- Home

- »

- Healthcare IT

- »

-

U.S. Healthcare Information System Market, Industry Report, 2030GVR Report cover

![U.S. Healthcare Information System Market Size, Share & Trends Report]()

U.S. Healthcare Information System Market Size, Share & Trends Analysis Report By Application, By Deployment (Web-based, On-premise, Cloud-based), By Component, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-293-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

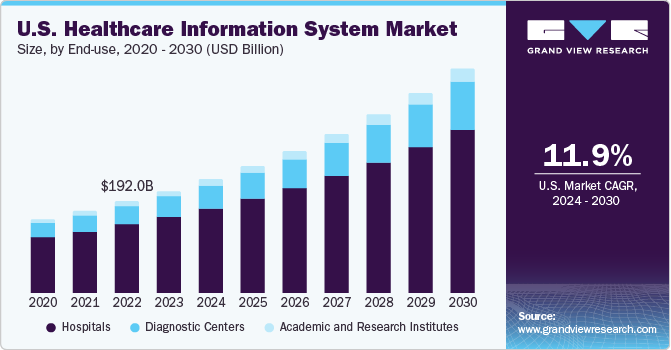

The U.S. healthcare information system market size was estimated at USD 213.93 billion in 2023 and is expected to register a CAGR of 11.97% from 2024 to 2030. Increasing instances of chronic conditions such as diabetes, cancer, and congestive heart failure in the country are driving the adoption of remote patient monitoring. This growing trend is anticipated to enhance the demand for IT solutions within the healthcare industry in U.S.

Various advantages, including cost reduction in operations, decreased medical errors, and improved successful outcomes, are anticipated to propel the healthcare information systems industry’s growth. Furthermore, supportive government initiatives focused on healthcare infrastructure development and IT integration into existing facilities are expected to boost industry expansion during the forecast period.

An increase in the number of government initiatives being undertaken across the globe to develop and deploy healthcare information systems is one of the main factors boosting adoption of healthcare information systems. The rising incidence of chronic diseases in U.S. is a significant factor expected to increase the demand for healthcare IT to enhance Chronic Disease Management (CDM).

Increasing applications of smartphones, such as telemedicine, remote disease management, Health Management Information Systems (HMIS), and others, are expanding the scope of IT in healthcare. Some healthcare IT applications utilized for CDM include telehealth for remote patient-provider connections in managing chronic illnesses, electronic health records (EHRs) with integrated chronic care management tools and decision support, and Clinical Decision Support (CDS) systems.

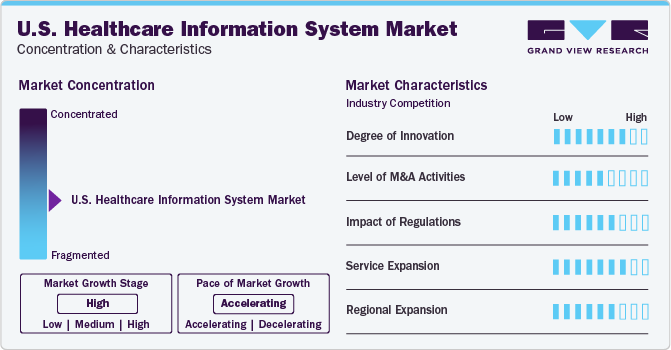

Market Concentration & Characteristics

U.S. healthcare information system market exhibits consolidation, marked by a high level of innovation. Chronic diseases contribute significantly to the per capita healthcare expenditure. High treatment costs necessitate adopting effective IT solutions, such as care management, patient engagement, and wearable devices. The rise in global public-private partnerships for eHealth or digital health is a funding and innovation catalyst, driving industry growth during the forecast period.

Numerous organizations in U.S. are incorporating healthcare information technology to improve their CDM programs. Moreover, existing market players have resorted to extensive merger and acquisition activities to increase their offerings in the industry. For instance, in May 2022, OncoHealth, a prominent digital health company specializing in oncology, secured strategic investments from Arsenal Capital Partners and McKesson Corporation. These investments aimed to enhance OncoHealth’ solutions-specific digital health solutions, addressing the increasing complexity and cost of cancer care due to the FDA approving over 285 new cancer indications since 2017.

The enactment of legislation such as the HITECH Act for promoting EHR adoption is among the major industry drivers in the U.S. Furthermore, the Meaningful Use (MU) directives have led to the complete adoption of EHRs in healthcare. Thus, government initiatives supporting eHealth programs and incentives promoting EHR implementation are expected to drive the industry over the forecast period.

Prominent industry players are targeting gaining a large market share and thereby adopting product and service differentiation strategies, which, in turn, results in high R&D investments for new product development and product modifications. For instance, in June 2020, Athenahealth, Inc. launched its Telehealth Solution called Athena Telehealth, which provides secure scheduling for the billing process for clinicians and patients.

In September 2023, London-based bladder health tech startup Jude secured USD 4.2 million in seed funding for its U.S. expansion. This funding is expected to aid the U.S. healthcare information system industry by supporting innovative solutions for bladder health issues, benefiting the 75 million individuals in the US facing such challenges and exemplifying the geographical expansion by global players in the U.S.

Application Insights

Healthcare information systems in revenue cycle management led the market in 2023, accounting for nearly 73.0% share. Increasing need for reducing medical billing errors, and reducing reimbursements in healthcare, shifting trend toward development of synchronized management systems, and increasing need for optimization of workflow in healthcare facilities are propelling market growth.

Hospital information systems are anticipated to register the fastest growth over the forecast period owing to several technological benefits such as low healthcare expenditure and high operational efficiency. Moreover, the subsequent need for reducing healthcare costs is among the key factors attributed to the segment growth.

Deployment Insights

Many healthcare information systems used web-based deployment in 2023, with the segment dominating 45.0% share. Web-based systems are favored for their accessibility, cost efficiency, and scalability. They allow healthcare professionals to access data remotely, reducing hardware costs and enabling easy scalability. These systems facilitate the integration of various healthcare technologies, enhancing efficiency and data sharing.

Cloud-based deployment is expected to grow the fastest from 2024 to 2030, owing to its widespread utility and ease of operation. Cloud-based technology usage has surged due to security breaches in on-premises and web-based systems. Traditional systems necessitate regular investments in software and system upgrades. As IT infrastructure needs and business requirements evolve, information sharing becomes crucial.

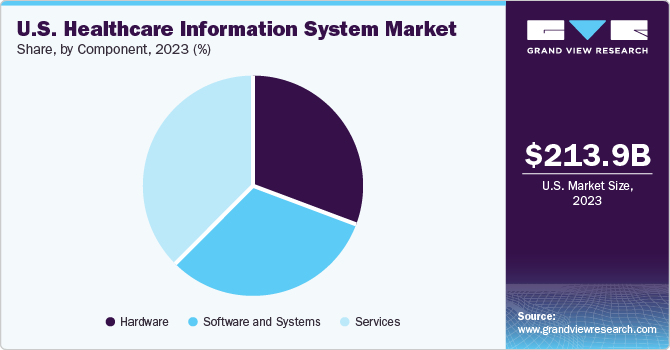

Component Insights

Healthcare information services, leading the segment, accounted for nearly 40.0% of the market revenue in 2023. The rise of digital health and connected care has broadened the reach of healthcare IT services. Advances in software and hardware are expected to drive demand for these services. Creating disease monitoring, diagnosis, and prevention platforms is a significant market booster. Healthcare IT services like installation, training, and upgrades rely on these platforms’ development, contributing to market growth.

The software sector is anticipated to experience the most significant compound annual growth rate (CAGR) due to the U.S. Healthcare Reform Act mandating the creation and use of Electronic Medical Records (EMR) for all patients. The increasing use of mobile technology and smartphones will enhance the demand for health information software in the coming years.

End-use Insights

In 2023, hospitals were the largest end-users of healthcare information systems in the U.S., accounting for over 75.0% share. Healthcare information systems’ interoperability facilitates smooth health data exchange among hospitals, enhancing patient care and decision-making. The cost-effectiveness, accessibility, and scalability of web-based IT systems allow hospitals to efficiently adapt to changing healthcare demands and integrate diverse technologies.

The diagnostic centers segment is experiencing lucrative growth and is anticipated to grow the fastest from 2024 to 2030. The rising prevalence of chronic diseases and the increased use of healthcare IT services in diagnostic centers are driving the segment growth. The implementation of laboratory information systems is a significant stimulant for the market. The growing demand for automated services and the need to integrate individual health data for efficient care delivery are other factors propelling the market.

Key U.S. Healthcare Information System Company Insights

The market is consolidated, marked by constant strategic collaborations and mergers & acquisitions. Players strive to gain a competitive advantage by capitalizing on available untapped opportunities. Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions Inc., IBM, GE Healthcare, and Philips Healthcare are some health tech players operating in the U.S. healthcare information system market.

The desire for companies to expand service offerings, access new markets, achieve economies of scale, and strengthen competitive positions is high. For instance, in November 2021, Athenahealth was bought by private equity firms Hellman & Friedman Bain Capital. The company, associated with more than 140,000 ambulatory care providers in all 50 states and across more than 120 specialties, aimed to build the foundations of a multi-sided digital care network between patients, payers, and providers following the acquisition.

Key U.S. Healthcare Information System Companies:

- Cerner Corporation

- Athenahealth Inc.

- Change Healthcare Inc.

- GE Healthcare

- IBM

- Oracle Corporation

- Dell Technologies Inc.

- Philips Healthcare

- Optum

- Infor

- Epic Systems Corporation

- Allscripts Healthcare Solutions Inc.

- Conduent Inc.

- Cognizant Technology Solutions Corporation

- eClinicalWorks LLC

Recent Developments

-

In February 2024, GE HealthCare and Biofourmis collaborated to extend patient monitoring outside the hospital, enhancing care-at-home solutions. This partnership aimed to reduce costs, improve patient outcomes, and drive healthy behaviors by leveraging Biofourmis’ AI-guided algorithms for personalized care at home.

-

In December 2023, the U.S. Department of Health and Human Services finalized its Health Data, Technology, and Interoperability: Certification Program Updates, Algorithm Transparency, and Information Sharing (HTI-1) rule proposed in April 2023. The HTI-1 final rule advances patient access, interoperability, and standards.

-

In November 2023, Thoma Bravo, a leading software investment firm, completed its acquisition of NextGen Healthcare, Inc., expanding its healthcare IT portfolio and customer base, thus enhancing its presence in the healthcare information systems market.

U.S. Healthcare Information System Market Report Scope

Report Attribute

Details

Market size in 2024

USD 238.6 billion

Revenue forecast in 2030

USD 470.3 billion

Growth rate

CAGR of 11.97% from 2024 to 2030

Actual data

2016 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, deployment, component, end-use

Country scope

U.S.

Key companies profiled

Cerner Corporation; Athenahealth Inc.; Change Healthcare Inc.; GE Healthcare; IBM; Oracle Corporation; Dell Technologies Inc.; Philips Healthcare; Optum; Infor; Epic Systems Corporation; Allscripts Healthcare Solutions Inc.; Conduent Inc.; Cognizant Technology Solutions Corporation; eClinicalWorks LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Healthcare Information System Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2016 to 2030. For this study, Grand View Research has segmented the U.S. healthcare information system market report based on application, deployment, component, and end-use:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Information Systems

-

Electronic Health Record

-

Electronic Medical Record

-

Real-time Healthcare

-

Patient Engagement Solution

-

Population Health Management

-

-

Pharmacy Automation Systems

-

Medication Dispensing Systems

-

Packaging and Labeling Systems

-

Storage and Retrieval Systems

-

Automated Medication Compounding Systems

-

Tabletop Tablet Counters

-

-

Laboratory Informatics

-

Revenue Cycle Management

-

Medical Imaging Information Systems

-

Radiology Information Systems

-

Monitoring Analysis Software

-

Picture Archiving and Communication Systems

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Web-based

-

On-premise

-

Cloud-based

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software and Systems

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Academic and Research Institutes

-

Frequently Asked Questions About This Report

b. The U.S. healthcare information system market size was estimated at USD 213.9 billion in 2023 and is expected to reach USD 238.6 billion in 2024.

b. The U.S. healthcare information system market is expected to grow at a compound annual growth rate of 12.0% from 2024 to 2030 to reach USD 470.3 billion by 2030.

b. Revenue cycle management segment dominated the U.S. healthcare information system market with a share of over 72% in 2023. The is attributable to increasing adoption of RCM software and services by small and medium sized healthcare facilities to adequately manage their finances.

b. Some key players operating in the U.S. healthcare information system market include Athenahealth, Inc.; Agfa Gevaert Group; eClinicalWorks; Philips Healthcare; Hewlett Packard; McKesson Corporation; Allscripts Healthcare, LLC; GEHealthcare; Epic Systems Corporation; Carestream Health; Medidata Solutions Inc.; Siemens Healthineers; NextGen Healthcare; Oracle; NXGNManagement, LLC.

b. Key factors that are driving the U.S. healthcare information system market growth include increasing adoption by hospitals, advanced research centers, universities, & medical device manufacturers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."