- Home

- »

- Healthcare IT

- »

-

U.S. Healthcare Payer Analytics Market Size Report, 2030GVR Report cover

![U.S. Healthcare Payer Analytics Market Size, Share & Trends Report]()

U.S. Healthcare Payer Analytics Market (2025 - 2030) Size, Share & Trends Analysis Report By Analytics Type (Descriptive Analytics), By Component (Software), By Delivery Model, By Application, And Segment Forecasts

- Report ID: GVR-4-68039-193-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

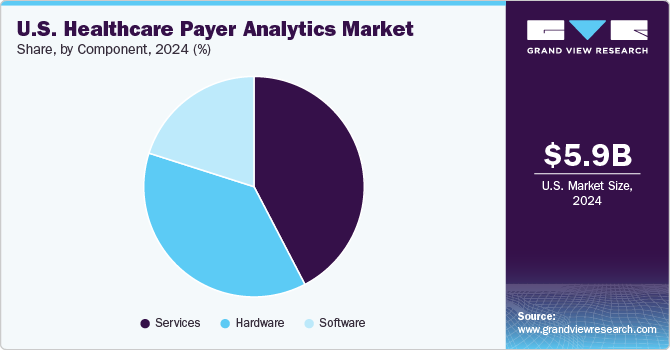

The U.S. healthcare payer analytics market size was estimated at USD 5.90 billion as of 2024. It is expected to expand at a CAGR of 21.5% from 2025 to 2030. The increasing rate of digitization in the healthcare industry is the primary factor driving growth in analytics for the payers’ market. The digital records and digital technology being adopted by the health system across the U.S. create a huge amount of data that can be used to derive meaningful results and observations to decrease cost, optimize treatment, and mitigate risks.

The U. S. has witnessed a steady rise in healthcare expenditure, reaching $4.9 trillion in 2023, which represents 17.6% of the national GDP, as reported by the National Health Expenditure. This upward trend reflects the increasing infrastructural investments and the need to manage higher patient volumes. Key growth drivers include the rising prevalence of chronic and acute diseases and the growing demand for advanced, patient-centric healthcare solutions. Additionally, the Affordable Care Act (ACA) has played a pivotal role in transforming the care delivery model, shifting the focus from volume-based services to value-based care, thereby influencing hospital systems to prioritize quality outcomes over patient throughput.

The adoption of healthcare analytical solutions has also resulted in massive growth in the market. Advanced analytical techniques are helpful in better decision-making, helping administrators make informed decisions about the business and the patients with healthcare plans, improving their efficiency, and improving the organization's overall profitability. During the pandemic, the adoption of healthcare analytics grew across the industry; this not only helped identify patients who were at greater risk but also identified potential risks related to the further spread of the virus by ensuring timely treatment of these individuals. Healthcare analytics also helps analyze the possible benefits and problems when implementing a new strategy for the organization, determining its chances of success.

Integrating Artificial Intelligence (AI) and Machine Learning (ML) into healthcare payer analytics rapidly transforms how health plans manage costs, improve outcomes, and enhance operational efficiency. AI and ML enable payers to move beyond traditional analysis by delivering predictive insights that identify high-risk members, forecast future healthcare utilization, and uncover real-time cost-saving opportunities. These technologies support automated claims adjudication, fraud detection, member engagement personalization, and risk adjustment optimization, allowing payers to make smarter, faster decisions.

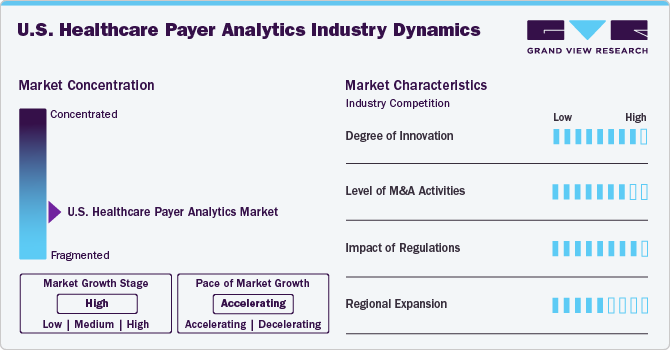

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the U.S. healthcare payer analytics industry is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, moderate growth was observed in regional expansion.

The industry's degree of innovation is high. The market is experiencing significant innovation as numerous players introduce new products with advancements in artificial intelligence (AI), machine learning (ML), and big data technologies. These innovations transform how payers manage costs, detect fraud, and enhance patient care. For instance, in June 2024, Milliman MedInsight launched a new Payer Platform offering advanced healthcare analytics to boost employer insights and support value-based care models.

The level of partnerships & collaboration activities by key players in the industry is high to increase their capabilities, expand product portfolios, and improve competencies. For instance, in April 2023, Cognizant and Microsoft expanded their healthcare collaboration to integrate Cognizant's TriZetto healthcare products with Microsoft Cloud for Healthcare, aiming to enhance interoperability and streamline claims management. This partnership enables healthcare payers and providers to access advanced cloud-based solutions, improving operational efficiency and patient experiences.

The impact of regulations on the market is high. The U.S. healthcare payer analytics industry is significantly influenced by various regulations, which play a critical role in adopting advanced data management solutions, ensuring compliance with interoperability and transparency requirements, enhancing patient data security, and promoting value-based care initiatives. With the growing data security and privacy concerns, related regulations are evolving, driving the demand for solutions complying with the regional regulations, such as the CMS Interoperability and Patient Access Final Rule.

The industry's level of regional expansion is moderate. While most companies operate nationally, there is a growing focus on expanding into specific high-opportunity regions such as California, Texas, Florida, and New York, where large insured populations and advanced Medicaid or value-based care programs exist.

Case Study:

Enhancing Healthcare Payer Interoperability and Claims Accuracy Through Advanced Integration Solutions.

Challenge:

A healthcare technology company aimed to develop a hybrid, cloud-based central platform for healthcare payers to enhance operational efficiency, reduce costs, and improve member experiences. The primary challenges included achieving rapid interoperability with third-party Core Administrative Processing Solutions (CAPS), seamlessly integrating HL7 FHIR and X12 EDI standards, and ensuring consistent, accurate, and timely claims processing.

Solution:

The company partnered with PilotFish to leverage its Integration Middleware, which offers a graphical Assembly Line approach for interface configuration. PilotFish’s eiConsole for Healthcare facilitated easy mapping of FHIR and X12 EDI transactions through a drag-and-drop Data Mapper. The solution also featured a lenient parser capable of handling non-compliant data and variations in trading partner requirements, ensuring robust support for HL7 FHIR with platform-neutral APIs and validation of FHIR extensions.

Outcome

By implementing PilotFish’s integration engine, the company successfully entered the Claims Accuracy space, delivering advanced FHIR capabilities alongside X12 EDI functionality. This led to 100% consistent, accurate, and timely claims processing, impressing the executive team and positioning the company as a market leader in healthcare payer solutions.

Best healthcare payer analytics type at each revenue cycle step

Revenue Cycle Step

Best Analytics Type

Purpose

Patient Registration

Descriptive & Diagnostic

Identify and rectify data entry errors to reduce claim denials.

Eligibility Verification

Predictive

Anticipate and address coverage issues before claiming submission.

Charge Capture

Discovery

Detect missing or incorrect charges promptly to prevent revenue leakage.

Coding & Documentation

Diagnostic

Analyze coding errors and benchmark against standards to improve accuracy.

Claims Submission

Prescriptive

Optimize submission processes to enhance first-pass yield and reduce denials.

Denial Management

Diagnostic & Predictive

Uncover root causes of denials and forecast potential future issues.

Payment Posting

Descriptive & Real-Time

Monitor payment accuracy and identify discrepancies in real-time.

Analytics Type Insights

The descriptive analytics segment had the largest market share in 2024. This analytics type is widely used in process optimization and administrative activities. This method analyzes past and present data to produce meaningful information or patterns that can significantly impact future decisions. Specifically, for COVID, it has been used to determine how contagious the virus is by studying the rate of positive COVID tests in a given population over a specific time.

The predictive analysis segment is expected to grow at the fastest CAGR over the forecast period. Predictive data analytics helps care providers create the best treatment plan for patients, resulting in better outcomes. Personalized care has been gaining a lot of momentum, and predictive analysis has proved useful in understanding the specific treatment needs of each patient.

Delivery Model Insights

The on-premises segment dominated the market with a share of 47.0% in 2024. The healthcare industry is evolving in terms of technology. The industry has largely adopted the use of on-premise models, and they have many benefits, like better access to data, reduced chances of data theft, reduced cost, and ease of maintenance. The biggest downside of on-premises data storage is storage capacity limitations, which make it a huge hurdle in the growth of this segment.

The cloud-based delivery model is the fastest-growing sub-segment, anticipated to register the fastest growth rate. The rapid adoption of cloud-based solutions within healthcare organizations has resulted in the rapid growth of the sub-segment. The biggest hindrance posed by the on-premise storage is easily managed by a cloud-based solution, since there are no capacity limitations, the data that can be stored is huge, and requires minimal setup by the organization, which has resulted in the market's growth.

Application Insights

Based on application, the financial application segment dominated the market with the largest revenue share in 2024. The increased adoption rate by government and private facilities alike has been the main factor driving the market's growth. Several financial applications can save millions in fraudulent claims, claims settlement, and risk analysis for insurance companies. According to the U.S. Sentencing Commission Office of Public Affairs, in 2023, 64,124 healthcare fraud cases were reported in the U.S., with an increase of 4.2% compared to 2019.The use of healthcare analytics can not only reduce incidences of fraud but can also optimize insurance plans and recover losses.

The clinical segment is expected to grow at a substantial rate during the forecast period. This growth is attributed to the advancements in predictive analytics enabling healthcare providers to personalize treatment plans more effectively, leading to improved patient outcomes and cost efficiencies. This personalized approach to care is becoming increasingly important as the industry shifts towards value-based models. In addition, the integration of advanced analytics in clinical applications also supports early disease detection and proactive health management, further contributing to the segment's growth. As healthcare organizations continue to invest in data-driven strategies, the clinical segment is expected to grow significantly in the coming years.

Component Insights

Based on the components, the services segment had the largest market share of 42.4% in 2024. Data outsourcing has recently become a trend in this segment. This not only offers establishments the chance to get the data analyzed from industry experts but also saves the cost of training and educating their staff to do the same. Furthermore, the growing need for consulting, implementation, data integration, and ongoing analytics support services among healthcare payers contributes to the segment's largest share.

The hardware segment in the market is experiencing steady growth, driven by increasing adoption of edge computing devices, secure data storage systems, and high-performance servers that support real-time claims processing, fraud detection, and population health analytics across payer networks.

Key U.S. Healthcare Payer Analytics Company Insights

The market is highly fragmented, with many small and large players operating. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are key in propelling market growth.

Key U.S. Healthcare Payer Analytics Companies:

- CloudMedx

- DataSmart Solutions

- Amitech Solutions

- Caserta Concepts

- Greenway Health, LLC

- IMAT Solutions

- Health Catalyst

- Indegene

- IBM

- Optum

- Oracle

- Citius Tech

- MedeAnalytics

- Verisk Analytics, Inc.

- McKesson Medical-Surgical Inc.

- Veradigm LLC

- IQVIA

Recent Developments

- In March 2025, Innovaccer, Inc. launched the 360-Degree Gap Closure Solution for Payers, an AI-powered platform to streamline health plan risk adjustment and quality improvement processes. This solution enables payers to proactively identify and close care gaps across various settings by leveraging real-time data integration, advanced analytics, and automated workflows.

“We are bringing a much-needed shift in how payers approach risk and quality,”

-Abhinav Shashank, cofounder and CEO at Innovaccer.”

- In November 2024, Inovalon has launched seven new software solutions and feature expansions, including Converged Provider Enablement, Converged Record Review, and Converged Outreach Connectors. These tools are designed to improve risk score accuracy, automate medical record reviews, and facilitate secure member data sharing, thereby advancing data-driven decision-making for health plans.

“With our deep industry expertise, extensive network of customers, and the largest healthcare primary source dataset in the industry, we continue to shape healthcare’s data-driven future”.

-Eron Kelly, President of Inovalon

- In September 2024, Talkdesk launched the Healthcare Experience Cloud for Payers, an AI-powered contact center platform tailored for U.S. healthcare insurance providers.

“This strengthens our leadership in the healthcare market by expanding the capabilities of Healthcare Experience Cloud. In addition to supporting healthcare providers like hospitals and clinics, the platform now offers pre-trained AI and workflows designed specifically for payers, delivering tailored CX solutions for both sides of the healthcare ecosystem.”

-Tiago Paiva, chief executive officer and founder of Talkdesk

- In June 2024, Cognizant launched its first suite of healthcare large language model (LLM) solutions on Google Cloud's generative AI platform. These AI-driven tools target key administrative workflows such as appeals management, provider contracting, marketing operations, and health plan selection. They aim to streamline processes, reduce manual errors, and enhance member experiences for healthcare payers.

“As we continue to build on our partnership with Google Cloud, we're working to keep clients in the healthcare industry at the forefront of AI-led transformation.”

-Surya Gummadi, EVP and President, Cognizant Americas.

U.S. Healthcare Payer Analytics Market Report Scope

Report Attribute

Details

Market Size for 2025

USD 7.33 billion

Revenue forecast in 2030

USD 19.38 billion

Growth Rate

CAGR of 21.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Analytics type, component, delivery mode, application

Key companies profiled

CloudMedx; DataSmart Solutions; Amitech Solutions; Caserta Concepts; Greenway Health, LLC; IMAT Solutions; Health Catalyst; Indegene; IBM; Optum; Oracle; Citius Tech; MedeAnalytics; Verisk Analytics, Inc.; McKesson Medical-Surgical Inc.; Veradigm LLC; IQVIA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Healthcare Payer Analytics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Healthcare payer analytics market report on the basis of analytics type, delivery mode, component, and application.

-

Analytics Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Descriptive Analytics

-

Predictive Analytics

-

Prescriptive Analytics

-

DiagnosticAnalytics

-

DiscoveryAnalytics

-

-

Component Outlook (Revenue, USD Million; 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Delivery Model Outlook (Revenue, USD Million; 2018 - 2030)

-

On-Premises

-

Web-Hosted

-

Cloud-Based

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Clinical

-

Financial

-

Operational & Administrative

-

Frequently Asked Questions About This Report

b. The U.S. healthcare payer analytics market size was estimated at USD 5.90 billion in 2024 and is expected to reach USD 7.33 billion in 2025.

b. The U.S. healthcare payer analytics market registered a CAGR of 21.5% from 2025 to 2030, and is expected to reach USD 19.38 billion by 2030.

b. The on-premises segment dominated the U.S. healthcare payer analytics market with a share of 47.0% in 2024, This growth is attributed to enhanced data security, greater control over sensitive information, and compliance with stringent regulatory requirements.

b. Some key players operating in the U.S. healthcare payer analytics market include CloudMedx; DataSmart Solutions; Amitech Solutions; Caserta Concepts; Greenway Health, LLC; IMAT Solutions; Health Catalyst; Indegene; IBM; Optum; Oracle; Citius Tech; MedeAnalytics; Verisk Analytics, Inc.; McKesson Medical-Surgical Inc.; Veradigm LLC; IQVIA

b. Key factors that are driving the U.S. healthcare payer analytics market growth include rising healthcare costs, regulatory pressures, demand for value-based care, fraud detection needs, and increasing adoption of AI for data-driven decision-making.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.