U.S. Healthcare Payers Core Administrative Processing Solutions Market Size, Share & Trends Analysis Report By Type (Software, Services), By Deployment (On-premise, Cloud-based), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-304-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

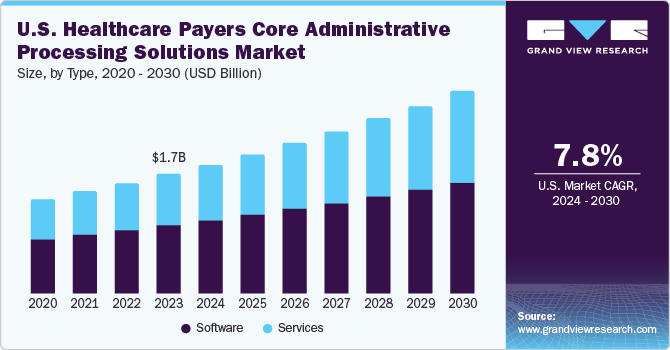

The U.S. healthcare payers core administrative processing solutions market size was estimated at USD 1.7 billion in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030. The market growth is attributed to the growing demand for cost reduction, technological advancements, the modernization of enrollment and billing processes, the increasing adoption of strategic initiatives by market players, and evolving regulatory and compliance requirements.

Modernizing enrollment and billing processes in the healthcare payer industry is contributing to market growth. By leveraging modern technologies and efficient systems, healthcare payers efficiently onboard new members, accurately bill for services and optimize revenue management. This shift improves operational efficiency and elevates the overall quality of service, leading to customer satisfaction and loyalty. Combining innovative approaches and adherence to best practices in the modernization of enrollment & billing empowers healthcare payers to gain a competitive edge in the market, ensuring sustainable growth and enhanced financial performance.

Moreover, the increasing advancements in artificial intelligence (AI) have captured the attention of healthcare industry leaders, including health plan executives and academia, regarding its potential effects on healthcare operations. Health payers are implementing AI within core administration processing systems to enhance auto-adjudication rates, streamline prior authorization processes, and mitigate fraud, waste, and abuse.

A study published by the National Bureau of Economic Research in January 2023 showcased that the broader adoption of AI in healthcare reduces 5 to 10 percent in U.S. healthcare expenditures, translating to annual savings of approximately USD 200 billion to USD 360 billion. The research identifies claims management, member services, and corporate functions as key areas where AI could significantly reduce administrative costs for healthcare payers.

Market Concentration & Characteristics

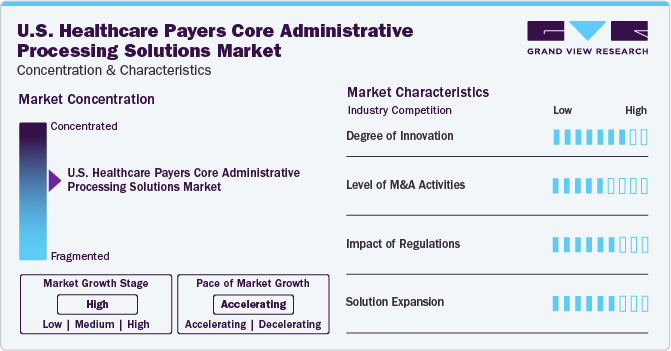

The market growth is high and accelerating. Prominent players in the market are investing in technological advancements of CAPS capable of meeting evolving healthcare regulatory requirements.

The technology solutions in the market is characterized by a high degree of innovation, with new technologies being developed and introduced at regular intervals.

Key market players, such as Cognizant and HealthEdge Software, Inc., are involved in merger and acquisition activities. These companies are expected to expand their geographic reach and enter new territories through M&A.

The regulations in the country are primarily aimed at fraud & abuse within healthcare, aiming to reduce provider misconduct and recover funds that healthcare programs have inappropriately disbursed. Thus, key players in the market are investing in developing solutions compliant with these regulations.

Key market players are investing in solution expansion to meet the growing demand for CAPS.

Case Study

Geisinger Health Plan (GHP) aimed to expand its market presence and develop new Type lines but faced challenges with its outdated 20-year-old core administration system. GHP partnered with Cognizant to implement the TriZetto Facets core administration platform, along with NetworX Pricer and TriZetto Elements, to enhance efficiency, scalability, and compliance with regulations. This modernization increased auto-adjudication rates from 75% to 85%, repurposed 20 staff members to higher-value activities, and enabled GHP to expand into new markets. The project was completed on time and within budget, achieving 100% on-time submissions to CMS and 99% provider payment accuracy.

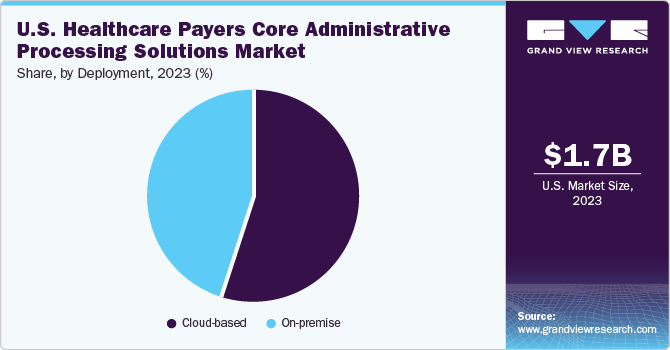

Deployment Insights

Cloud-based solutions accounted for a significant revenue market share of 55.42% in 2023 and is anticipated to witness the fastest growth at a CAGR of 9.3% over the forecast period. The market growth is primarily driven by the scalability of cloud-based solutions, which allows healthcare payers to adapt their administrative operations to changing needs efficiently. Moreover, adopting cloud-based systems reduces the necessity for on-premises hardware and subsequent maintenance costs, facilitating more effective resource allocation by organizations.

Moreover, cloud-based solutions offer remote accessibility, enabling collaboration among various healthcare professionals, irrespective of their geographical locations. This accessibility streamlines patient care and decision-making timelines. Furthermore, cloud platforms facilitate the integration of advanced analytics and machine learning algorithms. The rising awareness of the advantages of adopting CAPS is expected to propel market growth over the forecast period.

Type Insights

The software held the largest revenue market share of 57.56% in 2023. The increasing demand for advanced and integrated solutions to streamline administrative processes, reduce operational costs, and enhance efficiency is fueling the growth. In addition, regulatory changes and compliance requirements necessitate implementing advanced administrative software to ensure accurate and timely claims, billing, and payment processing. Moreover, advancements in technology, including artificial intelligence and machine learning, are enhancing the functionality and effectiveness of these software solutions, making them indispensable tools for healthcare payers.

The services segment is expected to grow at the fastest CAGR of 8.6% over the forecast period. The growth is driven by the increasing complexity of healthcare regulations and policies, which require specialized expertise and support for effective compliance and risk management.

Key U.S. Healthcare Payers Core Administrative Processing Solutions Company Insights

Key players are adopting new Type development, partnership, and merger & acquisition strategies to increase their market share. Market players such as HealthEdge Software, Inc., Optum, Cognizant, HealthAxis, Plexis Healthcare Systems, Mphasis, and SS&C Technologies dominated the market.

Key U.S. Healthcare Payers Core Administrative Processing Solutions Companies:

- HealthEdge Software, Inc.

- Optum

- Cognizant

- HealthAxis

- Plexis Healthcare Systems

- Mphasis

- SS&C Technologies

- Conduent

- RAM Technologies

- Evolent

- Advantasure

- VBA software

- Advalent Corp

Recent Developments

-

In March 2024, Cognizant collaborated with Microsoft to leverage generative AI in healthcare management to improve healthcare payers' and On-premise Typeivity and efficiency. This partnership focuses on the features of the TriZetto Assistant on Facets, employing Azure OpenAI Service and Semantic Kernel to incorporate generative AI functionalities directly into the TriZetto user interface.

-

In October 2022, Optum announced the acquisition of Change Healthcare. This acquisition unites the companies under a shared objective to foster a more streamlined, intelligent, and adaptable health system for patients, payers, and healthcare On-premise. This acquisition aims to streamline core administrative, clinical, and payment processes crucial for healthcare On-premise and payers in delivering patient care. This integration is expected to enhance operational efficiencies, minimize complexities, and contribute to overall health system improvements, potentially leading to reduced expenses and improved experiences for all involved parties.

U.S. Healthcare Payers Core Administrative Processing Solutions Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.84 billion |

|

Revenue forecast in 2030 |

USD 2.88 billion |

|

Growth rate |

CAGR of 7.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, deployment |

|

Key companies profiled |

HealthEdge Software, Inc.; Optum; Cognizant; HealthAxis; Plexis Healthcare Systems; Mphasis; SS&C Technologies; Conduent; RAM Technologies; Evolent; Invidasys; Advantasure; VBA software; Advalent Corp |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Healthcare Payers Core Administrative Processing Solutions Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. healthcare payers core administrative processing solutions market report based on type and deployment:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Standalone

-

Integrated

-

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud-based

-

Frequently Asked Questions About This Report

b. The U.S healthcare payers core administrative processing solutions market size was estimated at USD 1.7 billion in 2023 and is expected to reach USD 1.84 billion in 2024.

b. The U.S healthcare payers core administrative processing solutions market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 2.88 billion by 2030.

b. Software dominated the U.S healthcare payers core administrative processing solutions market with a share of 57.56% in 2023. This is attributable to the increasing demand for advanced and integrated solutions to streamline administrative processes, reduce operational costs, and enhance efficiency.

b. Some key players operating in the U.S healthcare payers core administrative processing solutions market include HealthEdge Software, Inc.; Optum; Cognizant; HealthAxis; Plexis Healthcare Systems; Mphasis; SS&C Technologies; Conduent; RAM Technologies; Evolent; Invidasys; Advantasure; VBA software; Advalent Corp.

b. Key factors driving market growth include the growing demand for cost reduction, technological advancements, modernization of enrollment and billing processes, increasing adoption of strategic initiatives by market players, and evolving regulatory and compliance requirements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."