transitioned to online learning, even though only a few 13% offered many online courses before the pandemic, including the University of Kentucky, Stanford Medicine, and the University of Pennsylvania's Perelman School of Medicine, The Kaiser Permanente Bernard J. Tyson School of Medicine in Pasadena, California.

There has been a growing recognition of the importance of health equity in the U.S. healthcare system. This recognition also influences the trends in the healthcare professional training industry, with an increasing focus on addressing disparities and promoting equitable access to quality healthcare. Moreover, many healthcare professional training programs expanded their cultural competence training. For instance, medical schools incorporated workshops and modules on culturally responsive care, addressing topics such as providing LGBTQ+ inclusive care, understanding the unique healthcare needs of immigrant populations, and recognizing the impact of systemic racism on health outcomes.

Mode of Education Insights

The offline segment dominated the market with a revenue share of 70.5% in 2022. The offline segment refers to in-person or traditional classroom-based training, which has traditionally been a prominent and essential component of healthcare education. Many healthcare professional training programs require students to gain hands-on experience through clinical practice and experiential learning. This involves working directly with patients, healthcare teams, and mentors in healthcare settings. These practical experiences are typically conducted offline to provide students with real-world exposure and skill development.

The online segment is projected to grow at the highest CAGR of 12.5% during the forecast period. Online learning is less expensive than traditional schooling since it eliminates the need for travel and infrastructure. Universities and colleges are rapidly updating their curricula to accommodate online education system protocols, which is expected to boost the online segment throughout the projection period. In recent years, there has been a gradual shift toward online and hybrid models of healthcare professional training. Online learning platforms and technologies have been increasingly integrated into educational programs, offering flexibility, accessibility, and the opportunity for self-paced learning. This shift has been further accelerated by the COVID-19 pandemic, which necessitated remote learning and social distancing measures.

Organization Type Insights

In 2022, training institute was the dominating segment, with a revenue share of 38.9%. The factors attributed to the segment growth include advancements in medical technology, an aging population, and increased demand for specialized healthcare services. Training institutes play a crucial role in preparing individuals for careers in the healthcare industry by providing them with the necessary skills and knowledge. Moreover, training institutes introduce innovative medical programs and platforms in both conventional and online formats to increase student engagement and enrollment in the medical profession in response to the growing need to provide experience in quality care management and upskilling of medical knowledge of nurses, physical therapists, and others.

Hospitals in the U.S. are expanding their residency programs to meet the growing demand for healthcare professionals. This includes increasing the number of residency positions and developing new programs in various specialties. The expansion aims to train and retain a skilled workforce to address healthcare needs across different regions. For instance, in January 2019, The University of California, San Francisco (UCSF) Medical Center expanded its residency programs in primary care and specialty fields to address the shortage of physicians in underserved areas. They have increased the number of residency slots and established new training sites in rural communities.

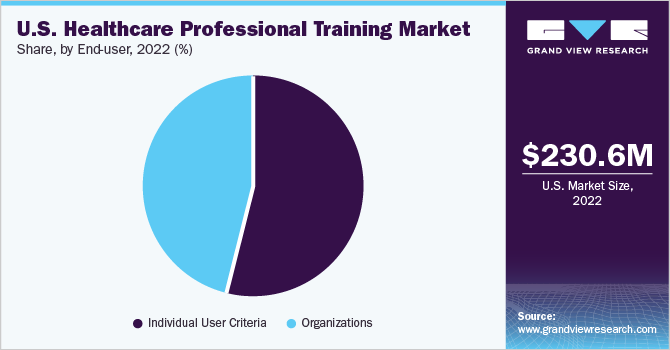

End-user Insights

The individual user criteria segment led the market with a revenue share of 54.1% in 2022. The U.S. healthcare professional training serves diverse end-users, including individuals with different backgrounds, qualifications, and career goals. There has been an increasing trend of individuals from non-healthcare backgrounds seeking training and education to transition into healthcare professions.

For example, professionals from IT or business backgrounds may pursue training in healthcare informatics or management to enter the healthcare industry. Moreover, healthcare professionals seek additional training and education to enhance their skills and specialize in specific areas. For instance, a registered nurse may pursue training in a specialized field, such as critical care or pediatric nursing, to expand their career opportunities and provide specialized care.

The organization end-user segment is anticipated to hold the highest revenue share of the U.S. healthcare professional training industry in 2030. Moreover, it is also estimated to dominate the market throughout the forecast period. This is due to the surge in government initiatives to enhance the country's health training quality and professionalism. These organizations include groups of doctors, hospitals, and other healthcare providers with strong networks in collaboration with other health associations, which helps them raise funds for their program.

Key Companies & Market Share Insights

The market is characterized by strong competition, with a few major U.S. competitors owning a significant market share. The major focus is developing new products and collaborating among the key players. For instance, in May 2023, Suki AI, Inc. announced the launch of Suki Experts, a broad and experienced group of doctors utilizing Suki AI Assistant. They will assist the business in developing healthcare tools driven by AI. Some prominent players in the U.S. healthcare professional training market include:

-

AiCure

-

Ava

-

Cass

-

Deep6.ai

-

Healthily

-

K Health

-

KANINI Software Solutions

-

Kantify

-

Lyssn.io

-

Microsoft Azure

-

Nuance Communications

-

Orion Health

-

Suki AI, Inc.

-

Veradigm LLC

U.S. healthcare professional training Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 244.49 million |

|

Revenue forecast in 2030 |

USD 408.77 million |

|

Growth rate |

CAGR of 7.6% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Mode of education, organization type, end-user |

|

Country scope |

U.S. |

|

Key companies profiled |

Nuance Communications; K Health; Ava; Lyssn.io; Healthily; Deep6.ai; Cass; Suki AI, Inc.; AiCure; KANINI Software Solutions; Orion Health; Microsoft Azure; Veradigm LLC; Kantify |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Healthcare Professional Training Market Report Segmentation

This report forecasts revenue growth in the U.S. and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. healthcare professional training market report based on mode of education, organization type, and end-user:

-

Mode of Education Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Organization Type Outlook (Revenue, USD Million, 2017 - 2030)

-

School of Medicine

-

Public Sector Organizations

-

Hospitals/Clinics

-

Training Institutes

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Individual User Criteria

-

Organizations

-

Frequently Asked Questions About This Report

b. The U.S. healthcare professional training market size was estimated at USD 230.60 million in 2022 and is expected to reach USD 244.49 million in 2023.

b. The U.S. healthcare professional training market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 408.77 million by 2030.

b. By organization type, the training Institute segment dominated the market with a revenue share of 38.9% in 2022. This is due to training institutes introducing innovative medical programs and platforms in conventional and online formats to increase student engagement.

b. Some key players operating in the U.S. healthcare professional training industry include AiCure, Ava, Cass, Deep6.ai, Healthily, K Health, KANINI Software Solutions, Kantify, Lyssn.io, Microsoft Azure

b. Key factors driving the market growth include the advent of multiple medical and educational online programs attributable to market expansion.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."